What is business finance? Definition, functions, and importance

- What is business finance?

- Why business finance matters for growth and survival

- Core functions every finance team owns

- Types of business finance

- Short-term vs. long-term finance sources

- How to manage working capital day to day

- Common mistakes and how to avoid them

- Close your books faster with real-time insights from Ramp

Business finance refers to how companies plan, raise, and use money to operate and grow. It goes beyond simple bookkeeping, covering funding, capital allocation, cash flow, and performance measurement.

Think of business finance as your business's circulatory system. Just as blood carries oxygen and nutrients throughout your body, financial resources flow through every department and function, enabling them to operate effectively.

Whether you’re running a small business, launching a startup, or serving as a controller or CFO, mastering business finance helps you make informed decisions that protect your margins and drive growth.

What is business finance?

Business finance is the practice of managing your company's money to achieve your business goals and support ongoing operations. It includes planning, obtaining, and distributing financial resources for daily activities and future expansion.

Business finance covers a wide range of decisions, from tactical tasks such as managing vendor payments to strategic choices such as determining capital structure and investment priorities. It involves securing initial funding, overseeing cash flow, analyzing financial performance, and planning for growth.

Whether you’re deciding on inventory levels, hiring new staff, or exploring expansion options, you're engaging in business finance decisions.

Why business finance matters for growth and survival

Stratefic financial management keeps your business stable and positions you for long-term success, allowing you to:

- Keep operations running: Reliable finance practices ensure you can cover payroll, pay suppliers on time, and prevent cash flow gaps that disrupt daily operations. Even profitable businesses can collapse if they lack liquidity.

- Maintain working capital: Adequate working capital and liquidity give you the flexibility to manage day-to-day expenses, absorb unexpected costs, and ride out seasonal swings in revenue without resorting to emergency funding

- Seize new opportunities: With accurate forecasts and healthy reserves, you can invest in new technology, expand into promising markets, or acquire complementary businesses at the right moment

- Stay competitive: Businesses with strong financial planning and forecasting consistently outperform peers, making better-informed decisions that sustain profitability and support long-term growth

Core functions every finance team owns

Finance teams manage four essential areas that support daily operations and long-term growth:

- Financial planning and forecasting

- Capital allocation and budgeting

- Risk and compliance management

- Cash flow and liquidity control

Together, these functions form the foundation of effective financial management.

Financial planning and forecasting

Financial planning creates budgets that map expected revenues and expenses over different time periods, from monthly operating plans to multi-year strategies. Forecasts then use historical financial data, market trends, and predictive models to anticipate future outcomes.

These tools help leaders make informed decisions, spot cash flow gaps in advance, and adjust before problems escalate. A strong forecasting process improves financial performance by linking day-to-day business expenses with long-term initiatives.

Capital allocation and budgeting

Capital allocation directs financial resources to the projects with the highest returns and strategic value. Companies weigh potential investments, such as new equipment, marketing campaigns, or product launches, against expected profitability and risk.

Capital budgeting frameworks such as net present value (NPV) and internal rate of return (IRR) provide objective measures for comparing opportunities. This discipline ensures you fund business needs responsibly while aligning growth initiatives with strategy.

Risk and compliance management

Risk management identifies and mitigates threats ranging from customer defaults to regulatory fines. Finance teams also safeguard against financial risk tied to market shifts, interest rates, or cybersecurity breaches.

Compliance requires accurate financial statements, reliable internal controls, and adherence to tax and reporting standards. Together, risk and compliance build stakeholder confidence and protect financial health.

Cash flow and liquidity control

Managing cash flow involves monitoring receivables, payables, and repayment schedules to keep working capital healthy. Liquidity control ensures the business can cover operational expenses and short-term obligations without disruption.

Effective practices include accelerating collections, optimizing payment terms with suppliers, and maintaining credit facilities or cash reserves. These measures preserve flexibility so the company can fund business development or weather downturns.

Types of business finance

Companies fund operations and growth through four main financing options: equity financing, debt financing, internal financing, and alternative financing. Each has unique trade-offs in ownership, cost, and repayment, so choosing the right mix depends on your business needs, stage of growth, and risk tolerance.

Equity financing

Equity financing raises capital by selling ownership stakes in exchange for cash. Startups often turn to angel investors or venture capital firms, while more established businesses may seek private equity or go public.

The trade-off here is dilution, with owners giving up both equity and, often, control over business strategy and decision-making. But equity backers often bring industry expertise, professional networks, and credibility that support long-term business development.

Debt financing

Debt financing provides capital through loans, bonds, or credit facilities, which you repay with interest. This option allows companies to keep ownership intact while accessing funds for expansion or working capital.

Repayment schedules are fixed, so debt works best for businesses with predictable cash flow. Interest payments are generally a tax-deductible expense, which can lower the effective cost of financing.

Internal financing

Internal financing relies on retained earnings and asset sales rather than external capital. You can reinvest profits, tighten collections, or sell unused assets to free up cash.

This approach gives full control and avoids repayment obligations, but growth is limited to the financial resources your business can generate internally. This can be a slower path to scaling if you’re running a new business or startup.

Alternative financing

Alternative financing includes newer options such as crowdfunding, peer-to-peer lending, and invoice factoring. These methods connect entrepreneurs with investors outside traditional banking channels.

They often provide faster access to capital, but terms can be more restrictive or costly. Businesses should weigh these financing options carefully to avoid financial risk that undermines long-term profitability.

Short-term vs. long-term finance sources

Businesses use different financing options depending on whether they need quick access to cash or funding for multi-year initiatives. Short-term finance covers operational expenses, while long-term finance supports growth and investment.

- Trade credit: Trade credit lets you purchase supplies now and pay later, usually within 30–90 days. It’s a common, low-cost way to smooth working capital and manage day-to-day cash flow.

- Business lines of credit: Lines of credit offer revolving access to funds you can draw and repay as needed. You only pay interest on what you borrow, making them flexible tools for covering seasonal swings or unexpected expenses.

- Term loans and bonds: Term loans provide fixed borrowing periods, often 1–10 years, with regular repayment schedules. They’re suited to larger purchases or initiatives that generate long-term returns.

- Corporate bonds: Bonds allow larger companies to borrow from many investors at once, often at lower rates than bank loans. Though issuance is more complex, bonds can fund acquisitions or expansions at scale.

- Leasing: Leasing gives you access to equipment or technology without the large upfront purchase, preserving cash for other needs. It’s especially useful for assets that depreciate quickly, such as vehicles or computers.

- Asset-based lending: Asset-based lending provides loans secured by inventory, receivables, or equipment. Borrowing capacity grows with your assets, so it’s a fit if you have tangible resources to unlock liquidity.

- Venture capital and angel investments: Angel investors and venture capital firms provide equity funding for startups and high-growth businesses. Angels invest personal capital, often in early stages, while venture capital firms deploy pooled funds at later stages for scaling.

How to manage working capital day to day

Working capital depends on balancing accounts payable, accounts receivable, and inventory while enforcing expense controls. These steps help protect cash flow and keep operations running smoothly.

Streamline payables

Negotiating better payment terms, such as net 45 or 60 instead of the standard net 30, can give your business more flexibility. Paying invoices on the due date rather than on receipt helps preserve liquidity without damaging supplier relationships.

Automation makes this easier. Scheduled payments let you capture early-payment discounts when it makes sense while avoiding premature outflows. Consolidating purchases with fewer vendors can also improve your leverage for discounts and favorable payment terms.

Accelerate receivables

Receivables directly impact cash flow, so speeding up collections is critical. Sending invoices immediately upon delivery rather than waiting to batch them at month-end shortens the cash conversion cycle and reduces strain on working capital.

You can also offer early-payment incentives such as 2/10 net 30. While you give up a small percentage of revenue, the accelerated cash flow often offsets the cost. A structured collections process, with reminders and clear escalation steps, helps reduce the risk of cash flow problems.

Maintain optimal inventory

Excess inventory ties up cash, while stockouts damage customer relationships. Using inventory management systems with turnover tracking and reorder points helps strike the right balance. Regular audits also uncover slow-moving items you can liquidate to free up capital.

Some businesses reduce working capital requirements by shifting arrangements to vendors. Programs such as vendor-managed inventory or consignment keep products on hand without requiring you to finance them until they sell, improving your cash conversion cycle.

Automate expense management

Without guardrails, day-to-day spending can drain cash unexpectedly. Expense management software like Ramp can enforce company expense policies automatically, flagging out-of-policy purchases and applying rules before money goes out the door. Virtual cards with spending limits add another layer of protection.

Real-time visibility into spending allows you to react quickly. Instead of waiting until month-end to discover overages, you can track activity as it happens, address issues on the spot, and protect financial health. Automation doesn’t just save time; it gives finance teams control over working capital in the moment.

How do you build a modern finance stack?

A finance stack brings together payments, expense management, accounting, and reporting tools into an integrated system. Modern teams gain real-time visibility, automation, and stronger controls by building on an integrated finance tech stack.

Common mistakes and how to avoid them

Financial management missteps can derail even profitable businesses. These are some of the most frequent pitfalls and how to address them:

- Overreliance on spreadsheets: Spreadsheets are fine for quick analysis, but they break down as transaction volumes grow. Shifting to automated systems with audit trails and access controls saves time and reduces inaccuracies.

- Ignoring cash flow forecasts: Many companies fail not because they’re unprofitable, but because they run out of cash. Without forecasts, you can’t see liquidity gaps coming. Weekly 13-week forecasts and monthly projections highlight problems early, giving you time to secure financing or adjust operations before bills come due.

- Mixing personal and business funds: Commingling creates legal and tax headaches, undermines liability protection, and muddies financial reporting. Keep business and personal finances completely separate with distinct accounts, cards, and records.

- Delayed close and reporting: A slow close delays decision-making and erodes stakeholder confidence. Automating reconciliations and standardizing workflows can cut close cycles from weeks to days while improving accuracy.

- Neglecting spend policies: Without clear expense policies, employees spend inconsistently, leading to waste, budget overruns, or even fraud. Define specific rules for purchases, vendors, and approval thresholds, then build them directly into expense systems.

Close your books faster with real-time insights from Ramp

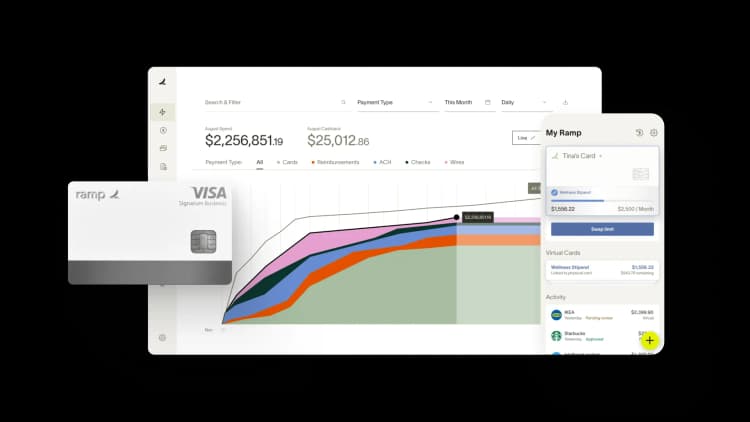

Modern finance platforms remove the friction from business finance by automating manual work and connecting core systems. With Ramp, finance teams can save time and money. Customers save an average of 5% a year while gaining the visibility they need to make better financial decisions.

Expense management automation eliminates the grind of receipt matching, expense reports, and reconciliation. Ramp enforces policies automatically so leaders can trust that every dollar spent aligns with company strategy.

Real-time dashboards replace after-the-fact reports with continuous insight. Finance teams spot unusual activity instantly, close the books up to eight times faster, and focus more energy on strategic growth instead of administrative tasks.

Ready to learn more? Try an interactive demo to see what Ramp can do for your business finance.

FAQs

Business finance offers strong job security and growth opportunities across industries. You'll develop skills in analysis, planning, and strategic decision-making that companies always need. Compensation typically exceeds average white-collar salaries, especially as you advance to senior positions.

Consider a fractional CFO when you're managing complex financial decisions, preparing for funding rounds, or need strategic financial guidance but can't justify a full-time executive. Most companies benefit from fractional CFO expertise when revenues reach $2–10 million.

You can learn business finance fundamentals through online courses, certifications, and hands-on experience. In fact, practical experience often matters more than academic credentials. Working in finance-adjacent roles, managing budgets, or running your own business provides real-world context that makes concepts stick.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits