- What's the difference between procurement and accounts payable?

- The risks of misalignment between accounts payable and procurement

- The advantages of aligning procurement and accounts payable

- 3 ways to unify accounts payable and procurement

- Unify accounts payable and procurement with Ramp

When procurement and accounts payable operate in silos, you're left with duplicate data entry, payment delays, and zero visibility into what you're actually spending. Unifying these functions eliminates manual errors and gives you real-time control over purchasing and payments.

You'll see faster payment cycles, stronger supplier relationships, and complete visibility into every dollar your company spends.

What's the difference between procurement and accounts payable?

Accounts payable and procurement are two distinct but related business functions that work together in the purchase-to-pay process.

Procurement is the strategic process of sourcing, negotiating, and acquiring goods and services that a company needs. This includes identifying suppliers, evaluating vendor proposals, and negotiating contracts and pricing. Your procurement team focuses on managing supplier relationships, getting the best value, managing risk, and ensuring suppliers meet quality standards.

Accounts payable handles the payment side of your purchases. Once your procurement team orders goods or services and your team receives them, accounts payable takes over. They process invoices, verify that charges match purchase orders and receipts, obtain proper approvals, and issue payments to suppliers.

The key difference: procurement handles the buying while accounts payable handles the paying. Procurement happens at the front end of your purchasing process and is strategic in nature. Accounts payable occurs at the back end and is more transactional and administrative.

| Function | Focus | Timing | Nature |

|---|---|---|---|

| Procurement | Sourcing and acquiring goods/services | Front end of purchase process | Strategic |

| Accounts Payable | Processing and issuing payments | Back end of purchase process | Transactional/Administrative |

The risks of misalignment between accounts payable and procurement

When your procurement and accounts payable teams operate separately, you'll face issues that hurt efficiency, transparency, and financial performance. Common problems include delayed payments, lost early payment discounts, and strained vendor relationships, all of which directly affect your bottom line.

- Duplicated efforts and inefficiencies: When both departments maintain separate vendor records, you might see duplicate invoice entry, leading to payment delays and extra work to resolve discrepancies

- Conflicting goals and performance metrics: Procurement teams typically focus on cost savings, contract compliance, and supplier consolidation. Meanwhile, accounts payable prioritizes processing speed, payment accuracy, and cash flow management

- Limited visibility between functions: When your AP team can't see upcoming purchase commitments, forecasting cash requirements becomes difficult

- Information gaps: Inconsistent documentation can result in reduced cash flow predictability, damaged supplier reliability due to delayed payments, and increased audit risks

Ultimately, this misalignment creates inefficiencies that slow your financial performance and limit your competitive edge. You'll spend more time resolving conflicts between teams than focusing on strategic finance work.

The advantages of aligning procurement and accounts payable

When accounts payable and procurement work together, the benefits extend across your entire business. Integrating AP and procurement helps you move faster, manage cash more confidently, reduce risk, and build stronger supplier relationships.

Here’s how:

Strategic cash flow management

When AP and procurement share real-time data, you can capture early payment discounts and avoid late fees. Your finance team can balance supplier payment terms with your cash position, maximizing working capital while keeping vendors happy.

Efficient processing

Invoice approvals happen faster because purchase information is readily available. Error rates drop as systems flag discrepancies between purchase orders and invoices. Fraud risk decreases thanks to better controls and visibility throughout the purchase-to-pay cycle.

Better supplier relationships

When procurement and accounts payable present a united front, vendors enjoy faster issue resolution and more favorable contract terms. You're more likely to become a preferred customer, which means better pricing and priority service when you need it most.

Easier data and analytics sharing

Integrated systems deliver comprehensive spending insights that help you improve future procurement strategies, enable more effective contract negotiations, support better vendor selection, and identify consolidation opportunities that would otherwise remain hidden.

3 ways to unify accounts payable and procurement

Real alignment between accounts payable and procurement requires focused work in three areas: technology integration, shared performance metrics, and better teamwork. When you invest in these areas, you'll reduce errors, speed up processes, and strengthen vendor relationships.

1. Implement integrated procure-to-pay systems

P2P software brings procurement and accounts payable together on a single platform. This integration eliminates manual handoffs, prevents data re-entry errors, and ensures information flows automatically from purchase request to final payment. Modern P2P platforms offer features like automated three-way matching, centralized invoice processing, and real-time budget visibility.

When you implement an integrated P2P system, you'll standardize processes, improve visibility, and create a single source of truth for all purchasing and payment activities.

2. Form and build cross-functional collaboration

Start by establishing shared workflows with clear handoff points to reduce friction and confusion. Create communication protocols that specify when and how information should flow between departments. Document these processes so they stay consistent, even as team members change.

To build empathy and understanding between teams, hold regular stand-up meetings and cross-functional workshops. Create job shadowing programs that let team members observe their counterparts in action. These activities foster personal connections and make day-to-day interactions smoother, leading to faster problem-solving and a more collaborative culture.

3. Create and refine shared objectives and KPIs

For true alignment, procurement and accounts payable need to agree on common goals and metrics. Both key performance indicators for AP and procurement should be actionable, measurable, and directly tied to business outcomes that matter to both teams. When everyone measures success the same way, collaboration naturally improves.

Effective shared KPIs include touchless invoice rate (aim for 70% or higher), on-time payment percentage, and early payment discount capture rate. Set a monthly schedule for reviewing these metrics together. Regular joint reviews help you identify process bottlenecks and improvement opportunities that might otherwise stay hidden.

When you align technology, metrics, and collaboration, you'll see faster invoice processing, fewer payment errors, and stronger vendor relationships. Start with one area where you can make quick progress, then build momentum across all three.

Unify accounts payable and procurement with Ramp

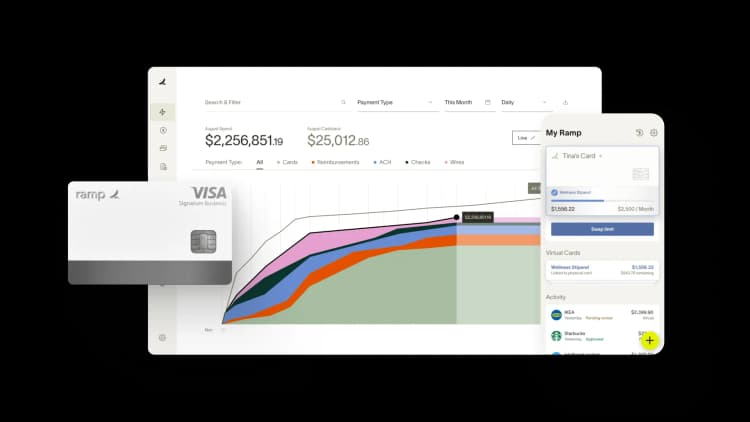

Ramp connects your AP and procurement teams on one platform, eliminating the back-and-forth between disconnected systems. You can automate purchase requests, approvals, and three-way matching to reduce manual work and catch errors before they become costly problems.

Real-time visibility means your teams can make faster decisions without waiting for end-of-month reports.

See how Ramp brings AP and procurement together—try the demo.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits