- Deal highlights: What you need to know

- Why Capital One is buying Brex

- What Brex customers can expect right now

- What this means for finance teams

- How the fintech market is shifting

- What to watch next

- Bottom line

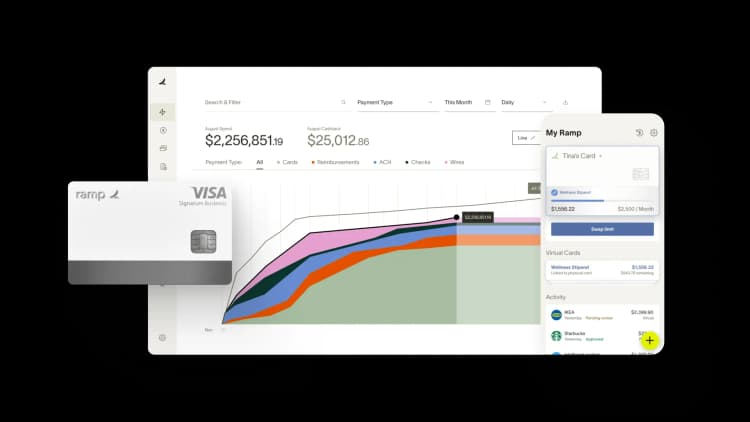

Brex customer? We'll give you $1,000 to see the better option.

Get $500 when you take a demo and share a recent Brex or Capital One statement, and another $500 when you become a Ramp customer.

The spend management market is shifting again.

Capital One announced it will acquire Brex for $5.15 billion, bringing one of the most prominent fintech platforms under the umbrella of a major U.S. bank. The deal combines Brex’s corporate card and software platform with Capital One’s scale and infrastructure, and it comes just a year after Capital One’s $35 billion acquisition of Discover.

For finance leaders, this move raises both strategic questions and immediate practical ones. Here’s a breakdown of what’s happening, what’s changing, and what to keep an eye on.

Deal highlights: What you need to know

- Who: Capital One is acquiring Brex in a cash-and-stock deal

- Value: $5.15 billion ($2.75 billion in cash, plus 10.6 million Capital One shares). This represents a significant markdown from Brex's $12.3 billion valuation in 2022.

- Timeline: The deal is expected to close in the second quarter of 2026, according to The Wall Street Journal

- Leadership: Brex co-founder and CEO Pedro Franceschi will continue leading the platform post-acquisition

Why Capital One is buying Brex

This acquisition gives Capital One access to Brex’s customer base, which spans from early-stage startups to large enterprises, and to its expense management platform.

For Capital One, the acquisition is a strategic play that deepens its presence in commercial payments, expands distribution to tech-forward customers, and nets modern infrastructure to compete with fintech-native platforms. It also follows a pattern: banks are increasingly acquiring fintechs to bridge the technology gap and accelerate innovation that would take years to build in-house.

What Brex customers can expect right now

There are no immediate changes to Brex’s products, pricing, or support. Day-to-day operations continue as normal, and Brex remains independent until the deal officially closes.

Co-founder and CEO Pedro Franceschi will continue leading Brex as part of Capital One, and there’s no public roadmap change yet. Still, customers should monitor how the acquisition affects integration plans, product roadmap, customer focus, and support structure over time.

If you’re a finance team currently using Brex, expect communications from the company closer to the deal closing with more detail. No action is required for now, but informed awareness is key.

What this means for finance teams

Acquisitions of this scale always raise questions. Finance leaders are already asking:

- Will Brex continue shipping features at the same pace?

- Will Capital One change platform flexibility, limits, or fee structures?

- Should we evaluate Brex alternatives in case of major shifts?

These are standard questions during any ownership change, and none imply an urgent need to switch. But they are signals to keep your options open and watch how Brex evolves over the next two quarters.

Now is a good time to review your current fintech stack, double-check renewal cycles, and stay informed on product updates from Brex or Capital One.

How the fintech market is shifting

This deal is part of a larger trend: traditional banks acquiring fintech companies to close tech gaps and stay competitive.

For buyers, the spend management space now includes:

- Independent platforms (Ramp, Rho, Navan)

- Bank-owned fintechs (Brex via Capital One, Center via American Express)

- Traditional banks offering basic card and AP products

Each model has tradeoffs. Bank-owned tools may offer stability and integrations but can be slower to innovate. Independent fintechs often ship faster and adapt better to growing teams, with a stronger focus on automation and control.

Choosing a platform now means weighing those priorities: flexibility vs. structure, innovation vs. infrastructure.

What to watch next

The Brex acquisition is scheduled to close mid-2026. Between now and then, watch for:

- Product roadmap clarity: Will Brex’s pace or focus shift?

- Support model updates: Will Capital One centralize service?

- Policy or pricing changes: Will anything feel more bank-like?

- Customer communications: Will there be opt-in options or account transitions?

Finance teams using Brex don’t need to make a move yet, but it’s smart to treat this as a transition window, not business as usual.

Bottom line

Capital One's $5.15 billion acquisition of Brex signals a major shift in how traditional banks are competing in the spend management space.

For now, Brex continues operating as-is. But for finance teams, this is the right moment to check in on your tools, your roadmap, and your vendors.

Because change is coming—and clarity favors those who prepare early.

FAQs

Yes. Capital One announced on January 22, 2026, that it will acquire Brex in a deal valued at approximately $5.15 billion.

Capital One Financial, a major U.S. bank and credit card issuer.

The deal is expected to close in mid-2026, subject to regulatory approvals and customary closing conditions.

No changes to products, pricing, or customer support have been announced at this time.

Co-founder and CEO Pedro Franceschi will continue leading Brex as part of Capital One.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits