Do business credit cards affect your personal credit score?

- How business credit cards can impact your personal credit score

- Understanding business credit vs. personal credit

- Which business credit cards report to personal credit bureaus?

- Can you build personal and business credit at the same time?

- Whose credit score is impacted by a business credit card?

- Does a corporate credit card affect your credit score?

- Build business credit with Ramp without affecting your personal credit score

A business credit card can affect your personal credit score, but it depends on how the card is structured and how you use it. If your business card requires a personal guarantee, the issuer may report activity to your personal credit report. That means late payments, high balances, or defaulting can hurt your score.

If the card doesn’t report to personal credit bureaus or only does so under certain conditions, your score will not be affected unless something goes wrong. Still, you're personally liable, so the risk is real.

How business credit cards can impact your personal credit score

If you apply for a business credit card, your personal credit score will likely take a temporary hit due to a hard inquiry from the credit card issuer. However, the impact is usually minor and brief.

Business credit card issuers typically check your personal credit when reviewing your application. They also require a personal guarantee, which makes you responsible for the debt if your business can't repay it.

Some issuers report only negative activity, like missed payments or defaults. Others report everything, including balances and payment history. If reported, high balances can raise your credit utilization ratio, which makes up 30% of your FICO score.

Carrying a large balance can lower your score even if your business pays on time. Missed payments have a bigger impact, as they stay on your report for up to seven years. You can protect your score by keeping balances low, making payments on time, and choosing a card that reports only to commercial credit bureaus when possible.

You can limit that impact by choosing business cards that don’t perform credit checks or report to your personal credit. For example, Ramp offers a corporate card that doesn’t require a personal credit score or personal guarantee. If you meet the eligibility criteria, such as having at least $25,000 in a US business bank account, you can access credit without putting your personal score at risk.

Likewise, any other business debts attached to your SSN will affect your credit score. So, be careful before attaching a personal guarantee to any business loan.

Getting a business credit card using your EIN number helps build your business credit. A good business credit score can lead to more favorable loan terms and repayment options.

Understanding business credit vs. personal credit

Your business credit score is linked to your Employer Identification Number (EIN), which is your business’s tax ID number. You can apply for an EIN online after you have registered your business with the state.

Your business credit score is used to apply for credit accounts, like small business loans and lines of credit. You can check your business credit score with the major commercial credit bureaus: Dun & Bradstreet, Equifax, and Experian.

Your personal credit score, often called a FICO score, is tied to your Social Security Number (SSN). This score reflects your personal financial history, including credit card usage, loan repayment, and other financial activities tied to your personal identity. Personal credit scores play a significant role when you are seeking personal loans, mortgages, or other forms of personal financing.

When you apply for a business credit card or loan, especially as a small business owner, lenders often check both your business and personal credit. That’s because most businesses, especially new ones, don’t have enough credit history to stand on their own. As a result, most applications require a personal guarantee.

That personal guarantee connects your business activity to your personal credit. If your business misses a payment or raises a high balance on a card that reports to personal credit bureaus, your score can take a hit. Even if the account is for business use, you’re still personally responsible for the debt.

Which business credit cards report to personal credit bureaus?

Business credit card activity usually isn’t reported to the personal credit bureaus, but there are some exceptions.

Certain business credit cards, like the Capital One Venture X Business and Capital One Spark Cash Plus, will report late payments and serious delinquencies to the consumer credit bureaus, negatively impacting your personal credit score.

If you have a business credit card from American Express or U.S. Bank, late payments will also show up on your personal credit report.

Issuer | Reports to consumer credit bureaus | Reports to commercial credit bureaus |

|---|---|---|

American Express | Yes, but only negative payment history | Yes |

Bank of America | No | Yes |

Capital One | Yes, the Capital One Spark Cash Plus and Venture X business credit cards report delinquencies | Yes |

Chase | Yes, but only if the account is seriously delinquent | Yes |

Citi | No | Yes |

U.S. Bank | Yes, but only if the account is seriously delinquent | Yes |

Wells Fargo | No | Yes |

Can you build personal and business credit at the same time?

You can build business credit and personal credit simultaneously, but only if the accounts you use affect both.

Some business credit cards report activity to both personal and business credit bureaus. When that happens, your payment history and balances can shape both scores. If you pay on time and keep balances low, you’ll strengthen both profiles. If you miss payments or overutilize credit, it can drag you down.

Not all cards work this way. Some report only to commercial bureaus, which means your business activity won’t touch your personal credit at all. Others report only when things go wrong, like missed payments or defaults.

If your goal is to grow both profiles, choose financial products that report to the right bureaus. Just make sure you're ready for the added responsibility because mistakes can follow you on both fronts.

You don’t need to choose one score over the other. With the right setup, you can grow both together and give your business more room to scale.

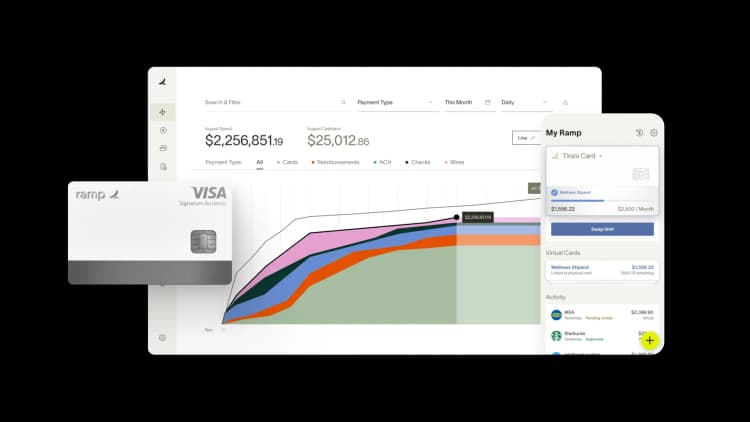

Discover Ramp's corporate card for modern finance

Whose credit score is impacted by a business credit card?

When business credit card activity is reported to the consumer credit bureaus, it typically only affects the primary cardholder, that is, the business owner who opened the card and personally guaranteed any credit card debt. Sometimes, a business owner may add an authorized user to their business credit card. In that case, the authorized user’s credit report could also be affected.

Primary cardholders

Whoever applies for and is approved for a small business credit card is considered the primary account holder. Usually, this is the company's owner, not an employee.

When you open the card as the primary account holder, the tax identification number you provide will determine whether the card reflects on your personal or business credit score. If you open the card with your SSN, it’ll be linked to your personal credit score. Opening the card with your business’s EIN will keep your business credit score separate.

If you open a card with your SSN, you’ll probably also have to provide a personal guarantee of repayment so that lenders know you’ll personally repay any debts if your business account defaults on its payments.

Authorized users

An authorized user is someone who has been added to a credit card account by the primary cardholder. This is usually an employee. This allows the employee to make purchases on the card as if it’s their own.

As an authorized user, your credit score will reflect how both you and the primary cardholder use the card. If the account holder makes timely payments, then it’ll help build your credit score. However, if the account holder fails to make payments, your credit score will take a hit.

If more than one person can use a card, the business needs a system that identifies who used the card and who must approve the purchase.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

Does a corporate credit card affect your credit score?

Generally, with corporate credit cards, your personal credit score won't be affected. Most corporate cards use your business’s EIN, not your personal SSN when you open the account. Business owners and employees shouldn’t see any changes to their personal credit scores when a corporate card is used.

As a business owner, corporate cards differ from traditional business credit cards in how they affect your business credit report. This is because:

- Corporate cards don't factor in credit utilization ratios. That means you don’t have to worry about how much of your available credit you’ve used out of your credit limit like you would with a traditional credit card.

- Corporate cards typically require full monthly balance payments. These are often automatically drawn from your business bank account. This prevents lenders from reporting late payments and credit card debt to the credit bureaus.

The only case in which a corporate card would affect an employee’s personal score is if the business made a billing mistake and added it in their name. If you see that a corporate charge card appears in a personal credit check, take steps to speak with the person in your company issuing the cards to remove your name.

Build business credit with Ramp without affecting your personal credit score

With a corporate card from Ramp, your credit score won’t be impacted when you apply because we don’t need to perform either a soft or hard inquiry. All you need to qualify is an EIN number attached to your registered business and at least $25,000 in any U.S. business bank account linked to your application.

Unlike a traditional business credit card, Ramp requires full monthly balance payments—avoiding worries about on-time payments and any negative impact on your credit score. But like other business cards, Ramp reports to the business credit bureaus, allowing you to build business credit.

What’s more, with Ramp’s advanced spend controls, you can automate many of the factors that might negatively affect both your personal and business credit score. Use Ramp to enact spending limits, automate expense reports, and get a clear picture of your company’s cash flow.

FAQs

Business credit reports are used to assess the financial health and creditworthiness of businesses. Personal credit reports, on the other hand, are used to evaluate individuals' credit behavior and ability to repay personal debts.

If your LLC has debts taken out in the company’s name, only the LLC’s business credit report will be impacted by whether you repay your debts on time. An LLC loan will only impact your personal credit if you cosign or guarantee it. Your credit report will remain unaffected if you don't do so.

Business credit cards aren’t covered by the same consumer protections under the CARD Act. That means issuers can raise interest rates or shorten billing cycles without as much notice. Always read the terms before applying.

If the card is tied to your business account and only reports to commercial credit bureaus, their activity won’t impact your personal credit. However, you’re still responsible for their charges as the primary cardholder.

There’s no universal limit, but most lenders look for a minimum business credit score of at least 75 to 80 on a scale of 1 to 100. For example, a PAYDEX score of 80 from Dun & Bradstreet signals that your business pays vendors on time and is considered low risk. Some lenders also use the FICO Small Business Scoring Service (SBSS), where a score of 140 or higher is often required for SBA-backed loans.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits