What is startup bootstrapping? How to succeed with self-funding

- What is bootstrapping in small businesses?

- Pros and cons of bootstrapping a startup

- Pros of bootstrapping in startup finance

- Cons of bootstrapping in startup finance

- 5 tips on how to bootstrap your startup as an entrepreneur

- Bootstrapping success stories

- Clear your growth runway with Ramp

You can’t have a successful startup without the funds to support it. But when you have a great business idea, the question quickly becomes: “Where will I get the money for it?”

Luckily, building a successful and sustainable business doesn't always require pitching investors, Shark Tank-style, or going to the bank for a loan. It can also look like starting slow and from scratch with your own personal funds—a business funding method called bootstrapping.

So if you think this style of building a business is right up your alley, this guide on bootstrapping a startup is for you. We’ll go over what bootstrapping is, the pros and cons, and some helpful tips and tools to take the weight of building a business off your shoulders. Let’s get started.

What is bootstrapping in small businesses?

Bootstrapping involves building a business from the ground up without any major loans or venture capital.

Founders that choose this route keep their business afloat with their own personal savings and capital. However, cash injections from friends and family, as well as sales made by the company post-launch, are also fair game for bootstrapped businesses.

Bootstrapping is a common, popular method of building a business—particularly for first-time entrepreneurs—but it’s one that comes with its fair share of challenges, as we’ll see later.

What alternative funding options are there?

Of course, bootstrapping isn’t the only way to fund a new business venture. Here are two alternative funding options entrepreneurs often consider when building a business:

- Equity funding: This method involves selling an ownership stake in the company to investors in exchange for business funding. Investments from venture capital firms and angel investors might come to mind when you think about this kind of external funding, but crowdfunding also falls under this category.

- Debt funding: Entrepreneurs that use this type of financing borrow money from a lender or investor and pay it back over time with interest. This includes traditional business loans, SBA loans, business credit cards, and peer-to-peer lending.

Pros and cons of bootstrapping a startup

So you want to start your own business. Maybe you’re already thinking about funding it yourself. If so, it’s important to understand that bootstrapping your startup is an unpredictable, volatile journey—but it can pay off beautifully with proper planning and preparation.

If you’re wondering whether bootstrapping is right for your business venture, here are some pros and cons to consider.

Pros of bootstrapping in startup finance

You have complete control over the direction of the company

Although selling shares of your company in exchange for business funding may seem like a shortcut to getting the money you need, it comes at a price. Outside investors seek an ownership stake in your company. If their vision of the company differs from yours, they may exert pressure on your team to do things their way.

But when you bootstrap your business, you’re free to make your own decisions about your company and take the risks you feel would be beneficial for the future of your venture.

You have no choice but to focus on business fundamentals

High-growth businesses driven by investor funding typically have much more resources to play with than their bootstrapped counterparts. As a result, they might burn cash quickly or make decisions that wouldn’t be sustainable for a normal business under normal circumstances.

Bootstrapped companies don’t have that luxury—you have no other choice than to build a sustainable business that can stand on its own two feet. But this isn’t a bad thing. It simply means you’re more likely to make practical business decisions and solve problems creatively with limited resources.

You don’t need a lot of money to get started

This is the nature of bootstrapping—starting your business with the funds and resources you have right now.

When you finance your business idea yourself, you become mindful of just how much of your own money you’re putting into the venture. You’re less likely to take financial risks, like taking out a huge business loan with high interest rates.

If the business doesn’t work out, you won’t have a huge debt burden to pay off. And if it does, then you succeeded at minimal cost to your personal finances.

Cons of bootstrapping in startup finance

It comes with a lot of risk

Life is unpredictable, and that unpredictability extends to your business as well. So when you fund the business completely by yourself, it’s your money you’ll lose if the company goes under or if you’re hit with a sudden emergency. And because you’re the only one supplying the funding, your business is at risk if you run out of money too.

Compare that with equity financing, where investors share your successes and your financial burden.

It limits the support and opportunities you have access to

When you work with investors, you often also gain access to their professional network and new opportunities you may not have had before. Even simply dropping the names of well-known investors you’ve connected with can open up new doors for you and your company.

In contrast, bootstrappers focus on slow, steady, and sustainable growth. You likely won’t have the same access to opportunities as you would with an investor, and the ones you do get are ones you drum up yourself.

Not having investor resources or outside funding also means that if demand for your product or service ramps up quickly, you may not have the infrastructure or the people in place to meet it—which can mean losing potential customers to the competition.

It’s not easy

The sheer nature of bootstrapping often requires you to put in much more work than with other funding methods. You may have to work longer hours, wear multiple hats, and manage stressful situations without the support of a team or the knowledge of a seasoned investor.

But if you make it through to the other side, your feelings of accomplishment may be well worth the effort.

5 tips on how to bootstrap your startup as an entrepreneur

Even if this is your first time starting a business, you don’t have to start at square one. Read the tips below to learn some of the fundamentals of bootstrapping your startup and efficiently managing your funding.

Start with a minimum viable product

When you’re first starting out, aiming for perfection will kill your momentum. So don’t aim for perfect—aim for your MVP instead.

Your MVP, or minimum viable product, is the most basic version of your product or service. It doesn't need all the bells and whistles, just enough so you can begin selling it and getting feedback from your customers. After all, you don’t want to spend precious time and resources creating the perfect version of your offering, only to find that no one wants to buy it.

For now, focus on creating your MVP so you can start bringing in money. Once you’ve gotten enough feedback, you can improve your offering based on what the market actually wants.

Keep costs as low as possible

Once money begins to come into the business, it may be tempting to spend your funds on the latest tool or shiny thing because you assume there’s more of it coming in. But when funds are limited, it’s important to keep your spending down and save as much as you can—you never know what the future will hold.

Create and maintain a responsible financial culture in your business. Track business expenses and regularly trim the unnecessary ones from your budget. Look for new and creative opportunities to save as well.

If your business is equipment-heavy, for example, you may decide to shop for secondhand versions of the equipment or rent them out if possible. Or, you may choose to teach yourself the basics of web development and design so you can build your website yourself.

Strategically grow your network

Without the connections and opportunities that working with an investor can bring, you’ll need to find a way to open new doors for yourself.

Attending local business networking meetups and virtual events, reaching out to like minded entrepreneurs on social media, even catching up with an old friend or colleague can help position you for the one opportunity that changes everything for your business.

When you’re ready, you’ll also want to look for a business mentor. Organizations like SCORE can connect you with business experts in your area who are interested in mentoring new entrepreneurs and business owners.

Turn to family and friends for extra bootstrapping funding

As we touched on earlier, bootstrapping doesn’t have to be 100% founder-funded—friends and family can pitch in, and growth may also be funded by your operating revenue.

As long as you don’t give up equity in your company or take on a major loan from a bank or other financial institution, you’re still bootstrapping.

Invest operating profits back into business growth

Resist the urge to spend your profits as if they’re your own personal paycheck. Instead, reinvest them into your business for even greater growth.

Consider increasing your marketing budget, for example, or buying more inventory. Conversely, you may decide to bring on a freelancer or virtual assistant to handle the business’s creative or admin tasks.

The sky’s the limit here. Just make your decision thoughtfully.

Bootstrapping success stories

Entrepreneurship can feel like a daunting endeavor—and even more so if you’re relying solely on your own funds in the beginning. But it’s not impossible.

Here are two bootstrapping success stories to help you envision the possibilities that await you and your own startup.

Spanx

In 2000, Spanx founder Sara Blakely started her undergarment business with all the money she had available in her savings account: a mere $5,000. By taking a DIY approach—including building the prototype, designing the packaging, and filing for her patent—she minimized her costs and retained full ownership of the company.

Since then, she’s grown Spanx into a $1.2 billion enterprise. And after selling a majority stake in the company to Blackstone in late 2021, she catapulted her own net worth over the billion dollar mark as well.

Mailchimp

Email automation company Mailchimp was founded in 2001 by Mark Armstrong, Ben Chestnut, and Dan Kurzius. The platform started out as a paid marketing automation software, but it didn’t get much traction until it debuted its freemium business model in 2009—and it was all uphill from there. In fact, in 2019 the SaaS company made $700 million in revenue.

For two decades the three founders turned down every acquisition offer they received. That is, until 2021, when Intuit acquired Mailchimp for $12 billion, making it the largest one of any standalone marketing software startup to date.

Clear your growth runway with Ramp

Your cash flow will make or break your business, so it’s important to prioritize initiatives that bring in steady money and keep your venture in the black. But cost cutting is still a huge headache for many entrepreneurs and founders, despite how crucial the practice is to your bootstrapping journey.

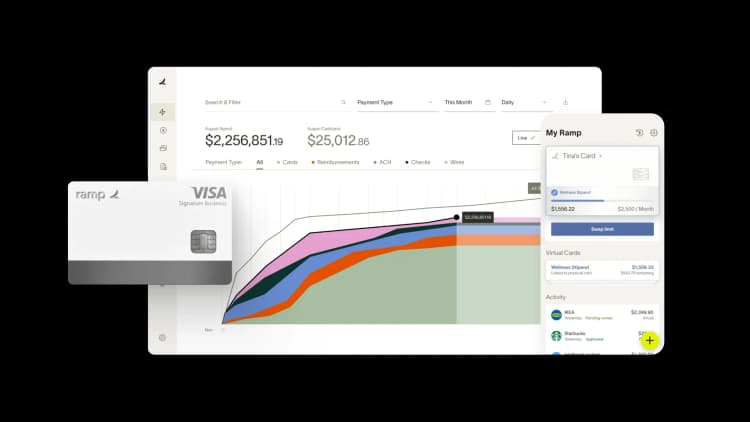

As a spend management platform, Ramp and its wealth of tools help bootstrapped startups find new ways to cut costs and make the most of their funds.

In particular, Ramp’s corporate card and expense management solution act as your trusty financial sidekicks. Set limits and spend controls with ease, monitor purchases against budget, and adjust controls on the fly so you can keep variable costs in check, leave room for growth-related costs, and direct funds to where they’re needed most.

Ready to see how Ramp can help you transform your business? Take a tour of the platform today.

FAQs

Bootstrapping works well for many businesses, but not all of them. This funding method allows you to keep full ownership and leadership of your company, but it also means putting your finances at risk to support your venture.

So, it’s important to assess your personal financial situation, risk tolerance, and business plan before you decide whether bootstrapping is right for you.

Bootstrapping refers to funding your business venture with your personal savings and assets. A woman starting an event planning business with $10,000 in savings and her personal credit card, then, would be considered bootstrapping.

According to Fundable and the US Chamber of Commerce, about 75-85% of startups are bootstrapped.

There are many free, freemium, and low-cost tools available to help you run your business and do more work with less effort. Here are some you may find useful in your own venture:

- Squarespace to build customizable, beautiful websites

- Typeform to create interactive and professional-looking questionnaires

- Hotjar to collect user feedback on your website

- Unsplash to search for beautiful and royalty-free stock photos

- Canva to edit and create images

- Udemy to learn new skills that help you better run your business

- LastPass to manage your login information

- Otter.ai to transcribe and take notes during video calls

- PayPal to send and receive payments

Ramp to manage and automate your finances

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits