Is accounts receivable an asset?

- What are accounts receivable?

- What are assets?

- Is accounts receivable an asset or liability?

- Why aren’t accounts receivable a liability or equity?

- Is accounts receivable a current asset?

- How to leverage accounts receivable in your business

Assets, liabilities, and shareholder equity are the three building blocks that make up a company's company's balance sheet. To achieve “balance,” the assets need to equal the sum of the liabilities and the equity. Accounts receivable are one piece in this complex puzzle. They show up on the balance sheet as current assets because they’re expected to convert to cash within one year.

The balance sheet is one of four financial statements that your company is required to file each quarter and at the end of the fiscal year. The others are the income statement, the statement of cash flows, and the statement of shareholder equity. In this article, we’ll focus solely on the balance sheet and where accounts receivable shows up there.

What are accounts receivable?

Businesses that sell goods and services can collect payment for them in several ways. One of them is payment upon delivery, which is essentially a cash payment, but that isn’t always practical. Some customers require payment terms of net-30 or other short term options to be able to pay for the product or services rendered. This requires an invoice that becomes part of accounts payable.

With an accrual accounting method, the money owed on an invoice is counted as revenue when the product sale or service is delivered, not when it’s paid for. It’s counted alongside other liquid assets like cash, bonds, stocks, CDs, and mutual funds. The assumption is that accounts receivable will be converted to cash within one year, making them current assets.

When accounts payables don’t convert within one year, they are moved over to long-term assets. In cases of default (bad debt), where customers don’t pay the invoice, those losses are included on the balance sheet as a “contra asset account.” Contra accounts are common in accounting. An example of this is accumulated depreciation, which is a contra account to fixed assets.

What are assets?

Assets are the lifeblood of every company. They are a key variable in calculating business liquidity and can be used as collateral for debt financing if it becomes necessary. Let’s go back to the balance sheet. It’s the one place in financial reporting where assets are broken out into categories. The first of these is“current assets.” The category looks like this:

· Cash and cash equivalents

· Accounts receivable

· Inventory

· Prepaid expense

· Investments

Accounts receivable is listed in the current assets section. These are assets that can be easily liquidated in a short period of time, thus the classification as “current.” Financial analysts use the “current assets” portion of the balance sheet to calculate liquidity ratios. Other line items on the asset side of the balance sheet are considered non-liquid assets. They include:

· Land

· Buildings

· Equipment

· Intangible assets

These assets are illiquid because they’re considered long-term and not guaranteed to convert to cash within one year unless they are sold. These assets also depreciate. Balance sheets with long-term illiquid assets on them will include a line item for “accumulated depreciation.” That depreciation decreases the asset value of a long-term asset.

Is accounts receivable an asset or liability?

There's a simple explanation for whether accounts receivable is a liability or asset. Accounts receivable are invoices that are expected to convert to cash within one year. That makes them a current asset. Owners and shareholders view them that way. Potential lenders use them to calculate risk and investors use them as part of a company’s valuation. We’ll get into that in more detail below.

Small businesses or companies that use cash-basis accounting don’t need to record accounts receivable because the category doesn’t exist in their accounting system. You won’t find that in the United States. Under the US Generally Acceptable Accounting Principles (GAAP), corporations are required to use an accrual accounting method because it's more accurate.

Why aren’t accounts receivable a liability or equity?

For financial reporting to be accurate, both sides of the balance sheet must equal each other. To calculate liabilities, the accountant adds up all the money that the company owes to others.

Accounts receivable are invoices for money owed to the company. The two cannot be on the same side of the balance sheet. This formula protects you from making that mistake.

Assets = Liabilities + Shareholder Equity

This is a cornerstone of accounting. Assets are listed on the left. Liabilities and shareholder equity are on the right. If the numbers at the bottom of each column don’t match, there’s an error in your accounting. This can be a blessing or a curse. Matching numbers mean you did it right. Mismatched numbers mean hours of work to figure out where you went wrong.

Is accounts receivable a current asset?

The income statement is a separate report from the balance sheet. Income statements record revenues and expenses. In accrual accounting, accounts receivable count as accrued revenue, but only actual revenue received is reported on the income statement, along with actual expenses paid (see our guide on accrual vs. deferral accounting for more). This helps businesses get a firmer grasp on spending for the current reporting period.

Liabilities don’t show up on the income statement either. The expenses listed there are bills that have already been paid. A liability is an amount owed that has not been paid yet. To simplify this, think of the income statement as a synopsis of past activity and the balance sheet as a present-day snapshot of the company that includes future expenses.

How to leverage accounts receivable in your business

Assets are the primary variable in calculating the monetary value and working capital of a company, prior to expenses and liabilities owed, in the event of a closure or acquisition exit. Accounts receivable are current assets, meaning they can be used in factoring the liquidity ratio of a business, which is a tool used by investors and lenders to assess risk.

If you’re short on cash and average a high monthly accounts receivable balance, explore accounts receivable financing or other types of funding that use receivables like transactional funding. This is essentially taking out a secured loan using the unpaid balances of your invoices as collateral. It’s common for businesses that have long payment cycles to create quick cash flow to pay suppliers and vendors.

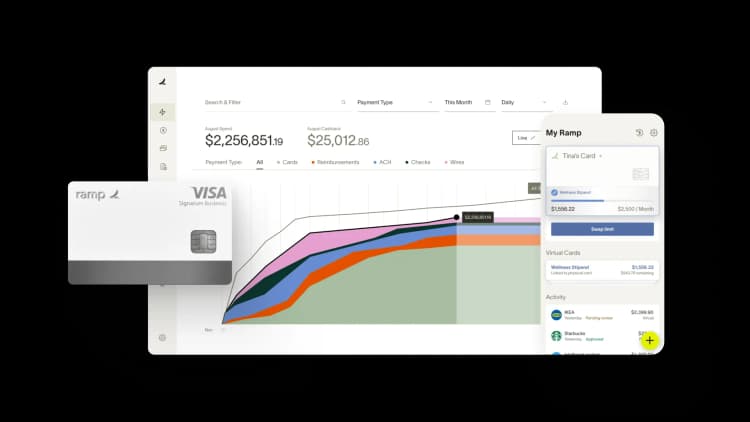

If you’re an e-commerce or small business, another option for you is Ramp’s commerce sales-based underwriting. This service alleviates the pain points of minimum bank balances and audited financials that many lenders and credit card companies require.

With substantial accounts receivable and online sales, Ramp can give you access to higher credit limitss.

FAQs

Accounts receivables are a tangible asset listed as a “current asset” account on the balance sheet because they convert to cash within one year. They can become a “long-term asset” if they go unpaid for more than a year or be included in a “contra asset account” if they are not paid.

Accounts receivable is a debit until the customer pays the invoice. After that, it becomes a credit, and a matching debit is applied to the cash account.

Yes. Accounts receivable can be negative if you collected more than you billed or collected a payment after writing off an accounts receivable.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits