- Why tracking business expenses matters

- 3 common business expense categories to track

- Sample expense template and workflow

- Tracking business expenses: Manual methods

- Digital tools and expense tracking software

- Expense tracking best practices

- Common mistakes to avoid

- Why Ramp is the best tool to track business expenses

- Put expense tracking on autopilot

Keeping track of business expenses is essential for claiming deductions, managing cash flow, and making informed decisions, but it often breaks down when records are scattered or inconsistent. A reliable system helps you see where money is going, stay compliant, and avoid scrambling at tax time.

Below, we break down how to keep track of business expenses in five practical steps, from separating finances to reviewing spending regularly.

Why tracking business expenses matters

Tracking business expenses matters because disorganized records make it easy to miss deductions, misread cash flow, and make decisions without a clear financial picture. When you know exactly how and where money is spent, you can plan with confidence instead of reacting after the fact.

Keeping track of business expenses isn’t just a bookkeeping concern. It directly affects your tax outcomes, compliance posture, and ability to forecast and control spending. Consistent tracking gives you reliable data to work from instead of assumptions. Tracking your business expenses has a direct impact on tax benefits, compliance, and financial planning.

Tax benefits and deductions

Accurate expense tracking lowers your tax bill by ensuring deductible costs are documented and easy to substantiate. When expenses are recorded consistently, you’re far less likely to overlook write-offs that reduce taxable income.

Commonly missed deductions include:

- Home office costs

- Meals tied to business purposes

- Vehicle expenses and mileage

- Depreciation on equipment

- Professional and legal fees

Proper tracking ensures you have the documentation needed to support these deductions and avoid disputes with the IRS.

Compliance and audits

Organized expense records make it much easier to prepare for an audit. Having receipts and logs on hand, especially for travel, meals, and vehicle use, reduces the risk of adjustments, penalties, or extended reviews.

Clear records show who was paid, what was purchased, when the expense occurred, why it was necessary, and how much it cost. Auditors look for documentation that demonstrates each expense was ordinary, necessary, and correctly categorized.

Financial planning and budgeting

When expenses are recorded in real time, you gain a more accurate view of how cash moves through your business. That visibility helps you anticipate slower periods, plan for large obligations like payroll or taxes, and avoid unpleasant surprises.

Over time, expense data reveals patterns that support better budgeting and forecasting. Historical records become a reference point for future spending decisions and revenue planning.

3 common business expense categories to track

Most businesses rely on a core set of expense categories for bookkeeping, reporting, and tax purposes. These categories act as the foundation for budgets, financial statements, and deductions, even though the exact labels may vary depending on your accounting system.

Before choosing tools or workflows, it helps to understand the types of expenses you’ll be tracking regularly and how they’re typically grouped.

Operating expenses

Operating expenses cover the everyday costs required to keep your business running. These expenses tend to be recurring and predictable, making them especially important to track consistently.

Common operating expenses include:

- Office supplies and equipment, such as computers, printers, and furniture

- Software subscriptions and licenses, including productivity and security tools

- Utilities and rent, such as electricity, internet, phone services, and office space

Tracking these costs over time makes it easier to spot changes in overhead and plan for growth.

Travel and entertainment

Travel and entertainment expenses occur when you’re away from your usual workplace for business purposes, such as meeting clients, attending conferences, or traveling between job sites. These expenses require careful documentation to remain deductible.

Typical travel and entertainment costs include:

- Mileage tracking for business vehicle use

- Meals connected to legitimate business purposes

- Accommodation and transportation, including hotels, airfare, rideshares, and rental cars

For 2026, the IRS standard mileage rate is 72.5 cents per mile. Keep receipts and note the business purpose to support deductions that meet IRS documentation guidelines.

Professional services and marketing

Professional services and marketing expenses support business growth rather than daily operations. These costs often involve external vendors and longer-term outcomes.

Examples include contractor and consultant fees, advertising spend, training programs, and professional development. Tracking invoices, contracts, and dates helps tie these expenses back to specific projects or campaigns and makes reporting easier.

Sample expense template and workflow

Before building tools or automations, it helps to see what expense tracking looks like in practice. A simple template paired with a consistent monthly workflow makes it easier to stay organized without overcomplicating the process.

In a typical month, you collect receipts and charges as they occur, log each expense with the right details, and reconcile totals against your bank and card statements. By the time month-end arrives, your records are already up to date, which reduces stress and speeds up reporting.

Think of your expense management template as a checklist for every transaction. Each expense gets a row, and each critical detail gets its own column, making reviews, reporting, and tax prep far more straightforward.

| Date | Vendor | Amount | Category | Business purpose | Receipt saved |

|---|---|---|---|---|---|

| 1/5/2026 | Office Depot | $124.50 | Office supplies | New printer ink | Yes |

| 1/12/2026 | Uber | $32.70 | Travel | Client meeting | Yes |

| 1/20/2026 | Zoom | $15.99 | Software | Monthly plan | Yes |

Tracking business expenses: Manual methods

Manual tracking methods let you start recording expenses immediately without new tools or subscriptions. For very small businesses or early-stage teams, paper logs and spreadsheets can be effective if they’re kept up consistently.

The trade-off is scale. Manual systems rely on regular upkeep and are more prone to errors as transaction volume grows, so it’s important to understand their strengths and limitations before committing to them long term.

Pros:

- No software costs or learning curve

- Full control over how data is organized

- Easy to customize for simple needs

- Works without internet access

Cons:

- Time-consuming as volume increases

- Higher risk of errors or missing entries

- Difficult to search or summarize

- No automatic backups or integrations

Setting up a spreadsheet system

Spreadsheets like Excel or Google Sheets are flexible and familiar for many teams. When setting up a spreadsheet to track expenses, include consistent columns for the information you’ll need later.

Common columns include:

- Date

- Vendor

- Amount

- Category

- Description

You can use formulas to summarize totals by category or month. For example, if expense amounts are listed in cells C2 through C10, this formula calculates the total:

=SUM(C2:C10)

Consistency matters more than complexity. Use the same category names every time, update entries at least weekly, and protect formulas to avoid accidental changes.

Organizing physical receipts

Even if you plan to move toward digital tracking, physical receipts still matter as a backup. A simple system can prevent loss and confusion with regard to what receipts to keep and for how long.

Common approaches include:

- Filing receipts by month or category

- Scanning receipts as soon as you receive them

- Retaining receipts for as long as tax rules require

Keeping receipts organized supports accurate records and makes audits far easier to handle.

Digital tools and expense tracking software

Digital tools can turn expense tracking from a manual chore into a faster, more reliable process. By automating data entry and syncing transactions, software reduces errors and gives you real-time visibility into spending.

One study found that companies using digital expense tracking saved more than 30,000 hours annually compared with manual systems. For growing teams, those time savings can translate into faster closes and better decision-making.

Expense tracking software generally falls into two categories:

- Simple trackers designed for solopreneurs or very small teams

- Full accounting platforms built for businesses with more complex reporting needs

Popular expense tracking apps

When comparing expense tracking apps, look for features such as receipt scanning, automatic categorization, real-time dashboards, and integrations with accounting software.

| App | Key features | Pricing | Mobile access |

|---|---|---|---|

| Ramp | Automated receipt capture, real-time dashboards, corporate card sync | Tiered; free version available based on business size | Yes |

| Expensify | Receipt scanning, mileage tracking, reporting workflows | Tiered, starting around $5 per member per month | Yes |

| QuickBooks | Full accounting integration, categorization, reconciliation | Tiered, starting around $20 per month | Yes |

Integrating with accounting software

Integrating expense tracking with your accounting software connects spending data directly to your general ledger. Bank and credit card charges sync automatically, reducing manual entry and reconciliation work.

Integrated systems help you categorize recurring expenses, apply rules based on vendors or amounts, and manage approvals in one place. For teams, this reduces confusion, limits policy violations, and keeps deductible expenses compliant without relying on after-the-fact cleanup.

Expense tracking best practices

Consistent expense tracking depends on habits, not just tools. By setting routines and expectations early, you make it easier to keep records accurate as your business grows.

Strong practices reduce errors, improve visibility, and prevent small issues from becoming expensive problems later.

Daily and weekly habits

Consistency is the most important factor in tracking expenses. Logging transactions as they happen, or at least within the same week, prevents receipts from piling up and details from being forgotten.

Use your phone to capture receipts right away, assign categories immediately, and add short notes explaining the business purpose. Calendar reminders or scheduled weekly check-ins can help you stay on track.

Month-end reconciliation

Month-end reconciliation ensures your expense records match your bank and credit card statements. By comparing totals and resolving discrepancies regularly, you catch mistakes early and keep reports accurate.

The month-end close process also prepares your books for budgeting, forecasting, tax prep, and team spending reviews. Regular reconciliation makes those downstream tasks faster and far less stressful.

Common mistakes to avoid

Small errors in expense tracking can compound over time, leading to missed deductions, reporting headaches, or compliance issues. Knowing what to watch for makes it easier to fix problems before they become costly.

Mixing personal and business expenses

Using the same account or card for personal and business purchases quickly muddies your records. It becomes harder to categorize transactions, justify deductions, and reconcile accounts accurately.

From a tax perspective, mixed expenses can raise red flags. The IRS expects a clear separation between personal and business spending, and unclear records may invite closer review. Using dedicated business accounts and documenting reimbursements consistently helps keep records clean.

Missing deductions

Many deductions are missed simply because expenses aren’t tracked in enough detail or are forgotten altogether. Mileage, software subscriptions, professional fees, and small recurring charges are common examples.

Tracking expenses throughout the year and reviewing categories monthly reduces the risk of overlooking deductible costs. Regular reviews make it easier to spot patterns and correct gaps before filing.

Incomplete descriptions

An expense without context is difficult to defend. Notes like “meeting” or “travel” don’t explain why the cost was necessary or who was involved.

Without clear descriptions, even legitimate expenses can be challenged. Adding brief but specific notes when logging expenses strengthens documentation and protects deductions if questions arise later.

Delaying submissions

When receipts pile up, details fade and accuracy drops. Logging expenses weeks later increases the risk of miscategorization or missing charges entirely. Recording expenses daily or weekly keeps information fresh and reduces cleanup at month-end. Same-day receipt capture, even a quick photo, improves accuracy and consistency.

Ignoring policy

Unclear or unenforced expense policies create confusion and delays, especially as teams grow. Inconsistent approvals make it harder to spot duplicate charges, policy violations, or potential misuse.

Clear guidelines on what’s reimbursable, what documentation is required, and when expenses must be submitted help prevent issues. Tools with built-in approval workflows can reinforce policies automatically and reduce friction for everyone.

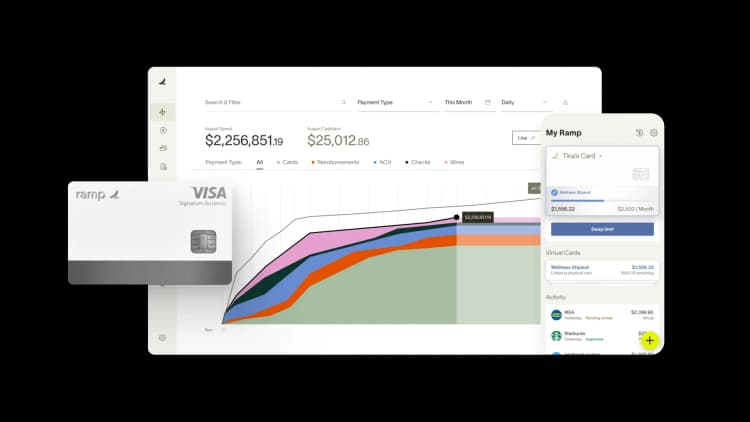

Why Ramp is the best tool to track business expenses

Tracking and categorizing business expenses is a time-consuming, error-prone process. Collecting paper receipts, manually entering data into spreadsheets, and chasing down missing information from employees leads to hours of tedious work each month. Ramp streamlines expense tracking from end to end, freeing your team to focus on higher-value work.

With Ramp's AI-powered expense management software, employees can simply take a photo of a receipt and submit it via web, mobile app, email, or text. Ramp automatically extracts the merchant name, date, and amount, then matches it to the corresponding Ramp card transaction—no more manual data entry or hunting for lost receipts.

Ramp also automatically categorizes each expense based on merchant category codes and your company's unique configuration. Granular category labels like "Advertising & Marketing" or "Meals & Entertainment" are applied instantly, ensuring consistent categorization across your organization. Direct integrations with popular accounting software and ERPs can sync transactions to your GL automatically.

For purchases that require extra context, Ramp makes it easy to add memos for expenses. Whether it's detailing client entertainment costs or explaining a one-off purchase, employees can add notes and tag transactions directly in Ramp. Come audit time, this supporting documentation is freely available, linked to each transaction.

This doesn't just save hours of bookkeeping work; it also helps ensure compliance with your expense policy and reduces fraud and misuse. With Ramp, you get more than an expense tracking solution. You gain end-to-end visibility and control over company spending.

Put expense tracking on autopilot

Ramp's expense management software offers a solution for overcoming the pitfalls of manually tracking business expenses. Together with industry-leading corporate cards, Ramp’s modern finance platform provides:

- Automated expense reporting and approvals

- Customizable spend controls

- A handy mobile app for capturing and storing receipts

Ramp automatically tracks and categorizes all your business expenses and can even offer intelligent recommendations for where you can reduce spending to improve cash flow. Check out our interactive demo environment and see why companies that choose Ramp save an average of 5% a year across all spending.$10 billion

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°