Best business credit cards for startups: Complete 2026 guide

- Can startups get approved for a business credit card early on?

- 6 key factors for choosing the best startup business credit card

- 5 best business credit cards for startups (2026 rankings)

- What to expect when applying for a startup business credit card

- Decision matrix: Best business credit cards for each startup profile

- What is Ramp, and why do startups use it?

- Get the best business credit card for startups

A business credit card can be one of the first financial tools that helps a startup operate with structure, flexibility, and control. The best startup business credit cards give your team a way to manage early expenses, access working capital, and track spending—sometimes even without relying on personal credit or complicated approval processes.

Still, getting a startup business credit card isn’t always straightforward. Maybe you don’t have revenue yet. Maybe your credit history is limited—or you’re looking for a card that lets you apply using your EIN instead of your personal credit. These are common scenarios for early-stage founders, and they often make it harder to get approved or find options that work.

In this guide, we’ll walk through the best business credit cards for startups, which features matter most early on, and what to look for if you have no revenue, poor or no credit history, or want to avoid personal credit checks. Let's break down your options and help you choose the best startup credit card that matches how your startup actually operates.

Key takeaways: Top 3 best business credit cards for startups (2026)

- Ramp Business Credit Card - Best overall for startups

- Chase Ink Business Preferred - Best for travel rewards

- Bank of America Secured - Best secured card for startups

Quick comparison: Ramp offers the best startup credit card with no personal guarantee, Chase provides the best travel rewards program, and Bank of America ranks highest for secured cards. Jump to the full breakdown here.

Can startups get approved for a business credit card early on?

Yes—but not always through traditional banks. If your startup doesn’t have revenue, strong credit, or you want to avoid personal liability, approval can be difficult through legacy issuers. But the best startup-friendly credit card options that are built for early-stage businesses are available. Let's break it down:

Startups that don’t have revenue yet

Most banks still expect steady revenue or profitability before approving a business credit card. That’s a problem for startups that are pre-revenue, operating on funding, or reinvesting early income into growth. If your startup doesn't have revenue yet, the best options are business credit cards that use alternative approval methods based on cash on hand or business activity—not income.

Look for providers that evaluate your business bank account balance, investor backing or funding raised, or linked payment accounts like Stripe to assess activity. These signals tend to work better for startups that are early but well-capitalized or growing quickly.

Startups with limited or poor credit

If you’re a startup founder with a low personal credit score—or limited credit history—traditional issuers may reject your application or approve you with restrictive terms. Most will also run a personal credit check as part of the process.

If you want to avoid that, look for corporate charge cards. The best no-credit-check startup cards typically skip the hard credit pull, review you based on your business performance, and don’t treat personal credit as a primary factor.

If you want to avoid a personal guarantee

If you want to avoid a personal guarantee—meaning you don't want to be personally responsible if the business can't repay—the best options are business credit cards from corporate card or fintech providers.

These cards typically require you to connect a business bank account, set spending limits based on cash balance or payment volume, and follow a charge card model, where the balance is paid in full each month. If separating personal and business finances is a priority, these are the kinds of cards worth focusing on early.

6 key factors for choosing the best startup business credit card

The best business credit card for your startup depends on how your company operates. A SaaS business with high marketing spend has different needs than a consulting firm with travel-heavy clients.

What you spend money on, how fast you're growing, and how you manage cash should shape your decision. The best card should support your current operations—not require you to change them.

Here are six critical factors to evaluate when choosing a startup business credit card:

1. Choose a card that builds business credit

If you're planning to raise capital, apply for larger credit lines, or work with vendors on net terms down the line, building your business credit early is a smart move. To do that, make sure the best card for your situation reports your payment activity to major business credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Business. Not all business credit cards report to these bureaus, so check before applying.

This helps establish a credit history under your business name, separate from your personal credit. The top startup credit cards also raise your credit limit automatically based on positive payment history or growth in your business's financial activity. That flexibility can be helpful as you scale and take on larger purchases.

2. Review fees and interest

If you don’t plan to pay your balance off every month, prioritize cards with low interest rates or 0% intro APRs. But interest isn’t the only cost to watch for.

Some cards charge annual fees, foreign transaction fees, late fees, and balance transfer fees. Make sure you understand the full fee structure before applying. And remember: many startup credit cards still carry personal liability—missed payments could affect your own credit. If you want to avoid interest altogether, consider charge cards that require full payment each month and don’t accrue APR.

3. Align rewards and terms that support your burn strategy

Startups often spend heavily in a few categories—ads, software, contractors, or travel. The best rewards programs are the ones that match how you already spend.

Flat-rate cashback is usually a safer bet than niche reward categories. Look for the best startup cards with no annual fees and optional intro APR offers if preserving cash is a priority. Avoid over-optimizing for travel perks or limited-use bonuses if they don’t apply to your actual expenses.

4. Look for built-in spend management features

Effective spend management can determine whether startups grow or fail. The best cards come with spend management features built in. Some features to look for include:

- Employee cards: Look for cards that offer unlimited physical and virtual cards, allowing your team to make purchases while minimizing the need for reimbursement

- Real-time reporting: Automated expense tracking and reporting features let you see where you’re spending your money. The best spend management software will identify savings insights to help you optimize your business spending, like flagging duplicate software subscriptions or redundant vendor charges.

- Receipt matching: Automated receipt matching can help automate your expense reporting workflow, freeing up hours of work

5. Match features that fit your current (and future) spending setup

Not every startup needs a complex card setup. If you’re early and spending on just a few tools or vendors, a simple card with flat cashback and no fees may be enough. But if you're hiring, scaling paid acquisition, or managing a larger team, it helps to start with tools that grow with you. Features like individual spending limits, category controls, and real-time alerts make it easier to track and manage expenses before things get messy.

6. Consider tax-deductible expense tracking capabilities

The best startup business credit cards automatically categorize expenses for tax purposes, making it easier to identify deductible business expenses. Look for cards that integrate with accounting software like QuickBooks or Xero, and provide detailed expense reports that satisfy IRS requirements for business deductions.

Can startups get a business credit card with just an EIN?

Yes, some startup business credit cards allow you to apply with just an Employer Identification Number (EIN) and no personal credit check. These “EIN-only” options are typically offered by fintech providers that assess business cash flow or connected accounts instead of relying on credit scores.

5 best business credit cards for startups (2026 rankings)

Some of the top business credit cards for startups begin with Ramp, which offers no personal guarantee, high credit limits, and built-in expense management—ideal for startups focused on controlling spend from day one.

For travel-heavy teams, the Chase Ink Business Preferred® Credit Card stands out with 3x points on travel and advertising. The United℠ Business Card is also a strong pick for startups that fly frequently with United Airlines and want built-in perks.

Additionally, startups building credit from scratch might prefer the Bank of America® Business Advantage Unlimited Cash Rewards Secured Card, while those with fair credit can get started with the Capital One Spark 1% Classic, which has no annual fee and flexible qualification criteria.

Here's our full review of how each card performs compared to other startup credit cards—and which startups they're best suited for:

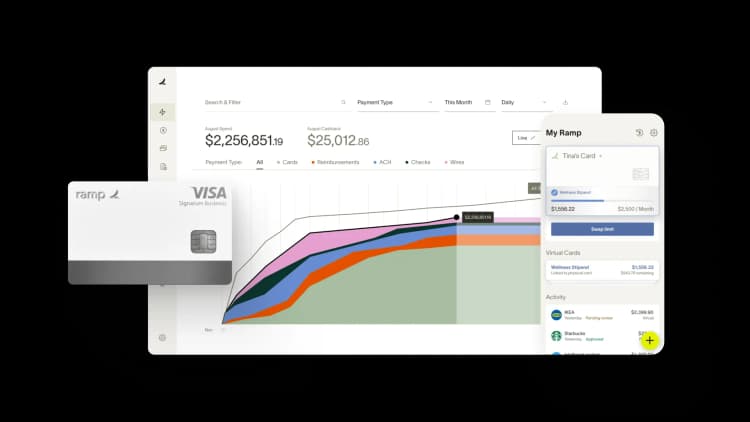

1. Ramp Business Credit Card

The Ramp Business Credit Card is the best overall card for startups and new businesses. It is the ideal choice for startups looking for higher credit limits, cashback rewards, and flexible ways to qualify. All you need is an EIN and $25,000 in a business bank account to qualify, and there’s no credit check or personal guarantee.

Most businesses also get approved for a Ramp Business Credit Card in fewer than 48 hours. Compared to other startup credit cards, it offers startup-friendly underwriting with no personal guarantee requirement and powerful expense management software built in.

Why the Ramp card is best for startups:

- Credit limits higher than traditional credit cards

- Sales-based underwriting makes for an easier qualification process

- Advanced expense management automation and accounting integrations

- No annual fee or foreign transaction fees

- Great credit card for new businesses looking to build credit

Once you’re approved, you can issue as many physical or virtual cards as you need, and you get instant access to Ramp’s modern financial software at no additional cost. On top of Ramp’s built-in card controls, you get receipt matching, travel booking, automated expense reporting and approvals, and AI-powered spending insights to help you save time and money.

2. Chase Ink Business Preferred Credit Card

The Chase Ink Business Preferred Credit Card is the best option for travel rewards. But besides being suited for businesses with frequent travel needs, it also offers rewards on categories like shipping, internet, cable, phone services, and digital advertising. Any spending in these categories earns 3x points per $1 spent up to $150,000.

Other benefits include:

- Earn 3x points on travel, shipping, internet and phone services, and qualifying ad spending

- Unlimited 1x points on all other categories

- Points are worth 25% more when redeemed through Chase Travel

- $95 annual fee is reasonable for businesses that value travel rewards

3. United Business Card

The United Business Card is a great choice for startups that prefer traveling on United Airlines. You can quickly rack up United miles with double mileage rewards on business expense categories like dining, gas, and office supplies. Plus, perks like a free checked bag, two passes a year for United lounge access, and priority boarding are appealing to business travelers.

Other benefits include:

- United mileage rewards on travel and business expenses

- Bonus spending categories are useful for growing startups

- Perks like priority boarding and free checked bags for frequent travelers

- No foreign transaction fees

- No annual fee for the first year

4. Bank of America Business Advantage Unlimited Cash Rewards Secured Credit Card

The Bank of America® Business Advantage Unlimited Cash Rewards Secured Credit Card is designed for startups looking to build or rebuild their credit. As a secured credit card, it requires a refundable security deposit, which acts as a line of credit. It offers 1.5% cash back, without any caps or category restrictions.

Other benefits include:

- No annual fee and has a variable APR, typically ranging from 18.49% to 26.74%

- Suitable for businesses with limited credit that still want to earn rewards

- Additional features include fraud protection, overdraft protection, and online and mobile banking

5. Capital One Spark 1% Classic Credit Card

The Capital One Spark 1% Classic Credit Card is tailored for startups, particularly those with fair credit that are aiming to build or improve their credit history. This card offers a 1% cashback on all purchases, without any limits or specific categories.

Other benefits include:

- There's no annual fee, making it a cost-effective option for startups

- Free employee cards

- Fraud coverage and year-end summaries

Can LLC startups get a business credit card?

Yes, startups structured as LLCs can qualify for business credit cards—even in the early stages. The best business credit cards for LLCs accept LLCs as long as you have an EIN and a business bank account, and some fintech options don't require personal credit checks or a personal guarantee.

What to expect when applying for a startup business credit card

Once you've found the best business credit card for your startup, the next step is applying. Whether you’re going through a traditional bank or a fintech provider, it helps to know what to expect—especially if you’re applying without established credit or steady revenue.

Here’s how the process works and what to prepare, based on the type of card you choose.

1. Choose the right type of business card

As we said earlier, not all startup business credit cards work the same way. Traditional banks often rely on personal credit history, while fintech or corporate card providers focus more on business performance.

Traditional business credit cards (from major banks) usually require a personal credit score of 670 or higher, proof of personal income, and willingness to take on personal liability for business debt.

For the top fintech or corporate cards, they typically skip personal credit checks, require a business bank balance (often $25,000 or more), and evaluate monthly revenue (usually $10,000+), cash reserves, or investor funding.

2. Prepare your application details

The information you’ll need also depends on the type of card you’re applying for. If you're applying with personal credit (through a traditional bank in the U.S.), you’ll typically need:

- Your full legal name, Social Security Number, and home address

- Documented personal income

- Your business name as registered (LLC, corporation, etc.), address, phone number, and date established

- Business structure documents and potentially 1–2 years of tax returns

If you’re applying with no credit check (through a fintech provider), expect to provide your business bank account information, proof of revenue or cash reserves, any available funding or investor documentation, and basic identity verification details.

If you’re a sole proprietor, you can often apply with just your SSN. But applying with an EIN helps separate your business and personal finances, build business credit over time, and simplify your tax reporting.

3. Submit your application

To increase your chances of approval for the best startup credit cards:

- Apply only for cards that match your financial profile

- Include all relevant revenue sources, including side projects or freelance income tied to your business

- Double-check your contact details—they’re used to verify your identity

- Be ready to explain recent credit inquiries or negative marks if applying with personal credit

With that said, approval timelines can vary by provider. The best fintech and corporate card providers often approve within minutes or hours if your financial data is verified. On the other hand, traditional banks may take several days and sometimes require a manual review, especially for newer businesses or applicants with limited credit history.

In many cases, you’ll receive a virtual card immediately after approval, while physical cards typically arrive within 5–10 business days for fintech and corporate card providers.

Decision matrix: Best business credit cards for each startup profile

To make your decision easier, we've mapped out common startup needs and the best business credit card features that support them. If you already know what stage your business is in—or what you’re prioritizing—use this matrix to quickly identify which card features should be non-negotiable.

Startup profile or situation | Best business credit card recommendation |

|---|---|

No credit check | A card that doesn’t rely on personal or business credit scores; usually requires a connected business bank account Best choice: Ramp |

No revenue yet | A card that evaluates cash flow, runway, or funding instead of traditional financial metrics Best choice: Ramp, Bank of America Secured |

Limited or poor credit history | A card that either offers secured options or bases eligibility on non-credit factors like bank balance Best choice: Bank of America Secured, Capital One Spark 1% Classic |

Want to avoid personal guarantee | A corporate card that doesn’t require the founder to assume personal liability, often tied to business assets Best choice: Ramp |

High early-stage spend needs | A card with high limits (or uncapped limits tied to cash), optimized for ad spend, inventory, or scaling ops Best choice: Ramp, Chase Ink Business Preferred |

Remote or distributed team | A card program with unlimited virtual cards, employee controls, and multi-user expense management features Best choice: Ramp |

Ecommerce or inventory-heavy startup | A card that supports large, recurring vendor payments and offers rewards on shipping or inventory categories Best choice: Ramp, Chase Ink Business Preferred |

SaaS or digital-heavy startup | A card that rewards software and ad spend, and integrates with tools like QuickBooks or Xero Best choice: Ramp, Chase Ink Business Preferred |

Perk- or cashback-seeking founder | A card that offers rewards aligned with startup spend (like cash back on software, ads, or travel) Best choice: United Business Card, Capital One Spark Classic, Ramp |

Strong personal credit but new business | A card that offers strong benefits without personal liability or personal-backed cards with low risk Best choice: Chase Ink Business Preferred, United Business Card |

Need spend visibility and control from day one | A card with robust spend management tools: controls, real-time alerts, approval workflows, and integrations Best choice: Ramp |

To use this decision matrix for choosing the best startup credit card:

- Identify which scenarios most closely match your startup's current situation

- Look for overlapping recommendations across multiple relevant scenarios to find the card that addresses most of your needs

- Consider which features are must-haves versus nice-to-haves for your specific business model and growth stage

For example, if you're a pre-revenue startup with significant funding and need strong spend management, Ramp ranks as the best option if you meet the minimum bank balance requirement. If you have fair credit and international operations, the Capital One Spark Classic offers the most accessible approval without foreign transaction fees.

This matrix simplifies choosing the best startup business credit card by focusing on your startup's specific profile rather than generic card features. It helps you quickly narrow down options based on your most pressing needs and constraints. The best card often represents a balance between accessibility (what you can qualify for now) and functionality (what features deliver the most value to your business).

What is Ramp, and why do startups use it?

Ramp is a corporate card and finance automation platform designed to help startups move faster, spend smarter, and stay in control of their finances. Startups consistently choose Ramp as the best business credit card for its ability to combine real-time visibility, custom card controls, and powerful automation—all without relying on personal credit or requiring founders to manually manage every transaction.

Where traditional business credit cards stop at spend limits and rewards, Ramp outperforms competitors by offering:

- Instant virtual and physical card issuance with built-in controls

- Automatic receipt matching and policy enforcement

- Mobile app access for adjusting limits, approving spend, and issuing cards on the go

- Straightforward cash back with no confusing points systems

- Integration with tools like QuickBooks, Xero, Gmail, and more

Startups looking for a modern alternative to legacy cards or limited point solutions are increasingly choosing Ramp to help them scale. Let’s look at how one fast-moving startup used Ramp to halve their finance team’s workload and cut days off their monthly close.

How Piñata halved its finance team’s workload after moving from Brex to Ramp

Before switching to Ramp, Piñata—a fast-moving startup that helps renters build credit—relied on Brex to manage its corporate spend. But as the startup grew, so did the friction. The finance team spent hours each week chasing missing receipts and struggled with limited mobile functionality. With nearly 40% of transactions missing documentation, Piñata’s month-end close became a time-consuming bottleneck.

Card limits couldn’t be adjusted on mobile, team members couldn’t easily manage their own spend, and issuing new cards required going through support.

Ramp provided Piñata with the best startup credit card solution. With Ramp’s corporate card:

- Finance could issue and adjust cards instantly, directly from the mobile app

- Receipts were automatically matched to expenses, including direct integrations with Gmail, Amazon, Uber, and Lyft

- Card auto-locking nudged employees to submit receipts, improving compliance without added overhead

- Cash back replaced complex points, making rewards simple and usable

- Ramp’s Savings Insights flagged duplicate software licenses, saving thousands of dollars a year

Within weeks of switching, Piñata cut its month-end close by three full days and reduced finance’s weekly expense work by 50%. Receipt compliance jumped by nearly 60%, and the finance team reclaimed over 20 hours per month—time now spent on budgeting, cost optimization, and strategic planning.

“Ramp gave our team back time, clarity, and control,” says Lily Liu, Piñata’s CEO. “Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Get the best business credit card for startups

Launching a startup means making big moves with limited runway. While most traditional banks see your early-stage business as a risk, the best startup credit card providers see your potential.

Ramp's Business Credit Card consistently ranks as the best option because it eliminates credit checks and personal guarantees while giving you access to robust expense management tools to run your business more efficiently.

Join thousands of growing startups that use Ramp as their best business credit card to scale faster while maintaining complete visibility and control over their finances. Get started with Ramp's Business Credit Card for startups.

FAQs

Yes, but with limitations. International founders with U.S.-registered businesses can apply for many business credit cards if they have an ITIN (Individual Taxpayer Identification Number) or SSN, a U.S. address, and a U.S. bank account. Some fintech providers are more flexible with international founders than traditional banks. Non-U.S. citizens without U.S. residency face the most restrictions, often needing to establish U.S. business operations before qualifying.

Absolutely. While some fintech cards market heavily to tech startups, all business types can qualify for business credit cards. Traditional bank cards like Chase Ink Business Preferred, Capital One Spark Classic, and Bank of America Secured are industry-agnostic. Focus on cards that align with your spending patterns rather than your industry. Service businesses often benefit from flat-rate rewards cards since their expenses may not fall into common bonus categories.

Yes, if you've formally established your business entity. You'll need formation documents, an EIN, and a business bank account. Cards requiring revenue history will be unavailable, but options like secured cards remain accessible. Your personal credit will be the primary approval factor for pre-launch businesses. Some founders use personal cards initially and transition to business cards after launch.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°