Assets vs. liabilities: Key differences and examples

- What are assets?

- What are liabilities?

- Key differences between assets vs. liabilities

- The impact of assets and liabilities on equity

- How assets and liabilities affect a company's financial health

- Tips for managing assets and liabilities

- 8 common business scenarios involving assets and liabilities

- Common misconceptions about assets and liabilities

- Balance your books in real time with Ramp's automated tracking and reporting

Understanding the difference between assets and liabilities isn’t just an accounting exercise—it’s the foundation of your company’s financial success. Knowing what you own, what you owe, and how each affects cash flow helps you make strategic decisions that boost profitability, optimize operations, and stay competitive.

It also gives you clearer insight into how money moves through your business. When you understand how assets and liabilities work together, you can identify opportunities, manage risk, and build a stronger financial structure.

What are assets?

An asset is a resource with economic value that your company owns or controls with the expectation that it will provide future benefits. Assets can generate cash flow, reduce expenses, or increase your ability to sell products or services. They can be tangible or intangible, and they play a central role in your business’s long-term financial health.

In simple terms, an asset is anything that adds value to your business or personal finances—something that puts money in your pocket today or has the potential to grow in value over time.

Types of assets

Assets fall into several categories based on how quickly they can be used or converted into cash:

- Current assets: Cash and cash equivalents, accounts receivable, inventory, and other assets expected to be converted into cash within one year

- Fixed assets or long-term assets: Property, equipment, and long-term investments that support operations and generate value over time

- Intangible assets: Non-physical assets such as patents, trademarks, copyrights, and goodwill that contribute to brand value or competitive advantage

Examples of assets

Personal assets include things like a home or condo, a car, savings and checking accounts, and retirement accounts or other investments.

Business assets include cash and cash equivalents, accounts receivable, inventory, property and equipment, investments, intellectual property such as patents and trademarks, and prepaid expenses.

What are liabilities?

A liability is your company’s financial debt or other obligations that arise during normal business operations. These obligations are settled over time through the transfer of economic benefits such as money, goods, or services.

Both assets and liabilities appear on your balance sheet and help show your company’s financial position. Understanding what you owe and when those obligations come due is essential for maintaining stability and planning ahead.

Types of liabilities

Liabilities are grouped by when they must be repaid and whether the obligation is certain or potential:

- Current liabilities: Debts or obligations due within one year, such as accounts payable or accrued expenses

- Long-term liabilities: Obligations due after one year, including long-term loans, mortgages, and notes payable

- Contingent liabilities: Potential future obligations, such as pending lawsuits or guarantees, that depend on the outcome of an uncertain event

Examples of liabilities

Personal liabilities include mortgages, credit card debt, auto loans, and student loans — obligations you are responsible for repaying over time.

Business liabilities include accounts payable, loans and notes payable, mortgages, accrued expenses such as wages payable or taxes payable, deferred or unearned revenue, and business credit card debt.

Key differences between assets vs. liabilities

Assets and liabilities play different roles in your business’s finances, and understanding how they compare helps you make clearer decisions about growth, risk, and cash flow.

| Aspect | Assets | Liabilities |

|---|---|---|

| Definition | Resources a company owns or controls that provide future benefits | Obligations owed to others that require settlement |

| Purpose and function | Support operations, generate revenue, and drive long-term value | Finance operations and represent future obligations |

| Impact on financial statements | Increase company value; recorded on the left side | Reduce company value; recorded on the right side |

| Revenue vs. obligation | Contribute to revenue generation | Represent future payments the company must make |

| Liquidity | Can be liquid or illiquid | Have specific repayment terms that affect liquidity |

| Timeframe | Current or non-current (long-term) | Current or non-current (long-term) |

| Risk factor | Reduce risk by providing resources | Increase risk by adding financial obligations |

| Accounting treatment | Subject to depreciation or amortization | May accrue interest and change with borrowing or repayment |

Impact on financial health

Assets strengthen your financial position by building value over time, generating revenue, and improving long-term stability. Liabilities can support growth when used to finance productive investments, but they can also strain cash flow if they become too large or costly to manage.

This is where the idea of good debt vs. bad debt becomes important. Good debt funds assets that create returns, while bad debt creates obligations that don’t improve your financial position.

How assets and liabilities appear on a balance sheet

A balance sheet lists your assets at the top or on the left, your liabilities on the right or below them, and equity underneath to show what your business truly owns after debts are paid. All three categories are connected by the accounting equation:

Assets = Liabilities + Equity.

For example, if your business owns $500,000 in assets and owes $300,000 in liabilities, your equity is the remaining $200,000.

The impact of assets and liabilities on equity

Equity

Equity represents the value of an owner's interest in a company after all liabilities have been deducted from the assets. It is often referred to as shareholders’ equity for corporations or owners’ equity for sole proprietorships and partnerships.

Equity shows the net worth or book value of your business and is a key indicator of financial health. It reflects what’s left after subtracting everything you owe from everything you own.

Examples of calculating equity

Example 1: Basic calculation

Suppose your company has $800,000 in total assets and $500,000 in total liabilities. Using the equity formula (Equity = Assets – Liabilities), your company’s equity is $300,000, representing your stake in the business.

Example 2: Detailed balance sheet items

Say your business has the following balance sheet components:

- Current assets: $200,000

- Non-current assets: $600,000

- Current liabilities: $150,000

- Non-current liabilities: $350,000

First, calculate total assets:

- Total assets = Current assets + Non-current assets

- $200,000 + $600,000 = $800,000

Then, total liabilities:

- Total liabilities = Current liabilities + Non-current liabilities

- $150,000 + $350,000 = $500,000

Finally, compute equity:

- Equity = Total assets – Total liabilities

- $800,000 – $500,000 = $300,000

Example 3: Negative equity scenario

If your company has $400,000 in total assets and $450,000 in total liabilities, your equity is –$50,000. A negative equity of $50,000 indicates that your liabilities exceed your assets, which may signal financial distress or insolvency.

How assets and liabilities affect a company's financial health

The balance between assets and liabilities plays a major role in your company’s financial health. Tools like the equity multiplier can help you evaluate how your use of assets and liabilities affects financial leverage and long-term stability.

Having liabilities isn’t inherently negative. When managed well, liabilities can help finance essential assets and investments that strengthen growth and profitability. The goal is to maintain a balance where your assets comfortably cover your liabilities, resulting in positive equity.

Real-world example of balancing assets and liabilities

Consider the following scenario: You own a retail company and plan to open new stores to expand your market reach. Your business obtains a loan to fund the new locations.

- Asset: The new store locations become assets that can generate additional revenue

- Liability: The loan used to finance the expansion is a liability that will be repaid over time

If the revenue from the new stores exceeds the cost of the loan and operating expenses, your company improves its financial health and equity position.

Balancing assets and liabilities allows your company to pursue opportunities while maintaining financial integrity. Monitoring this balance helps you identify potential risks and make strategic decisions that support long-term growth.

Tips for managing assets and liabilities

Effective management of assets and liabilities helps you maintain liquidity, ensure operational efficiency, and stay on track with your financial goals. This starts with understanding business finance and applying a few practical strategies.

- Optimize asset utilization: Review the performance and value of your assets regularly to ensure they contribute meaningfully to revenue

- Maintain liquidity: Keep an appropriate balance of current assets to meet short-term obligations without unnecessary borrowing. Effective liquidity management helps you stay flexible when cash needs change.

- Invest strategically: Allocate resources to assets that have strong potential for growth and long-term profitability

- Manage debt responsibly: Align debt obligations with cash flow patterns so repayments stay predictable and manageable

- Diversify funding sources: Explore multiple financing options to reduce reliance on a single creditor

- Monitor liabilities: Keep track of both current and long-term liabilities to prevent financial strain and maintain creditworthiness

8 common business scenarios involving assets and liabilities

Understanding how assets and liabilities function in everyday business situations can make these concepts easier to apply. Below are common scenarios that highlight the differences between what you own and what you owe.

1. Purchasing office equipment

- Asset: Office equipment like computers and printers provides future economic benefits by improving operational efficiency

- Liability: If purchased on credit, the amount owed to the supplier becomes a liability (accounts payable) until it’s repaid

2. Taking out a business loan

- Asset: The cash received from a business loan increases resources available for operations or investment

- Liability: The loan itself is a liability that must be repaid over time with interest

3. Purchasing inventory on credit

- Asset: Inventory acquired for resale is an asset because it will generate revenue when sold

- Liability: If purchased on credit, the amount owed to the supplier is a liability (accounts payable)

4. Receiving customer prepayments

- Asset: Cash received in advance from customers increases your company’s cash balance

- Liability: The obligation to deliver goods or services later is recorded as unearned or deferred revenue

5. Paying employee salaries

- Liability: Wages earned by employees but not yet paid are liabilities (accrued wages)

- Expense: Once wages are paid, they’re recorded as an expense rather than a liability

6. Obtaining a mortgage for business property

- Asset: The property purchased is a long-term asset with potential appreciation

- Liability: The mortgage financing the purchase is a liability repaid over time with interest

7. Investing in marketable securities

- Asset: Investments in stocks, bonds, or other securities are assets with income or appreciation potential

- Liability: If purchased using borrowed funds (such as a margin loan), the balance owed becomes a liability

8. Incurring credit card debt for business expenses

- Asset: Goods or services purchased, like business travel expenses or office supplies, support operations and can be treated as assets or expenses

- Liability: The outstanding balance on the business credit card is a liability that must be repaid

Common misconceptions about assets and liabilities

- Depreciating assets: Some assets, like vehicles or equipment, lose value over time. They’re still assets, but their declining worth can affect long-term financial strength.

- Strategic debt: Not all liabilities are harmful. Borrowing to acquire revenue-generating assets or expand operations can improve profitability and growth.

- Expenses vs. liabilities: Expenses reduce profit in the period they occur; liabilities are financial obligations you still owe. An expense becomes a liability only when it remains unpaid at period-end.

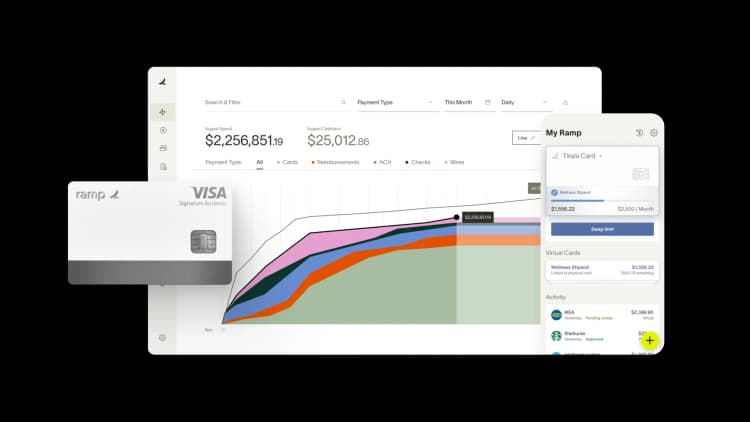

Balance your books in real time with Ramp's automated tracking and reporting

Balancing assets and liabilities manually means chasing receipts, reconciling spreadsheets, and piecing together incomplete data—all while trying to close your books on time. Ramp's accounting automation software eliminates this friction by tracking every transaction in real time and syncing it directly to your ERP, so your balance sheet stays accurate without the manual work.

Ramp captures spend as it happens and codes transactions automatically across all required fields, including accounts, departments, classes, and locations. You'll see exactly where money flows, which liabilities are outstanding, and how assets shift throughout the month. When receipts are missing or transactions need review, Ramp flags them immediately so you can resolve issues before they compound.

Here's how Ramp keeps your books balanced:

- Real-time transaction tracking: Every purchase, reimbursement, and bill payment posts instantly with complete context, so you always know your current financial position

- Automated coding and syncing: Ramp learns your accounting patterns and syncs in-policy transactions to your ERP automatically, reducing manual entry and coding errors

- Built-in reconciliation: Ramp's reconciliation workspace surfaces variances and missing entries so you can tie out accounts quickly and confidently

- Accrual automation: Post and reverse accruals automatically to ensure expenses land in the right period, keeping your balance sheet accurate month over month

Try a demo to see how Ramp helps finance teams maintain accurate balance sheets with 3x faster month-end close.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°