- Is Brex being acquired?

- 1. Best overall Brex alternative: Ramp

- 2. Navan (formerly TripActions)

- 3. Paylocity

- 4. BILL Spend & Expense (formerly Divvy)

- 5. Spendesk

- 6. SAP Concur

- 7. Expensify

- Brex alternatives for small businesses

- Brex competitors with business bank accounts

- How to choose a platform for banking, procurement, and corporate cards

- So, what is the best Brex alternative?

Brex customer? We'll give you $1,000 to see the better option.

Get $500 when you take a demo and share a recent Brex or Capital One statement, and another $500 when you become a Ramp customer.

Is Brex still right for you? With Brex's recent acquisition by Capital One, businesses are weighing whether the platform will maintain its startup focus or shift toward the enterprise customers Capital One traditionally serves. If you're evaluating whether an independent spend management platform built for high-growth companies will fit your needs better, you're not alone.

There are several Brex alternatives out there to choose from, including:

- Ramp

- Navan (formerly TripActions)

- Paylocity

- BILL Spend & Expense

- Spendesk

- SAP Concur

- Expensify

To compile this list, we looked at the G2 ratings of comparable corporate credit card providers and spend management platforms, and analyzed customer reviews. Combining our own research with this user feedback, we selected seven top Brex competitors.

Note: The cashback percentages, limits, fees, and other figures mentioned in this article are for illustrative purposes only. They do not represent guaranteed or expected rates. Actual terms, credit limits, rewards, and approval criteria vary by card issuer and may change at any time. Readers should verify current details directly with each issuer before applying.

Is Brex being acquired?

Yes. On January 22, 2026, Capital One agreed to acquire Brex for $5.15 billion in cash and stock. The deal is expected to close in the second quarter of 2026.

For businesses currently evaluating Brex, this acquisition introduces some uncertainty around the fintech platform’s product roadmap, pricing, and customer focus. Capital One historically serves enterprise customers, which may signal a shift away from Brex's core focus on startups and high-growth companies.

If you're looking for an independent spend management platform designed specifically for modern finance teams, Ramp remains purpose-built for startups and scaling businesses. Our product roadmap is driven directly by customer needs, with faster feature releases and no competing priorities from a traditional financial institution.

1. Best overall Brex alternative: Ramp

Full disclosure: We’re a little biased about why Ramp should be your choice for finance automation. From corporate cards and expense management to bill pay and AI accounting software, our platform is purpose-built to save your business time and money month after month.

So, how is Ramp different from Brex?

One of the biggest differences is independence. Ramp is an independent spend management platform built for modern finance teams. Our product roadmap is driven entirely by customer needs, with faster feature velocity and no competing priorities from a legacy banking institution.

Brex, now being acquired by Capital One, was originally designed for venture-backed startups. With the acquisition, current and prospective customers might question whether its product direction, pricing, and customer focus will shift toward Capital One's traditional enterprise customer base.

Ramp serves businesses of all sizes and stages, from bootstrapped startups to large enterprises. But unlike platforms transitioning to bank ownership, our independence means we can move faster, ship features that matter to growing companies, and keep our roadmap aligned with the teams we serve.

Key Ramp features

- Unlimited physical and virtual cards for employees

- Single platform for data and workflows between payables, business travel, and accounting

- Companies who use Ramp save an average of 5% across all spending

- Procure-to-pay automation, including vendor management, price intelligence, and negotiations

- Easy-to-use interface for finance teams and employees with reliable support

- Free bill pay via multiple payment options, including cards, ACH, checks, and wire transfers

Why businesses choose Ramp vs. Brex

More than 50,000 businesses have already saved $10 billion and 27.5 million hours by switching to Ramp, and over 4,200 companies have switched directly from Brex. Almost 90% of people who reviewed Ramp on G2 gave our platform a 5-star rating.

Ramp provides:

- Independence and customer focus: Ramp is purpose-built for modern finance teams. Our product roadmap is driven by customer needs, not the competing priorities of a legacy banking institution. With faster product velocity and no uncertainty around strategic direction, you can trust that Ramp will serve startups and established businesses alike.

- Business banking connections on your terms: Ramp provides more than 80 bank connections to diversify your funds across multiple bank accounts. By ensuring you are not locked into one financial provider—like with Brex’s business bank accounts—you lower your risk exposure.

- Easier expense reports for all: Ramp provides an employee experience that enables people to complete expenses on time. Ramp’s receipt capture can auto-match transactions, auto-populate memo fields, and auto-generate receipts if missing.

- Insights into big-picture business spend: Brex’s sparse procurement capabilities have led some firms to pick Ramp for vendor management, savings intelligence, and procure-to-pay.

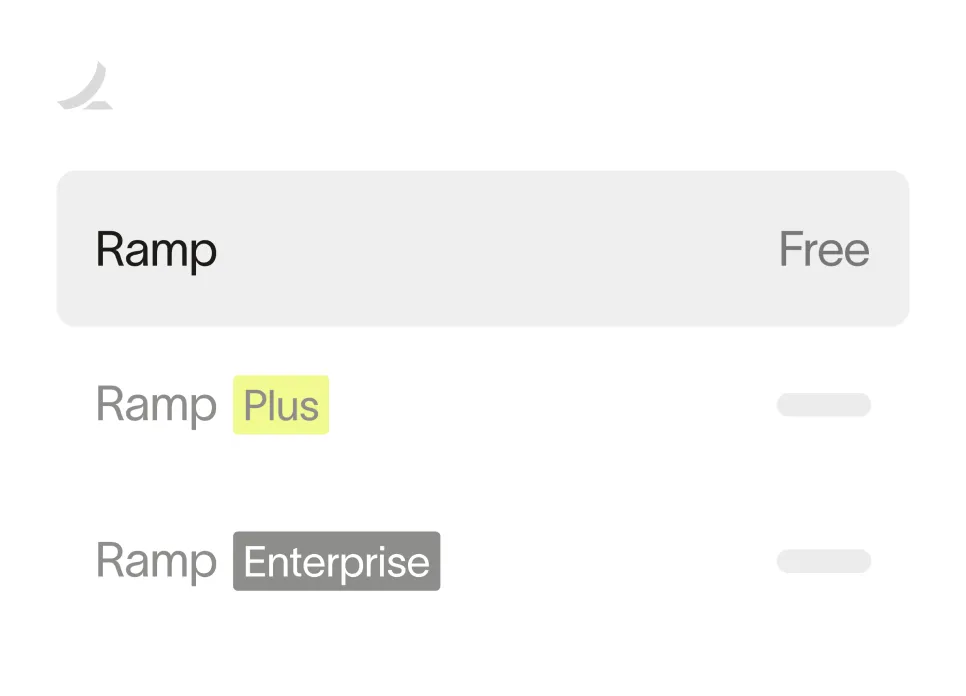

Ramp pricing

- Ramp helps you control spend, automate payments, and rapidly close your books—all for free.

- Ramp Plus is $15 per person a month. It gives you more control and greater customization.

Ramp reviews and ratings

- G2: 4.8/5 (2,200+ reviews)

- Capterra: 4.9/5 (200+ reviews)

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

2. Navan (formerly TripActions)

Navan is a travel and expense management solution that allows professionals to book, view, and manage trips and expenses.

Key features

- Controls at the point of sale to stop out-of-policy spending

- Automated reconciliation to help finance teams track and monitor spend

- Virtual cards tied to each travel booking, removing the need for manual reconciliation

- Reimbursements for employees across 45 countries and 25 currencies

Why businesses choose Navan over Brex

A reviewer on G2 notes that Navan's interface is friendlier and easier to use than Brex's. Specifically, uploading receipts and writing descriptions for expenses are much easier.

Pricing

Navan is free for companies’ first 5 monthly active users, with a fee for live travel agent support. The company can provide custom quotes for companies that exceed those needs.

3. Paylocity

Paylocity has recently expanded into the finops space, integrating Airbase’s former technology to offer a more complete expense management experience. The platform now brings together purchasing workflows, bill payments, and expense tracking in one system. With an average G2 rating of 4.5 out of 5 from thousands of reviewers, Paylocity is often compared to Brex for its unified approach to managing company spend.

Features

- Guided procurement with configurable approvals and vendor management tools

- Automated invoice processing and bill payments within a single platform

- Real-time expense tracking that captures and categorizes spend instantly

- Digital receipt capture with scanning and OCR capabilities

Why businesses choose Paylocity over Brex

Reviewers point to Paylocity’s automation, centralized spend visibility, and built-in procurement controls as standout advantages. Many users note that its unified system streamlines expense reporting and payables, reducing the manual work and disconnected processes that can occur with Brex’s more card-focused approach.

Pricing

Paylocity doesn’t list public pricing for its spend and expense management tools. Companies need to reach out to the Paylocity sales team to receive a custom quote based on their size, usage, and specific requirements.

4. BILL Spend & Expense (formerly Divvy)

BILL Spend & Expense, formerly known as Divvy, combines corporate cards and expense management software in one platform. It’s built for businesses that want real-time visibility into budgets and spending, along with automated expense tracking and reconciliation. BILL Spend & Expense holds a 4.5 out of 5 rating on G2.

Key features

- Smart budgets to allocate funds by team, department, or project

- Real-time spend visibility and automatic transaction categorization

- Physical and virtual corporate cards with customizable controls

- Built-in receipt capture and reimbursement tools for employee expenses

Why businesses choose BILL over Brex

Users highlight its strong budgeting capabilities, intuitive design, and seamless integration with the broader BILL ecosystem for payables and accounting. Many small and midsize companies prefer BILL Spend & Expense for its no-fee card program, transparent controls, and flexibility without requiring a tied-in business bank account.

Pricing

BILL Spend & Expense is free to use, with no software or card fees.

5. Spendesk

Founded in Europe in 2016, Spendesk provides company cards and software to help companies manage expense approvals, budgets, and accounting automation. Customers give Spendesk a 4.6 out of five rating on G2.

Key features

- Real-time spending dashboard displaying online and offline transactions

- Team budgets, request tracking and approvals, and expense reimbursements

- Invoice automation and approval workflows for more control over the invoicing lifecycle

- Single-use virtual cards to reduce fraud risks for one-off purchases, plus dedicated virtual business cards for recurring costs.

Why businesses choose Spendesk over Brex

One G2 reviewer complimented Spendesk for clearly showing which invoices were approved and for its clear approval records.

Pricing

Spendesk can provide custom quotes to companies of all sizes.

6. SAP Concur

While SAP Concur rates lower than Brex, it remains a popular choice for enterprise companies due to its integration with existing SAP systems and its comprehensive feature set for travel and expense management. However, it has the lowest rating on our list, scoring 4.0 out of 5 on G2.

Key SAP Concur features

- Automated fraud detection and compliance monitoring for all expense reports

- Real-time budget visibility and accurate expense reporting

- Streamlined accounts payable, from invoice capture to payment

Why businesses choose SAP Concur vs. Brex

As a legacy finance management tool, SAP Concur has a proven track record of being a trusted solution for expense management. It is a better fit than Brex for businesses already using SAP ERP systems or other SAP modules.

SAP Concur pricing

SAP Concur offers custom pricing plans that are not publicly available.

SAP Concur reviews and ratings

- G2: 4.1/5(6,000+ reviews)

- Capterra: 4.3/5 (2,000+ reviews)

7. Expensify

Expensify is a comprehensive expense management platform offering corporate cards, expense tracking, invoicing, bill pay, and travel booking. Though it ranks lower on G2 with a 4.5 compared to Brex, it excels in certain areas.

Key Expensify features

- Effortless expense submission with SmartScan receipt capture

- Automated expense categorization and account assignment

- Flexible reimbursement options

- Simplified credit card import and checking account integration

Why businesses choose Expensify vs. Brex

A G2 review praised the tool’s email uploading capabilities as a big upgrade from other, more tedious expense platforms and manual spreadsheet files.

Expensify pricing

Ranges from $0 per user per month to $36 per user per month, depending on your plan specifics and how you pay.

Expensify reviews and ratings

- G2: 4.5/5 (5,000+ reviews)

- Capterra: 4.5/5 (1,000+ reviews)

Brex alternatives for small businesses

On June 17, 2024, Brex announced that it would no longer serve small businesses, shifting its focus to "technology startups and larger companies." As a result, small businesses using Brex were forced to transfer all funds from their Brex Cash account to an external bank account or another cash account provider by August 15.

This change was highly inconvenient and disruptive for the tens of thousands of small businesses that relied on Brex as their financial hub, forcing them to seek new financial partners. With Brex's acquisition by Capital One, a bank that historically focuses on enterprise customers, the platform's direction may continue shifting away from smaller, high-growth startups.

Choosing the right software for flexible banking, spend management, and procurement can make all the difference for a small business looking for a management solution for its finances and to streamline operations.

Brex competitors with business bank accounts

One of the main reasons why companies use Brex is its built-in banking solutions, so you may be looking for alternatives that likewise offer checking and other business bank accounts. Your options include:

- Mercury: Offers checking and savings accounts for tech startups that include FDIC insurance. The Mercury IO Mastercard also provides 1.5% cashback on certain categories of spending

- Novo: Provides business checking accounts, debit cards and FDIC insurance, plus cashback rewards through its business credit card

- Relay: A digital banking platform that offers checking and savings accounts with bill pay services, and The Relay Visa Credit Card offers unlimited 1.5% cashback on all purchases

How to choose a platform for banking, procurement, and corporate cards

All of the Brex alternatives listed here could be a better fit for your business. Here are some key considerations to help guide your decision:

- Scalability: Choose software that can grow with your business. It should accommodate an increasing number of transactions, users, and data as your business expands.

- User-friendliness: The software should have an intuitive interface and organized, helpful training documentation. This helps reduce training time and increases productivity.

- Independence and roadmap certainty: Consider whether the platform is independently operated or owned by a larger financial institution. Independent platforms like Ramp often have faster product development cycles and roadmaps driven directly by customer needs rather than corporate banking priorities.

- Integration capabilities: Ensure that the software integrates seamlessly with your current systems, such as accounting software, payroll systems, and CRM tools to streamline data flow and reduce manual entry.

- Security and compliance: Verify that the software provides robust security features to protect sensitive financial data. Make sure it complies with relevant regulations and standards in your industry and has a reputation for being proactive about updating as regulations change.

- Vendor reputation: Research the software vendor's reputation, including customer reviews, case studies, and industry recognition. Gartner and G2 are good places to research this.

So, what is the best Brex alternative?

Ramp offers a versatile and robust alternative to Brex for SMBs across industries. As an independent spend management platform built specifically for modern finance teams, Ramp delivers intuitive employee experiences and powerful finance workflows without the uncertainty and red tape that comes with ownership by a legacy bank.

If maintaining a customer-driven product roadmap and faster feature velocity matter to your business success, consider Ramp. We hope our research helps you find a better fit for expense reports and management, AP automation, and corporate credit cards.

Card comparison

Starting at

$0/month

APR

N/A

Fees

No annual fee

Personal Guarentee

None

Net Savings

$0

APR

N/A

Fees

No annual fee

Personal Guarantee

None

FAQs

Yes. On January 22, 2026, Capital One announced a $5.15 billion acquisition of Brex, bringing the fintech company under the traditional bank’s ownership.

Many businesses are evaluating Ramp due to its independence, modern spend controls, customer-driven roadmap, and focus on automation. These qualities set it apart from legacy banking infrastructure, making it appealing for startups and other businesses focused on growth.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits