How accounts receivable financing can help your business

- What is accounts receivable financing?

- What are the common forms of receivables financing?

- Pros and cons of accounts receivable financing

- Should I use accounts receivable financing for my small business?

- Alternatives to AR financing

As a small business owner, unexpected cash shortfalls can occur at any moment. Financing options help you plug cash flow holes but bank loan applications take a long time and quick cash infusion options come with high interest rates attached. And even if you decide to go another route, figuring out which of the many alternative funding options are right for you is a challenge in itself.

Accounts receivable (AR) financing might be your best option from the many small business financing choices. Not only can you access cash relatively quickly, but you won’t have to bear high interest expenses.

In this article, you will learn how AR financing works, along with the following:

What is accounts receivable financing?

Accounts receivable financing (also called AR financing) is a business financing option that allows businesses to use their outstanding invoices to raise cash. The lender offers you a loan, and you pay interest during the loan's term, using unpaid invoices as collateral.

AR financing is often confused with invoice factoring. Invoice factoring is a different financing method, as you'll learn shortly.

How do you borrow against accounts receivable?

Borrowing against accounts receivable is easier than it sounds. The trick is to prepare before you meet a lender. By preparing ahead of time, you’ll experience a smooth application and approval process. Follow the steps below if you’re looking for AR financing:

- Gather AR and payment collection records: Gather your invoice processing data and related records. The AR financing company will eventually review these records.

- Compare lenders: You can choose from multiple lenders offering different financing options. Compare fees and timelines before choosing a lender.

- Submit documents: Submit all the documents the lender needs. The lender may ask you for additional documents beyond the ones you gathered in the first step.

- Receive approval and cash: Once the lender approves your application, you'll receive cash in your account.

- Collect customer payments and pay interest: You'll continue collecting payments from your customers and make monthly interest payments to your AR financing lender.

What are the common forms of receivables financing?

There are two forms of accounts receivables financing:

- Asset-based loans: Since accounts receivable is an asset, it can be used as collateral for an asset-based loan. With this option, you will commit the majority of your outstanding receivables as collateral for a loan. The loan is recorded as a liability on your balance sheet and interest payments as expenses on your income statement. Some lenders offer selective receivables financing, where you can earmark a few invoices to borrow against.

- Securitization: Similar to asset-based loans but on a larger scale, securitization is an option for large businesses. In this method, a company works with a bank to securitize its receivables. The bank sells the asset to investors. The investors receive timely payments in exchange for buying the asset. The bank subtracts its fees and passes the rest to the company. This option might not be suited to a small business due to its complexity.

AR financing versus invoice factoring

Invoice factoring and AR financing are often used interchangeably. However, they have different balance sheet implications. In the invoice factoring method, you sell your receivables at a discount to a buyer. With AR financing, you receive a loan while placing your invoices as collateral.

AR financing | Invoice factoring |

|---|---|

Receive a loan against outstanding receivables | Sell outstanding receivables to a buyer |

Increases cash, liabilities, and interest expense | Increases cash, reduces receivables |

Retain collection responsibility | Collection responsibility transferred to buyer |

Once you factor your invoices, you offload the risk of customer default. With AR financing, you do not offload this risk and have to collect payment from your customers. Despite these differences, both options work for small businesses. But the “best” option depends on the state of your business and cash flow. A third (and less common) option is transactional funding, which involves using an intermediary to connect a seller and purchaser.

Pros and cons of accounts receivable financing

Like with any other financing method, AR financing has its advantages and disadvantages. Here they are in no particular order.

✅ Pro: Relatively fast approvals and quick application process

Applying for and receiving AR financing is simple. Lenders will quickly arrange financing as long as you have all documents ready and a steady business track record. You will receive cash quickly and can deploy it in your business.

For instance, if you need a small infusion of cash to overcome seasonal variations, AR financing is a great choice.

❌ Con: Qualification might be tough

AR financing flexibility comes at a price: You must have a successful and lengthy business track record. Lenders will want to see a history of successful customer relationships and collections. Qualification might be unlikely if you lack this data or do not have a track record.

✅ Pro: Flexibility in choosing financing amounts and payouts

AR financing lenders often let you select which invoices you would like to borrow against. Thus, you can choose the amount you would like to borrow, giving you flexibility in structuring your balance sheet. Interest rates are also highly negotiable, giving you control over your interest expenses.

❌ Con: Reduces margins

Receivables financing creates interest expense and reduces your net margins. AR financing could leave you facing a loss if you're operating in a low-margin business. Also, if you think the economic conditions affecting your small business are changing, it’s best to stay away from AR financing since the margin shrinkage might be too adverse to bear.

✅ Pro: Maintain equity

AR financing helps you retain business equity. While it adds a liability to your balance sheet, you can mitigate this risk by carefully managing cash flow. For instance, you can finance invoices you're guaranteed to collect and reduce the risk of lengthy credit cycles.

Interest expense is a small price to pay if you use the lender's cash to generate greater ROI. You maintain control of your business and won’t have to post valuable business assets as collateral, unlike with bank loans or traditional small business lenders.

❌ Con: Customer dependence

Qualifying for traditional financing depends on your business' credit history. However, AR financing depends on your customer relationships and their history of paying bills. If you've worked with low-quality customers in the past, they will hamper your ability to qualify.

Thus, you're not fully in control of your financing qualification, something that is frustrating to most business owners.

Should I use accounts receivable financing for my small business?

You should use accounts receivable financing for your business if:

- You need cash quickly: Speedy timelines will ensure you receive cash injections right when you need them.

- You want to avoid collection hassles: If you're tired of chasing clients for on-time payments, AR financing might be right for you. You can offer them more time to pay while mitigating late-payment risk.

- You have good credit history: To qualify for AR financing, you must have a good credit history. Credit history isn't the most important qualification factor, but you cannot have poor credit and expect to qualify.

- Customers have a record of repayment: If you have a good track record collecting payments from customers, an AR financing lender is more likely to approve your application.

- Have a substantial business record: Have you been in business successfully for at least five years? If so, you stand a good chance of qualifying for AR financing. If not, you're better off choosing other business financing options.

Alternatives to AR financing

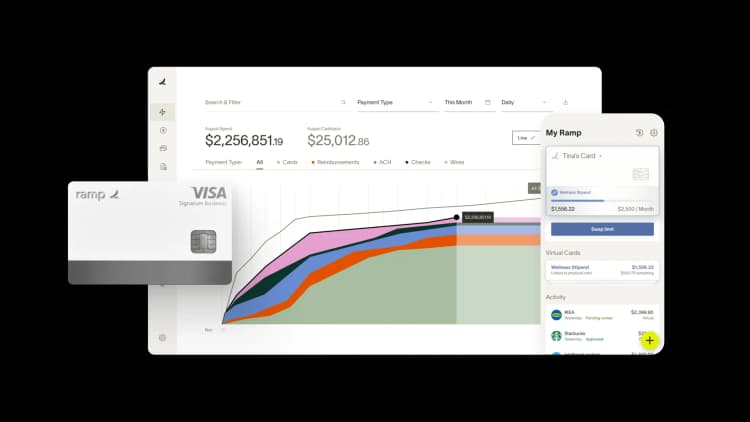

AR financing is a great option for small business owners looking for a quick infusion of working capital to fund critical expenses. But if you're looking for another form of financing to help scale your business, Ramp can help. From finding hidden savings to leveraging revenue, here's how Ramp can help you quickly access the cash you need.

Commerce sales-based underwriting

Ramp's commerce sales-based underwriting process helps you access higher credit limits, up to 30x on average. E-commerce businesses need just a year's worth of sales to qualify. Ramp integrates with Stripe, Amazon, and Shopify, to provide streaming sales data, removing time-consuming paperwork.

You can manage your growth capital through spending limits and multi-level approval workflows. Use Ramp's integration with Slack to approve expenses in a few minutes. You can centralize all company spending and expenses in a single platform, giving you full visibility into your cash flow.

Expense management and automated accounting

Compared to the multiple weeks most businesses typically take, Ramp helps you close your books within a day. You can connect your cards, bills, accounting data, audit trails, and collaborative data from different sources onto a single platform.

When coupled with Ramp's robust expense management functionality, you'll spend less time approving expenses. Ramp simplifies cash flow analysis, giving you the information you need to run your business efficiently.

Building business credit

Ramp's virtual and physical cards help you build your business' credit with control. Thanks to functionality such as pre-approved expense limits, vendor-specific spending thresholds, and real-time card management, you can rest assured that your business' expenses won't jeopardize your credit score.

Learn how Ramp simplifies accounts receivable financing through automated expense management, accounting, and credit building.

FAQs

Factoring and receivables financing have different impacts on your balance sheet. Once you sell your invoices to an invoice factoring company your cash increases and receivables decrease. Accounts receivable financing companies offer you a loan with your receivables as collateral. Thus, your cash increases, receivables remain unaffected, liabilities increase, and interest expense increases (on your income statement.)

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits