- Understanding book value

- Book value vs. market value

- How book value is calculated

- Where to find book value on financial statements

- Key ratios involving book value

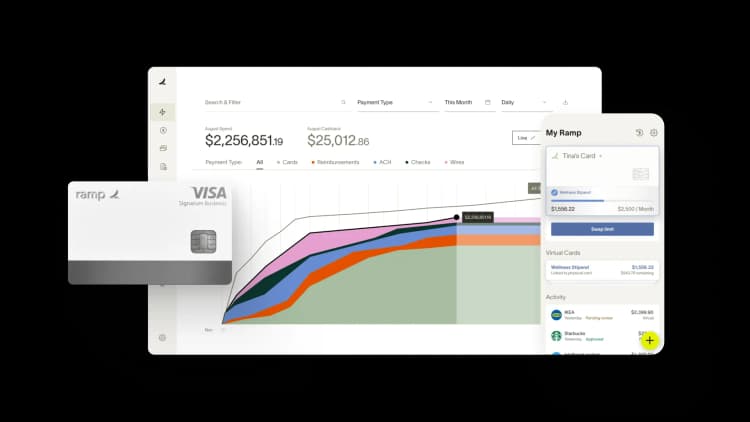

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Book Value

Book value refers to the net worth of a company based on its financial records. It represents the total value of a business's assets after subtracting what it owes. It shows how much the company would be worth if it were to close today and sell off everything it owns to pay its debts.

When analyzing a business, book value helps you understand its actual financial position, stripped of market hype or investor sentiment. Investors use it to spot undervalued stocks. Business owners use it to track equity growth and asset strength over time.

Understanding book value

Book value gives you a baseline view of what a company is worth. To understand how it’s built, it helps to break down its core components. The most common inputs include:

- Tangible assets: These are physical items the company owns, such as machinery, equipment, buildings, and inventory. They appear on the balance sheet at their historical cost, adjusted for depreciation.

- Liabilities: This includes outstanding debts, accounts payable, and other financial obligations that are due and payable. Liabilities are subtracted from assets to arrive at book value.

- Shareholders’ equity: This reflects what’s left for owners after liabilities are paid. It includes items like retained earnings (profits kept in the business) and additional paid-in capital.

Book value typically does not include intangible assets, such as brand reputation or proprietary algorithms, unless they were acquired and recorded during a merger. For example, if a company’s book value is $500 million and its market value is $300 million, it may suggest undervaluation.

But that doesn’t always mean it’s a good investment. Some industries naturally operate with lower book values because they rely less on physical assets. That’s why companies in tech, media, or SaaS often show a low book value despite high market valuations.

If your team tracks assets and liabilities manually, it’s easy to miss updates or misclassify capital expenses. Ramp automates this by detecting patterns in how purchases are recorded and suggesting the correct accounting treatment in real-time.

For example, if a laptop purchase should be capitalized but is coded as an expense, Ramp flags the error and recommends a fix. This ensures that assets are recorded accurately and the book value accurately reflects the true net worth.

Book value vs. market value

The biggest difference between book value and market value is what they are based on. Book value looks backward and is rooted in what the company has already earned and owns. Market value looks forward, shaped by what investors think the company will achieve.

The gap between the two can be wide. For example, as of 2023, Apple’s book value was around $66.8 billion, while its market value exceeded $2.9 trillion.

If the market value drops below the book value, some investors view it as a buying opportunity, assuming the company remains financially healthy. But that’s not always the case.

A low price-to-book ratio can signal deeper issues, such as poor future earnings potential, declining cash flow, outdated or overstated assets, or legal and regulatory risks that haven’t yet affected the financials. In these cases, the market may be pricing in problems the balance sheet doesn’t capture.

Is book value and carrying value the same?

They can be, but it depends on the context. Carrying value refers to the value of a single asset after depreciation or amortization. Book value often refers to a company’s total equity. If you're looking at an individual asset, the carrying value and book value are usually the same. But when you're evaluating a company as a whole, book value reflects overall net worth, not just one item.

How book value is calculated

A company’s accounting team calculates book value as part of its regular financial reporting process. You will typically see it updated every quarter when companies release their quarterly financial statements, also known as balance sheets. For public companies, this data appears in 10-Q and 10-K filings and reflects the company’s net worth at a specific point in time.

Here’s how you can calculate it yourself using the company’s balance sheet:

- Step 1: Locate total assets. Go to the company’s latest balance sheet. Find the line item labeled “Total Assets.” This includes everything the company owns, including cash, inventory, equipment, real estate, and long-term investments. Use the most recent figures available.

- Step 2: Find total liabilities. On the same balance sheet, look for “Total Liabilities.” This includes short-term debt(like accounts payable or taxes owed) and long-term obligations (like bonds, leases, or pension liabilities). These are the company’s financial responsibilities.

- Step 3: Subtract liabilities from assets. To calculate book value, you should subtract the total liabilities from the total assets of the company. The result is the company’s net worth, as reported in its financial statements. This is also known as shareholders’ equity.

- Step 4: Adjust for preferred stock. If the company has issued preferred stock, you’ll need to subtract the value of that stock from total shareholders’ equity. This gives you the book value that belongs to common shareholders. Preferred shareholders have a higher claim on assets, so their portion is excluded when calculating equity available to common stockholders.

- Step 5: Review for one-time adjustments. Some companies carry goodwill, intangible assets, or write-downs that may distort book value. Review the notes to financial statements to check if major adjustments have impacted the final number.

Once you know the book value, you can compare it to the market value or use it to calculate key ratios, such as the price-to-book ratio. It helps you understand how much value a company has built over time.

Always check the footnotes in financial statements. One-time charges, asset write-downs, or changes in accounting methods can affect book value but may not be obvious from the balance sheet alone.

Where to find book value on financial statements

You can find book value on a company’s balance sheet, listed under the Shareholders’ Equity section. This is typically located at the bottom of the balance sheet after total assets and total liabilities have been listed.

To locate it, start by reviewing the company’s latest financial statements. In most balance sheets, book value appears as “total shareholders’equity” or “total stockholders’ equity,” as these two terms are used interchangeably.

This total is made up of several key line items, including:

- Common stock

- Additional paid-in capital

- Retained earnings

- Treasury stock (a negative value)

These amounts are either added to or subtracted from the total equity. If the company has issued preferred stock, it'll usually be listed separately. In that case, you will need to subtract it to calculate the book value for common shareholders.

Here’s a simplified version of what this might look like on a balance sheet:

Shareholders’ Equity

Common Stock...........................$10,000,000

Additional Paid-in Capital..........$50,000,000

Retained Earnings......................$40,000,000

Treasury Stock...........................($5,000,000)

Total Shareholders’ Equity.........$95,000,000

Key ratios involving book value

Book value becomes more useful when you connect it to other financial metrics. Investors and analysts often use it to calculate valuation and performance ratios that reveal how efficiently a company is using its equity and whether its stock price reflects real underlying value.

Price-to-book (P/B) ratio

The price-to-book (P/B) ratio compares a company’s market value to its book value. It helps you see how the market is valuing the company relative to its worth on paper. To calculate the P/B ratio, you can follow the formula:

P/B ratio = Share price ÷ Book value per share

A P/B ratio of 1 means the stock is trading at exactly its book value. A ratio below 1 may signal undervaluation, while a ratio above 1 suggests the market expects future growth, brand value, or strong profitability that isn’t reflected in the balance sheet.

For example, Meta Platforms has consistently traded at a P/B ratio well above 4, despite having relatively low tangible assets. That’s because investors place a high premium on its data assets, ad network reach, and long-term earnings potential—none of which are fully captured in book value.

P/B is especially useful when comparing companies in asset-intensive industries, such as banking, insurance, and manufacturing. In these sectors, book value tends to reflect real economic worth more closely. For tech or service firms, high P/B ratios are common because their value often lies in intangible assets that don’t appear on the balance sheet.

Return on equity (ROE)

Return on equity (ROE) measures how effectively a company uses its book value to generate profits. It tells you how much net income is earned for every dollar of shareholders’ equity. The higher the ROE, the more efficiently the company is turning equity into earnings. To calculate ROE use the formula:

ROE = Net income ÷ Shareholders’ equity

You’ll find both numbers on the income statement and balance sheet. Use figures from the same reporting period to keep the calculation accurate.

The average ROE for S&P 500 companies was about 17.24%, though this varies widely by industry. Banks and financial firms often report higher ROEs because they use leverage to increase returns. In contrast, capital-intensive sectors, such as utilities, tend to exhibit lower ROE due to their larger equity bases.

ROE is most useful when you are comparing companies in the same industry or tracking performance over time. A rising ROE can signal stronger profitability or better asset management. If the ROE is high but the book value remains flat, it may suggest that the company is over-relying on debt or not reinvesting its earnings.

Because ROE depends on both accurate net income and up-to-date equity, clean data is essential. Ramp connects expense management and accounting in one system, so changes to spending or reimbursements flow directly into your books.

You don’t need to wait until the end of the month to see how equity is shifting. This helps finance teams calculate ratios like ROE with current data, making it easier to monitor profitability in real-time.

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

Book value becomes negative when a company’s total liabilities exceed its total assets. This usually signals ongoing losses, large write-downs, or excessive debt. If the business were liquidated in this state, shareholders would likely receive nothing, since debts outweigh assets.

Tangible book value removes intangible assets like goodwill, patents, and trademarks from the standard book value calculation. It reflects the value of a company’s physical assets after liabilities are paid. This metric is often used in asset-heavy industries where real property holds more weight than brand or IP.

Buybacks reduce both total equity and the number of outstanding shares. If equity declines faster than the share count, BVPS can fall, even if the business remains profitable. This can inflate the price-to-book ratio and make the stock appear more expensive relative to its book value, even when fundamentals haven’t changed.

Book value is based on historical cost and not on current market prices. In high-inflation environments, older assets can appear undervalued on the balance sheet, making book value less reflective of real economic worth.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits