- What are accounts payable metrics?

- What are the 3 main categories of accounts payable metrics?

- 10 accounts payable metrics every team should track with examples

- Advanced AP metrics for strategic decision-making

- How to track and improve accounts payable performance

- Best practices for monitoring and improving AP performance

- How Ramp Bill Pay automates your entire AP process

- Why choose Ramp Bill Pay?

According to the Ardent Partners State of ePayables 2024 report, the average cost to process a single invoice is $12.88, while Best-in-Class teams bring that number down to $2.78. Managing invoices, payments, and vendor relationships is a constant balancing act. Without the right systems in place, staying on top of everything can quickly become overwhelming.

Tracking the right accounts payable metrics makes this process much easier. By focusing on specific AP metrics, you can gain insights that help streamline operations and save money.

What are accounts payable metrics?

Accounts payable metrics

Accounts payable (AP) metrics are key performance indicators (KPIs) that measure the efficiency and accuracy of your AP processes.

Accounts payable performance metrics help your business track invoice processing times, payment accuracy, and vendor relationships to identify areas for improvement. Without them, it’s difficult to identify inefficiencies across the various steps of AP, from invoice approvals to payment scheduling.

By monitoring the right AP metrics, your business can gain visibility into performance, strengthen supplier trust, and make smarter financial decisions. Modern AP automation tools can improve these metrics while also providing built-in tracking dashboards to ensure continuous improvement.

What are the 3 main categories of accounts payable metrics?

AP metrics fall into three key categories, each offering insight into different aspects of your accounts payable process:

- Operational metrics: Measure AP efficiency by tracking how quickly and accurately invoices are processed. Examples include invoice processing time and invoices processed per full-time employee.

- Financial metrics: Assess the cost-effectiveness of your AP processes, helping your business optimize cash flow. Key examples include average cost per invoice, early payment discounts captured, and late payment penalties incurred.

- Supplier metrics: Evaluate your vendor relationships and payment reliability, ensuring smooth operations. A few examples include supplier inquiries and disputes, as well as payment terms compliance.

Monitoring these categories provides your business with a comprehensive view of AP performance, enabling smarter financial decisions and more efficient operations.

10 accounts payable metrics every team should track with examples

1. Days payable outstanding (DPO)

Days payable outstanding measures how long, on average, your business takes to pay suppliers. It’s a key liquidity and working capital metric that shows whether you’re optimizing cash flow or risking strained vendor relationships by delaying too long.

DPO = Accounts payable / (Cost of goods sold / 365)

For example, if your company has $300,000 in accounts payable and $3,650,000 in annual COGS, your DPO is 30 days.

A higher DPO improves liquidity by holding onto cash longer, but it may harm supplier trust if stretched too far. A lower DPO shows faster vendor payments but can reduce available working capital. Most businesses aim for 30–60 days, depending on industry standards and negotiated terms.

2. Average cost per invoice

Tracking your average cost per invoice provides a clear picture of how much your business spends to process each invoice. The lower this cost, the more efficient your AP function becomes.

Average cost per invoice = Total invoice processing costs / Number of invoices processed

For example, if your company processes 1,000 invoices per month at a total cost of $10,000, the average cost per invoice is $10.

This metric highlights how efficiently your AP team is operating. Labor costs, overhead, transaction fees, and software expenses all influence the final figure. High costs suggest inefficiencies such as heavy manual work, redundant tools, or payment methods with high fees.

Companies that use automated invoice management software often see a notable reduction in cost per invoice, leading to significant savings.

3. Average invoice processing time

The average invoice processing time measures how long it takes for an invoice to move from receipt to payment.

Average invoice processing time = Total processing time for all invoices / Number of invoices processed

For example, if your AP department processes 100 invoices in a total of 1,000 days, your average processing time is 10 days. However, let’s say that industry benchmarks hover around 5 days for average processing time. Then that means there’s room for improvement.

The faster the process, the more efficient your AP function. Processing time is shaped by approval bottlenecks, manual data entry, invoice discrepancies, and the speed of payment methods. Shorter cycle times improve cash flow, strengthen vendor relationships, and reduce the risk of late payment penalties.

4. Percentage of invoices processed straight-through

Straight-through processing (STP) refers to invoices that go from receipt to payment without manual intervention. A higher percentage means fewer errors and less manual work.

STP percentage = (Number of invoices processed without manual intervention / Total invoices processed) * 100

For example, if 7,000 out of 10,000 invoices are processed without manual touchpoints, your STP rate is 70%. Increasing this percentage leads to faster approvals, lower labor costs, and fewer payment delays.

STP is one of the clearest indicators of AP efficiency. Digital invoices (e-invoices, XML, or EDI) process faster than paper, while clean, structured data reduces exceptions. Vendors that comply with invoicing requirements and automation tools that capture and match data accurately all contribute to higher rates.

Companies with high STP rates can reduce processing costs by using AP automation to ensure invoices flow through seamlessly, minimizing human intervention and error risks.

5. Number of invoices processed per full-time employee

This metric measures the productivity of your AP team by tracking how many invoices a single full-time employee (FTE) processes within a given period.

Invoices per FTE = Total number of invoices processed / Number of full-time AP employees

For example, if your AP team of 5 full-time employees processes 2,500 invoices per month, the average productivity per FTE is 500 invoices per month.

This measure shows how effectively labor resources are being used. A higher number of invoices processed signals greater efficiency, while a lower number may indicate bottlenecks, manual inefficiencies, or the need for process improvements. It also helps finance leaders benchmark staffing needs against growth.

6. Invoice exception rate

The invoice exception rate measures the percentage of invoices that require manual intervention due to errors or discrepancies. A high exception rate slows down processing, increases labor costs, and introduces payment delays, making it a key metric for AP efficiency.

Invoice exception rate = (Number of exception invoices / Total number of invoices processed) * 100

For example, if your team processes 5,000 invoices per month and 500 require manual intervention, your invoice exception rate is 10%.

Lowering this rate can reduce processing delays, labor costs, and payment errors. Some common factors that contribute to invoice exceptions mainly include data discrepancies (like mismatched invoice details) and vendor errors (like invoices submitted in incorrect formats).

Try to aim for an exception rate below 5% by standardizing invoice formats, improving vendor compliance, and using automation for real-time validation.

7. First-time match rate

The first-time match rate shows the percentage of invoices that match purchase orders (POs) and receipts correctly on the first attempt, without manual rework. A high rate reflects accurate data and smoother AP operations.

First-time match rate = (Invoices matched on first attempt / Total invoices) * 100

For example, if 9,000 out of 10,000 invoices match correctly on the first attempt, your first-time match rate is 90%.

This matters because fewer mismatches mean less time wasted resolving disputes, faster cycle times, and stronger supplier trust. You can raise this metric by automating 3-way matching between invoices, purchase orders, and receipts, standardizing invoice formats and coding, and collaborating with vendors to reduce input errors.

8. Percentage of late payments and penalties incurred

Tracking this metric helps you understand the financial impact of late payments. A high percentage signals inefficiencies in AP workflows, cash flow issues, or approval bottlenecks, all of which can hurt financial stability.

Late payment percentage = (Number of late payments / Total payments made) * 100

For example, if your company processes 1,000 payments in a month and 50 are late, your late payment rate is 5%.

Beyond being operational red flags, a high percentage of late payments can damage supplier trust, incur penalty fees, and even affect your company’s credit standing. Building reliable, automated workflows reduces these risks and helps maintain strong vendor relationships.

9. Number of supplier inquiries and disputes

This metric tracks the volume of payment-related inquiries and disputes from suppliers, providing insight into the efficiency and accuracy of your AP process. A high number of inquiries suggests recurring issues with invoice accuracy, payment delays, or poor communication, which can damage vendor relationships and slow down operations.

Supplier inquiry rate = (Total supplier inquiries and disputes / Total payments made) * 100

For example, if your company processes 1,000 payments per month and receives 50 supplier inquiries, the inquiry rate is 5%, signaling potential inefficiencies.

Frequent supplier inquiries often stem from unclear payment timelines, invoice mismatches, or missing remittance details. If vendors don’t receive payments when expected or notice discrepancies in amounts, they’ll reach out for clarification, adding extra work for your AP team.

Minimizing supplier inquiries requires a combination of automation, clear communication, and standardized processes. Automated invoice matching and real-time payment status updates can significantly reduce disputes by ensuring accuracy before payments are sent.

10. Supplier's payment terms

Tracking the average payment terms you have with suppliers helps manage cash flow and optimize working capital. Longer payment terms allow more flexibility, while shorter terms require faster outflows, impacting liquidity.

Average payment terms = Sum of all supplier payment terms (in days) / Number of suppliers

For example, if your company works with five suppliers offering terms of 30, 45, 30, 60, and 45 days, your average payment term is 42 days.

Payment terms directly affect both cash flow and supplier trust. Industry norms often set the baseline, but factors like supplier leverage, your company’s creditworthiness, and the reliability of your payment processes shape what terms you can negotiate. Stronger relationships and predictable payments can secure more favorable terms.

Your business can improve this metric by renegotiating contracts, demonstrating strong credit history, and leveraging automation to build supplier confidence. Extending terms strategically, without damaging vendor trust, helps free up cash for operations while still maintaining healthy supplier relationships.

Advanced AP metrics for strategic decision-making

While core AP metrics measure day-to-day efficiency, advanced metrics highlight opportunities for strategic improvement. These indicators go beyond tracking costs and cycle times to show how well your team captures discounts, avoids costly errors, and leverages automation for scale.

Percentage of early payment discounts captured

This metric measures how effectively your AP team takes advantage of early payment discounts, directly impacting cash flow and cost savings. A higher percentage means better cash management and stronger vendor relationships, while a lower percentage indicates missed opportunities for savings.

Early payment discounts captured (%) = (Number of discounts captured / Total available discounts) * 100

For example, if your company had 100 early payment discount opportunities in a month and captured 80, your discount capture rate is 80%.

Capturing more early payment discounts reduces procurement costs, improves supplier goodwill, and strengthens financial efficiency. Missed discounts, on the other hand, point to approval delays or liquidity issues that weaken cash management.

AP teams can raise this percentage by speeding up invoice approvals, maintaining sufficient cash flow, and using automation tools to flag and prioritize discount opportunities.

Vendor payment error rate

The vendor payment error rate tracks the percentage of payments that are incorrect, such as duplicates, overpayments, or payments sent to the wrong vendor.

Vendor payment error rate = (Number of payment errors / Total payments processed) * 100

For example, if your team processes 2,000 payments in a month and 40 are incorrect, your error rate is 2%. While that may sound small, even a 2% error rate can result in thousands of wasted dollars and hours spent fixing mistakes.

These mistakes not only create financial leakage but also add reconciliation work and can damage supplier trust. You can reduce errors by using AP automation with built-in duplicate detection, validating vendor master data before releasing payments, and enforcing approval workflows that separate duties.

AP automation rate

The AP automation rate measures the percentage of invoices processed automatically versus manually. Unlike ROI, which focuses on financial savings, this metric highlights operational efficiency and scalability.

AP automation rate = (Invoices processed automatically / Total invoices processed) * 100

For example, if your AP team processes 5,000 invoices in a month and 4,000 are automated, your automation rate is 80%.

A higher automation rate typically reduces cost per invoice, shortens cycle times, and helps teams handle larger volumes without increasing headcount. To increase automation, adopt e-invoicing standards, use AI-powered invoice capture and matching, and integrate AP tools directly with your enterprise resource planning (ERP) or accounting systems.

How to track and improve accounts payable performance

To make meaningful improvements in AP performance, you first need to understand where you stand. Setting clear AP goals and identifying inefficiencies are essential steps toward optimizing processes and reducing costs.

1. Establish AP performance benchmarks

Define benchmarks to measure AP efficiency and pinpoint areas for improvement. Key benchmarks to focus on include average invoice processing time, cost per invoice, and the percentage of invoices processed, as mentioned earlier. Industry standards and historical data can help you set realistic targets.

Ensuring your team is well-trained in AP best practices will also improve accuracy and consistency in meeting these benchmarks.

2. Identify areas for improvement

Once benchmarks are in place, analyze your current AP workflows to uncover inefficiencies. Common red flags include delays in invoice approvals, high exception rates, and frequent supplier disputes. Addressing these problem areas helps streamline processes and improve overall AP performance.

3. Implement process optimizations

Optimizing AP processes improves efficiency, reduces costs, and enhances financial accuracy. By streamlining workflows and using automation, your business can:

- Streamline invoice receipt and data entry: Electronic invoicing reduces manual entry errors and ensures all invoices are captured in a centralized invoice management system. This speeds up processing and minimizes the risk of misplaced invoices.

- Automate invoice matching and coding: Automated matching of invoices to purchase orders and receipts eliminates manual verification delays. Predefined coding rules ensure accuracy and free up AP staff for strategic tasks.

- Enable mobile approvals: Allowing decision-makers to approve invoices from anywhere prevents bottlenecks and ensures timely payments, reducing the risk of late fees and missed discounts

- Use early payment discounts: Prioritizing invoices with supplier discounts lowers costs and strengthens vendor relationships. A well-configured AP system can flag and process these opportunities automatically.

4. Track progress with AP dashboards and analytics

Dashboards and analytics provide real-time visibility into AP performance, making it easier to track progress against your benchmarks and forecast AP. By monitoring trends, bottlenecks, and processing times, you can make data-driven adjustments to improve efficiency.

Regular performance reviews keep your AP team focused on continuous improvement, and conducting an AP audit ensures accuracy and compliance.

Best practices for monitoring and improving AP performance

These best practices help ensure your team uses data to improve efficiency, accuracy, and vendor relationships over time:

Create an AP dashboard

An effective AP dashboard consolidates your most important key performance indicators in one view. Visualizations like trend lines for cycle times, bar charts for cost comparisons, and heatmaps for exception bottlenecks make performance issues easy to spot.

You may want to review dashboards weekly for operational insights and monthly at the leadership level to inform strategic decisions.

Set performance targets

Dashboards only add value when paired with clear performance targets. Start by establishing baselines using your current data, then compare them against industry benchmarks to set realistic goals.

A continuous improvement framework works best. Instead of trying to cut costs or speed up processes overnight, focus on steady, small improvements. This makes progress more sustainable and easier to adjust as your business grows.

Provide training and drive adoption

Metrics and dashboards only work if your team actually uses them. Make sure AP staff and stakeholders are on board so new processes and automation tools become part of the daily routine.

Training should focus on both how to use the tools and why they matter. For example, faster processing helps capture discounts, and accurate data prevents vendor disputes. When people see the impact, they’re more likely to stay engaged and committed to continuous improvement.

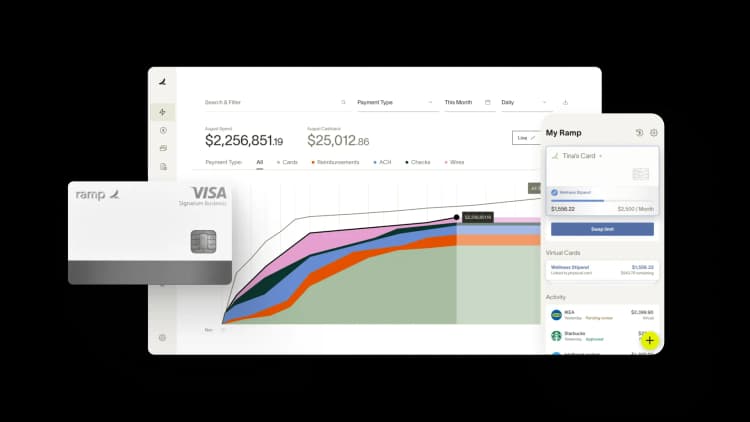

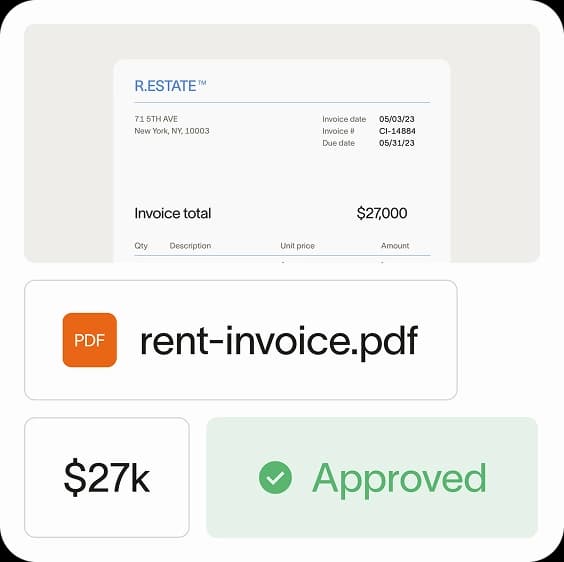

How Ramp Bill Pay automates your entire AP process

Ramp Bill Pay is autonomous AP software that turns manual tasks into touchless workflows. Four AI agents handle invoice coding, flag fraudulent payments before they go out, build approval summaries, and push card payments to vendors—taking your team out of repetitive AP work.

Run Ramp Bill Pay on its own, or connect it with Ramp's corporate cards, expense tools, and procurement platform for complete spend visibility. Companies switching to Ramp see up to 95% better oversight of their payables1. And, the platform's OCR hits up to 99% accuracy on data extraction while processing invoices 2.4x faster than legacy systems2.

Features include but are not limited to:

- Real-time invoice tracking: Monitor every invoice from receipt through payment

- Real-time ERP sync: Connect your vendor master data bidirectionally with 10 ERPs such as NetSuite, QuickBooks, Xero, Sage Intacct, and more for audit-ready books

- Reconciliation: Close books faster with automatic transaction matching

- Approval orchestration: Reduces clicks, improves visibility, and accelerates processing across reviewers

- Auto-coding agent: Analyzes historical coding patterns and invoice details like product IDs, descriptions, and shipping addresses to map expenses to the correct GL codes instantly

- GL coding: Map transactions to the correct accounts with AI-assisted recommendations

- Intelligent invoice capture: Extracts data across every line item with 99% OCR accuracy

- Automated PO matching: Verifies invoices against purchase orders with 2-way and 3-way matching to catch overbilling before payment

- Payment methods: Pay vendors via ACH, corporate card, check, or wire transfer

- Vendor Portal: Let vendors securely update payment details, view payment status, and communicate with your AP team

- Roles and permissions: Enforce separation of duties with granular user controls

Why choose Ramp Bill Pay?

Ramp Bill Pay reshapes how AP should perform—accurate data capture, autonomous operations, touchless processing, and fast workflows. Over 2,100 verified G2 reviews average 4.8 stars, with finance teams repeatedly citing it as one of the most straightforward AP platforms to implement.

Ramp Bill Pay functions as standalone AP software with everything built in. But teams that want to unify bills, card transactions, expenses, and procurement can also access Ramp's integrated spend management platform to bring everything into a single system.

Start with Ramp's free tier covering core AP automation, or upgrade to Ramp Plus at $15 per user monthly for expanded capabilities.

Get started with Ramp Bill Pay.

1. Based on Ramp’s customer survey collected in May’25

2. Based on Ramp's customer survey collected in May’25

FAQs

KPIs are key performance indicators that measure how efficiently your AP team works, such as cost per invoice or DPO. Service level agreements (SLAs) are commitments between your company and vendors, like paying invoices within 30 days.

You can improve AP metrics by automating invoice processing, reducing manual errors, setting clear approval workflows, and regularly tracking benchmarks. Strong vendor communication also helps lower disputes and delays.

Evaluate AP services by looking at automation features, integration with your accounting system, reporting capabilities, cost, and customer support. Consider how well the service helps you meet KPIs and SLAs.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°