How to calculate and interpret cash ratio for your small business

- What is the cash ratio?

- Cash ratio formula

- How to calculate your cash ratio step by step

- How to interpret your cash ratio results

- Cash ratio vs. other liquidity ratios

- Why the cash ratio matters for your business

- Limitations of the cash ratio

- How to improve a low cash ratio

- Common mistakes when calculating and interpreting cash ratio

- Tracking your cash ratio over time

- Cash ratio in financial modeling and forecasting

- Real-world cash ratio scenarios

- Improve liquidity management with Ramp

The cash ratio shows whether a business can cover its short-term obligations using only cash and cash equivalents. By excluding receivables and inventory, it offers the most conservative view of liquidity and answers a simple question: if payments came due today, could you pay them with cash on hand?

For lenders, investors, and finance leaders, the cash ratio provides a clear snapshot of immediate financial flexibility. It’s especially useful during periods of uncertainty, when access to cash matters more than projected inflows.

What is the cash ratio?

The cash ratio measures a company’s ability to pay off short-term liabilities using only cash and cash equivalents. Because it excludes accounts receivable and inventory, it is considered the most conservative liquidity metric.

By focusing solely on assets that are immediately available, the cash ratio shows how much of your current obligations you could cover if cash inflows stopped today. This makes it especially useful for evaluating financial resilience during downturns, credit stress, or periods of tight liquidity.

Different stakeholders rely on the cash ratio for different reasons:

- Lenders use it to assess credit risk and determine loan terms or covenant thresholds

- Investors look at it to evaluate financial stability before committing capital

- CFOs and financial analysts monitor it to maintain adequate liquidity buffers and flag emerging cash flow risks early

Cash ratio formula

The cash ratio formula compares a company’s most liquid assets to its short-term obligations:

Cash ratio = (Cash + cash equivalents) / Current liabilities

Understanding cash and cash equivalents

Cash and cash equivalents are assets that are immediately available or can be converted to cash within 90 days. Including only these assets ensures the ratio reflects true, near-term liquidity. Cash typically includes physical currency and funds held in checking or savings accounts. Cash equivalents include short-term, highly liquid investments with minimal risk of value fluctuation.

Examples of assets commonly included are:

- Physical cash

- Checking and savings accounts

- Money market accounts

- Treasury bills

- Commercial paper

- Marketable securities maturing within 90 days

Assets that are excluded from the calculation include accounts receivable, inventory, prepaid expenses, and long-term investments, even if they are expected to convert to cash later.

Identifying current liabilities

Current liabilities are financial obligations due within the next 12 months. These liabilities form the denominator of the cash ratio and represent claims that must be settled in the near term.

Common current liabilities include:

- Short-term debt: Loans or credit facilities due within one year

- Accounts payable: Amounts owed to suppliers and vendors

- Accrued expenses: Unpaid wages, utilities, taxes, and operating costs

- Current portion of long-term debt: Scheduled principal payments due within 12 months

- Deferred revenue: Customer prepayments for goods or services not yet delivered

You can find current liabilities listed in the liabilities section of your balance sheet, typically grouped separately from long-term obligations.

How to calculate your cash ratio step by step

You can calculate the cash ratio using figures directly from your balance sheet. The process is straightforward and requires only your most liquid assets and total current liabilities.

- Locate your balance sheet for the period you’re analyzing, such as a quarterly or annual statement

- Find total cash and cash equivalents in the current assets section, usually listed near the top

- Identify total current liabilities in the liabilities section of the balance sheet

- Apply the formula by dividing cash and cash equivalents by current liabilities

- Express the result as a decimal for easier interpretation

Cash ratio calculation example

Consider the following simplified balance sheet for Company XYZ:

| Balance sheet item | Amount |

|---|---|

| Cash | $150,000 |

| Money market funds | $75,000 |

| Treasury bills | $25,000 |

| Total cash and cash equivalents | $250,000 |

| Accounts payable | $180,000 |

| Short-term debt | $120,000 |

| Accrued expenses | $50,000 |

| Total current liabilities | $350,000 |

Using the cash ratio formula:

Cash ratio = $250,000 / $350,000 = 0.71

This result means Company XYZ has $0.71 in cash for every $1.00 of current liabilities. In practical terms, it could cover about 71% of its short-term obligations using cash alone.

How to interpret your cash ratio results

A “good” cash ratio depends on your industry, business model, and operating context. While there’s no universal benchmark, the ratio provides clear signals about how well your business could handle short-term obligations using cash alone.

Cash ratio benchmarks: What’s considered good?

| Cash ratio | Interpretation | Typical scenario |

|---|---|---|

| Below 0.5 | Low liquidity | May struggle to meet immediate obligations without relying on receivables or new financing |

| 0.5–1.0 | Adequate liquidity | Generally healthy; can cover 50–100% of short-term liabilities with cash |

| 1.0 or higher | Strong liquidity | Can pay all current liabilities using cash alone |

| Above 1.5 | Excess cash | May indicate idle cash that could be reinvested for growth |

As a general rule, ratios closer to 1.0 signal greater short-term flexibility, while very low ratios increase reliance on incoming cash or external financing.

Industry-specific cash ratio benchmarks

Cash ratio norms vary widely based on how quickly businesses collect revenue and how much working capital they need to operate.

| Industry | Typical cash ratio range | Why it differs |

|---|---|---|

| Retail and restaurants | 0.2–0.4 | Frequent cash inflows reduce the need for large cash reserves |

| Technology and SaaS | 0.5–1.0+ | Longer sales cycles and subscription models require more cash on hand |

| Manufacturing | 0.3–0.6 | Capital tied up in inventory leads to lower cash balances |

| Healthcare services | 0.4–0.7 | Delayed reimbursements increase the need for liquidity buffers |

| Professional services | 0.6–1.0 | Project-based billing creates uneven cash flow |

When interpreting your own ratio, compare it to peers in the same industry and track how it changes over time. A ratio that looks weak in isolation may be normal for your business model, while a sudden decline can signal emerging liquidity risk.

Cash ratio vs. other liquidity ratios

Liquidity ratios serve different purposes, depending on how conservative you want your analysis to be. Comparing the cash ratio to other common liquidity metrics helps you choose the right tool for the question you’re trying to answer.

| Ratio | Formula | What’s included | Conservatism level | Best used for |

|---|---|---|---|---|

| Cash ratio | (Cash + cash equivalents) / Current liabilities | Only cash and near-cash assets | Most conservative | Worst-case liquidity assessment |

| Quick ratio | (Cash + cash equivalents + receivables) / Current liabilities | Cash and receivables | Moderately conservative | Short-term liquidity with reliable collections |

| Current ratio | Current assets / Current liabilities | All current assets | Least conservative | General working capital health |

When to use the cash ratio vs. the current ratio

Use the cash ratio when you need to understand how your business would perform in a stressed scenario, such as during credit reviews or periods of uncertainty. It’s especially useful for companies with slow-moving inventory or unpredictable collections.

The current ratio is more appropriate when you want a broader view of working capital and day-to-day operating flexibility. It works best for comparisons among similar companies within the same industry.

When to use the cash ratio vs. the quick ratio

Choose the cash ratio for conservative lending decisions or when evaluating distressed businesses, since it excludes receivables that may not be collected quickly.

The quick ratio is better suited for ongoing operational monitoring, particularly for businesses with strong collection histories where receivables are close to cash in practice.

Why the cash ratio matters for your business

The cash ratio influences how external stakeholders assess risk and how internal teams plan for short-term obligations. Because it focuses only on cash and near-cash assets, it highlights financial flexibility when access to funding or incoming revenue is uncertain.

For lenders and creditors

Lenders use the cash ratio to evaluate repayment capacity and default risk. A higher ratio often supports more favorable loan terms, while a low ratio can trigger tighter covenants or additional scrutiny during credit reviews.

For business owners and CFOs

For finance leaders, the cash ratio acts as an early signal of liquidity pressure. Tracking it regularly helps teams decide when to conserve cash, adjust spending, or rely more heavily on credit facilities to bridge short-term gaps.

For investors and stakeholders

Investors look to the cash ratio for insight into financial stability and risk management. A ratio that aligns with industry norms suggests disciplined cash planning, while extreme values can raise questions about either liquidity risk or inefficient capital use.

Limitations of the cash ratio

The cash ratio provides a clear snapshot of immediate liquidity, but it doesn’t tell the whole story. Because it excludes assets that many businesses rely on to meet short-term obligations, it should be used alongside other financial metrics.

Overly conservative for most businesses

- Excludes receivables: Companies with reliable customers and short collection cycles may appear weaker than they are

- Ignores recurring revenue: Subscription-based or contract-driven businesses can generate predictable cash even with low balances

- Understates operational liquidity: Firms with efficient cash conversion cycles may look riskier on paper despite strong performance

Point-in-time snapshot limitations

- Misses cash flow timing: A single calculation doesn’t reflect when cash actually moves in and out

- Sensitive to timing effects: Large payments or receipts near period end can distort results

- Doesn’t account for known inflows: Signed contracts or scheduled payments aren’t reflected until cash is received

A high cash ratio isn’t always positive

- Idle cash may limit returns: Excess balances can signal missed opportunities to invest in growth or efficiency

- Overly cautious capital use: Holding too much cash can slow expansion or innovation

- Context matters: What looks excessive in one industry may be appropriate in another

Restricted cash considerations

- Not all cash is usable: Funds set aside for payroll, taxes, or escrow may inflate the ratio without improving flexibility

- Covenant requirements aren’t visible: Minimum balance requirements can reduce available liquidity

- Additional analysis may be needed: Adjusting for restricted cash provides a more accurate picture

How to improve a low cash ratio

Improving a low cash ratio usually means increasing liquid assets, reducing short-term obligations, or doing some of both. The goal is to strengthen short-term flexibility without disrupting day-to-day operations.

Increase cash and cash equivalents

- Accelerate receivables: Tighten payment terms, offer early payment incentives, or use electronic invoicing to shorten collection cycles

- Optimize inventory: Clear excess stock and reduce carrying costs through more efficient ordering and demand planning

- Improve profitability: Review pricing, cut unnecessary expenses, and prioritize higher-margin products or services

- Use short-term financing selectively: Rely on tools like revolving credit lines to bridge temporary cash gaps, not to fund ongoing losses

Reduce current liabilities

- Negotiate payment terms: Extend supplier terms where possible, especially when you have established volume or long-term relationships

- Restructure short-term debt: Refinance or consolidate obligations to spread payments over a longer horizon

- Manage accrued expenses: Time discretionary spending carefully and spread large annual costs when feasible

Common mistakes when calculating and interpreting cash ratio

Even when the calculation is correct, the cash ratio can be misleading if it’s interpreted without context. These are some of the most common pitfalls to avoid:

- Misclassifying assets: Including accounts receivable or inventory in the numerator overstates immediate liquidity

- Using the wrong time period: Comparing ratios without accounting for seasonality or timing effects distorts conclusions

- Ignoring industry context: Applying the same benchmark across very different business models leads to false signals

- Focusing on a single snapshot: Looking at one period instead of tracking trends over time hides emerging risks

- Overlooking restricted cash: Treating escrowed or earmarked funds as available inflates the ratio

- Comparing incomparable companies: Benchmarking against businesses with different operating models produces misleading results

Tracking your cash ratio over time

A single cash ratio calculation offers only a snapshot. Tracking the ratio consistently over time reveals patterns that help you anticipate liquidity pressure and make more informed decisions.

How often should you calculate your cash ratio?

The right tracking cadence depends on how quickly your cash position changes and how much risk you need to manage.

| Business type | Recommended frequency | Why |

|---|---|---|

| High-growth startups | Monthly | Rapid changes in cash position require frequent monitoring |

| Seasonal businesses | Monthly | Cash balances fluctuate significantly across peak and off-seasons |

| Stable, mature companies | Quarterly | Cash patterns are more predictable and change gradually |

| Companies with debt covenants | As required by lenders | Ratios are often tested quarterly for compliance |

| Businesses under financial stress | Weekly or biweekly | Close monitoring helps manage tight liquidity |

Using cash ratio trends for better decision-making

Cash ratio trends can provide valuable insight for decision-making when interpreted over time rather than in isolation. Improving trends, reflected in rising ratios, often support expansion plans by indicating stronger liquidity. However, they may also justify a review of whether excess cash is being held inefficiently and could be deployed more productively.

Declining trends deserve early attention, as a steady drop typically signals increasing liabilities, shrinking cash reserves, or a combination of both. Volatile patterns, marked by sharp swings in the ratio, can point to inconsistent cash management practices or gaps in cash-flow forecasting.

Seasonal patterns are also common, particularly in businesses with cyclical revenue, and while they are generally normal, they require deliberate planning to ensure adequate liquidity is maintained throughout the year.

Cash ratio in financial modeling and forecasting

Incorporating the cash ratio into financial models helps turn it from a backward-looking metric into a practical planning tool. Instead of reacting to liquidity shortfalls after they appear, teams can use projected ratios to identify pressure points in advance.

Incorporating the cash ratio into projections

When building forecasts, model future cash balances alongside expected changes in current liabilities. Scenario analysis, such as best-case, base-case, and downside assumptions, helps illustrate how sensitive liquidity is to slower collections, higher expenses, or delayed funding. Setting internal target ranges for the cash ratio can also help teams align liquidity planning with risk tolerance and growth goals.

Managing debt covenant compliance

Many lending agreements include minimum cash ratio thresholds, often in the range of 0.25 to 0.50. Falling below these levels can trigger penalties or tighter oversight. Monitoring projected ratios on a rolling basis gives teams time to adjust spending, financing, or working capital strategies before covenant tests occur.

Real-world cash ratio scenarios

These examples show how the same cash ratio can mean very different things depending on business context, timing, and operating model.

Scenario 1: Startup with recent funding

A technology startup has just closed a Series A round. It holds $4.8 million in cash and has $400,000 in current liabilities.

- Cash ratio: 12.0

- Interpretation: This elevated ratio is typical immediately after fundraising. The cash represents runway that will be deployed into hiring, product development, and growth over the coming quarters.

Scenario 2: Seasonal retail business

A holiday-focused retailer is reviewing its financials in January, after the peak sales season. The company has $800,000 in cash and $1.2 million in current liabilities.

- Cash ratio: 0.67

- Interpretation: For a seasonal business, this ratio reflects normal post-season cash usage as the company pays suppliers. Comparing it to prior January periods provides more insight than viewing it in isolation.

Scenario 3: Manufacturing company with large receivables

A manufacturer operating on 60-day payment terms holds $500,000 in cash and reports $2 million in current liabilities.

- Cash ratio: 0.25

- Interpretation: While the ratio looks low on its own, the company also has substantial accounts receivable due within the next two months. In this context, the cash ratio understates near-term liquidity and should be evaluated alongside the quick ratio.

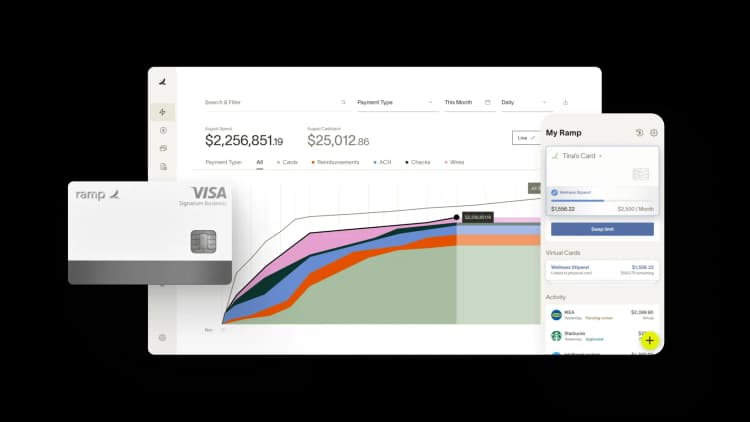

Improve liquidity management with Ramp

Understanding your cash ratio is only useful if you can act on it. Managing liquidity day to day requires visibility into cash balances, control over spending, and confidence that short-term obligations won’t catch you off guard.

Ramp brings spending, payments, and accounting data together so finance teams can monitor cash positions in real time and respond faster when conditions change. With built-in controls and automated workflows, it’s easier to protect liquidity without slowing down the business.

With Ramp, you can:

- Track cash balances and short-term liabilities with up-to-date reporting

- Control spend proactively through automated approvals and policies

- Improve forecasting accuracy with integrated accounting data

- Reduce manual tracking with dashboards that surface liquidity trends

Whether you’re managing routine expenses or planning for growth, Ramp helps finance teams stay ahead of liquidity risk and make more confident decisions.

Try Ramp for free and see how automated financial operations can support better liquidity management.

FAQs

The cash ratio is a liquidity valuation, while cash turnover is an efficiency ratio. The cash ratio allows analysts to determine how much cash is on hand to pay the company's total current liabilities. It considers only details found on the company's balance sheet.

Cash turnover evaluates how quickly the company generates cash. It incorporates the company's revenue, money, and cash equivalents obtained from its financial statements. The cash turnover does not consider the company's debts or ability to pay for them.

The cash ratio indicates a company's ability to pay its debts without needing to obtain outside financing. Companies with a cash ratio of 1 or above are fully liquid, meaning they can pay off their debts immediately using their available resources.

A cash ratio below 0.5 is considered low. Companies with a low cash ratio may struggle with covering their short-term debts and have meager growth potential. Their efforts for expansion through research and development, mergers and acquisitions, or other means are limited. Organizations with a low cash ratio may have difficulty obtaining a bank loan and may be unattractive to investors.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°