- What is days cash on hand (DCOH)?

- Days cash on hand calculation

- Why days cash on hand matters

- How to improve your days cash on hand

- Common mistakes and how to avoid them

- Automate your DCOH tracking with Ramp Treasury1

- Ramp is a modern business account for modern companies

You check your business bank account and see a healthy balance, but that number alone doesn’t show how long your cash will last. Days cash on hand tells you how many days your business can operate using only its existing cash reserves. Knowing this number gives you an early warning system for cash flow issues and helps you decide when to slow spending, pursue new funding, or time growth investments responsibly.

What is days cash on hand (DCOH)?

Days cash on hand (DCOH) tells you how long your business can keep operating using only its available cash reserves, with no new money coming in. It’s similar to knowing how many days your car can run on the fuel already in the tank.

The calculation focuses on liquid assets you can access immediately, such as checking accounts, savings accounts, money market funds, and short-term investments. Accounts receivable don’t count because the cash isn’t available yet, and inventory doesn’t count because it must be sold before it turns into cash.

For example, say your business has $50,000 in cash and spends an average of $2,500 per day to operate. Divide $50,000 by $2,500 and you get 20 days cash on hand, meaning you have enough runway to cover 20 days of operations.

Days cash on hand vs. other cash flow metrics

Days cash on hand differs from other cash flow and liquidity metrics because it measures runway in days rather than percentages or ratios. The cash on hand ratio expresses your liquid assets as a share of total assets instead of showing how long that cash can support your operations.

The cash conversion cycle focuses on the time your cash is tied up in operations, from purchasing inventory to collecting customer payments. You might have strong days cash on hand but a slow cash conversion cycle if collections take months.

Liquidity ratios such as the current ratio and quick ratio compare assets to liabilities and help you determine whether you can cover short-term debts. These ratios don’t tell you how long your cash will last under normal operating conditions.

Use days cash on hand to plan for operational continuity and evaluate whether you need additional funding. Use liquidity ratios to assess your ability to meet upcoming obligations, and use the cash conversion cycle to identify working capital inefficiencies.

| Metric | What it measures | Best used for | Key limitation |

|---|---|---|---|

| Days cash on hand (DCOH) | How many days you can operate using only cash reserves | Assessing runway and cash sufficiency | Doesn’t account for upcoming liabilities |

| Cash on hand ratio | Liquid assets ÷ current liabilities | Understanding liquidity strength at a point in time | Doesn’t show operational survival time |

| Quick ratio | Cash, receivables, and marketable securities ÷ current liabilities | Evaluating short-term liquidity without inventory | Includes receivables that may be slow to collect |

| Cash conversion cycle (CCC) | Time between paying for inputs and receiving customer cash | Identifying working capital inefficiencies | Doesn’t measure cash sufficiency |

Days cash on hand calculation

Calculating days cash on hand requires two numbers from your financial statements: your cash balance and your average daily operating expenses (OpEx). Together, they show how long your existing cash can support your business.

Days cash on hand formula

The formula is:

DCOH = (Cash and cash equivalents * Number of days) / Operating expenses

You can also express it more simply as:

DCOH = Cash and cash equivalents / Average daily operating expenses

To find average daily operating expenses, divide your total operating expenses by the number of days in the reporting period.

DCOH formula variables

Cash and cash equivalents include liquid assets you can access immediately, such as checking accounts, savings accounts, money market accounts, and short-term investments maturing within 90 days.

Operating expenses reflect your day-to-day costs of running the business. These include payroll, rent, utilities, supplies, and other recurring expenses that appear on your income statement.

The number of days you use depends on the period you’re analyzing. Use 365 for annual figures, 90 for quarterly, or 30 for monthly calculations.

Days cash on hand example

Consider a marketing agency reviewing its third-quarter finances. The balance sheet shows $180,000 in cash and cash equivalents as of September 30, including $145,000 in its business checking account and $35,000 in a money market fund.

The income statement shows $450,000 in operating expenses for the quarter. This includes $280,000 in salaries, $85,000 in contractor fees, $40,000 in software subscriptions and tools, $25,000 in rent, and $20,000 in other overhead costs.

Step-by-step calculation

First, calculate daily operating expenses by dividing $450,000 by 90 days in the quarter, which equals $5,000 per day.

Then apply the formula. Divide $180,000 in cash by $5,000 in daily expenses to get 36 days cash on hand. This gives the agency roughly five weeks of runway, which allows time to collect on outstanding invoices but doesn’t leave much cushion for unexpected delays or expenses.

Factor in non-cash expenses

This includes items such as depreciation and amortization, which reduce net income without affecting actual cash flow.

Additional days cash on hand example

A retail store entering its busy season has $90,000 in cash and cash equivalents, including checking, savings, and a short-term treasury fund. Over the past six months, the store recorded $540,000 in operating expenses.

To find daily operating expenses, divide $540,000 by 182 days, which equals about $2,967 per day.

Now calculate DCOH by dividing $90,000 by $2,967. The result—about 30 days cash on hand—shows the store can operate for roughly a month without new revenue. For retailers with seasonal swings, this helps them decide whether current reserves can carry them through slower periods.

Why days cash on hand matters

According to a study by the JPMorgan Chase Institute, the average small business holds just 27 days of cash on hand. Another study showed that 82% of small businesses fail because of cash flow issues. Days cash on hand serves as an early warning system by showing whether you have the cash to absorb a dip in sales, slow customer payments, or an unexpected repair.

Lenders and investors pay close attention to days cash on hand because it reflects how responsibly a business manages liquidity. A healthy cash position signals that you can meet obligations during difficult periods. Many banks set minimum DCOH requirements for loan covenants, and investors view strong reserves as a sign of financial discipline.

The measure also helps you time major decisions. Before hiring more employees, investing in equipment, or expanding to a new location, you need to know whether your cash reserves can support the added expense. Days cash on hand shows the impact on your runway so you can decide when the move is feasible.

Benefits of tracking days cash on hand

Regularly tracking days cash on hand gives you clearer visibility into your cash position and allows you to spot trends before they become problems. It helps you see seasonal patterns, identify months when cash typically runs low, and forecast future needs more accurately.

Monitoring this metric also supports stronger financial planning. Early warning signs give you time to adjust spending, pursue additional revenue, or activate a credit line instead of making rushed decisions under pressure. Budgeting becomes more grounded when you know exactly how much runway you have.

This tracking also improves strategic decision-making. Before committing to a large purchase or investment, you can model how it affects your DCOH. If a new hire costs $5,000 each month and you have 45 days of runway, you can estimate how much that expense shortens your cushion and plan accordingly.

Industry benchmarks and standards

Target ranges for days cash on hand vary widely by industry, business model, and growth stage. Companies with predictable revenue can operate with fewer days cash on hand, while businesses with volatile demand usually need a larger cushion.

| Business type / Context | Recommended days cash on hand | Rationale |

|---|---|---|

| Small businesses | 30–90 days | Helps manage short-term cash flow and emergencies |

| Mid-sized businesses | 60–120 days | More complexity requires a larger buffer |

| Large corporations | 30–60 days | Often have access to credit and financing options |

| Seasonal businesses | 90–180 days | To cover low-revenue periods |

| Startups / High-growth companies | 180+ days | Higher burn rates and funding uncertainty |

| Nonprofits | 90–180 days | To cover grant cycles and mission-critical continuity |

| Highly stable industries | 30–60 days | Lower risk allows for smaller cash cushion |

| High-risk or volatile industries | 120–180+ days | Higher risk calls for larger cash cushion |

Service-based companies often need less runway than product-based businesses because they carry little inventory and collect payments more quickly. Manufacturers and retailers typically require higher reserves to cover inventory costs and longer cash conversion cycles.

Startups and high-growth companies often keep more cash on hand to support expansion and survive until they become profitable. Established businesses with steady revenue can operate safely with fewer days cash on hand, since they have a consistent track record of generating income.

Use these benchmarks as a starting point rather than a strict rule. Your specific circumstances, risk tolerance, and revenue patterns should guide your target number.

How many days cash on hand should a business have?

The ideal number of days cash on hand varies by business type, risk tolerance, and how predictable your revenue is. Businesses with steady income can safely operate at the lower end of typical ranges, while those with seasonal or volatile revenue benefit from keeping more cash in reserve. Use the benchmark ranges above as a starting point, then adjust your target based on how quickly you collect payments, how often unexpected costs arise, and whether you have reliable access to credit.

How many days cash on hand is good for a nonprofit?

How many days cash on hand is good for a nonprofit?

For nonprofits, a good rule of thumb is 90 to 180 days of cash on hand, although the ideal amount depends on funding cycles, mission-critical needs, and financial stability.

How to improve your days cash on hand

Finding the right cash balance takes judgment. Too little cash leaves you vulnerable to slow periods or unexpected expenses, while too much cash sitting idle can mean missed opportunities to invest in growth or earn returns elsewhere.

Strategies to increase cash reserves

Building your cash reserves comes down to three main levers: collecting money more quickly, spending less, and generating more revenue. Improving cash collection shortens the time between delivering value and receiving payment.

- Invoice as soon as work is completed rather than waiting until month-end

- Offer early payment discounts such as 2% off for payment within 10 days

- Accept multiple payment methods, including credit cards and ACH transfers

- Follow up on overdue invoices within days instead of weeks

Reducing expenses creates immediate improvements in your cash position. Review subscriptions and cancel services you rarely use. Negotiate better rates with vendors by committing to longer terms or larger volumes. Switch to annual billing when it offers meaningful discounts over monthly plans.

Revenue optimization focuses on increasing cash inflows without significantly raising costs. Raise prices on high-value offerings where demand remains strong. Add premium service tiers with higher margins, and focus sales efforts on customers who pay quickly rather than those who delay payment for months.

Managing operating expenses

Lower operating expenses directly extend your runway by reducing the daily cash burn that drives your days cash on hand. Common areas to reduce costs include:

- Office space: Downsize, sublease unused areas, or shift to remote work

- Software subscriptions: Consolidate tools with overlapping features

- Outsourced services: Bring certain functions in-house or renegotiate contracts

- Marketing spend: Focus on channels with the highest return on investment

Every dollar you cut from daily operating expenses extends your cash runway. For example, if you spend $10,000 per day and reduce expenses by $1,000, your cash reserves last 11% longer. These gains add up when you make several small reductions across different expense categories.

Sustainable expense management means making cuts that don’t weaken your ability to deliver value or serve customers. Focus on reducing waste, redundancy, and low-impact spending, while protecting investments in customer service, product quality, and employee development.

Common mistakes and how to avoid them

Even experienced business owners make errors when calculating and interpreting days cash on hand. Avoiding these common pitfalls helps you get more accurate results and make better financial decisions.

Calculation pitfalls

Small errors in your inputs can lead to misleading results. Common data-gathering mistakes include:

- Including restricted cash: Money set aside for specific purposes, such as security deposits or loan reserves, shouldn’t count as available cash.

- Counting accounts receivable: Outstanding invoices aren’t cash yet and shouldn’t be included, even if you expect payment soon.

- Missing cash equivalents: Money market funds and short-term investments under 90 days should be counted but often get overlooked.

- Using inconsistent time periods: Mixing annual expenses with quarterly cash balances produces results that don’t reflect reality.

Seasonal businesses need to adjust their calculations throughout the year. A landscaping company with $100,000 in June might calculate 90 days of runway, but that same amount in December covers far less because winter expenses continue while revenue declines. Use average expenses from comparable periods rather than annual averages.

One-time expenses can also distort your daily operating expense calculation. If you bought $50,000 of equipment last quarter, including that cost makes your days cash on hand appear artificially low. Remove capital expenditures, loan payments, and other non-recurring costs to get a more accurate picture of your normal operations.

Strategic mistakes

Relying only on DCOH ignores other important financial indicators. This metric shows your cash runway but doesn’t address profitability, growth potential, or debt obligations. A business with 90 days cash on hand may still have underlying issues if it’s losing money on each sale.

Holding too much cash creates opportunity costs. Money sitting in a checking account earning minimal interest could support marketing, hiring, or equipment purchases that fuel growth. Beyond your safety cushion, put excess cash toward initiatives that generate returns.

Insufficient reserves expose you to preventable cash crunches. Running with only 15 days cash on hand leaves no margin for delayed customer payments or unexpected expenses. Constantly operating under pressure also leads to rushed decisions that may not align with long-term goals.

Why would days cash on hand decrease?

Why would days cash on hand decrease?

Days cash on hand can fall when operating expenses rise, cash reserves shrink, or income slows due to delayed payments or reduced demand. Large unexpected expenses or weak budgeting can also reduce available cash.

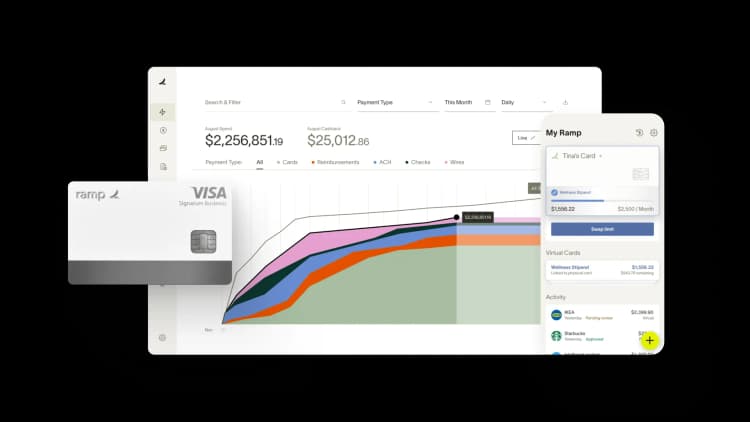

Automate your DCOH tracking with Ramp Treasury1

While calculating days cash on hand is crucial, manual tracking can be time-consuming and error-prone. Here's how Ramp Treasury automates this process:

Real-time data aggregation

Ramp Treasury captures and categorizes transaction data automatically across all your financial accounts. The platform continuously imports banking transactions, credit card activity, and payment processing information without requiring manual data entry or reconciliation.

With multi-account tracking capabilities, Ramp Treasury consolidates information from various financial institutions into a unified view. The system automatically applies custom categorization rules to incoming transactions and updates your DCOH calculations in real-time, allowing you to set alert thresholds that notify you when your cash runway approaches critical levels.

Automated monitoring

Ramp Treasury continuously tracks your cash position throughout each business day, providing up-to-the-minute visibility into your liquidity status. The system alerts stakeholders when predefined threshold levels are approached, eliminating the surprise factor in cash management. By employing proactive liquidity management strategies, you can better anticipate and respond to cash flow challenges, and Ramp Treasury supports this with its advanced monitoring tools.

The platform's advanced analytics engine identifies spending patterns and seasonality in your cash flow, enabling more accurate forecasting. Ramp Treasury's predictive modeling capabilities can project future DCOH based on historical data and current trends, while also benchmarking your performance against industry standards to provide contextual understanding of your liquidity position.

Enhanced reporting

Ramp Treasury offers customizable dashboard views that highlight your most critical financial metrics, including DCOH, in formats tailored to different stakeholders' needs. The system generates and distributes scheduled reports automatically, ensuring decision-makers receive updated information without manual intervention.

With comprehensive historical tracking capabilities, Ramp Treasury allows you to visualize DCOH trends over time through intuitive charts and graphs. The platform makes it easy to identify seasonal patterns and long-term changes in your cash position, automatically sending these insights to key stakeholders through customizable reporting schedules that keep everyone informed without additional effort.

Ramp is a modern business account for modern companies

Ramp Treasury reimagines business banking by helping you earn a high-yield 2.5%2 APY on every dollar stored, with no fees or minimums. Your funds remain protected through comprehensive FDIC insurance3, providing confidence about your cash's security.

You'll benefit from unlimited same-day ACH transfers, enabling you to move money precisely when needed. The platform's intelligent balance management and real-time payment tracking optimize your cash position while ensuring vendors receive timely payments.

Beyond conventional banking, Ramp Treasury delivers sophisticated automation through customizable approval workflows and seamless ERP integration.

Opening your free account takes less than a minute.

1) Ramp Business Corporation is a financial technology company and is not a bank. All bank services provided by First Internet Bank of Indiana, Member FDIC.

2) Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

3) Customers with a Ramp Business Account can use the ICS service provided by IntraFi Network LLC. Ramp is a financial technology company, not an FDIC-insured depository institution. Banking services are provided by First Internet Bank (FIB), member FDIC. Subject to the terms of the applicable ICS Deposit Placement Agreement, FIB will place deposits at FDIC-insured institutions through IntraFi’s ICS service. A list identifying IntraFi network banks appears at https://www.intrafi.com/network-banks. Certain conditions must be satisfied for “pass-through” FDIC deposit insurance coverage to apply. To meet the conditions for pass-through FDIC deposit insurance, deposit accounts at FDIC-insured banks in IntraFi’s network that hold deposits placed using an IntraFi service are titled, and deposit account records are maintained, in accordance with FDIC regulations for pass-through coverage. Deposits are insured by the FDIC up to the maximum allowed by law; deposit insurance only covers deposits in the Ramp Business Deposit Account in the event of the failure of the FDIC-insured bank.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits