What is equity financing, and how does it work? A complete guide for startups

- What is equity financing?

- Debt financing vs. equity financing

- How equity financing works

- Sources of equity financing

- Equity financing examples and dilution math

- Advantages of equity financing

- Disadvantages of equity financing

- Step-by-step funding strategy

- Investor metrics that influence valuation

- Balancing debt financing and equity financing over time

- Spend capital smarter with Ramp

Equity financing lets you raise capital by selling ownership shares in your company to investors. You get the funding you need without taking on debt, but you give up a percentage of your business in return. For cash-strapped startups that need significant capital to scale quickly, equity financing can provide the runway to build something valuable—even if it means sharing the eventual rewards with investors who believed in your vision early on.

What is equity financing?

Equity financing is the process of raising capital by selling ownership shares in a company. Investors provide money in exchange for equity stakes, which represent partial ownership and potential future returns.

Unlike loans, equity financing doesn't require scheduled repayments or interest. Instead, investors participate in the upside if the company grows in value. They're betting on your success rather than collecting guaranteed payments.

Debt financing vs. equity financing

Debt financing and equity financing serve different purposes depending on your startup's stage and cash flow situation:

| Criterion | Debt Financing | Equity Financing |

|---|---|---|

| Repayment requirements | Requires regular payments with interest that can strain your cash flow. | Requires no repayments—investors only make money if you do. |

| Cost | Costs you interest payments over time. | Costs you a share of future profits and exit value—potentially much more expensive if your company succeeds. |

| Risk distribution | Places all repayment risk on your company. | Shares business risk with investors who lose their investment if you fail. |

You should consider using debt when:

- You have predictable cash flows to cover monthly payments

- You need short-term working capital

- You have assets to use as collateral

Use equity financing when:

- You're a high-growth startup needing significant capital

- You need a longer runway before generating profits

- You want strategic support beyond just money

How equity financing works

The basic mechanics of equity financing are simple: A startup sets a valuation, issues shares, then sells a percentage of ownership to investors in exchange for capital.

The process starts with an exercise that determines how much your company is worth, called your pre-money valuation. You then engage investors and negotiate how much ownership you’ll sell them in exchange for the funding you need.

Your investors receive equity stakes and often voting rights or governance provisions proportionate to their ownership. These rights may include board seats, approval requirements for major decisions, or access to your financial data.

Founders trade dilution for funding to accelerate growth. You own less of your company after each round, but ideally, you own a smaller piece of something much more valuable.

Sources of equity financing

There are the five primary channels startups use to raise equity capital:

1. Angel investors

Wealthy individuals invest personal funds at early stages, often providing mentorship, domain expertise, and valuable industry connections alongside capital. Angels need to qualify as an accredited investor per the SEC and typically write checks in the $25,000 to $100,000 range. Angels can move much faster than institutional investors since they're investing their own money.

2. Venture capital firms

Venture capital (VC) firms manage pooled funds from limited partners and invest larger checks in startups with strong growth potential, typically leading priced rounds and taking board seats. They bring institutional rigor, follow-on capital for future rounds, and portfolio company networks that can help accelerate your growth.

3. Equity crowdfunding platforms

Startups raise smaller amounts from many investors online, gaining both capital and market validation by demonstrating broad interest. Platforms like Republic and StartEngine let you tap into retail investors who might also become customers and brand advocates.

4. Corporate investors

Established companies invest for strategic access to innovation, partnerships, or potential acquisitions, sometimes providing distribution and resources. Corporate venture arms can open doors to customers and partnerships that pure financial investors can't match.

5. Initial public offerings

IPOs sell shares to public investors, typically for mature startups ready for public markets, providing large capital infusions and liquidity. Going public brings significant regulatory requirements and scrutiny but offers access to vast capital pools and liquidity for early investors and employees.

Equity financing examples and dilution math

Let’s walk through a simple example of how equity financing would work in practice for a new startup.

1. Seed round

Your startup needs its first institutional capital to build your product and find product-market fit:

- Pre-money valuation: $4 million

- Investment: $1 million

- Post-money valuation: $5 million

- Seed investor ownership: $1 million / $5 million = 20%

As founders, you owned 100% of your company pre-seed; you now collectively own 80% post-seed.

2. Series A

You've found product-market fit after raising seed money. Now, you need capital to scale your go-to-market efforts:

- New pre-money valuation: $15 million

- Investment: $5 million

- Post-money valuation: $20 million

- Series A investor ownership: $5 million / $20 million = 25%

You and your seed investors previously combined for 100% ownership pre-Series A. After this funding round, your ownership is diluted by 25%:

- Founders ownership: 80% * (1 – 0.25) = 60%

- Seed investor ownership: 20% * (1 – 0.25) = 15%

3. Late-stage growth round

Your company is scaling rapidly, and you need capital for expansion into new markets.

- Pre-money valuation: $60 million

- Investment: $20 million

- Post-money valuation: $80 million

- New investor ownership: $20 million / $80 million = 25%

As a result, the existing owners’ equity is diluted by 25%:

- Founders ownership: 60% * (1 – 0.25) = 45%

- Seed investor ownership: 15% * (1 – 0.25) = 11.25%

- Series A investor ownership: 25% * (1 – 0.25) = 18.75%

Advantages of equity financing

Equity financing appeals to founders who’d rather spend on growth than debt repayments. It keeps cash in the business and brings in partners who are invested in your success.

1. No repayment or interest

Equity financing eliminates monthly loan payments and interest, preserving cash flow for your product, hiring, and growth. You can invest every dollar into building your business rather than servicing debt obligations.

2. Shared risk

Investors share downside risk with you. If your company fails, there's generally no personal obligation to repay invested equity capital. Your investors lose their money just like you lose your sweat equity.

3. Strategic support and networks

Investors often provide guidance, recruiting help, industry expertise, customer introductions, and partnership opportunities. The right investors become true partners in building your business, not just check writers.

4. Larger capital infusions

Equity rounds can deliver substantial funding beyond the limits of traditional loans, enabling faster growth. Banks might lend you hundreds of thousands; VCs can invest millions or tens of millions when you're ready to grow aggressively.

Disadvantages of equity financing

While equity can fuel growth, it also comes with tradeoffs. You often give up more than just shares when you raise outside capital.

1. Ownership dilution

Selling shares reduces founder ownership and future participation in profits and exit proceeds. Every new round creates dilution, meaning you own less of the company you're building. This can be painful if you achieve a massive exit.

2. Loss of control

Investors may obtain board seats, voting rights, or vetoes on key decisions, influencing strategy and governance. You might need investor approval for hiring executives, raising more capital, or selling the company.

3. Complex negotiations

Valuation, terms, and legal documentation can be time-consuming and distract from operating the business. Fundraising can become a full-time job for founders, pulling focus from customers and product development.

4. Disclosure requirements

Founders must share sensitive financials, metrics, and plans during diligence and ongoing reporting. You'll need to provide regular updates, board decks, and financial statements that take time to prepare and expose your business details.

Step-by-step funding strategy

A thoughtful funding strategy helps you raise with purpose, stay in control of your cap table, and set the stage for sustainable growth.

Step 1: Define capital needs

Calculate how much capital you need, why you need it, and the milestones it will fund. Break down your use of funds into specific categories like runway (months of operating expenses), new hires (by role and timing), product development (features and timeline), and go-to-market strategy (customer acquisition and expansion).

Be realistic about your burn rate and build in a buffer for unexpected challenges. Investors want to see that you've thought through exactly how their money will create value.

Step 2: Determine your valuation

Use comps, traction metrics, revenue multiples, and investor feedback to determine valuation. Research similar companies at your stage, analyze recent funding announcements in your sector, and understand standard valuation ranges for your metrics.

Remember, your valuation dictates what percentage of the company you sell for the capital you need. A $5 million raise at a $20 million pre-money valuation means selling 20% of your company; at $10 million pre-money, you'd sell 33%.

Step 3: Build an investor pipeline

Research stage-appropriate angels, VCs, corporates, and platforms that invest in your sector and stage. Seek warm introductions through your network, create targeted outreach that shows why you're a fit for their thesis, and track progress in a CRM to manage follow-ups and feedback.

Quality beats quantity. Focus on investors who genuinely align with your vision and stage rather than spraying and praying.

Step 4: Negotiate a term sheet

Focus on valuation, option pool size, board composition, pro rata rights, liquidation preferences, anti-dilution, and information rights. These terms matter as much as valuation since they determine your control and economics in various exit scenarios.

Don't just optimize for the highest valuation. Consider the investor's reputation, value-add potential, and whether the terms let you operate effectively.

Step 5: Close and update the cap table

Complete diligence and legal docs, collect funds, issue shares, and update your cap table to reflect new ownership. Work with experienced counsel to ensure proper documentation, stock issuance, and regulatory compliance.

Maintain a clean cap table from day one. It'll save headaches in future rounds and make you look professional to investors.

Investor metrics that influence valuation

Investors typically evaluate these key metrics when determining what your company is worth:

- Revenue growth: Consistent month-over-month increases show momentum and market demand. Investors want to see acceleration, not just linear growth—doubling revenue quarterly beats growing 10% monthly.

- Customer acquisition cost: Efficient spend relative to customer value proves you can scale profitably. If you spend $100 to acquire customers worth $500 in lifetime value, you've got a highly scalable model.

- Market size: A large total addressable market justifies the risk of early investment. Investors need to believe you can build a billion-dollar business, not just a nice lifestyle company.

- Team experience: Founder and leadership track record reduces execution risk. Previous startup success, domain expertise, or prior experience at high-growth companies all increase investor confidence.

Balancing debt financing and equity financing over time

Successful startups often blend equity and debt as they mature. Use equity for high-risk growth phases when you lack revenue predictability and need patient capital for product development and strategic hiring.

Once revenue becomes predictable, layer in venture debt or startup lines of credit to extend runway between equity rounds. This reduces dilution while providing working capital for inventory, equipment, or short-term growth investments.

The optimal mix depends on your growth rate, cash flow forecast, and risk tolerance. Many startups raise equity for major expansions, then use debt to smooth cash flow between rounds and minimize dilution.

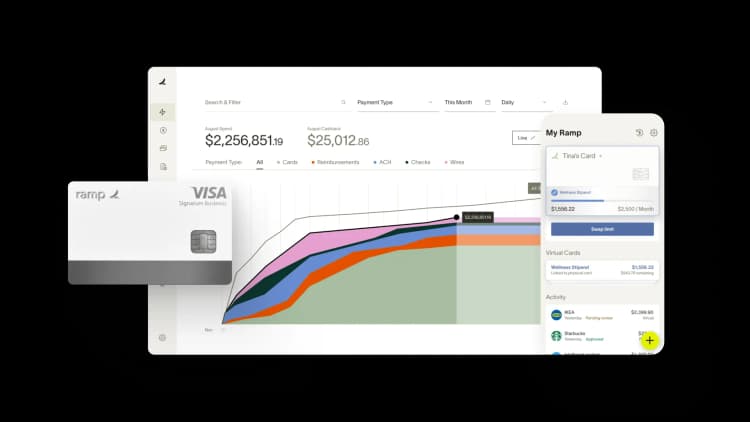

Spend capital smarter with Ramp

Ramp helps extend runway between rounds through real-time spend controls, automated expense management, and AI-powered savings insights, making every invested dollar go further. Our platform identifies duplicate subscriptions, flags unusual spending, and gives you insights to negotiate better rates with vendors automatically.

Try an interactive demo and see why companies that choose Ramp save an average of 5% a year across all spending.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits