How and when to hire an accountant for your small business

- Does a small business need an accountant?

- What does a small business accountant do?

- Benefits of hiring an accountant

- When to hire an accountant for your small business

- What to look for when hiring an accountant

- How to find and hire an accountant for your small business

- How much does an accountant cost?

- How Ramp's automation handles the work that typically requires an accountant

Small business owners often hire an accountant when they encounter an event that requires deep accounting expertise, such as a funding round or audit. Some hire an accountant during tax filing season or to free up time to focus on other priorities.

As you grow, you'll inevitably start thinking about when you need to hire an accountant. After all, you have plenty of other jobs to do, not least of all planning your business’s growth.

To help answer that question, we've outlined when to hire an accountant for your small business, what services they provide, key benefits, cost considerations, and how to choose the right one.

Does a small business need an accountant?

Hiring a small business accountant is a significant step in building out your company's financial operations. While not every business needs full-time accounting support from day one, many owners face challenges such as time constraints, limited accounting expertise, and the risk of costly errors when trying to manage finances on their own.

If your business is still small and your finances are relatively simple, DIY accounting or in-house bookkeeping can work, especially if someone on staff already has those skills along with a solid grasp of financial reporting.

But as your business expands, your taxes grow more complex, or you need to meet strict compliance requirements, handling it yourself becomes riskier. At that point, an accountant can help reduce your administrative burden and provide the strategic insights you need.

What to consider before you hire an accountant

Here are a few key factors to consider before bringing an accountant onto your team:

- Level of financial support: Are your financial needs still relatively simple, or are they becoming more complex? Bookkeepers handle day-to-day transaction tracking, while accountants interpret that data for tax filing, compliance, and long-term planning.

- Budget: If you don’t have the income to bring on a full-time accountant, you might start with a part-time hire or an accounting firm. These options can be cost-effective in the early stages of your business.

- Business size and growth: A larger business or fast-scaling organization may benefit from dedicated accounting support to improve financial reporting and guide strategic decisions

- Tax situation: Are your business taxes straightforward, or do you deal with frequent deductions, quarterly filings, or multi-state operations? If it’s the latter, an accountant can help ensure compliance and identify tax-saving opportunities.

- Compliance needs: If you’re subject to industry-specific regulations or anticipate an audit, professional accounting guidance can reduce risk and help you stay prepared

What does a small business accountant do?

A small business accountant handles more than just tax filing; they manage the financial side of your business so you can focus on growth. Typical services include:

- Bookkeeping and recordkeeping: Organizing and tracking income, expenses, and receipts

- Tax preparation and filing: Ensuring returns are accurate, timely, and optimized for deductions

- Payroll management: Processing employee paychecks, withholdings, and payroll taxes

- Financial reporting and analysis: Creating balance sheets, income statements, and cash flow reports to inform decision-making

- Business structure advice: Helping you choose or change your legal structure to align with tax and growth goals

- Ongoing compliance and regulatory support: Keeping you up to date with changing tax laws and industry-specific requirements

Benefits of hiring an accountant

Bringing an accountant onto your team can deliver more than just accurate books. The right professional can save you time and reduce stress while giving you the financial insights you need to grow. Here are a few key benefits:

Saves you time and reduces stress

Accountants take on time-consuming tasks such as bookkeeping, tax preparation, and financial reporting. Instead of spending hours chasing receipts during tax season, you can hand off the details and trust that everything is filed correctly and on time.

Ensures compliance and accuracy

Accountants help you avoid costly mistakes and penalties, whether it’s staying on top of changing tax laws or preparing your business for an audit. Their expertise ensures accurate financial statements and organized records. They also make sure you meet all regulatory requirements year-round.

Provides strategic financial insight

Beyond day-to-day accounting, a good accountant can guide bigger-picture decisions. They can help you identify tax deductions, optimize cash flow, and prepare budgets or forecasts. If you’re seeking funding or applying for a loan, they can also supply the detailed financial documentation and analysis lenders look for.

When to hire an accountant for your small business

Certain business milestones or financial situations can signal it’s time to bring in a professional for your small business accounting needs. Here are a few instances where it makes sense to hire an accountant:

You’re starting a business or registering a new entity

An accountant can help you choose the right business structure, set up your accounting system, and help you meet initial tax and compliance requirements. Getting this foundation right early on can prevent costly mistakes down the road.

You’re entering a funding round or seeking a loan or investors

Whether you’re raising money through a traditional funding round, pitching to investors, or applying for a business loan, an accountant can ensure the influx of capital flows into your financial statements correctly and establish appropriate reporting practices. The right accountant can also make projections and run reports to secure future funding rounds.

You need help during tax season or face complex tax situations

Even if you’re comfortable filing your own business taxes, hiring an accountant can save you valuable time and reduce the risk of costly errors. A knowledgeable small business accountant may uncover additional small business tax deductions and recommend strategies that lower your overall liability. They can also guide broader financial decisions that improve your long-term tax position.

You’re experiencing rapid growth or increased transaction volume

A fast-scaling business needs stronger financial oversight. An accountant can improve transaction tracking, streamline reporting, and provide insights that help you manage cash flow and plan for sustainable growth.

Your FP&A requires better inputs

Financial planning and analysis (FP&A) relies heavily on accurate financial data and reporting. Accountants provide the foundational inputs FP&A needs to analyze performance and guide strategic decisions. A good relationship between accounting and FP&A can lead to more innovative and effective financial management, especially when assessing cash flow.

Your business faces an audit or compliance review

While no business wants to hear that the IRS is reviewing their financial records, having a skilled, certified accountant on staff can make it a much smoother process. An experienced accountant will ensure your balance sheet and other financial documentation are in order and help guide you through the audit with ease.

What to look for when hiring an accountant

Here are some qualities to consider when hiring an accountant for your small business, whether it’s in-house or through a third-party firm:

- Billing structure: Will you pay for their services hourly, on a retainer rate, or on a project-based fee? It’s important to understand how much an accountant charges and how they assess their fees.

- Services provided: Some accountants specialize in services such as tax preparation or payroll management. Make sure the person you work with offers the accounting services your business needs and has the flexibility to support your growth.

- Experience: Look for an accountant with experience working with businesses like yours, particularly in terms of industry and business size. Their understanding of your unique challenges will help make managing your business finances easier.

- Certifications: While hiring an accountant with a certified public accountant (CPA) license typically costs more, the designation signifies they have more training and experience. Other valuable certifications to look for include chartered accountant (CA), certified management accountant (CMA), or enrolled agent (EA).

- Communication style: Choose an accountant whose communication style aligns with yours, whether that’s weekly phone calls, meetings, or daily email exchanges. If they work for a firm, ask whether you’ll communicate directly or through an assistant.

How to find and hire an accountant for your small business

Here’s step-by-step guidance for finding and hiring a small business accountant:

1. Identify your unique accounting needs

Start by determining what level of support you need. Are you looking for help with tax filing only, or do you want a full-service accountant who can also handle payroll, financial reporting, and long-term planning? Make a list of your current pain points and your short- and long-term business goals to help narrow down candidates.

2. Set your budget and expectations

Accountants may charge hourly, on retainer, or per project. Typical rates can vary widely depending on location, experience, and scope of work. Decide how much you can afford, keeping in mind that greater expertise often means better accuracy and strategic insight. Set expectations for deliverables and response time before beginning your search.

3. Evaluate firms or individual accountants

Research potential candidates by reviewing their credentials, online reviews, and industry experience. Look for professionals who have worked with businesses similar to yours in size and sector, and check for relevant certifications, such as CPA or EA, which can indicate additional training and expertise.

4. Schedule interviews and check references

Prepare a list of questions for each candidate, covering their experience, approach to problem-solving, and preferred communication style. Ask for references from current or past clients, and follow up to confirm their reliability and quality of work.

5. Meet to discuss ongoing support

Before you make a final decision, have a meeting to align on expectations for ongoing support. Discuss how frequently you’ll communicate, what reports you’ll receive, and how they can help your business grow.

How much does an accountant cost?

The median pay for accountants is roughly $39 per hour or $81,680 per year, according to 2024 data from the U.S. Bureau of Labor Statistics.

Salary can vary by industry and region, with those in finance and insurance earning a median wage of just under $88,000. Per Indeed, accountants in New York and Irvine, California, report the highest average salaries, in line with areas with higher costs of living.

If you want to hire a full-time accountant, you’ll need to factor in salary, benefits, and other compensation. Outsourcing accounting duties to an accounting firm or hiring a part-time accountant can be more cost-effective in some instances.

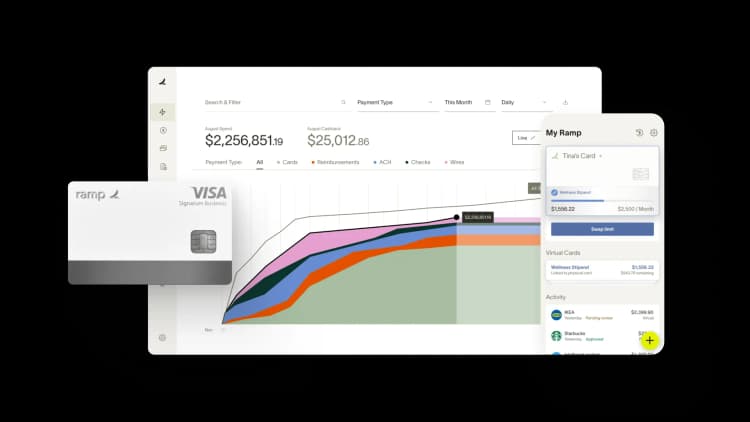

How Ramp's automation handles the work that typically requires an accountant

You know it's time to hire an accountant when manual tasks pile up, errors creep into your books, and month-end close drags on for days. But before you expand your team, consider how AI-powered accounting software can handle the repetitive work that typically requires a full-time hire.

Ramp automates the core accounting functions that consume most of an accountant's time. The platform codes transactions in real time across all required fields, learning your patterns and applying your feedback to maintain consistency. You'll see a 67% increase in zero-touch codings compared to rules-only automation, which means fewer transactions need manual review.

Receipt collection and coding happens automatically: Employees submit receipts through Ramp's mobile app, the system matches them to transactions instantly, and transactions are automatically coded across all required fields based on transaction info and your team’s historic coding patterns. This eliminates the manual processes that typically eat up 16+ hours every month. Ramp also handles accruals automatically, posting and reversing them so expenses land in the right period without manual intervention.

The platform doesn't replace strategic accounting judgment, but it handles the volume work that typically justifies a new hire. You maintain control and visibility while Ramp manages the repetitive tasks in the background.

Try an interactive demo to see how Ramp can empower your accounting team to stay lean, move fast, and close confidently every month.

FAQs

Many small business owners start out managing their own accounting. However, as your finances become more complex, hiring an accountant can help you stay compliant with small business tax laws, financial regulations, and reporting requirements.

Yes, an accountant can help you identify tax deductions, credits, and strategies that lower your overall tax liability. They also help you avoid tax errors and penalties, which can add up over time.

While accountants and CPAs handle many of the same tasks, CPAs complete licensing and certification requirements through their state and meet ongoing education requirements. A CPA may be a better choice if your business requires highly complex tax planning or if you're facing an IRS audit.

While an LLC isn’t legally required to have an accountant, hiring one can help you stay compliant with tax laws, manage bookkeeping, and optimize deductions. This is especially valuable if your LLC has multiple members or operates in multiple states.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°