Inventory financing: How it works, costs, and risks

- What is inventory financing?

- Types of inventory financing

- Who should consider inventory financing?

- Inventory financing benefits

- Inventory financing: Costs and rates

- Inventory financing: Risks and disadvantages

- Inventory financing alternatives

- How to apply for inventory financing

- Ramp helps you get more value from inventory financing

Inventory financing lets you borrow money using your inventory as collateral, freeing up cash flow without selling equity or draining operating cash. Instead of paying upfront for large inventory purchases, you spread costs over time while keeping products on shelves. Retailers, wholesalers, and manufacturers use inventory financing to fund stock purchases and manage cash flow gaps as inventory moves from purchase to sale.

What is inventory financing?

Inventory financing is a loan or line of credit secured by your business’s inventory, meaning the inventory itself serves as collateral. Lenders typically advance a percentage of the inventory’s appraised value and structure repayment around sales or a fixed schedule. In some contexts, inventory financing is also called warehouse financing, and in the automotive industry it’s commonly referred to as floor plan financing.

Unlike traditional business loans, inventory financing places more weight on the value and liquidity of your inventory than on long operating history or hard assets like real estate. That makes it a practical option for growing businesses that need cash to restock without committing long-term capital.

According to a 2025 Federal Reserve report, 59% of small employer firms sought new financing in the prior 12 months, and 37% applied for a loan, line of credit, or merchant cash advance during that period.

How inventory financing works

Inventory financing follows a predictable flow from application to repayment and is designed to align financing with how inventory turns into revenue.

Most lenders follow these steps:

- Apply and submit inventory data: You provide inventory lists, turnover rates, and basic financials. Lenders assess how quickly inventory sells and how easily it could be resold if needed.

- Inventory valuation and advance rate: The lender evaluates your inventory and offers an advance based on its appraised value. Faster-moving, non-perishable goods typically qualify for higher loan-to-value ratios.

- Funding and inventory monitoring: Once approved, the lender releases funds. Ongoing monitoring may include periodic inventory reports or audits to track collateral value.

Loan-to-value (LTV) ratios typically range from 50% to 80% of inventory value, depending on inventory type, turnover speed, and market demand. Approval timelines vary by lender:

- Online and alternative lenders: 24–72 hours

- Banks and credit unions: 2–4 weeks

Inventory serves as collateral throughout the loan term. If the business defaults, the lender has the right to seize and liquidate inventory to recover losses.

Types of inventory financing

Inventory financing generally comes in three forms: inventory loans, inventory lines of credit, and floor plan financing. Each option supports different cash-flow needs depending on how often you restock inventory and how predictable your sales cycles are.

Inventory loans

Inventory loans provide a one-time lump sum based on the value of your inventory. They’re commonly used for planned purchases, such as pre-season stocking, bulk supplier orders, or product launches with defined timelines.

| Best use case | Typical term | Repayment structure |

|---|---|---|

| Seasonal inventory build-up | 6–24 months | Fixed monthly payments |

| Bulk supplier discounts | 6–18 months | Fixed monthly payments |

| Product launches or minimum order requirements | 6–12 months | Fixed repayment schedule |

For example, a clothing retailer preparing for the holiday season may need to pay suppliers weeks before sales begin. An inventory loan helps bridge that gap, allowing the business to buy ahead of demand without straining payroll or rent.

Repayment is usually fixed, which supports predictable budgeting and financial planning but offers less flexibility if sales fluctuate.

Inventory lines of credit

Inventory lines of credit offer revolving access to funds, similar to a credit card, but secured by inventory. You draw funds as needed and repay balances as inventory sells, then borrow again as long as you stay within your approved limit.

You typically pay interest only on the amount you use, which makes this option well suited for businesses with frequent restocking needs and steady inventory turnover, such as wholesalers or multi-location retailers. Inventory lines of credit function similarly to other business lines of credit, but approval is tied more closely to inventory value and turnover.

Floor plan financing

Floor plan financing is most common in industries that sell high-value items, such as auto dealerships and heavy equipment retailers. Instead of financing pooled inventory, each unit is financed individually.

Interest accrues on each item until it’s sold, at which point the balance is repaid. This structure allows dealers to maintain a full inventory without tying up large amounts of capital in unsold stock.

Common applications include:

- Financing vehicles in auto dealerships until sale

- Financing agricultural or construction equipment with long sales cycles

Who should consider inventory financing?

Inventory financing works best for businesses that rely heavily on physical goods and have relatively predictable sales cycles. It’s most useful when inventory purchases are essential to revenue generation but paying upfront would strain cash flow.

Businesses that commonly benefit include:

- Seasonal businesses: Prepare for peak demand without depleting cash reserves during slower periods

- Retail and wholesale operations: Maintain consistent stock levels while preserving liquidity for payroll, rent, and marketing

- Manufacturers: Fund raw materials and work-in-progress inventory without disrupting production schedules

Inventory financing requirements to qualify

Most lenders require at least 6–12 months of operating history, and revenue minimums typically range from $50,000 to $100,000 annually for non-bank lenders. Bank lenders often set higher thresholds.

Credit score requirements vary, but many inventory lenders accept scores in the mid-600s, which is generally lower than traditional bank loan requirements. Approval depends more on inventory quality, turnover, and resale value than on credit alone.

Lenders also expect reliable inventory tracking systems that provide accurate counts, turnover data, and valuations. Common documentation includes:

- Inventory reports

- Supplier invoices

- Bank statements

- Tax returns or financial statements

Inventory financing benefits

Inventory financing improves cash flow management by aligning inventory costs with sales instead of requiring large upfront payments. This flexibility helps businesses restock, grow, and meet demand without creating short-term cash crunches.

It also makes it easier to take advantage of bulk purchasing discounts. Buying in larger quantities often lowers per-unit costs, which can improve margins without increasing immediate cash outflows.

Inventory financing supports seasonal planning by keeping working capital available for operating expenses such as payroll, rent, and marketing, rather than tying up cash in inventory ahead of sales cycles.

Consistent, on-time repayment can help build business credit and expand future financing options. Compared with traditional loans, inventory financing often offers faster approval timelines, particularly through online and alternative lenders.

Advantages over traditional business loans

Inventory financing is typically faster to fund than traditional bank loans, which may take weeks to approve. Many inventory lenders can approve financing within days.

Collateral requirements also differ:

- Inventory-backed financing uses inventory as collateral, reducing the need for real estate or personal guarantees

- Approval depends more on inventory quality and turnover than on long operating history

Inventory financing also provides greater flexibility in how funds are used, supporting ongoing operations rather than fixed long-term investments.

Inventory financing: Costs and rates

Inventory financing interest rates typically range from 6% to 20% APR, depending on lender type, inventory quality, and overall risk profile. Bank lenders and government-backed programs tend to offer lower rates, while alternative and specialty inventory lenders usually charge higher rates in exchange for faster approvals and more flexible requirements.

To illustrate how wide pricing can vary in practice, LendingTree’s January 2026 market listings show inventory financing products with starting interest rates in the high single digits, while other offers reach APRs above 30% depending on repayment structure and borrower risk.

In addition to interest, inventory financing often includes fees that reflect the ongoing monitoring required for collateral-based lending. Common fees include origination charges, maintenance fees, and inventory inspection or audit costs.

Rates and total costs are influenced by:

- Inventory turnover speed

- Industry risk profile

- Credit history and financial stability

Compared with merchant cash advances, inventory financing generally offers lower overall costs and more predictable repayment terms.

Hidden costs to consider

Some lenders charge inventory valuation fees to cover third-party appraisals used to assess collateral value. Ongoing monitoring and reporting requirements can also add administrative overhead, particularly for businesses with complex inventory systems.

Early repayment penalties may apply, which can reduce flexibility if sales exceed expectations. In default scenarios, lenders may seize inventory, potentially disrupting operations and future sales.

Inventory financing: Risks and disadvantages

Inventory financing carries risks tied directly to inventory value and sales performance. If inventory becomes obsolete, damaged, or harder to sell, its value can decline, reducing the effectiveness of the collateral securing the loan.

Slower-than-expected sales can increase default risk and strain cash flow, particularly when repayment schedules are fixed. Because inventory financing is often more expensive than traditional bank loans, costs can add up quickly for newer or higher-risk businesses.

Lenders also impose ongoing monitoring requirements, such as periodic inventory reporting or audits. These obligations can increase administrative workload and limit operational flexibility.

How to mitigate risk

You can take several steps to reduce the risks associated with inventory financing:

- Implement inventory management best practices: Accurate forecasting and reliable inventory tracking help prevent overstocking and reduce the risk of valuation declines. Clean records also improve lender confidence and can lead to better advance rates and terms.

- Diversify inventory and suppliers: Carrying multiple product lines or sourcing from multiple suppliers limits exposure if one category underperforms, helping stabilize inventory value and sales velocity

- Carry inventory insurance: Insurance coverage protects against theft, damage, or loss that could otherwise trigger loan defaults. Some lenders require coverage, but even when optional, it adds a critical layer of protection.

- Plan an exit strategy: Planning how you’ll refinance or transition to a different financing structure reduces surprises if sales patterns change and helps preserve long-term flexibility

Inventory financing alternatives

Inventory financing isn’t the right fit for every business. Depending on your cash-flow needs and how revenue is generated, other financing options may offer more flexibility or lower costs.

Invoice factoring

Invoice factoring provides cash advances based on unpaid customer invoices rather than inventory. A factoring company purchases your receivables, advances a portion of their value, and collects payment directly from customers.

This option works best for business-to-business companies with long payment terms but limited physical inventory. If delayed customer payments, rather than inventory purchases, are constraining cash flow, factoring aligns financing with receivables instead of inventory risk.

Merchant cash advances

Merchant cash advances provide fast access to capital by advancing funds in exchange for a percentage of future sales. Repayment adjusts automatically with daily revenue, which can help during high-volume periods but can become expensive over time.

Compared with inventory financing, merchant cash advances typically carry higher effective costs and can strain cash flow if sales slow. They’re best suited for short-term needs where speed matters more than cost.

Traditional business lines of credit

Traditional business lines of credit offer flexible access to funds, often at lower interest rates than inventory financing. Banks typically require strong credit, longer operating history, and consistent profitability.

Unlike inventory financing, these lines aren’t tied to specific assets, which can make them less accessible for newer businesses. For established companies with predictable cash flow, they provide broad working capital flexibility without inventory monitoring requirements.

Corporate cards

Modern corporate card providers offer higher credit limits than traditional cards by underwriting based on business performance rather than personal credit. Businesses using platforms like Stripe, Shopify, or Amazon Business may qualify for larger limits that can be applied toward inventory purchases.

Corporate cards are not designed to finance long-term inventory balances, but they can be useful for short-term purchasing needs when paired with disciplined cash management and clear repayment cycles.

| Financing option | Best for | Main trade-off |

|---|---|---|

| Invoice factoring | B2B businesses with long payment terms | Fees add up and customer payments are handled by a third party |

| Merchant cash advances | Urgent, short-term funding needs | High effective cost |

| Traditional business lines of credit | Established businesses with strong credit | Stricter approval requirements |

| Corporate cards | Short-term inventory purchases | Not suited for long-term inventory financing |

How to apply for inventory financing

Applying for inventory financing typically follows a straightforward process, though timelines and requirements vary by lender.

The application process usually includes the following steps:

- Submit financial statements and inventory data, including inventory lists, turnover rates, and recent sales history

- Undergo inventory valuation to determine eligible collateral and advance rates

- Review loan terms, including interest rates, fees, and repayment structure

- Receive funding once terms are finalized and collateral requirements are met

Online and alternative lenders may fund within days, while banks often take several weeks. Preparing documentation in advance can help speed up approvals and improve loan terms.

Choosing the right lender

Banks generally offer lower rates but slower approvals and stricter eligibility requirements. Alternative and specialty inventory lenders move faster and may approve businesses with shorter operating histories, but often at higher costs.

When comparing lenders, focus on more than just the maximum advance rate. Higher advance percentages can come with tighter monitoring, higher fees, or less flexible repayment schedules. Pay close attention to repayment structure, especially whether payments are fixed or tied to sales. Flexible repayment terms can reduce cash-flow pressure during slower periods.

Also review reporting requirements and inspection frequency. Excessive audits or manual reporting can increase administrative burden and hidden costs over time. Be cautious of red flags such as unclear fee structures, aggressive monitoring terms, or unusually short repayment windows.

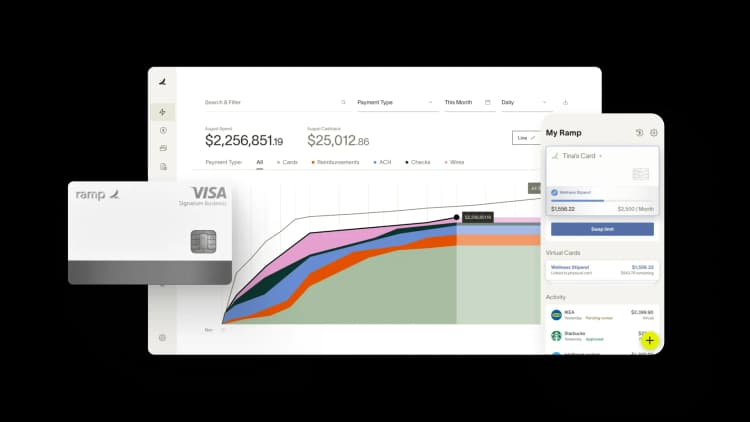

Ramp helps you get more value from inventory financing

Inventory financing can unlock working capital, smooth cash flow, and help you grow without sacrificing liquidity. The right structure depends on your inventory type, sales cycle, and growth goals.

Ramp helps you extend these benefits further. With Ramp’s corporate cards, spend controls, and real-time cash-flow visibility, you can pair inventory financing with smarter purchasing and tighter expense management:

- Real-time spend tracking keeps inventory purchases aligned with cash flow

- Automated accounting reduces reconciliation work

- Flexible controls help prevent over-ordering and budget overruns

Used together, inventory financing and Ramp give you the tools to grow responsibly, maintain liquidity, and keep capital working where it matters most.

FAQs

If your business depends heavily on selling inventory to finance future purchases and faces seasonal demand, inventory financing might be your best choice. If you're unsure of collection times and have a strong credit history, traditional business loans or private investment might be better options.

Inventory is an asset, and for retailers it can be one of their more valuable assets. Retailers typically try to limit the amount of working capital tied up in inventory since, despite inventory usually being considered a liquid asset, it isn’t as liquid as cash and can also depreciate if retained too long. However, inventory financing enables companies to borrow against the value of their inventory.

With inventory financing, you can apply for a loan less than or equal to the full value of your inventory, on which, if approved, you could get up to 80% of the value as a loan. However, the loan amount is determined during the audit and assessment process. Once your business’s creditworthiness has been established, the lender will disclose the amount or percentage you are viable for.

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they're seeing the quick payment. That started with Ramp—getting everyone paid on time. We'll get a 1-2% discount for paying early. That doesn't sound like a lot, but when you're dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group