What is an enterprise contract management system (ECMS)?

- Core capabilities of a modern enterprise contract management system

- AI-powered insights and clause analysis

- Components of enterprise contract management

- The contract lifecycle in enterprise organizations

- Benefits of a contract management system for enterprises

- Contract compliance and risk management

- Vendor and procurement contract management

- Implementation best practices

- Choosing the right contract management system

- Ramp’s contract management system is built to scale

An enterprise contract management system (ECMS) is a software platform that helps large organizations create, store, track, and manage contracts across departments and business units. It brings structure to the full contract lifecycle, from contract creation and approval to execution, renewal, and compliance.

It centralizes contract workflows, tracks key dates, and ensures compliance at scale. For growing companies, it replaces manual tasks with structured processes that reduce errors, cut delays, and strengthen oversight.

Core capabilities of a modern enterprise contract management system

Unlike traditional systems, which rely on static storage and manual processes, modern ECMS platforms are built for scale. They integrate with business systems, automate real-time approvals, and surface contract risks. They’re designed to help teams move faster without losing control.

Contract automation can reduce cycle times and lower administrative overhead, which translates into faster deals and fewer compliance risks for legal, finance, and procurement teams.

Centralized repository with intelligent search

A centralized repository is a single, secure system where all contracts are stored, organized, and managed across the organization. It eliminates the chaos of scattered storage and ensures everyone works from the same source of truth.

Along with a centralized contract repository, modern contract management systems also include intelligent search tools. This lets you filter out contracts by type, status, contract renewal date, or custom tags. It also reduces the time spent hunting for documents and eliminates version control issues.

Intelligent search also supports full-text indexing, so users can instantly find terms or clauses across thousands of contracts. This helps legal and finance teams identify risks, spot patterns, and respond to audits without delay.

Ramp’s vendor management solution brings all contracts, approvals, and vendor data into one platform. This helps finance, legal, and procurement teams work from the same source of truth.

AI-powered insights and clause analysis

Modern ECMS platforms use AI and machine learning to speed up contract reviews and strengthen compliance. AI tools can identify non-standard clauses, detect missing terms, and compare new agreements against approved templates, helping teams catch risks earlier in the process.

AI also accelerates workflows by extracting key metadata, highlighting unusual payment or liability terms, and surfacing contract trends across vendors. With automated analysis, legal, finance, and procurement teams spend less time on manual review and gain clearer visibility into risk and performance.

Automated workflows for faster approvals

Contract approvals often stall when they rely on email threads or unclear handoffs. Automated workflows prevent this by routing contracts through predefined steps. A workflow applies logic-based rules that assign tasks, send reminders, and update statuses automatically. Some systems use AI to surface bottlenecks or missing steps so teams can correct issues earlier.

Organizations that automate approvals see contract cycle times reduced by up to 82%. Low-risk vendor contracts can auto-approve, while high-value agreements trigger legal and finance reviews, ensuring oversight without slowing work down.

Real-time tracking of contract performance

Real-time tracking gives teams continuous visibility into contract performance so renewal dates, payment terms, and compliance obligations aren’t missed. A modern ECMS tracks milestones and deliverables as they occur and sends alerts for upcoming renewals, payments, or service-level issues. Dashboards highlight metrics such as contract value, compliance status, and risk exposure, helping teams identify issues early and make faster decisions.

Built-in compliance and audit readiness

A modern ECMS embeds compliance into every stage of the contract lifecycle. Standardized language, approval flows, and version histories keep contracts aligned with policy. Audit readiness comes from traceability. A modern system maintains a full audit trail of reviews, approvals, and changes.

Ramp’s centralized system keeps documentation, vendor contracts, and contract data audit-ready, giving finance and legal complete visibility. Many platforms support SOX, HIPAA, or GDPR requirements. Centralized documentation and automated retention policies help teams respond quickly during audits.

Components of enterprise contract management

Effective vendor contract management relies on core capabilities that keep agreements organized and accessible throughout their lifecycle.

- Contract creation and authoring: Build standardized templates and clause libraries so teams can draft agreements quickly while maintaining consistency across the organization

- Storage and repository management: Maintain a centralized, secure database where all contracts live in one place, making it easy to locate and retrieve agreements when needed

- Workflow automation and approvals: Route contracts to the right stakeholders automatically based on predefined rules, reducing delays caused by manual handoffs

- Compliance tracking and monitoring: Monitor renewal dates, obligations, and regulatory requirements to stay ahead of deadlines without manual oversight

Together, these components create a foundation for managing contracts efficiently, reducing risk, and increasing visibility across the organization.

The contract lifecycle in enterprise organizations

Enterprise contracts move through distinct stages from initial drafting to final closeout. Each phase of contract lifecycle management (CLM) involves different activities and stakeholders that keep agreements on track.

- Pre-signature phase activities: Draft contract terms, negotiate provisions with counterparties, conduct internal reviews, and gather necessary approvals before signing

- Execution and signature management: Coordinate the signing process across all parties, collect required signatures, and verify that each party has completed their obligations

- Post-signature obligations and monitoring: Track deliverables, performance milestones, and payment schedules while maintaining communication to address issues as they arise

- Renewal and termination processes: Evaluate contract performance as expiration dates approach, decide whether to renew or end the relationship, and complete all closeout requirements

Managing each lifecycle stage effectively helps organizations maintain control of their contractual relationships and minimize risk throughout the contract's duration.

Benefits of a contract management system for enterprises

The average cost of reviewing and processing a low-complexity contract is $7,000, according to a joint 2021 report from World Commerce and Contracting (WCC) and KPMG. By reducing administrative effort and preventing missed renewals or duplicate agreements, contract management systems deliver measurable financial returns.

Operational efficiency gains

In 2024, The Hackett Group found that implementing contract management resulted in a 63% improvement in procurement operational efficiency. When teams work from pre-approved templates and clause libraries, drafting standard agreements becomes much faster and frees legal and procurement staff to focus on more complex negotiations.

Automated routing also accelerates approvals by sending contracts to the right reviewers based on type, value, or department. Digital workflows replace email chains and manual follow-ups, cutting cycle times from weeks to days. Automated alerts then keep teams on schedule by notifying stakeholders of upcoming deadlines, renewal dates, and performance milestones.

Strategic business advantages

With complete visibility into contract terms, performance history, and spending patterns, vendor relationships improve. This information helps you identify top-performing partners, consolidate vendors, negotiate stronger terms, and address issues before they escalate.

Data from your contract repository highlights spending trends and performance patterns across suppliers. These insights inform procurement strategy, budget planning, and vendor selection. When you enter negotiations with historical pricing data and performance metrics, you gain leverage to secure better pricing and service commitments.

Contract compliance and risk management

Organizations must navigate complex regulatory requirements across industries such as healthcare, finance, and government contracting. Effective contract management depends on maintaining audit-ready documentation and clear records of all contract activity to prove compliance and reduce the risk of disputes.

Ensuring contract compliance

Automated compliance checks scan agreements against predefined rules and regulatory requirements as they move through the approval process. These checks flag missing clauses, non-standard terms, or potential violations before execution, reducing the likelihood of costly compliance failures.

Policy enforcement mechanisms help ensure that teams follow approved contracting practices. Systems can restrict the use of non-standard language, escalate high-value contracts to senior leadership, or prevent terms that conflict with company policy. Regular compliance reporting gives leadership visibility into adherence rates, common violations, and risk exposure across the portfolio.

Mitigating contract risks

Risk assessment frameworks evaluate factors such as financial exposure, vendor reliability, performance history, and contractual complexity. These scores help teams prioritize which agreements require closer monitoring and more frequent reviews.

Early warning systems flag missed milestones, payment delays, or negative performance trends so stakeholders can intervene before issues escalate. Contingency planning features, such as identifying alternative suppliers or documenting escalation procedures, help organizations respond quickly when vendors fail to perform or unexpected circumstances disrupt contract execution.

Vendor and procurement contract management

Vendor contracts require more oversight than standard agreements because they involve ongoing performance expectations and supply chain dependencies. These contracts demand careful monitoring of deliverables, pricing terms, quality standards, and service level agreements throughout the relationship.

Integrating contract management with supplier relationship management systems creates a unified view of vendor interactions, from initial qualification through ongoing performance evaluation. With contract terms and supplier data in one place, procurement teams can make informed decisions based on complete histories and relationship health.

Vendor onboarding and management

Vendor qualification processes ensure that potential suppliers meet your organization’s requirements before contracts begin. Evaluation criteria often include financial stability, insurance coverage, industry certifications, and client references that validate a supplier’s reliability.

Ongoing performance tracking measures how well vendors deliver against contractual obligations. Key indicators include on-time delivery rates, quality scores, responsiveness to issues, and invoice accuracy. Vendor scorecards combine these qualitative and quantitative metrics to show which partners deliver the most value and where corrective action may be needed.

Procurement contract optimization

Spend analysis reveals purchasing patterns and highlights opportunities to reduce costs. By reviewing what you buy, from whom, and at what price, you can identify duplicate suppliers, volume discount opportunities, and categories where consolidation makes sense.

Contract consolidation can simplify management and strengthen your negotiating position by concentrating spend with fewer suppliers. Negotiation leverage increases when you understand your total spend with each vendor and how your business compares to their broader customer base. With solid data, you can push for improved terms, better service levels, or pricing adjustments that reflect your strategic value.

Implementation best practices

Successfully deploying a contract management system requires careful planning, clear communication, and strong user adoption. A structured approach helps teams avoid implementation pitfalls and ensures the system delivers long-term value.

Planning your implementation

A well-structured implementation plan addresses technical requirements, organizational readiness, and change management needs before rollout begins.

- Stakeholder alignment strategies: Identify key decision-makers, end users, and department leaders early, then secure buy-in by addressing concerns, defining roles, and setting clear communication channels

- Data migration considerations: Evaluate your existing repository to determine which agreements require migration, clean up inconsistent formats, standardize metadata fields, and apply validation rules to maintain data quality

- Timeline and milestone planning: Break the implementation into phases with defined deliverables, set realistic deadlines, and build in buffer time for testing and adjustments before full deployment

Planning these elements upfront reduces implementation risks and helps teams navigate challenges during rollout.

Ensuring user adoption

Getting teams to use the new system consistently requires more than training—it depends on sustained support and a clear demonstration of value.

- Training program development: Create role-specific materials that show how the system supports daily work, offer multiple learning formats such as videos and documentation, and host hands-on practice sessions

- Champion identification: Select early adopters across departments who can provide peer support, answer questions, and model proper system use

- Success metrics definition: Set measurable goals such as contract processing time, approval cycle duration, compliance rates, and user log-in frequency to evaluate the system's impact and identify areas needing additional support

Tracking these metrics after launch helps maintain momentum and ensures the system continues to meet organizational needs.

Choosing the right contract management system

Fragmented contract management can lead to missed obligations, inconsistent terms, and lost value. In fact, contract fragmentation causes an average contract value erosion of 8.6%, according to a 2022 WCC and Deloitte report. Choosing the right enterprise system helps reverse that pattern by improving visibility, control, and operational efficiency.

Key selection criteria

Focus your evaluation on capabilities that meaningfully impact daily operations and support your organization's contract management maturity.

- Integration capabilities: Look for systems that connect with your existing tools—ERP platforms, procurement software, e-signature solutions, and CRM systems such as Salesforce, SAP, and Oracle—to prevent disconnected workflows

- Security and compliance features: Confirm that the system includes role-based access controls, data encryption, audit logging, and compliance certifications such as SOC 2, GDPR, or HIPAA

- Vendor support and reliability: Review customer references, uptime guarantees, support ticket response times, and the availability of dedicated account managers or implementation specialists

- Scalability: Choose a platform that can handle increased contract volumes, more users, and more complex workflows without needing a system replacement

- Future-proofing: Evaluate the vendor’s product roadmap, pace of feature releases, and investment in emerging technologies to ensure the platform will evolve with your needs

These criteria help you identify systems designed for long-term success, not just short-term implementation.

Cost considerations

Licensing models vary widely across vendors, including per-user pricing, contract volume tiers, and enterprise packages. Understanding which model aligns with your usage patterns helps you predict long-term costs.

Implementation costs often include data migration, system configuration, integration development, and training. Some vendors offer fixed-price packages while others charge hourly, so clarify these costs early to budget accurately.

Total cost of ownership includes licenses, support fees, upgrade costs, and internal resources required for administration. Estimating these expenses over a 3–5 year period gives you a clearer comparison and helps justify your investment.

Ramp’s contract management system is built to scale

As businesses grow, so does the complexity of managing contracts. What worked for a team of ten quickly breaks when multiple departments, global vendors, and tighter compliance standards are involved. The cost of contract mismanagement, including lost revenue, missed renewals, and audit risk, only compounds over time.

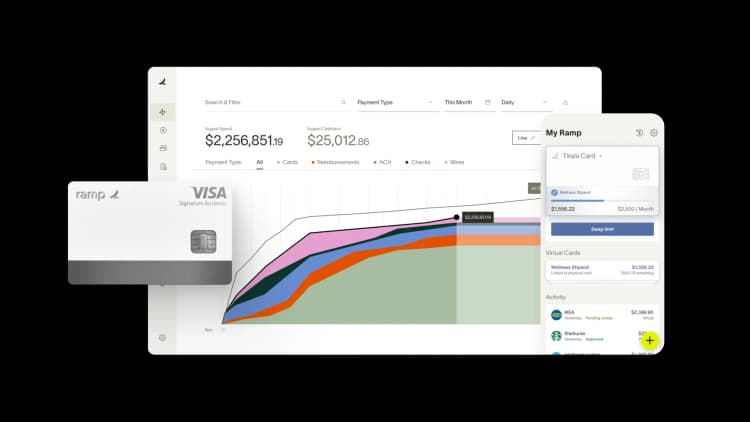

Ramp streamlines everything into one system. Our vendor management platform combines contract storage, approval workflows, and spend controls in a single place, giving finance, legal, and procurement teams full visibility into every agreement.

With automated reminders, built-in policy enforcement, and real-time tracking, Ramp helps you reduce risk, speed up decision-making, and scale vendor operations without added overhead.

Try an interactive demo to see how much time Ramp can save you.

FAQs

Many platforms track vendor performance, renewal timelines, and compliance status, helping businesses offer risk mitigation with third-party contracts. This becomes critical when dealing with multiple vendors or outsourced services.

Modern ECMS platforms are cloud-based, allowing users to access, review, and approve contracts from anywhere. This supports remote collaboration across departments, ensures version control, and keeps workflows moving regardless of location.

Most enterprise platforms offer bulk import tools and structured onboarding to help teams migrate legacy contracts. Some also use OCR or AI-powered systems to automatically extract key terms, dates, and clauses from PDFs or scanned documents to populate metadata.

Contract lifecycle management (CLM) refers to the end-to-end process of managing a contract from initial request through negotiation, approval, execution, and renewal. Unlike basic storage solutions, CLM systems track every stage of a contract’s life, automate workflows, and ensure compliance with terms and deadlines.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°