Accounts payable outsourcing: Pros, cons, and alternatives

- What is accounts payable outsourcing?

- Why businesses outsource accounts payable

- AP outsourcing pros and cons

- AP outsourcing vs. AP automation

- How much does accounts payable outsourcing cost?

- How to choose an AP outsourcing provider

- Beyond AP: Can you outsource accounts receivable too?

- Why Ramp Bill Pay is the best way to simplify your AP workflow

Outsourcing accounts payable (AP) is an attractive option for many small businesses because it frees your team from the manual work of managing invoice processing and vendor payments.

But before you jump at the opportunity to outsource AP, you should weigh the pros and cons, such as workload, efficiency, security, and cost. If you find you’d rather keep the process in-house, financial technology is one alternative that can help simplify your AP process.

What is accounts payable outsourcing?

Accounts payable outsourcing is the process of hiring a third party to handle most (or all) of the tasks in your accounts payable workflow. Instead of having your internal team handle every invoice, vendor payment, and related paperwork, you partner with experts who take care of these responsibilities on your behalf.

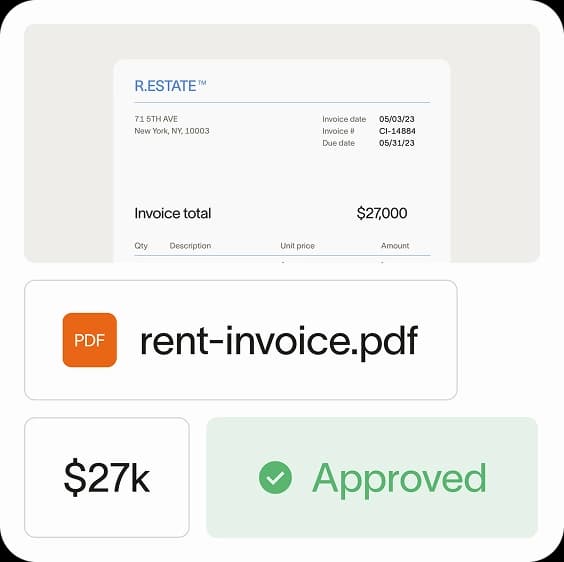

The scope of what gets outsourced can vary depending on your business needs, but most businesses delegate several key areas. Invoice processing sits at the heart of AP outsourcing. This includes receiving invoices, verifying their accuracy, matching them against purchase orders (POs), and preparing them for approval.

Vendor communication is another major component, covering everything from answering payment inquiries to resolving disputes about billing discrepancies. Many companies also outsource payment approvals and the actual disbursement of funds, whether through checks, ACH transfers, or other electronic payment methods.

When do companies outsource accounts payable?

Companies typically start exploring outsourcing options when their accounts payable workload begins to strain their internal resources. This often happens during periods of rapid growth when invoice volumes spike faster than staffing can manage.

Other businesses turn to AP outsourcing when they need specialized knowledge they don't have in-house, such as navigating industry-specific or international payment requirements. Some also consider outsourcing when they want to reduce overhead costs, or when their current AP process is prone to errors that create costly delays and damaged vendor relationships.

Why businesses outsource accounts payable

The decision to outsource accounts payable usually stems from practical business challenges that companies face as they grow and evolve. You may find yourself dealing with mounting paperwork, stretched resources, and processes that consume more time and energy than they should. Here's why you may want to outsource accounts payable:

- Manual error reduction: Manual invoice processing can result in duplicate payments, missed early payment discounts, incorrect vendor information, or payments to the wrong accounts. Outsourcing providers use specialized software and established procedures to reduce these types of mistakes.

- Cost control: Running an internal AP department means investing in staff, software, and overhead. When you outsource, you typically pay a predictable monthly fee that's often lower than your total internal costs.

- Speed and accuracy: Providers can often complete tasks faster and more accurately than internal teams that juggle AP responsibilities alongside other duties. This translates into better cash flow management and stronger vendor relationships.

- Strategic growth: Instead of spending hours on data entry and invoice matching, your finance team can concentrate on financial analysis, planning, and other activities that require their unique knowledge of your business

- Compliance and security: Companies that provide accounts payable services invest in security measures to protect sensitive financial data. They often have certifications and security protocols that would be expensive and time-consuming for individual companies to implement on their own.

Outsourcing accounts payable helps you reduce manual data entry errors, control costs, improve operational efficiency, and redirect internal teams toward strategic financial planning and analysis activities.

AP outsourcing pros and cons

Benefits of accounts payable outsourcing

The AP process has many steps and requires constant attention. That means there are some pretty clear benefits of outsourcing accounts payable:

- Cost savings: Hiring a third-party AP provider can be a cost-effective option because it reduces the hefty costs of full-time employment, like payroll expenses, software, and equipment. It can also reduce your processing costs if the provider can help you avoid late payment fees or negotiate with vendors for early payment discounts.

- Increased efficiency: A company that specializes in AP tasks should be a model of efficiency. High-quality service providers will have comprehensive business processes in place to streamline invoice tracking and related tasks. They’ll also hire quality employees and invest in specialized training that makes the entire workflow seem effortless.

- Solves pain points: If parts of your AP process are ineffective, tedious, or stressful, an AP service provider can slip right in and do those tasks for you. For example, if you’ve detected duplicate payments or missed payment deadlines, an AP service provider should be able to provide the financial controls you’re missing.

- Provides credibility: Using a well-known provider to perform AP functions can lend credibility to your business. Suppliers, vendors, banks, and manufacturers who see that you contract with a high-quality provider will feel confident that they’ll get paid on time and in the correct amounts, making it easier for you to commission deals.

By outsourcing your accounts payable functions, you can reduce expenses, boost efficiency, build stronger vendor relationships, and gain access to specialized expertise while allowing your internal team to concentrate on activities that directly drive business growth and revenue.

Drawbacks of AP outsourcing

Accounts payable outsourcing isn't a perfect solution for every business, and it's important to weigh the potential challenges before making the switch:

- Security risk: There’s inherent risk whenever you grant systems access to a third party, so be sure the risk is worth it. If the AP service provider processes your data within their own systems, make sure they provide at least the same level of security you require from your internal tools.

- Loss of control: This may go without saying, but if you rely on a third party to perform most aspects of your collection cycle, you’ll lose some control over your AP workflows. You might find it harder to make quick adjustments to processes or respond immediately to urgent payment requests that fall outside standard procedures.

- Less vendor contact: When a third party handles your AP processes, you may have fewer direct interactions with suppliers, which can weaken the personal relationships you've built over time and make it harder to address vendor concerns quickly

- Less flexibility: If you want to do something outside the prescribed method—such as expediting payment to show good faith to a new supplier or to improve relationships—it could be more difficult with a third-party provider controlling your invoice payment process

Despite these potential drawbacks, the benefits of AP outsourcing may outweigh the challenges when you choose the right provider and communicate clear expectations.

AP outsourcing vs. AP automation

Accounts payable outsourcing and AP automation represent two distinct approaches to managing your invoice processing workload. While outsourcing transfers responsibility to an external provider, automation keeps operations in-house while leveraging technology to reduce manual tasks.

The State of e-Payables 2024 report from Ardent Partners shows that top-performing enterprises leverage technology to streamline their AP, resulting in invoice processing costs dropping from approximately $13 to $3 per invoice, and processing time dropping from roughly 17 days to just 3 days per invoice.

Both methods aim to improve efficiency and accuracy in your AP department, but they differ significantly in how they achieve these goals and what outcomes you can expect. If you're weighing both options, comparing accounts payable automation software can help you identify platforms that match your team’s needs—especially if you’re leaning toward keeping AP in-house.

Implementation and setup

AP outsourcing typically involves minimal technology setup since you'll be using your provider's systems and processes. Most vendors can begin processing invoices within a few weeks, requiring mainly data transfer and access arrangements.

Automation requires installing new software and integrating it with your current accounting software, ERP systems, and banking tools. Depending on the complexity of your setup and other customization needs, this process can take weeks to several months. Your team will need training on new workflows, and you'll likely spend time fine-tuning settings to match your requirements.

The setup timeline varies considerably between these options. Outsourcing offers faster initial deployment but less control over the process, while automation may take longer up front but provide greater flexibility to match your specific requirements and preferences.

Cost and ROI

Accounts payable services are typically charged per invoice processed or as flat monthly fees based on transaction volume. While this creates predictable recurring payments, costs can escalate quickly with add-on services such as rush processing, special reporting, or custom approval workflows. You'll want to scrutinize contract terms for potential fee increases over time.

Automation solutions usually operate on subscription or licensing models with predictable monthly or annual fees. Although initial software costs and implementation expenses create higher up-front investments, the per-transaction cost often decreases significantly as volume grows. Expect to see savings within 12–18 months of deployment.

Return on investment timelines differ substantially between approaches. Outsourcing delivers immediate labor cost reductions, but ongoing fees limit long-term savings potential. Automation requires patience for payback but often provides superior financial benefits over the long term, especially for high-volume operations.

Security and compliance

When you outsource accounts payable, your data security depends entirely on your provider's controls, certifications, and protocols. Reputable vendors maintain SOC 2 and ISO 27001 compliance and strong cybersecurity measures, but you're still trusting another organization with sensitive financial information. Due diligence is critical when evaluating potential partners.

Automation software includes built-in security features such as encryption, role-based access controls, and audit logging capabilities. However, you remain responsible for proper configuration, user management, and ongoing monitoring. The technology provides tools for protection, but your team must implement and maintain appropriate safeguards.

Both approaches offer strong fraud prevention capabilities through different mechanisms. Outsourcing relies on provider expertise and established procedures, while automation uses workflow controls and approval routing to prevent unauthorized payments. Audit trails exist in both scenarios, though automation typically provides more detailed visibility into processing activities.

Scalability and control

AP providers excel at handling volume fluctuations without requiring additional hiring or training on your part. They can easily accommodate seasonal spikes or business growth by allocating more resources to your account. However, this flexibility comes with reduced oversight of daily operations and less ability to make immediate process adjustments.

Automation scales naturally with your business, processing higher volumes without proportional staff increases. You maintain complete control over approval workflows, vendor management, and reporting requirements. The software adapts to organizational changes through configuration updates rather than renegotiating service agreements with external providers.

The trade-off between convenience and control becomes most apparent in scalability scenarios. Outsourcing offers effortless expansion but limits your ability to customize processes or implement changes quickly. Automation requires more internal management but provides superior flexibility to adapt workflows as your business grows.

How much does accounts payable outsourcing cost?

The most common approach is per-invoice pricing, where you pay a set fee for each invoice. The amount per invoice usually depends on complexity and volume. Many providers also offer flat monthly fees, which can be more predictable for budgeting purposes and often work well for companies with consistent invoice volumes.

Volume-based discounts are another key consideration. Most outsourcing partners provide tiered pricing that reduces your per-invoice cost as your monthly volume increases. For example, you might pay $8 per invoice for the first 100 invoices, $6 for invoices 101–500, and $4 for anything above 500 invoices per month.

Potential add-on charges

Beyond the base pricing, several add-on charges can affect your total investment:

- Rush processing fees for urgent vendor payments

- System integration costs for connecting your existing ERP or accounting software

- Ongoing technical support charges for user training and troubleshooting

- Custom reporting fees for specialized financial reports

- Document storage costs for maintaining digital invoice archives

- Multi-currency processing fees for paying international vendor invoices

Based on these various pricing models and potential add-on fees, the total cost of accounts payable outsourcing will depend on your company's specific invoice volume, processing complexity, and required service features.

How much does AP automation cost?

When comparing automation solutions, consider that AP software licenses are typically charged monthly per user, and implementation can cost several thousand dollars depending on system complexity. While automation software is often less expensive up front, you must also factor in the ongoing costs of staff training, system maintenance, and internal management time.

The key is getting complete transparency on all potential costs before signing any agreement, whether for outsourcing or automation. Request detailed pricing breakdowns that include base fees, volume thresholds, and any additional charges that might come up. Ask for examples of total monthly costs based on your typical invoice volume and processing requirements.

This comprehensive view will help you accurately compare different providers and determine whether outsourcing or automation makes more financial sense for your organization.

How to choose an AP outsourcing provider

Not all accounts payable outsourcing companies are created equal. To get the best services, make sure your third-party provider offers these benefits in addition to core accounts payable functions:

- Experience and reputation: The company you hire should be able to deliver the services it promises. Look at online reviews and testimonials, or get recommendations from your business partners or network to find someone reliable.

- Security and compliance standards: Ask prospective providers targeted questions about their security practices and verify that they follow third-party data security standards, such as SOC 2, ISO 27001, and the NIST framework. If relevant, ensure the provider complies with data security and privacy regulations such as HIPAA and GDPR.

- Technology and integration capabilities: Your AP provider should work seamlessly with your existing accounting software and ERP systems. Look for companies that offer modern APIs, real-time data syncing, and compatibility with popular platforms such as QuickBooks or NetSuite.

- Service-level agreements and support: Your provider should offer specific commitments around processing times, accuracy rates, and response times for support requests. Look for companies that provide dedicated account managers and multiple support channels.

- Customization and scalability: Choose a company that can customize their processes to match your AP approval processes, reporting requirements, and unique business rules. They should also handle volume fluctuations smoothly, whether you're processing 100 invoices per month or 10,000.

Your AP service provider should also be able to set up payment gateways that make sending payments easier and potentially help you get paid faster.

Cost structures and fee transparency

Get clear details about providers' pricing models up front. Most companies use different approaches: Some charge per transaction processed, others work with monthly retainers, and many offer volume discounts for higher invoice volumes. Ask for specific examples of how costs would scale as your business grows.

Transparent pricing protects you from unexpected expenses down the line. The best providers will give you a detailed breakdown of all fees, including any setup costs, implementation charges, or additional services such as rush processing.

Watch out for providers who are vague about their pricing or mention "custom quotes" without providing concrete examples. You want a partner who's clear about costs from the beginning, so you can budget accurately and avoid surprises on your monthly invoices.

Beyond AP: Can you outsource accounts receivable too?

Many AP outsourcing providers have expanded beyond accounts payable to include accounts receivable management. These comprehensive solutions handle invoice processing, vendor payments, customer billing, collections, and payment processing. This dual approach allows you to consolidate your financial operations under one experienced partner.

Centralizing both AP and AR functions creates significant benefits. Your financial reporting becomes more cohesive when handled by one provider, making it easier to track cash flow and identify issues. The unified approach also reduces the complexity of managing multiple vendor relationships while providing consistent service standards across all payment activities.

Before committing to both services, assess your company's specific requirements and capabilities. Consider factors such as transaction volumes and existing staff expertise. You may benefit from outsourcing one function initially, then expanding your partnership as you gain confidence and see results.

Why Ramp Bill Pay is the best way to simplify your AP workflow

Ramp Bill Pay is a powerful autonomous accounts payable platform designed to address the core pain points in AP. From capturing invoice data and coding expenses to scheduling outgoing payments and automating reconciliations, Ramp streamlines each step and integrates seamlessly with your ERP—helping you close your books efficiently, not just add more tasks.

Unlike outdated AP systems that struggle with limited ERP connectivity, inconsistent purchase order matching, and fragmented processes, Ramp Bill Pay automates the entire AP journey. The result? Invoices that process 2.4x faster than traditional software1, along with up to 95% of companies reporting better visibility over their finance operations2.

Ramp continues to be recognized as the easiest AP software to use based on G2 reviews. With 2,000+ user reviews averaging 4.8 out of 5 stars, finance teams from every sector trust Ramp to reduce manual tasks, prevent costly mistakes, and keep financial records accurate. One reviewer even described Ramp as the best method for handling AP and expense management.

Here’s a closer look at what Ramp Bill Pay brings to the table:

- AI agents that categorize invoices using past transaction data, flag fraudulent activity pre-payment, generate approval records, and execute vendor payments via cards—removing manual roadblocks from your workflow.

- Intelligent approval workflows with customizable routing and user permissions

- Automated invoice capture powered by AI and suggested GL codes

- Comprehensive controls that unify AP, procurement, expenses, and accounting

- Automated PO matching that compares invoices to purchase orders with 2-way and 3-way matching to catch overbilling

- Batch payment processing, recurring bill support, and complete vendor payment tracking

- Seamless ERP connections with popular systems such as Sage Intacct, NetSuite, and Xero

- Flexible payment support for ACH, cards, checks, plus domestic and international wires

- AI-powered 1099 prep that automatically categorizes bill pay spend into 1099-NEC and 1099-MISC boxes with calculations

- Send W-9 and e-consent requests in bulk to your vendors simultaneously

- Submit filings to IRS and eligible states in minutes without extra portals

Companies of all sizes, from small businesses and mid-market to enterprise teams, choose Ramp to give their AP department more control and efficiency. Here are just a few success stories:

- Hospital Association of Oregon shortened AP processing from 10 hours per batch to just a few minutes

- Snapdocs switched from BILL to Ramp and accelerated bill pay processes with accurate OCR

- Advisor360 cut accounts payable processing down by 50%

What sets Ramp Bill Pay apart?

Ramp Bill Pay shows what AP automation can achieve—precision, autonomous operations, touchless processing, and speed. With advanced AI, robust ERP integrations, and workflow automation built for today’s teams, Ramp empowers you to work smarter and faster with every invoice.

Use Ramp Bill Pay independently as your core AP system, or connect it with Ramp's corporate card programs, expense management, and procurement platform for complete spend oversight. Get started with Ramp’s AP automation solution for free, then scale up for $15 per user monthly or custom enterprise pricing.

It’s time to upgrade your AP process. Get started with Ramp Bill Pay.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°