- Why real estate finance teams need specialized AP automation

- What AP automation actually does for real estate teams

- How Ramp Bill Pay automates AP for real estate companies

- How real estate companies use AP automation

- Why real estate companies automate AP with Ramp Bill Pay

Real estate firms face highly fragmented accounts payable (AP) processes: property managers submit invoices, regional teams route approvals, and central finance teams struggle to track payments across dozens or even hundreds of properties. Manual workflows introduce delays, reconciliation headaches, and vendor friction.

If you're looking at AP automation software, you're probably trying to get your payment processes under control. The right solution centralizes invoice intake, approval routing, and vendor payments. It also lets you track everything by property, location, or entity, which matters when you're managing multiple sites.

This guide explains how AP automation software can make your AP process less chaotic, and what to look for when choosing a solution that actually fits how real estate finance works.

Why real estate finance teams need specialized AP automation

Accounts payable in real estate directly affects operations. Payments tied to property maintenance, utilities, taxes, and service vendors impact tenant satisfaction and your bottom line.

Managing AP at this scale gets complicated fast. You're dealing with multiple entities, properties, and vendor relationships that all need their own tracking and visibility.

Key challenges in real estate AP include:

- High invoice volumes across distributed property portfolios

- Entity-level accounting, where each property may have separate books

- Manual coding and approval processes that delay payments and introduce errors

- Vendor relationships that depend on fast, reliable payment cycles

- Cash flow variability tied to rent collection and seasonal expenses

When you're handling all this manually, these problems get worse. Late payments disrupt maintenance. Inconsistent coding makes property-level reporting unreliable. Reconciliation delays stretch close cycles. And as your portfolio grows, headcount needs increase just to keep up.

What AP automation actually does for real estate teams

For real estate companies, managing accounts payable means maintaining property operations, protecting vendor relationships, and keeping financial data accurate across a large, often decentralized portfolio.

AP automation software tackles these problems. It reduces manual work, enforces financial controls, and gives you visibility into property-level spend.

Core capabilities of AP automation for real estate teams include:

- Automated invoice capture and coding. These systems extract and categorize data from various formats using OCR and AI-driven logic. This eliminates manual entry and ensures invoices are coded accurately to properties, units, or cost centers.

- Customizable approval workflows. Invoices route automatically based on dollar amount, property, department, or vendor type. Whether it's a routine utility bill or a large capital improvement, approvals follow a defined logic that mirrors how your team operates.

- Real-time visibility into spend. Centralized dashboards let finance, asset managers, and property teams monitor spending in real time across properties, regions, or the entire portfolio.

- Cash flow and payment control. Automated scheduling tools help align payment timing with rent collection and reserve funding. Finance teams can optimize for early payment discounts, avoid late invoice fees, and maintain working capital predictability.

- Secure and auditable processing. Role-based access controls, multi-level approvals, and system-generated audit trails help prevent unauthorized payments and ensure compliance.

- Integration with property management systems. Look for AP systems that integrate with industry-standard tools and accounting platforms such as NetSuite and QuickBooks. These integrations reduce duplicate entry, sync vendor and property records, and simplify month-end close.

- Easier audit prep and compliance. Digital records, searchable documentation, and consistent approval logs make it easier to prepare for audits, comply with investor requirements, and respond to regulatory inquiries.

If you're managing a real estate portfolio, you'll want a system built to handle that complexity.

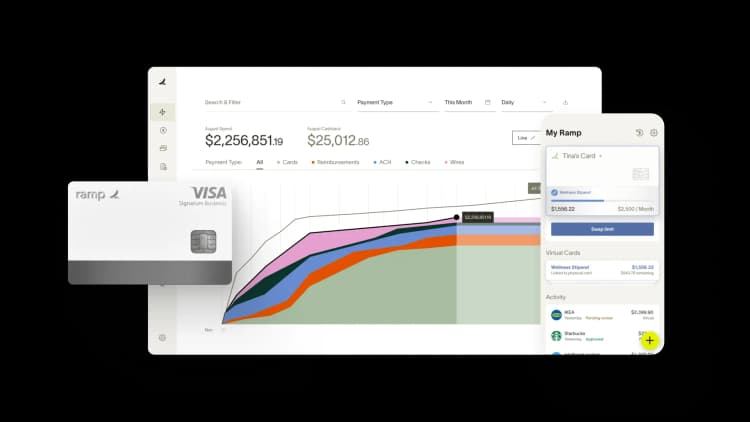

How Ramp Bill Pay automates AP for real estate companies

Ramp Bill Pay handles the full accounts payable process, from invoice capture to payment to reconciliation. It's built to work with how real estate companies actually operate, with support for multiple properties, entities, and approval chains.

The platform uses OCR to extract invoice data, routes approvals based on your rules, and syncs everything with your ERP system. You can pay vendors via ACH, check, or card.

Here's how Ramp Bill Pay can help you handle that without adding more manual work to your plate.

Multi-level approval workflows

Ramp Bill Pay provides approval workflows that can be configured to route invoices based on, department, vendor, or location. This allows managers to review larger or non-routine spend, and leadership to approve high-value or portfolio-wide transactions.

Integrated vendor payments and flexible scheduling

Ramp Bill Pay can issue payments via ACH, virtual card, check, or wire. That means you can pay vendors however they prefer, all from one platform.

You can automate standard vendor payments and schedule them to align with your cash flow. Vendors get automated payment notifications, so you're not fielding follow-up calls.

Ramp Bill Pay also flags early payment discount opportunities. This helps you capture savings where they make sense and avoid overextending during maintenance-heavy periods.

Automated invoice capture

Ramp Bill Pay helps streamline this process by using OCR technology to extract invoice details automatically, minimizing the need for manual entry. Custom fields allow you to tag expenses by department, location, or vendor—making it easier to track costs.

Integrations with accounting platforms

Ramp integrates with whichever accounting system your business uses—so you can reconcile your books without friction. We offer direct integrations with leading ERPs and accounting platforms like NetSuite, QuickBooks Online, Sage Intacct, and Acumatica, enabling real-time sync of vendor bills, reimbursements, payments, and accounting fields. Select systems also support bi-directional sync for vendor bills and imported item receipts.

For platforms without native integrations—like Yardi Voyager—Ramp also provides Universal CSV (uCSV) exports that match your chart of accounts, tracking categories, and project codes for seamless reconciliation. Ramp also offers a robust API and trusted implementation partners to support custom integrations when needed.

Reporting and analytics

Ramp Bill Pay gives you visibility into expenses, approvals, and payment status. You can segment reports by custom fields to see exactly where money is going.

Real estate finance leaders and property managers can track costs in real time instead of waiting for month-end close. When integrated with your accounting system, you can spot spending trends and manage budgets more proactively.

Low pricing and processing fees

Ramp offers a free plan that lets you manage spend, automate vendor payments, and speed up your month-end close. For organizations with more advanced needs, Ramp Plus is available at $15 per user per month, and custom Enterprise plans are also available upon request. Plus, you can handle all domestic and global vendor payments on a single platform—by check, card, ACH, or international wire with zero fees*.

AI agents for accounts payable

Ramp is also introducing AI agents for AP—autonomous systems built into Ramp that go beyond workflow automation. These agents understand invoice context and take action on behalf of your team. They code line items based on historical data, flag potential fraud, suggest the appropriate approver, and submit card payments when applicable.

Ramp customers can enable or join the waitlist for AP Agents in the Early Access tab. Auto-coding and approval recommendations are only available to Ramp Plus customers.

How real estate companies use AP automation

Finance teams across industries are moving away from juggling multiple disconnected systems. They're consolidating their accounts payable work into single platforms that actually talk to each other.

For real estate companies, this shift means invoices get processed faster, and finance teams can see exactly where money is going. Here's how two companies made that switch.

1. How Tomo cut month-end close time with Ramp

Tomo’s finance team had been juggling three separate systems for cards, reimbursements, and bill payments—none of which talked to each other. This fragmentation made spend oversight difficult, delayed approvals, and pushed month-end close out to 15 business days. Without automation, recurring vendor charges had to be manually reviewed and coded every time, adding even more pressure.

By switching to Ramp, Tomo centralized its AP workflows in a single platform. The team now sets automated expense rules to handle recurring charges, routes vendor payments through a streamlined approval process, and syncs financial data directly to NetSuite. Expense review happens continuously throughout the month, reducing surprises and making audits easier with traceable workflows and documentation.

With AP automation in place, Tomo cut its close time by half, eliminated manual reconciliation across platforms, and freed up over 40 hours per month for higher-value work across finance and HR.

“Our auditors love all the separation of duties. It’s very nice to know that if our auditors ask us to show the approval workflow for a bill, I can send screenshots right from Ramp on the lifecycle of approvals.” — Eric Ho, SVP, Head of Finance at Tomo

2. How UpEquity gained clearer spend control with Ramp

UpEquity’s finance team was managing reimbursements and expense approvals across fragmented systems—including Brex, Divvy, and Expensify—which created inefficiencies and limited cost oversight. Reimbursement approvals were time-consuming, and visibility into spend patterns was limited, making it difficult to identify and act on opportunities for savings.

By moving to Ramp, UpEquity consolidated these workflows into a single system. Ramp’s fast reimbursement approval flow now takes just 10–15 minutes per week. Virtual cards are deployed across departments in seconds, with controls in place for department heads to manage their own teams’ spend. Automated categorization and spend tracking by vendor or category helps the finance team quickly identify duplicate spend or opportunities to switch to more cost-effective options.

With Ramp, the team streamlined reimbursements, gained deeper insight into departmental spend, and built a more scalable, efficient finance operation—supporting UpEquity’s growth from 20 to over 80 employees, with more on the horizon.

“Ramp’s ability to approve reimbursements and employee expenses on the fly has made my job a lot easier. Reimbursements now take 10-15 minutes out of my week, since I can either approve requests or delegate their approval to department managers. ” — Tyler Bliha, Head of Strategy and Finance at UpEquity

Why real estate companies automate AP with Ramp Bill Pay

Manual AP workflows break down as your portfolio grows. You're chasing down paper invoices for emergency HVAC repairs while trying to track capital improvements across multiple properties. Vendor payments get delayed, and month-end close becomes a scramble to reconcile everything.

At a certain scale, most real estate operators move to AP automation. Ramp Bill Pay consolidates invoice management, approvals, and payments in one place. Instead of emailing PDFs back and forth, your property managers submit invoices directly, and approvals route based on rules you set.

If you're managing multiple properties with dozens of active vendors, automation usually pays for itself in time saved and errors avoided. You can keep using spreadsheets and email, but the manual work compounds quickly.

Tired of manual workarounds? Get started with Ramp Bill Pay.

*Same-day ACH payments and International payments may incur a fee unless you are using a Ramp Business Account. Ramp Bill Pay is available on our free plan with no software or transaction fees. Note that certain ERP integrations require a Ramp Plus account, which includes a monthly fee.

FAQs

Ramp Bill Pay is Ramp’s name for its accounts payable software—a modern AP automation system that helps finance teams manage invoices, streamline approvals, and make vendor payments all in one place. It automates manual AP tasks, syncs directly with accounting systems like NetSuite, QuickBooks, and Sage Intacct, and gives businesses real-time visibility and control over spend.

Learn how your team can simplify and automate AP on our official Ramp Bill Pay page.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits