What is venture debt financing? Pros and cons for startups

- What is venture debt financing?

- Venture debt vs. venture capital equity

- When startups should consider venture lending

- Types of venture debt loans

- Typical venture debt terms and interest rates

- Venture debt providers and lenders

- Eligibility checklist for debt venture capital funding

- Pros and cons of venture debt financing for startups

- How to decide the right venture debt loan size

- Negotiating a venture debt term sheet

- Venture debt on your financial statements

- Growth debt alternatives for startups

- Get access to the working capital you need with Ramp

Venture debt is a type of financing for high-growth, early-stage startups to help extend cash runway. It gives venture-backed startups access to capital without requiring them to give up additional equity. Before pursuing venture debt as a financing option, it’s important to understand how it differs from other options like bank loans and startup lines of credit.

What is venture debt financing?

Venture debt is a financing option specifically designed for VC-backed startups that lets you access capital while preserving equity ownership.

Unlike traditional bank loans, which require steady cash flow and profitability, lenders provide capital based on your future funding potential rather than current cash flow. They're betting that your next equity round will provide the funds to repay the loan, so having strong VC backing is typically a prerequisite.

Here are the key characteristics that distinguish venture debt from other financing:

- Non-dilutive financing: You maintain ownership percentages, though warrants can create limited dilution (typically 10–20% of the loan amount, according to Flow Capital)

- Higher interest rates: SVB estimates you should expect annual interest rates of 7–12% due to the inherent risk of lending to startups

- Warrant component: Lenders receive warrants to purchase equity, giving them upside if your company succeeds

- Milestone-based covenants: Venture lending often requires performance conditions tied to revenue targets, burn rate limits, or minimum cash balances

Venture debt vs. venture capital equity

Understanding the differences between venture debt and equity financing helps you choose the right option for your business case. Each has advantages depending on your company's stage and capital needs.

| Aspect | Venture debt | Venture capital |

|---|---|---|

| Dilution impact | Minimal (5-15% warrant coverage) | Significant (10-30% per round) |

| Repayment requirements | Monthly payments required | No repayment obligation |

| Timeline to close | 4-6 weeks | 3-6 months |

| Control & governance | No board seats, limited covenants | Board representation, voting rights |

| Cost structure | Cash interest payments | Ownership percentage |

Venture debt makes sense when you need to extend runway between rounds or fund specific initiatives without dilution. Equity financing works better for major pivots, long-term R&D, or when you need patient capital without repayment pressure.

When startups should consider venture lending

Timing matters when you add venture debt to your capital structure. The best opportunities often come up when you have strong momentum but want to preserve equity for future growth.

1. Extending runway between equity rounds

Venture debt buys you 6–12 additional months to hit key milestones before your next equity raise. This lets you demonstrate traction, reduce risk, and command a higher valuation.

For example, if you're burning $500,000 monthly with 8 months of runway, a $3 million venture debt facility extends that to 14 months. Those extra months could mean the difference between raising at a valuation of $50 million vs. $100 million.

2. Funding capex or product launches

Use venture loans to fund specific growth initiatives without diluting your equity. Typical uses include purchasing equipment, investing in R&D and infrastructure, or financing market expansions.

These one-time investments often generate returns that exceed the cost of debt. In some cases, a $2 million loan for sales and marketing might boost customer acquisition enough to justify the interest expense.

3. Hedging against slower fundraising markets

Venture debt acts as an insurance policy during uncertain market conditions. An undrawn credit facility gives you flexibility if fundraising takes longer than expected.

When VC markets tighten, companies with venture debt have more negotiating leverage. You don’t have to accept unfavorable terms just because you're running low on cash.

Types of venture debt loans

Different loan structures serve different purposes for growing startups. Understanding these options helps you match the right product to your needs:

- Term loan: The term loan is the most common venture debt structure. You receive a fixed amount up front, with scheduled repayments over 24–48 months. Most term loans include an interest-only period of 6–12 months, followed by principal amortization. This structure gives you time to deploy capital before repayment begins.

- Revolving line of credit: A revolving credit line, or business line of credit, provides flexible access to capital up to an approved limit. You only pay interest on the amount you've drawn, making it ideal for managing working capital fluctuations. You can draw funds when you need them and repay when cash flow improves.

- Equipment venture loan: Equipment loans provide asset-backed financing for purchasing technology infrastructure or specialized equipment. The equipment itself serves as collateral, often resulting in better terms. These loans match the financing term to the useful life of the asset. For example, if you're buying servers with a 3-year depreciation schedule, you'll get a 3-year loan term.

Typical venture debt terms and interest rates

Venture debt terms will vary based on your company's profile, but certain components appear in every deal. Understanding these elements helps you evaluate and compare offers.

Interest rates typically range from prime plus 4–8%, though rates fluctuate with market conditions. Repayment periods span 24–48 months, with 6–18 months of interest-only payments before principal amortization begins.

Warrant coverage usually equals 10–20% of the loan amount, giving lenders equity upside. These warrants can have an exercise period of anywhere from 1–15 years at the price of your most recent equity round, according to Flow Capital.

Other key term sheet components include:

- Covenants: Financial metrics such as minimum cash balance or revenue targets, plus operational requirements such as board observer rights

- Pre-payment penalties: Fees for early repayment, typically declining over time from 3% to 1%

- Exit fees: Additional payments due upon acquisition or IPO, usually 1–3% of the loan amount

- Default triggers: Specific events that accelerate repayment, including covenant breaches or material adverse changes, such as missing revenue targets or a sudden loss of key customers

Venture debt providers and lenders

The venture debt landscape includes different lender types, each with unique approaches and risk appetites. Choosing the right partner depends on your needs and relationship preferences.

- Venture banks: Traditional banks with specialized venture lending arms take a relationship-focused approach. SVB, Square 1 Bank (now part of PacWest), and Bridge Bank lead this category. These banks often make you move your operating accounts to them. In exchange, they offer comprehensive banking services and potentially better rates due to the broader relationship.

- Specialized venture debt funds: Non-banks such as Hercules Capital, TriplePoint Capital, and WTI focus exclusively on venture debt. They typically offer more flexible terms and higher risk tolerance than banks. These funds move faster and structure more creative deals. They're ideal when you need customized terms or don't meet traditional bank criteria.

- Government or quasi-public programs: Government-backed programs offer startup lending at attractive rates. The Small Business Administration (SBA) and state-specific programs provide this financing. These programs feature lower rates but require extensive documentation and reporting. And unlike most venture debt facilities, SBA loans also require a personal guarantee from founders.

Eligibility checklist for debt venture capital funding

Venture debt lenders evaluate specific criteria when reviewing applications. Meeting these requirements improves your chances of approval and better terms.

1. Recent institutional equity round

Prior VC funding validates your business model and provides confidence in future funding ability. Venture debt lenders typically require an equity raise from recognized institutional investors within the past 12 months. This recent funding serves as the primary repayment source in lenders' underwriting. They assume you'll raise another round before the debt matures.

2. Minimum revenue or gross margin

Revenue thresholds vary by lender but generally start at $1–2 million annually. More important than absolute revenue, however, is demonstrating strong unit economics and growth trajectory. Lenders focus on gross margins above 50% and improving metrics over time. These indicators suggest you can generate cash to service debt obligations.

3. Path to next funding or profitability

You need a clear plan showing how you'll repay the debt through future equity raises or cash generation. Lenders want to see 12–18 months of runway post-funding and milestones that support your next raise. Your financial projections should demonstrate a path to profitability or metrics that attract Series B/C investors.

4. Board approval and covenant monitoring

Venture debt requires board approval and ongoing governance oversight. Your board must understand the obligations and support the decision to take on debt. Lenders require monthly or quarterly financial reporting to monitor covenant compliance. You'll need systems to track metrics and alert management to potential breaches.

Pros and cons of venture debt financing for startups

Pros:

Venture debt financing offers compelling advantages when used strategically. These benefits make it an attractive complement to equity financing:

- Minimal equity dilution: Venture debt preserves founder and employee ownership compared to raising additional equity. While warrants create some dilution, it's significantly less than an equity round. This preservation becomes even more valuable as your company grows.

- Faster access to capital: Closing venture debt takes 4–6 weeks, versus 3–6 months for equity rounds. The diligence process focuses on financial metrics rather than extensive technical and market analysis. This speed helps you capitalize on time-sensitive opportunities.

- Maintains founder control: Lenders don't take board seats or voting rights. You maintain operational control without adding new voices to strategic decisions. While covenants create some constraints, they're typically financial guardrails rather than operational interference. You keep autonomy over business decisions.

- Extends cash runway: Additional runway lets you hit value-inflection milestones before raising equity. Each month of extension could significantly impact your next valuation. This buffer also provides negotiating leverage with investors. You're not desperate for capital, which strengthens your position in term sheet discussions.

Cons:

Venture debt carries real risks that require careful consideration. Understanding these downsides helps you make informed decisions:

- Mandatory repayment obligations: Unlike equity investors who share downside risk, lenders expect repayment no matter what. Missing payments triggers default provisions that could force asset sales or bankruptcy. This means extra pressure during challenging periods.

- Higher interest rates and fees: Premium pricing reflects the risk of lending to unprofitable startups. Total costs, including interest, warrants, and fees, can reach 20–25% annually. These costs reduce cash available for investments. Every dollar you spend on debt service is one less dollar you have to fund growth.

- Covenant default risk: Missing financial or operational milestones triggers technical defaults. Even if you're making payments, covenant breaches give lenders heavy leverage. Common consequences include accelerated repayment, increased interest rates, or forced equity raises.

- Warrant dilution: While smaller than equity rounds, warrant dilution means more if your company succeeds. Those warrants priced at your Series A could be worth millions at IPO. The 10–20% warrant coverage seems modest initially, but it compounds with success. Early-stage warrant grants have an outsized impact on fully diluted ownership.

How to decide the right venture debt loan size

Sizing your venture debt appropriately balances your growth capital needs with your repayment capacity. A few quick calculations can help determine the right amount.

Start with ratios to your recent equity raise. Most companies borrow 25–50% of their last round size. If you raised $10 million in Series A, consider $2.5–5 million in venture debt.

Calculate your runway extension by dividing the loan amount by your monthly burn rate. A $3 million loan at $500,000 monthly burn adds 6 months of runway before accounting for interest payments.

Factor in cash flow metrics like burn rate, current cash balance, and the expected timing of your next equity round. You want enough cushion to weather delays without triggering covenant breaches.

Negotiating a venture debt term sheet

Effective negotiation focuses on terms that matter most for your situation. Understanding these points helps you push for favorable adjustments:

1. Interest and amortization

Structure payments to match your cash flow projections. Push for longer interest-only periods if you need time to deploy capital before generating returns.

Negotiate for monthly or quarterly payment options based on preference. Some companies prefer predictable monthly payments; others opt for quarterly to reduce administrative burden.

2. Warrant coverage

Highlight strong fundamentals or competitive term sheets to minimize warrant percentages. Consider offering higher interest rates in exchange for lower warrant coverage.

Negotiate the strike price and exercise terms carefully. Push for warrants priced at a premium to your last round or with shorter exercise periods.

3. Covenant flexibility

Build reasonable cushions into financial metrics to avoid technical defaults. If covenants require $2 million minimum cash, negotiate for $1.5 million if that better matches your projections.

Include cure rights that give you time to fix breaches before triggering defaults. Request grace periods and waiver processes that don't require excessive fees.

4. Pre-payment and exit fees

Reduce or eliminate pre-payment penalties after the first year. These fees shouldn't punish you for successful fundraising or early profitability.

Cap exit fees at reasonable levels and clarify triggering events. Make sure acquisition scenarios don't create excessive fees that complicate deal negotiations.

Venture debt on your financial statements

Venture debt affects multiple financial statements with implications for reporting and analysis. Understanding this impact helps you communicate with investors and board members.

- The balance sheet classifies debt as current or long-term liabilities, with current liabilities due within 12 months. Principal payments due within that year appear as current liabilities, affecting working capital ratios.

- Your income statement shows interest expense monthly, reducing net income. Warrant accounting complicates things, with fair value adjustments potentially affecting earnings.

- The cash flow statement reflects the initial loan as a financing inflow. Subsequent interest and principal payments appear as financing outflows, reducing cash from operations.

These entries affect key metrics such as debt service coverage ratios and enterprise value calculations. Investors adjust valuations for outstanding debt, and covenant compliance requires careful monitoring of coverage ratios.

Growth debt alternatives for startups

Beyond traditional venture debt, alternative financing options provide different structures and terms. These might better match your business model or funding needs:

Revenue-based financing

Revenue-based financing ties repayment to a percentage of monthly revenue rather than fixed payments. You pay more when revenue is strong and less during slow periods.

This structure works well if your business has variable revenue or seasonal fluctuations. It reduces default risk but typically costs more than traditional debt.

Asset-backed line

Credit facilities secured by inventory, receivables, or intellectual property offer lower rates than unsecured venture debt. The specific assets serve as collateral, reducing lender risk.

These facilities work if your company has valuable tangible or intangible assets. For instance, e-commerce businesses might borrow against inventory, while SaaS companies could leverage their recurring revenue.

Working capital facility

Short-term financing helps bridge the gap between necessary expenses and receiving customer payments. These facilities typically have 6–12 month terms with higher rates than longer-term debt.

Working capital loans help manage growth-related cash crunches. They're ideal when you scale quickly, but your customer payments lag behind your expenses.

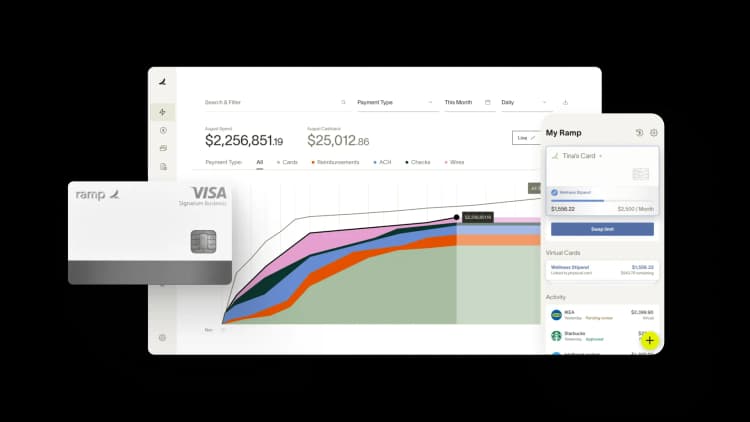

Get access to the working capital you need with Ramp

When you need working capital to fuel your vision, venture debt financing is just one option. If you’re looking for faster, simpler access to funding, try Ramp.

The Ramp Business Credit Card offers high-growth startups credit limits up to 20x higher than traditional corporate cards. You can get the capital you need without giving up equity.

Get approved within 48 hours, with no interest, no annual fee, no foreign transaction fees, and no personal guarantee. Plus, you'll unlock more than $350,000 in exclusive partner rewards from vendors like AWS, Notion, and OpenAI.

Try an interactive demo and join more than 50,000 businesses that trust Ramp to power their growth.

FAQs

Your burn multiple measures how efficiently you turn cash burn into new revenue. Venture debt can improve it by extending runway without heavy equity dilution. While you’ll make interest payments, the extra time to grow often outweighs the added cost if you put the capital into activities that drive revenue.

Often, yes. Many lenders allow upsizing or refinancing tied to milestones or new equity rounds. Refinancing makes sense if rates fall or your financial profile strengthens, but watch for prepayment penalties or relationship terms that could offset the benefit.

Venture debt works best right after an equity raise, when you have strong investor backing and clear milestones ahead. It can extend runway, fund specific projects, or provide insurance if fundraising slows. It’s less useful if you struggle to raise or lack predictable growth.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits