How to calculate and interpret your cash conversion cycle

- What is the cash conversion cycle?

- Cash conversion cycle formula

- Putting it all together: Example cash conversion cycle

- What is a good cash conversion cycle?

- Cash conversion cycle benchmarks by industry

- How to improve the cash conversion cycle

- Understanding negative cash conversion cycles

- How Ramp accelerates your cash conversion cycle

- Accelerate cash flow with Ramp's automated AP and real-time spend controls

Managing working capital is crucial to any business's agility and resilience. It’s so important that business owners and investment analysts have devised several metrics to measure a company’s ability to maintain working capital.

One such metric is the cash conversion cycle, which tells business owners and investors how long it takes to turn inventory into cash. This information is critical because a shorter conversion cycle means the company can generate cash more quickly, improving liquidity and reducing the need for external financing while enabling faster reinvestment in growth opportunities.

In this guide, we'll explain what the cash conversion cycle is, how to calculate it, discuss what good cash conversion looks like, and review some industry benchmarks.

What is the cash conversion cycle?

The cash conversion cycle (CCC) is a financial metric that measures how long it takes your company to convert inventory and other resources into cash from sales.

Also known as the cash flow conversion cycle, cash-to-cash cycle, or net operating cycle, it estimates the number of days it takes you to sell your inventory, collect receivables, and pay your bills. Think of it as tracking the complete journey of a dollar from the moment you spend it on raw materials or products until it returns to your bank account as payment from a customer.

The cash conversion cycle consists of three key measures:

- Days inventory outstanding (DIO): How long inventory sits before being sold

- Days sales outstanding (DSO): How long it takes to collect payment after a sale

- Days payable outstanding (DPO): How long you take to pay your suppliers

Each component plays a vital role in calculating your overall cash conversion cycle.

Why is it important to calculate your cash conversion cycle?

The CCC is a key measure of your operational efficiency and liquidity. A shorter cash conversion cycle means you're getting your money back faster, which gives you more flexibility to pay bills, invest in growth, or handle unexpected expenses. Companies with longer cycles often find themselves stretched thin, waiting for cash to come in while bills pile up.

Finance managers rely on the cash conversion cycle to optimize working capital, while business owners use it to make informed decisions about inventory purchases and payment terms. Investment analysts also pay close attention to this metric when evaluating a company's operational efficiency and financial stability.

Cash conversion cycle formula

The formula to calculate your cash flow conversion cycle is fairly straightforward:

CCC = DIO + DSO – DPO

Where:

- CCC is the cash conversion cycle value

- DIO represents days inventory outstanding

- DSO represents days sales outstanding

- DPO represents days payable outstanding

You’ll need multiple items from your company’s financial statements to calculate your CCC, including:

- Revenue and cost of goods sold (COGS) from the income statement

- Beginning and ending accounts receivable (AR) for the time period

- Beginning and ending accounts payable (AP) for the time period

- Number of days in the time period

Once you have that information, you're ready to calculate your cash conversion cycle.

Days inventory outstanding (DIO)

Days inventory outstanding measures how long it takes your company to sell its inventory. Think of it as the number of days your products sit on shelves before customers purchase them.

DIO forms the first component of the cash conversion cycle, calculated by dividing your average inventory by daily cost of goods sold, and then dividing by the target time period:

DIO = (Average inventory / COGS) / 365 days

To calculate your average inventory, add your beginning inventory to your ending inventory and divide the number by 2.

A high DIO might indicate strong stock availability for customers, but it could also signal slow-moving products or overordering. High DIO ties up working capital in products rather than cash, which can strain your financial flexibility.

Low DIO generally reflects efficient inventory management and quick product turnover, freeing up cash for other business needs. However, extremely low DIO might mean you're running too lean, risking stockouts that could disappoint customers.

The ideal DIO varies by industry. Grocery stores maintain low DIO since products spoil quickly, while furniture retailers carry higher DIO due to seasonal business patterns and longer customer decision cycles.

Days sales outstanding (DSO)

Days sales outstanding represents the average number of days it takes your company to collect payment after making a sale. You calculate DSO by dividing your accounts receivable by your average daily revenue over a specific period:

DSO = Average accounts receivable / Average revenue per day

Average your accounts receivable by adding your beginning and ending AR balances together and dividing the total by 2. Then, average your revenue by dividing your total revenue for the period by the number of days in the period.

DSO reveals how long your money stays tied up in unpaid invoices, which directly affects your cash flow. When customers take longer to pay, you have less working capital available for daily operations, inventory purchases, or growth investments.

High DSO creates problems for your business. Your cash flow becomes unpredictable, making it harder to plan for expenses or invest in opportunities. You might struggle to pay suppliers on time or miss out on early payment discounts. High DSO also increases your risk of bad debt and forces you to spend more time chasing payments.

Low DSO means customers are paying quickly, which keeps your cash flow healthy and predictable. You'll have more flexibility to take advantage of supplier discounts and invest in growth opportunities. However, extremely low DSO might signal that your payment terms are too restrictive. The key is finding the right balance that maintains healthy cash flow while remaining competitive.

Days payable outstanding (DPO)

Days payable outstanding measures how long your company takes to pay its suppliers and vendors. Think of it as the flip side of receivables: While DSO tracks how quickly customers pay you, DPO tracks how quickly you pay others. While DSO and DIO tie up your cash, DPO actually frees it up by allowing you to hold onto cash longer and put it to work elsewhere in your business.

You calculate DPO by dividing the average accounts payable by the average COGS per day:

DPO = Average accounts payable / COGS per day

Average your accounts payable by adding your starting and ending AP balances and dividing the result by 2. Then, average your COGS by dividing your total COGS for the period by the number of days in the period.

A high DPO can signal positive things about your company. It might indicate strong negotiating power with suppliers, allowing you to secure extended payment terms. However, extremely high DPO might raise red flags if payment periods stretch beyond industry norms, potentially suggesting cash flow problems or strained supplier relationships that could damage your reputation.

Low DPO isn't necessarily bad news, either. Some companies choose to pay suppliers quickly to capture early payment discounts, which can deliver attractive returns. Low DPO might also reflect a company's commitment to maintaining excellent vendor relationships.

The key is finding the sweet spot where you optimize cash flow without damaging supplier partnerships. The best companies carefully balance their payment timing to maximize working capital while preserving the relationships that keep their operations running smoothly.

Putting it all together: Example cash conversion cycle

Let's walk through how to use the cash conversion cycle formula to calculate CCC for a fictional company. We'll use the following data:

- COGS: $400,000

- Revenue: $700,000

- Beginning inventory: $80,000

- Ending inventory: $60,000

- Beginning accounts receivable: $100,000

- Ending accounts receivable: $120,000

- Beginning accounts payable: $50,000

- Ending accounts payable: $70,000

- Period: 365 days (1 year)

Step 1: Calculate days inventory outstanding

To calculate DIO, you'll first need your average inventory:

- Average inventory = (Beginning inventory + Ending inventory) / 2

- 70,000 = (80,000 + 60,000) / 2

Now, plug it into the DIO formula:

- DIO = (Average Inventory / COGS) * 365

- 63.9 days = (70,000 / 400,000) * 365

Step 2: Calculate days sales outstanding

To calculate DSO, you'll first need your average accounts receivable:

- Average AR = (Beginning AR + Ending AR) / 2

- 110,000 = (100,000 + 120,000) / 2

Next, calculate your revenue per day:

- Revenue per day = Revenue / 365

- 1,917.8 = 700,000 / 365

Now, use the two values to calculate DSO:

- DSO = Average AR / Revenue per day

- 57.4 days = 110,000 / 1,917.8

3. Calculate days payable outstanding

First, calculate your average accounts payable:

- Average AP = (Beginning AP + Ending AP) / 2

- 60,000 = (50,000 + 70,000) / 2

Divide your total COGS by 365 to arrive ar your COGS per day:

- COGS per day = COGS / 365

- 1,095.9 = 400,000 / 365

Next, divide your average AP by COGS per day to get DPO:

- DPO = Average AP / COGS per day

- 54.8 days = 60,000 / 1,095.9

4. Calculate cash conversion cycle

Finally, let's put it all together using the CCC formula:

- CCC = DIO + DSO – DPO

- 66.5 days = 63.9 + 57.4 – 54.8

In this example, the company's cash conversion cycle is 66.5 days, meaning they take about 67 days to convert their investments in inventory and other resources into cash flows from sales.

What is a good cash conversion cycle?

A good cash conversion cycle depends on the context, but it generally refers to how efficiently a business turns its sales into cash:

- Negative or low CCC (ideal): The business collects cash quickly and delays payments to suppliers

- Positive CCC but under industry average: The business efficiently manages cash but still has room for improvement

- High CCC (bad): The business is slow to collect cash or holds inventory too long

Cash conversion cycle benchmarks by industry

Your company’s cash conversion cycle tells you quite a bit about your operational efficiency. Here’s a reminder of how to interpret your CCC:

- Lower CCC: If your cash conversion cycle is lower than the average for your industry, you’re in good shape. It means your company takes less time to turn its inventory into cash than your competitors do. It also means you have less reliance on outside funding to keep the ship afloat.

- Higher CCC: If your cash conversion cycle is higher than the average for your industry, you may want to work to optimize your operational efficiency. This means it takes your company longer to turn its inventory into cash and increases your reliance on outside funding. If you’re a small business, a higher CCC could even be a sign of coming insolvency.

Keep in mind that average cash conversion cycles vary widely from one industry to another due to differences in inventory management, payment terms, and customer payment behavior. For the best interpretation for your business, be sure to compare your CCC with others in the same industry:

Retail

- Average CCC: 60–90 days

- Details: Retailers typically hold inventory for extended periods but often receive customer payments quickly. However, due to competitive payment terms from suppliers, DPO can vary. For example, large retailers such as Walmart or Amazon have very low CCC because of fast turnover and extended payment terms.

Technology and Electronics

- Average CCC: 35–55 days

- Details: Tech companies, particularly hardware manufacturers, generally have shorter CCCs. This is because of fast inventory turnover and short collection periods from customers. However, companies with longer production cycles, such as those that produce semiconductors, may have longer CCCs.

Automotive

- Average CCC: 60–100 days

- Details: The automotive industry generally has long CCCs due to the extended time needed for vehicle production and sales. Manufacturers often hold inventory for long periods and might have extended DSO periods with dealers. Suppliers, on the other hand, often have favorable payment terms.

Manufacturing

- Average CCC: 50–100 days

- Details: Manufacturers often deal with raw materials and production processes that take time, resulting in a high DIO. They may also have extended terms for accounts receivable, though DPO can be negotiated for longer periods.

Food and beverage

- Average CCC: 20–50 days

- Details: The cash conversion cycle in the food and beverage industry is relatively short due to quick inventory turnover, as products are perishable. However, smaller businesses may have longer CCCs compared to larger companies that can negotiate better payment terms from suppliers.

Pharmaceuticals

- Average CCC: 100–150 days

- Details: The pharmaceutical industry typically has a long cash conversion cycle due to significant research and development, long inventory periods, and stringent regulations. The time from production to sale is extended, though larger companies may negotiate favorable DPO terms.

Apparel

- Average CCC: 50–90 days

- Details: Apparel companies often have to hold large amounts of inventory for long periods before selling it, especially in fast fashion. However, they usually have favorable payment terms with suppliers (high DPO), which can offset the CCC.

Aerospace & defense

- Average CCC: 150–300 days

- Details: This industry has one of the longest cash conversion cycles due to the lengthy manufacturing processes, high DIO, and long periods before receiving payment. These companies usually operate on large contracts with extended timelines.

Consumer goods

- Average CCC: 40–70 days

- Details: Companies in this industry typically have shorter CCCs because of fast-moving goods and the ability to negotiate good payment terms from suppliers (longer DPO)

Telecommunications

- Average CCC: 30–60 days

- Details: Telecom companies often have relatively short CCCs, with moderate DIO and DSO values. Their large customer bases allow for efficient revenue collection, but they often deal with capital-intensive equipment with longer inventory turnover.

How to improve the cash conversion cycle

Reducing your cash conversion cycle delivers immediate benefits. When you shorten this cycle, you free up working capital that would otherwise be tied up in operations. This gives you more financial flexibility to invest in growth, handle unexpected expenses, or simply maintain a healthier cash flow position.

Here are some practical strategies to improve your cash conversion cycle:

- Optimize inventory management: Use demand forecasting tools to avoid overstocking and implement just-in-time ordering to reduce carrying costs

- Negotiate better payment terms with suppliers: Request extended payment periods or early payment discounts that work in your favor

- Shorten collection times from customers: Offer early payment incentives and follow up promptly on overdue accounts

- Leverage technology for faster invoicing: Automate invoice generation and use electronic payment systems to speed up transactions

- Implement inventory tracking systems: Use real-time monitoring to identify slow-moving stock and adjust purchasing accordingly

- Review credit policies regularly: Assess customer creditworthiness and adjust payment terms based on risk levels

- Consider factoring or invoice financing: Convert receivables to immediate cash when cash flow timing is critical

Understanding negative cash conversion cycles

A negative cash conversion cycle might sound like financial trouble, but it's actually the opposite. When a business achieves a negative CCC, it means they're collecting money from customers faster than they're paying suppliers. In practical terms, they're getting paid before they have to pay their bills, creating a perpetual source of free financing.

Amazon provides a textbook example of mastering negative cash conversion. The retail giant collects payment from customers immediately when they purchase items online, but negotiates extended payment terms with suppliers, sometimes 60–90 days. Many large retailers follow similar patterns, using their market power to negotiate favorable supplier terms while maintaining quick customer payment collection.

Supermarket chains such as Walmart and Costco offer another compelling case. They turn inventory quickly—often within days—while paying suppliers on extended terms. Fresh produce might sell within 3–4 days of arrival, but payment to suppliers might not be due for 30–45 days.

The benefits extend far beyond just having extra cash on hand. Companies gain significant financial flexibility, reducing their dependence on external financing for growth initiatives. They can weather economic downturns more easily and deploy accumulated cash for investments or acquisitions.

The risks of a negative cash conversion cycle

This financial arrangement comes with notable risks. The primary danger lies in vendor relationships. When payment terms become too extended, suppliers may demand faster payment or reduce credit limits. Companies that have built operations around extended supplier credit can find themselves in a cash crunch if these arrangements suddenly change.

Market power concentration presents another risk. If competition intensifies or market share erodes, bargaining power with suppliers diminishes, potentially forcing shorter payment terms. Customer behavior changes can also disrupt the balance. If sales velocity slows, the cash conversion cycle can quickly swing from negative to positive, creating unexpected financing needs.

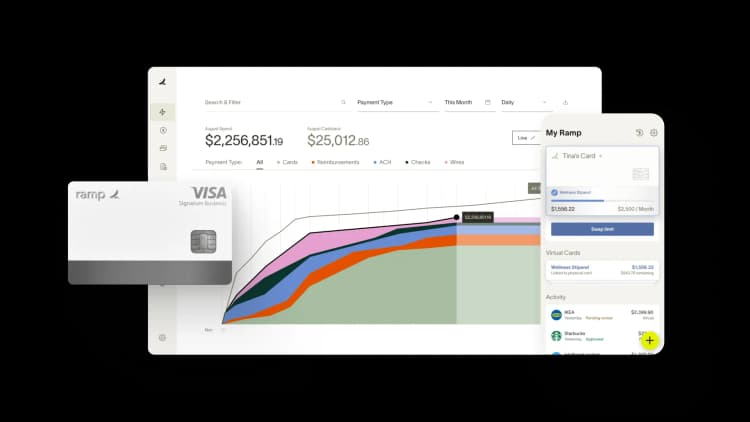

How Ramp accelerates your cash conversion cycle

Managing your cash conversion cycle can feel like juggling three balls at once—you're tracking how quickly inventory moves, chasing down customer payments, and negotiating with vendors for better terms. The longer it takes to convert your investments into cash, the more working capital gets tied up, leaving you scrambling to cover operational expenses or missing growth opportunities.

Ramp's automated financial platform directly tackles one of the biggest drags on your cash conversion cycle: the accounts payable process. Instead of waiting days or weeks for employees to submit expense reports, Ramp captures and categorizes expenses in real-time as transactions occur. This immediate visibility means you know exactly what you owe and when, allowing you to optimize payment timing and take advantage of early payment discounts without the usual administrative delays.

The platform's virtual and physical corporate cards give you unprecedented control over the purchasing side of your cycle. You can set spending limits, restrict vendor categories, and require pre-approvals for certain transactions—all of which prevent unauthorized purchases that could unexpectedly extend your payables period. When employees make purchases, receipt capture happens automatically through Ramp's mobile app, eliminating the back-and-forth that typically slows down expense reconciliation.

Ramp's real-time reporting and analytics transform how you monitor and optimize your entire cash conversion cycle. You get instant insights into spending patterns, vendor payment terms, and cash flow trends without waiting for month-end closes. This visibility lets you identify which vendors consistently offer early payment discounts, which expense categories are growing unexpectedly, and where you might negotiate better payment terms. By automating the tedious parts of expense management and providing actionable insights, Ramp helps you shorten your cash conversion cycle and keep more working capital available for what matters—growing your business.

Accelerate cash flow with Ramp's automated AP and real-time spend controls

Cash conversion cycles drag when payments sit in queues, approvals stall, and you're manually chasing receipts and reconciling spend. Ramp's accounting automation software compresses your cash conversion cycle by automating payables, enforcing spend controls at the point of transaction, and eliminating manual work that slows down your close.

Ramp's bill pay platform processes invoices faster with AI-powered data extraction and automated approval routing. You set payment terms that optimize cash flow, schedule payments strategically, and eliminate the manual data entry that creates bottlenecks. Every invoice is coded, approved, and synced to your ERP automatically, so you're not waiting on manual processes to free up working capital.

On the spend side, Ramp's virtual cards and real-time controls prevent unauthorized purchases before they hit your books. You set spending limits, require receipts at the point of purchase, and enforce policy automatically so every transaction is compliant and audit-ready from day one. This means fewer disputes, faster reconciliation, and more predictable cash outflows.

Here's how Ramp improves liquidity:

- Automate invoice processing: AI extracts data from bills, routes approvals, and syncs to your ERP so payments move faster

- Optimize payment timing: Schedule payments strategically to preserve cash while maintaining vendor relationships

- Enforce spend controls: Real-time limits and policy enforcement prevent unauthorized spend before it impacts cash flow

- Eliminate manual reconciliation: Transactions sync automatically with receipts and approvals attached, so you close faster and free up working capital

Try a demo to see how Ramp helps businesses shorten their cash conversion cycle.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits