What is debt financing? Overview, how it works, pros and cons

- What is debt financing?

- How debt financing works

- Types of debt financing

- Short-term vs. long-term debt financing solutions

- Advantages of debt financing

- Disadvantages and risks of debt financing

- Debt financing vs. equity financing

- Debt financing examples and use cases

- Sources of debt financing

- When should you use debt financing?

- Get the funding you need with Ramp

Debt financing is borrowing money that you repay over time with interest. It gives your business access to capital without giving up ownership, so you maintain full control while funding growth.

Unlike equity financing, where you exchange ownership for investment, debt financing creates a lender relationship that ends once you repay the balance. The lender doesn’t gain decision-making power or a claim on future profits beyond agreed interest payments.

What is debt financing?

Debt financing is borrowing capital from a lender that you must repay with interest, without giving up ownership of your business. It’s one of the two primary ways to fund a business—the other being equity financing—and includes loans, bonds, lines of credit, and invoice factoring.

When you use debt financing, you enter into a formal agreement with a lender such as a bank, credit union, online lender, or bond investor. That agreement defines the key terms of the borrowing arrangement:

- Principal: The original amount you borrow

- Interest: The cost of borrowing, paid to the lender for taking on risk

- Repayment terms: The schedule, frequency, and duration of payments

Unlike equity financing, debt financing does not give lenders ownership or decision-making power. Once you repay the principal and interest according to the agreement, the relationship ends.

How debt financing works

Debt financing follows a structured process from application to final repayment. Once approved, you receive funds and make scheduled payments until the balance is fully repaid.

Here’s how it typically works:

- Application: Submit financial statements, your business plan, and supporting documentation

- Approval: The lender evaluates your credit history, revenue, collateral, and repayment capacity

- Disbursement: You receive funds as a lump sum or gain access to a credit line

- Repayment: You make scheduled principal and interest payments until the debt is satisfied

Debt financing gives you predictable access to capital while preserving ownership, but it requires consistent cash flow to meet repayment obligations.

Securing debt financing

To secure debt financing, you’ll typically:

- Determine your funding needs and repayment capacity: Confirm how much capital you need and whether your cash flow can support regular payments

- Choose the right financing option: Compare short- and long-term loans, lines of credit, business credit cards, or bonds based on your goals

- Prepare financial documentation: Gather financial statements, revenue records, and supporting materials lenders require

- Submit applications and negotiate terms: Compare offers and negotiate interest rates, fees, and repayment terms

- Finalize the agreement and manage repayment: Sign the agreement, receive funds, and make payments according to the schedule

Taking a disciplined approach improves your chances of securing favorable terms aligned with your financial capacity.

Repayment schedules and covenants

Repayment schedules depend on the loan type. Term loans and credit lines typically require monthly payments, while bonds may pay interest semi-annually with principal due at maturity.

Loan covenants are conditions you must meet throughout the loan term:

- Financial covenants: Requirements to maintain specific ratios, such as debt-to-equity or interest coverage

- Operational covenants: Restrictions on additional borrowing, large purchases, or dividend payments

Violating a covenant can trigger a technical default, even if you’re current on payments. Consequences may include higher interest rates, accelerated repayment, or seizure of collateral for secured loans.

Interest calculation methods

Interest rates may be fixed or variable.

Fixed rates remain constant for the full term, making payments predictable. Variable rates fluctuate based on benchmarks such as the prime rate plus a lender margin, which means your payments can rise or fall over time.

Interest typically accrues daily based on your outstanding principal balance. Some loans use simple interest, calculated only on principal, while others use compound interest, calculated on principal plus unpaid interest, which increases total borrowing costs.

Types of debt financing

Businesses can access several types of debt financing, each suited to different funding needs. Choosing the right option depends on how much capital you need, how quickly you need it, and how predictable your cash flow is.

Bank loans

Bank loans provide a lump sum that you repay over a fixed period with either fixed or variable interest. Terms typically range from 1–10 years for working capital and up to 25 years for real estate.

You’ll generally need strong credit, steady revenue, and sometimes collateral to qualify for competitive rates. Term loans work best for defined purchases such as equipment or property, where you know exactly how much capital you need.

Lines of credit

A line of credit gives you access to funds up to a set limit, and you only pay interest on what you draw. As you repay, funds become available again.

Business lines of credit can be revolving or non-revolving. Rates are usually variable and higher than term loans, but the flexibility makes them useful for managing short-term cash flow gaps.

SBA loans

SBA loans are partially guaranteed by the Small Business Administration, which reduces lender risk and allows for lower interest rates and longer repayment terms.

The tradeoff is a more involved application and underwriting process that can take weeks or months. For qualifying businesses, however, the long-term cost savings can be significant.

Bonds and notes

Bonds and notes are debt securities issued to investors, typically for larger funding needs. These instruments pay interest on a regular schedule, with principal repaid at maturity.

Public bond issuances require regulatory compliance and financial disclosures. Private placements offer more flexibility but are generally limited to larger or more established companies.

Invoice financing

Invoice financing allows you to access cash tied up in unpaid invoices. A financing company advances a percentage of the invoice value and collects payment from your customer.

This option helps businesses with long payment cycles maintain liquidity. Costs are higher than traditional loans, but approval often depends more on your customers’ creditworthiness than your own.

Asset-based lending

Asset-based lending uses collateral such as inventory, accounts receivable, equipment, or real estate to secure funding. Borrowing limits are typically tied to a percentage of the asset’s value.

Because the loan is secured, rates are often lower than unsecured options. However, lenders may require ongoing reporting and collateral monitoring, which adds administrative complexity.

Short-term vs. long-term debt financing solutions

Short-term and long-term debt serve different purposes depending on how quickly you need to repay the funds and what you’re financing. The right choice depends on your cash flow stability and the useful life of the asset or expense.

| Characteristic | Short-term debt | Long-term debt |

|---|---|---|

| Timeframe | Due within 12 months | Due after 12 months |

| Typical uses | Working capital, payroll, inventory | Equipment, real estate, expansion projects |

| Interest rates | Often higher | Generally lower for qualified borrowers |

| Payment structure | Frequent principal and interest payments | Scheduled principal and interest payments |

| Common types | Lines of credit, invoice financing | Term loans, bonds, mortgages |

| Flexibility | Often more flexible prepayment options | May include prepayment penalties |

| Balance sheet impact | Recorded as current liabilities | Recorded as noncurrent (long-term) liabilities |

In general, short-term debt works best for temporary cash flow gaps, while long-term debt aligns better with major investments that generate value over multiple years.

Advantages of debt financing

Debt financing allows you to raise capital while keeping full ownership of your business. If you can manage the repayment obligations, it offers cost predictability and potential tax advantages.

Preserved ownership

You retain 100% ownership and decision-making authority when you use debt financing. Lenders don’t influence hiring, operations, or long-term strategy—they simply expect repayment according to the agreement.

Keeping your equity intact also preserves flexibility for future fundraising or an eventual sale. You aren’t diluting ownership early in your company’s growth.

Predictable costs

Fixed-rate loans provide consistent payment amounts throughout the loan term, which makes cash flow planning more reliable. Variable-rate debt introduces uncertainty, but many agreements include caps that limit how high rates can rise. Even with rate fluctuations, you can model your maximum potential payment.

Tax benefits

Interest payments on business debt are generally tax-deductible, which lowers your effective borrowing cost. This tax shield can improve your return on investment when you use debt to fund growth.

For example, if you borrow at 8% and your marginal tax rate is 25%, your effective after-tax cost is closer to 6%. That spread can meaningfully improve project profitability.

Build business credit history

Making on-time payments strengthens your credit profile and improves your access to future financing. Lenders look for consistent repayment history when evaluating applications. A strong business credit history can help you secure better rates, higher limits, and more favorable terms over time.

Disadvantages and risks of debt financing

Debt financing preserves ownership, but it creates fixed obligations that can strain your business if revenue declines. If you can’t meet repayment terms, the consequences can be serious.

Cash flow pressure

Loan payments are due regardless of your revenue or profitability. Even during a slow month, you’re still responsible for scheduled principal and interest payments.

This rigidity can force difficult tradeoffs. You may delay hiring, cut marketing, or reduce operational investment just to meet debt obligations, which can limit long-term growth.

Collateral requirements

Secured loans put specific business assets at risk. If you default, the lender can seize pledged collateral such as equipment, inventory, or receivables.

Some loans also require a personal guarantee, which puts your personal assets on the line. Even unsecured loans may include blanket liens that give lenders broad claims over business assets in the event of default.

Potential for default

Missing payments can trigger late fees, penalty interest, and credit damage. A weakened credit profile makes future financing more expensive and harder to obtain.

Loan covenants add another layer of risk. Violating required financial ratios or operational restrictions can cause a technical default, even if you’re current on payments. In severe cases, lenders can accelerate the loan balance, demand immediate repayment, or pursue legal remedies.

Debt financing vs. equity financing

Debt and equity financing differ in ownership impact, repayment obligations, and risk. The right choice depends on your cash flow stability, growth plans, and appetite for dilution.

| Factor | Debt financing | Equity financing |

|---|---|---|

| Ownership | You retain full ownership | Investors receive ownership shares |

| Control | No lender control over operations | Investors may influence decisions |

| Repayment | Fixed principal and interest payments | No repayment obligation |

| Cash flow impact | Regular payments required | No required payments |

| Tax treatment | Interest is generally tax-deductible | No comparable tax deduction |

| Risk | Risk of default and asset loss | Risk of ownership dilution |

| Approval speed | Often faster underwriting | Longer due diligence and negotiation |

| Balance sheet impact | Recorded as a liability | Increases shareholders’ equity |

Debt financing works well when you have predictable revenue and want to maintain control. Equity financing may be more appropriate if your cash flow is uncertain or you prefer not to take on fixed repayment obligations.

Debt financing examples and use cases

Debt financing works best when you can clearly connect borrowed capital to revenue generation or short-term liquidity needs. These common scenarios show how businesses use debt strategically.

Equipment purchase

Financing equipment is one of the most straightforward uses of debt. If you purchase a $200,000 CNC machine expected to generate revenue for 10 years, matching the loan term to the asset’s useful life aligns costs with benefits.

Because the equipment serves as collateral, rates are often lower than unsecured loans. If the machine generates predictable monthly profit that exceeds your loan payment, you create positive cash flow while preserving ownership.

Expansion into new markets

Debt can fund expansion without diluting equity. Opening a new location, entering a new region, or launching a product line allows you to scale while maintaining control.

This approach works best when your existing operations generate steady cash flow. Your current revenue can support debt payments during the expansion ramp-up period, reducing financial risk while you grow.

Strong cash flow management becomes critical here. If your base business is stable, debt can accelerate growth without giving up ownership.

Bridging seasonal cash gaps

Short-term debt helps businesses manage cyclical revenue. For example, a landscaping company might rely on a line of credit to cover payroll during winter and repay it during peak spring and summer months.

Invoice financing serves a similar purpose for B2B companies with long payment terms. If customers pay in 60–90 days but expenses are due sooner, financing receivables provides working capital without waiting for collections.

The key is aligning repayment timing with revenue cycles. When structured correctly, short-term debt smooths volatility without creating long-term financial strain.

Sources of debt financing

Where you obtain debt financing affects your interest rate, approval speed, and flexibility. Each funding source comes with different requirements and tradeoffs.

Traditional banks and credit unions

Banks and credit unions often offer the lowest interest rates, especially if you have strong credit and consistent revenue. In exchange, they require detailed documentation, collateral in many cases, and a longer underwriting process.

Approval can take several weeks or more. However, for established businesses, traditional lenders often provide the most cost-effective long-term financing.

Online lenders

Online lenders prioritize speed and accessibility. Many provide decisions within days and may approve businesses with shorter operating histories or lower credit scores.

The tradeoff is higher interest rates and fees. Convenience and faster access to capital typically increase the total cost of borrowing.

Government-backed programs

Government-backed programs, including SBA loans, reduce lender risk through partial guarantees. That structure allows for competitive rates, lower down payments, and longer repayment terms.

The application process is more involved than most alternatives. If you qualify, though, the long-term savings can outweigh the extended approval timeline.

Private credit providers

Private debt funds and alternative lenders serve businesses that fall outside traditional lending criteria. They may offer customized structures or faster approvals when banks decline applications.

Rates are generally higher to compensate for added risk. This option works best when you need flexibility or don’t qualify for conventional financing.

When should you use debt financing?

Debt financing makes sense when you can confidently support fixed repayment obligations and tie borrowed funds to measurable returns. It’s most effective in stable, revenue-generating businesses.

Consider debt financing if you have:

- Established revenue streams: Reliable income that supports consistent payments

- Defined funding needs: Clear ROI, such as equipment purchases, inventory, or expansion

- Strong credit profile: A history that helps you secure competitive rates

- Desire to maintain ownership: A preference to avoid equity dilution

Lenders often evaluate your debt-to-equity ratio when assessing new borrowing. Calculated as Total liabilities / Shareholders’ equity, it measures how much of your company is financed by debt versus owner capital. Higher ratios signal greater leverage and risk, which can limit access to additional financing.

Debt may not be ideal if your revenue is unpredictable or your business is still proving product-market fit. If you can’t reasonably forecast repayment capacity, equity financing or bootstrapping may reduce financial risk.

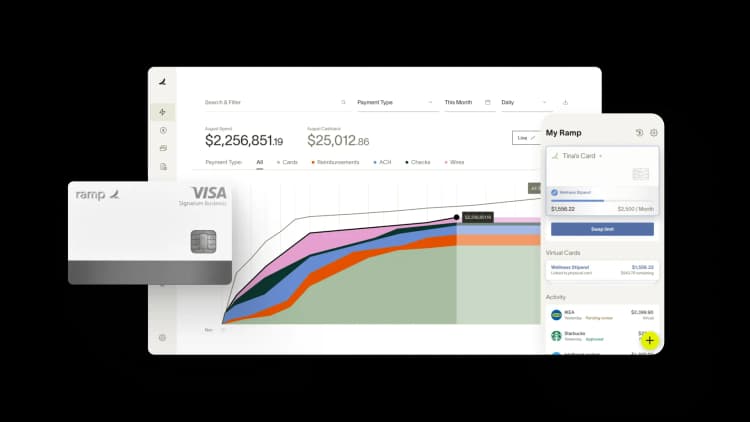

Get the funding you need with Ramp

Traditional debt options like bank loans or invoice factoring can provide growth capital, but they also come with fixed repayment obligations and underwriting complexity. In some cases, a corporate card program may offer a more flexible way to fund operating expenses.

Ramp’s corporate cards provide access to capital based on your business fundamentals rather than personal guarantees alone. To qualify, you need a registered business with an EIN and at least $25,000 in a US business bank account.

Beyond funding, Ramp helps you control and optimize spend. Built-in expense management automatically tracks and categorizes transactions in real time, while customizable spending limits enforce policy at the point of purchase.

Try an interactive demo to see how companies using Ramp save an average of 5% a year across all spending.

FAQs

Debt financing is neither inherently good nor bad—it depends on your cash flow and repayment capacity. It works well if you have predictable revenue and clear returns on investment, but it can create strain if your income is volatile.

Term debt financing is a loan with a fixed repayment schedule over a defined period, usually 1–10 years. You make regular principal and interest payments, making it common for equipment purchases, real estate, and expansion projects.

Lenders evaluate your credit score, revenue history, debt obligations, collateral, and intended use of funds. Their primary concern is whether your business can reliably repay the loan under the agreed terms.

Startups can qualify, but options are more limited. Many lenders require revenue history or personal guarantees, though SBA microloans and revenue-based financing may be available for earlier-stage companies. As you build revenue and repayment history, more financing options typically open up.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits