- Step 1: Open a dedicated business bank account and credit card

- Step 2: Use accounting or expense tracking software

- Step 3: Connect your bank and credit card to your accounting software

- Step 4: Automate invoice and receipt management

- Step 5: Record expenses and file receipts regularly

- Manual vs. automated expense tracking

- Common business expense categories

- Benefits of business expense tracking

- Challenges of tracking business expenses manually

- Why Ramp is the best tool to track business expenses

- Put expense tracking on autopilot

Key takeaways

- Tracking business expenses involves recording all company spending to improve budget accuracy, financial visibility, and tax compliance.

- Before choosing an expense tracking solution, you should start by opening a dedicated business bank account and credit card.

- Automating the process by connecting your accounts to your software saves time, reduces human error, and provides real-time visibility into spending.

- Consistent expense tracking gives you an accurate view of business performance, improves cash flow management, and ensures you're prepared for tax audits.

- Ramp's AI-powered platform helps you overcome manual tracking challenges by automatically capturing receipt data, categorizing transactions, and syncing with your accounting software.

Accurately tracking business expenses helps you create more useful budgets and make better financial decisions. But when things get busy, it’s easy to get overwhelmed, misplace receipts, and lose track of what you need for taxes.

Knowing how to keep track of business expenses is an invaluable skill. With the right tools and processes, you’ll gain a better sense of your financial resources, stick to your budgets, reduce fraud, and improve your bottom line.

In this article, we outline the key steps to keep track of business expenses, discuss the benefits of expense tracking, and provide tips for overcoming common challenges.

Step 1: Open a dedicated business bank account and credit card

Keeping your business and personal expenses separate makes bookkeeping and tax filing much easier. For that reason, it’s important to open a dedicated business bank account. Be sure to choose a business debit or checking account with useful features like online and mobile banking and accounting software integrations.

Adding a business credit card or corporate card can further maintain a proper division between your personal and business expenses. What’s more, using your business credit card responsibly can help you build your business credit score.

A strong business credit score can:

- Make your business more attractive to investors

- Give you access to a higher credit limit

- Yield a lower interest rate on card balances

Step 2: Use accounting or expense tracking software

Manual bookkeeping processes are time-consuming, labor-intensive, and often error-prone. Business expense tracking software eliminates these challenges, providing a more accurate and efficient way to keep track of business expenses.

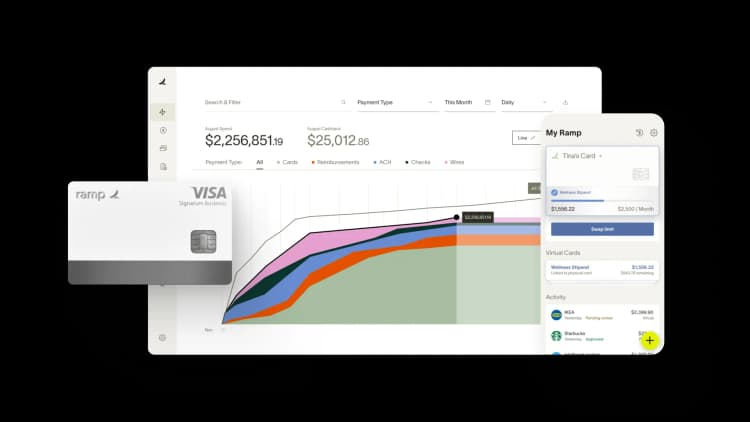

Choose a platform that automatically tracks business expenses and provides real-time reporting. Some corporate cards, like Ramp, come with built-in spend management software that offers features like receipt matching, automatic expense categorization, custom spend controls, and integrations with accounting software.

Step 3: Connect your bank and credit card to your accounting software

Once you choose an accounting platform, connect it to your bank and credit card accounts. Modern solutions can automatically import your banking and card transactions for real-time visibility.

By automating the process, you can easily compare accounting transactions with bank and credit card data. An automated system speeds up the account reconciliation process, helping you close your books faster.

Thoroughly research any tool to understand how it protects your data and whether there have been past breaches before connecting your accounts.

Step 4: Automate invoice and receipt management

Managing and tracking invoices and expense receipts is a fundamental part of expense management. Look for a tool that can capture, store, and categorize receipts instantaneously. Receipt scanning apps can help, as you can scan a receipt right from the table of a business dinner.

The best expense management software handles all this for you. For example, Ramp's AI automatically matches receipts to transactions and correctly categorizes the expenses. Ramp also offers accounts payable automation features that manage invoice processing and payment with no manual effort.

Step 5: Record expenses and file receipts regularly

Don’t set it and forget it when it comes to recording your expenses. You need to track business expenses regularly and consistently. The cadence you choose should ultimately depend on the cadence of your spending.

If you’re managing a small business with limited expenses, a weekly or monthly check-in on recordkeeping makes sense. However, as your company grows and you make more frequent transactions, you may want to consider reviewing and tracking them daily. For starters, maybe set aside 15 minutes every Friday to upload receipts, and then scale up from there as needed.

Properly filing receipts and invoices is the foundation of good recordkeeping. The IRS mandates that you keep all hard-copy receipts and other financial records, such as bank statements, for at least 3 years. Digital storage is highly recommended because it's easily searchable, saves space, and is more environmentally friendly.

Manual vs. automated expense tracking

If your company is small and you don’t have many expenses, manually tracking them in a spreadsheet is probably sufficient. But as your business scales and you incur more expenses, Excel spreadsheets can quickly become unmanageable, growing increasingly time-consuming and prone to human error. Not only that, if you’re holding onto paper copies of receipts, they’re easy to lose or damage.

This is where automated expense tracking comes in. According to the Harvard Business Review, 80% of employees reported that automation freed them up to spend time on what matters, such as building customer relationships and career development. Automation doesn’t just save time; it reduces mistakes and offers you real-time insights via platform dashboards.

Common business expense categories

Organizing all your expenses into expense categories ensures you know exactly how your business spends money, allowing you to identify trends and make adjustments to your budget as needed. Properly categorizing expenses also helps you claim all the business tax deductions you're entitled to each year.

Some common categories of business expenses include:

General and administrative (G&A) expenses

Operating expenses that aren’t related to the production or sale of goods and services are known as general and administrative expenses, or G&A expenses. Examples of G&A expenses include rent, utilities, office supplies, and insurance.

Cost of goods sold (COGS)

Costs directly related to the production or delivery of your products or services are known as the cost of goods sold (COGS). Examples of COGS include direct labor costs, raw materials, and hosting costs associated with delivering software.

Marketing and advertising costs

Marketing and advertising costs are the expenses associated with selling and promoting your business. These include ad spend, promotional materials, sales conferences, and other events.

Benefits of business expense tracking

Consistent and accurate business expense tracking can help you better manage your current financial resources and plan for the future. But the benefits extend beyond that. Here are a few of the most meaningful reasons to track expenses:

- More accurate view of business performance: When it comes time to look at your monthly P&L statements, you need a comprehensive view that accounts for the entirety of your business spending. This gives you a clear picture of your company’s financial health, allowing you to adjust as needed.

- Better cash flow management: Daily and monthly expense tracking enables you to identify trends and outlying costs. To gain a clear picture of your business finances, you must be able to identify the small costs that add up and determine whether larger expenses are justifiable.

- Improved budgeting: Business expense tracking is one of the best ways to ensure your spending habits align with your established plan. At the end of each month, if your actual spending exceeds your projections, you can identify areas where you can cut back.

- Easier tax prep and audit readiness: Tracking your business expenses will better prepare you for tax season. If your tracking system logs receipts and invoices, you can easily see which of your payables and receivables are tax-deductible when it’s time to prepare your tax returns, and you’ll have everything you need in the event of an audit.

Challenges of tracking business expenses manually

Manually tracking expenses presents a number of challenges:

- Scale: The sheer number of expenses to track can be overwhelming. In particular, managing tail spend can be challenging since it typically accounts for 80% of business transactions but only 20% of costs. Expense management becomes far more challenging when you manually process a high volume of transactions.

- Human error: When processes rely on human input, mistakes are inevitable. Manual processes are harder to optimize since human error will always be present to some degree, whether it’s a miscategorized expense or a lost receipt. That’s why modern businesses look for ways to digitize—and automate—their financial activities.

- Approval delays: As expenses work their way through the approval process, it’s easy for expense reports to be overlooked or forgotten, delaying approval or expense reimbursement

- Expense fraud: The Association of Certified Fraud Examiners (ACFE) estimates that companies lose up to 5% of their revenue due to fraud. And since manual expense tracking makes it difficult to verify every business expense for accuracy, you could be at risk for expense report fraud.

- Outdated financials: Expense audits are usually limited to end-of-month financial reports. If you don't analyze expenses until the end of the month, you may be relying on outdated information to make financial decisions. In a competitive environment, you need to be able to monitor spending in real time and adjust accordingly.

Tips for overcoming business tracking challenges

If you need some help in overcoming the challenges, here are a few quick tips that can help you get organized:

- Hire someone to help: If the thought of bringing on a new tool is also stressful, consider hiring a bookkeeper or a contract project manager to get it up and running

- Create an expense report policy: A policy helps keep both you and your team accountable for managing expenses. It is time well spent in the long run as your business grows.

- Understand which expenses are tax-deductible: If you know which expenses will help you come tax time, it helps your bottom line. Keep an eye not just on spending broadly, but also on how you’re spending, and particularly how those costs can help decrease your tax burden.

Why Ramp is the best tool to track business expenses

Tracking and categorizing business expenses is a time-consuming, error-prone process. Collecting paper receipts, manually entering data into spreadsheets, and chasing down missing information from employees leads to hours of tedious work each month. Ramp streamlines expense tracking from end to end, freeing your team to focus on higher-value work.

With Ramp's AI-powered expense management software, employees can simply take a photo of a receipt and submit it via web, mobile app, email, or text. Ramp automatically extracts the merchant name, date, and amount, then matches it to the corresponding Ramp card transaction—no more manual data entry or hunting for lost receipts.

Ramp also automatically categorizes each expense based on merchant category codes and your company's unique configuration. Granular category labels like "Advertising & Marketing" or "Meals & Entertainment" are applied instantly, ensuring consistent categorization across your organization. Direct integrations with popular accounting software and ERPs can sync transactions to your GL automatically.

For purchases that require extra context, Ramp makes it easy to add memos for expenses. Whether it's detailing client entertainment costs or explaining a one-off purchase, employees can add notes and tag transactions directly in Ramp. Come audit time, this supporting documentation is freely available, linked to each transaction.

This doesn't just save hours of bookkeeping work; it also helps ensure compliance with your expense policy and reduces fraud and misuse. With Ramp, you get more than an expense tracking solution. You gain end-to-end visibility and control over company spending.

Put expense tracking on autopilot

Ramp's expense management software offers a solution for overcoming the pitfalls of manually tracking business expenses. Together with industry-leading corporate cards, Ramp’s modern finance platform provides:

- Automated expense reporting and approvals

- Customizable spend controls

- A handy mobile app for capturing and storing receipts

Ramp automatically tracks and categorizes all your business expenses and can even offer intelligent recommendations for where you can reduce spending to improve cash flow. Check out our interactive demo environment and see why companies that choose Ramp save an average of 5% a year across all spending.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group