How leading accounting firms are creating more value for clients with spend management

- How spend management is helping firms achieve more

- Innovative firms are now able to deliver even more value to clients

For decades, accountants have been bogged down with time-consuming, manual processes that often get in the way of more proactive advisory and relationship building with their clients. While some tools emerged to support accountants, they were generally provided by legacy vendors that either didn’t fully understand an accountant’s needs or only enabled one of the many workflows accountants are tasked with.

But now, new spend management products and services, specifically created for accounting firms, are improving how these firms can support their clients. They are empowering their clients to make strategic decisions to help extend the lifespan of their businesses.

We spoke with Zunie Nguyen, Founder and CEO of Yogi CPA, 2021’s CPA.com “Innovative Practitioner of the Year” winner and Joshua Lance, Managing Director of Lance CPA Group, a 2022 award finalist, about how spend management is helping take their firms to the next level.

How spend management is helping firms achieve more

Spend management is a method of managing cash flow that helps companies maximize value while decreasing costs and risk. It can help companies:

1. Helps to shift from reactive to proactive advisory

While reactive accounting services (e.g. compliance work) is an important function, spend management solutions can provide firms with even more ways to provide value to their clients. Instead of spending quarterly or year-end reviews discussing old balance sheets or income statements, firms can now help their clients charter a strategic path forward.

“Adding spend management to our offerings has helped us become better stewards to our clients,” says Zunie. “Many of our customers care about how they’re benchmarking compared to their industry peers. We do KPI analyses and calculate cash-to-conversion cycles and use that information to inform clients on whether they’re under or over-performing in specific categories. With Ramp, we now have the analytics to create these reports and help clients recalibrate their KPIs and spend.”

This information helps firms act more proactively as they’re receiving actionable data that can guide present and future decisions, rather than stale data that simply explains the past.

2. Gives clients the tools they need to weather market volatility

The recession and inflation are making many businesses more deliberate about both how they’re spending and when they’re paying their bills, in an effort to help manage cash flow and prolong their life cycle. Josh, whose firm works with a number of craft breweries, has experienced the positive effects of spend management in helping his companies stay above water.

“A hot topic with our clients is how we can help them deal with the rising costs of goods. For example, the raw ingredient costs of beer and the cost of employees have risen. Some of our clients have experienced a great deal of stress around spend management and stretching their dollars. Solutions that provide data and insights on spend help provide clarity around how a business is spending money, ultimately allowing for better financial management."

These insights and controls can ultimately make the difference between businesses surviving volatile market conditions or going under.

3. Encourages more operational rigor

A lack of information around what employees are spending and why can make it challenging to stay within budget. Spend management allows for spend controls and real-time reporting that can help prevent out-of-control expenses before they happen. The pandemic made some of Josh’s brewery clients, who were operating with a slightly more relaxed approach, become much more conscientious about their cash flow management.

“The pandemic was a forcing mechanism for many of these businesses to become more diligent in their operations. We’re spending a lot more time around cash flow management, which includes not only Bill Pay and AP, but also employee spend and budgeting. Clients are now more amenable to having guardrails in place that can promote better financial habits.”

These concerns are prompting Josh and his team to have more conversations with clients about cash flow projections, concerns about current spending, and which spend controls can be put in place to provide a healthy operating structure and peace of mind.

Spend management can also help promote accountability. For example, issuing a virtual credit card rather than relying on reimbursements can not only empower clients in decision making for their businesses, but also prompt them to be more responsible with receipt submissions as well. This has helped Josh not only with his clients, but with his own firm as well.

“I even notice increased accountability in myself and in our team. There are times when I’ll spend money, lose a receipt, and not pay attention to it. But when I receive a text saying that my card will be shut off if I don’t find and submit the receipt, it holds me accountable and incites action. And I know this applies to our firm’s employees and trickles down to our clients.”

4. Allows firms to expand service offerings

Top firms are embracing spend management as a tool to help them effectively expand their services. Yogi CPA recently launched their CFO branch, The Mindful CFO, which includes a full-scope of related CFO services, such as bookkeeping, payroll, and taxes. Zunie and her team view Ramp’s spend management features as a vital component to successfully launching these new CFO offerings.

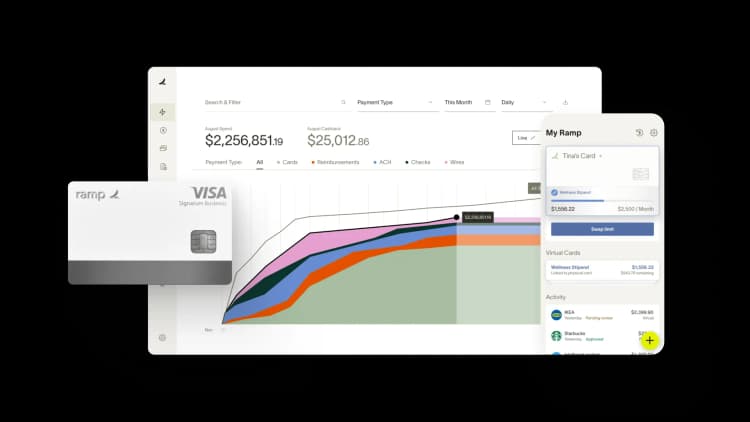

“Spend management is a key component in the month-to-month CFO services that we provide to help startups and small businesses be strategic about their spending. I personally don't like the term "spend management" because I think it limits the vision of these solutions to bring the businesses to the next level of financial independence. When a business is able to spend strategically, it will grow faster. Before this, we would have to go into the accounting software, and engage in multiple steps to communicate with my clients or understand the data because the analytics weren’t readily available. But now we can just log into Ramp and view categorized data, by expense and vendor, right away.”

5. Enables stronger advisory

As companies grow, the potential for expense management complications also increases. The controls needed for a smaller company consisting of 10 employees are vastly different than those needed for a larger company with a workforce of +50. Josh notes one of his successful clients, which encountered rocketship growth, quickly needed an approvals process in place to avoid spend complications.

“Cerebral Brewing is an example of where we were spending a lot of time following up with employees on where they were spending money, how much, and whether it was within their expense policy. Receipts were frequently lost and this put a lot of pressure on us as advisors because we didn’t have the information necessary to do the required job.”

After Josh’s team moved Cerebral Brewing to Ramp, his firm had the visibility necessary to better advise Cerebral and no longer had to waste time wrangling employees for receipts or chasing down out of policy spend. “They’ve only been on Ramp a couple months now, but we’ve already seen a substantial night and day difference in our ability to help Cerebral manage their finances.”

Accounting automation tools can also help firms save valuable time that could be better allocated toward strategic tasks to help their companies grow. Zunie explains how these tools helped her pull detailed reports, faster than ever, to help strengthen the scope of the consulting firm's CFO advisory services.

“Before spend management software, we would depend on our bookkeeping software to pull reports, analyze the details and then communicate it to my clients. Bookkeeping software wasn’t really built for providing the data analytics at the CFO level. That resulted in inefficient time that could have otherwise been spent with the client. Now we're able to access the data almost immediately, with insights by expense categorization and vendor. It is powerful!”

Innovative firms are now able to deliver even more value to clients

Spend management is helping these trailblazing accounting firms with scaling new service offerings centered around innovation. Interested in delivering more value across your portfolio and acting as a trusted advisor to your clients? Sign up to become a Ramp accounting partner.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits