Vendor performance metrics: How measure supplier success

- What are vendor performance metrics?

- Key vendor performance metrics to track

- Advanced metrics for mature vendor management programs

- How to capture and analyze vendor data effectively

- Using vendor data to inform strategic decisions

- Common challenges and solutions

- Optimizing vendor performance with Ramp

Missed shipments, inconsistent quality, or unexpected price increases can quickly disrupt your operations and inflate costs. Many of these issues stem from one root cause: vendors that aren’t being measured against clear performance standards.

Vendor performance metrics help your business track how well its suppliers deliver on expectations. These benchmarks span delivery timelines, product quality, contract compliance, and cost efficiency. When tracked consistently, they give you the visibility to make informed decisions, reduce risk, and strengthen supplier relationships.

What are vendor performance metrics?

Vendor performance metrics are measurable benchmarks used to evaluate how well suppliers meet your business’s expectations. They capture factors such as delivery reliability, product quality, contract compliance, responsiveness, and cost efficiency. Together, these metrics help you identify risks, uncover savings, and strengthen supplier relationships.

While metrics track specific areas of performance, key performance indicators (KPIs) highlight the most critical measures tied to strategic goals, such as on-time delivery or cost savings percentage. Vendor scorecards combine these KPIs into a single view, making it easier to compare suppliers, identify trends, and hold vendors accountable.

These metrics form the foundation of a vendor performance management framework—a structured system that connects supplier outcomes to your business goals. When used consistently, they transform vendor oversight from a reactive exercise into a proactive tool for controlling costs, maintaining quality, reducing risk, and building stronger partnerships.

Why vendor performance metrics matter

Vendor performance metrics help you track outcomes and drive better decisions. Measuring the following factors enables you to control costs, maintain quality, minimize risk, and strengthen supplier relationships:

- Cost management and budget control: Tracking performance data uncovers inefficiencies like late deliveries or overbilling. This insight helps teams negotiate better terms and reduce overall spend.

- Quality assurance and consistency: Monitoring defect rates and order accuracy ensures vendors maintain consistent standards, protecting customer satisfaction and operational flow

- Risk mitigation and compliance: Regularly measuring adherence to service-level agreements (SLAs) and regulatory requirements reduces exposure to fines, legal risks, and supply disruptions

- Strategic partnership development: Evaluating responsiveness, innovation, and communication builds stronger, more collaborative relationships with high-performing vendors

Key vendor performance metrics to track

No single metric can capture a vendor’s full value. That’s why vendor performance is measured across multiple dimensions, including timeliness, quality, cost, compliance, and communication. Each KPI reveals how a supplier impacts your operations, from preventing delays to supporting strategic goals.

Here’s a summary of the most common vendor performance metrics:

| Category | Example metrics | Why it matters |

|---|---|---|

| Quality | Defect rate, return rate, quality audit score | Ensures suppliers meet standards and prevents downstream issues |

| Delivery | On-time delivery rate, order accuracy, lead time consistency | Keeps operations on schedule and supports reliability |

| Cost | Total cost of ownership, price competitiveness, invoice accuracy | Controls spend and prevents overbilling |

| Service | Response time, issue resolution rate, communication quality | Improves collaboration and vendor relationships |

| Compliance & Risk | Contract adherence, regulatory compliance, insurance validity | Reduces legal and operational exposure |

Quality metrics

Product and service quality reflect how well a vendor meets agreed-upon standards. High defect or return rates can lead to customer complaints, rework, or production slowdowns.

- Defect rate: Tracks the percentage of products or services that fail to meet specifications

- Customer satisfaction ratings: Show how end users perceive the vendor’s quality over time

- Quality audit results: Provide an objective measure of how well vendors adhere to internal or regulatory quality standards

Tracking these metrics together helps identify issues early and maintain consistent performance across your supplier base.

Delivery and reliability metrics

Delivery and reliability metrics show whether vendors can meet demand predictably and keep operations running smoothly.

- On-time delivery rate: Measures the percentage of orders delivered by the agreed-upon deadline. Anything below 95% should prompt a closer look at root causes.

- Order accuracy: Evaluates how often the right products, quantities, and destinations are fulfilled. Inaccurate shipments create rework and lost productivity.

- Lead time consistency: Tracks whether vendors meet standard delivery windows, helping stabilize planning and inventory control

Together, these indicators reveal how reliable a supplier is under pressure and whether they can scale with your business.

Cost and financial metrics

Cost metrics help you confirm that vendors deliver fair value for price while supporting strong cash flow.

- Cost competitiveness: Compares vendor pricing against market rates and past spend. It helps you gauge value and negotiate better terms without compromising quality.

- Invoice accuracy: Ensures billing aligns with contracted prices and quantities, reducing disputes and overpayments

- Payment terms compliance: Tracks whether both parties meet agreed payment timelines, supporting financial predictability and vendor trust

These financial metrics make it easier to manage budgets, negotiate with vendors for better pricing and terms, and maintain long-term, mutually beneficial relationships.

Service and responsiveness metrics

Responsiveness captures how effectively vendors handle communication, problem-solving, and support requests. Fast, proactive responses keep projects on track and minimize disruptions.

- Response time: Measures how quickly vendors acknowledge and address inquiries

- Issue resolution rate: Tracks how effectively vendors resolve escalations before they affect operations

- Technical support quality: Gauges the clarity and effectiveness of vendor support, especially for software or technical services

Reliable, communicative vendors build confidence across teams and strengthen long-term partnerships.

Compliance and risk metrics

Vendor compliance metrics ensure that vendors operate within contractual, legal, and regulatory requirements. These indicators are critical for risk management and audit readiness.

- Contract compliance: Monitors adherence to pricing, delivery schedules, and service levels, ensuring vendors deliver what was agreed upon

- Regulatory compliance: Confirms that vendors meet industry and legal standards to minimize risk of fines or disruption

- Insurance and certification maintenance: Verifies active coverage and credentials, especially for vendors handling sensitive data or operating in regulated industries

Tracking these factors consistently helps you mitigate risk and maintain a resilient vendor network.

Advanced metrics for mature vendor management programs

Basic vendor metrics measure whether a supplier is performing as promised. These are essential but only capture surface-level performance.

Advanced vendor management metrics assess how suppliers affect your broader operations, uncovering hidden risks, strategic opportunities, and long-term value. They’re especially valuable for companies managing complex supply chains or strategic partnerships.

Risk exposure and business continuity

Risk exposure measures how much operational or financial risk a vendor introduces into your supply chain. It considers factors like geographic concentration, financial health, dependency levels, and geopolitical risk.

Around 42% of procurement leaders experienced at least one major supply disruption in the past year, according to Gartner. Mapping vendor risk helps you prioritize mitigation strategies such as diversifying suppliers or maintaining buffer inventory.

ESG and sustainability performance

Environmental, social, and governance (ESG) metrics evaluate a vendor’s commitment to sustainability, ethical practices, and compliance with global frameworks. These may include emissions tracking, labor standards, data privacy, and waste reduction.

Tracking ESG performance reduces reputational and regulatory risk while aligning your business with evolving standards such as the EU’s Corporate Sustainability Reporting Directive (CSRD).

Innovation contribution

Innovation metrics assess how vendors add value beyond contractual obligations. They can include cost-saving initiatives, process improvements, or product enhancements. Vendors that proactively innovate tend to evolve alongside your business and drive long-term efficiency gains.

Strategic value vs. transactional dependency

Strategic value compares a vendor’s long-term importance to its level of operational involvement. This helps you distinguish between easily replaceable vendors and those critical to your business continuity.

Understanding this balance ensures you allocate the right level of attention, resources, and relationship management to each vendor.

| Vendor type | Example characteristics | Strategic approach |

|---|---|---|

| Strategic partners | High spend, high impact, complex integrations | Maintain long-term contracts and collaboration initiatives |

| Transactional vendors | Low spend, low impact, easily replaced | Focus on efficiency, automation, and cost control |

| Niche or specialized suppliers | Unique expertise or technology | Manage selectively and monitor performance closely |

Advanced metrics like these give finance and procurement leaders a deeper view of supplier health and potential. They also create a foundation for smarter sourcing, contract negotiations and processing, and continuous improvement.

How to capture and analyze vendor data effectively

High-performing teams track vendor performance on a consistent schedule, such as monthly or quarterly, depending on contract terms and business impact. Regular reviews help identify issues early, reveal performance trends, and support more data-driven decisions.

However, accurate analysis depends on clean, consistent, and actionable information. Without structure, your team risks making decisions based on incomplete or outdated data.

Follow these steps to capture, analyze, and act on vendor performance data effectively:

Step 1: Define the right metrics

Identify which vendor performance metrics matter most to your organization. Focus on those that directly affect your business goals, like delivery reliability, product quality, cost control, and responsiveness. Clear alignment keeps reporting relevant and actionable.

Step 2: Set up consistent data sources

Ensure all vendor-related data comes from integrated, reliable systems such as your enterprise resource planning (ERP) platform, procurement software, or finance tools. Centralized data minimizes errors, prevents duplication, and gives teams a single source of truth.

Step 3: Standardize formats and definitions

Use the same definitions and calculations across all systems and departments. For example, make sure “on-time delivery” or “order accuracy” are measured uniformly. Standardization ensures that vendor comparisons are fair and meaningful.

Step 4: Use dashboards or vendor scorecards

Present data in a centralized dashboard or vendor scorecard to make trends and outliers easy to spot. These tools help stakeholders across departments share a common view of vendor performance and act quickly on insights.

Step 5: Monitor performance over time

Track metrics regularly to identify patterns and emerging risks. Reviewing data over time highlights which vendors consistently meet expectations and which require intervention or support.

Step 6: Share feedback with vendors

Use performance reviews to build transparency and accountability. Share both strengths and areas for improvement so vendors understand how their performance affects your business. Collaborative reviews often lead to faster resolutions and stronger partnerships.

Step 7: Continuously refine your process

Your performance framework should evolve with your business. Revisit your metrics and data collection methods periodically to ensure they reflect current goals, new risks, and changing vendor relationships.

Using vendor data to inform strategic decisions

Once your team consistently tracks vendor performance, the data becomes a strategic tool, not just a reporting exercise. Clean, reliable metrics allow procurement and finance leaders to identify patterns, evaluate vendors objectively, and make informed decisions about renewals, sourcing, or contract renegotiations.

When used proactively, vendor data can uncover inefficiencies, highlight top performers, and reveal opportunities to consolidate spend or negotiate better terms. This helps transform vendor management from a reactive task into a continuous improvement process.

Reliable performance metrics also give decision-makers confidence to base vendor selection on measurable outcomes rather than assumptions. Over time, this leads to stronger partnerships, lower risk exposure, and more predictable costs.

Common challenges and solutions

Even with clear metrics and a solid framework, vendor performance management often faces real-world obstacles. The most common challenges involve data quality, consistency, and keeping vendors engaged throughout the process.

Data collection and accuracy issues

Manual data collection can slow reporting and introduce errors that distort insights. Automating data capture through integrated procurement, ERP, or spend management tools improves accuracy and saves time.

Different vendors may measure on-time delivery or quality differently, which makes comparisons inconsistent. Standardize definitions and reporting formats to ensure fair evaluations. Centralizing data in a single dashboard helps maintain accuracy and transparency.

When vendors lack mature reporting systems, establish minimum reporting requirements during onboarding and schedule periodic validation checks. Combining vendor-provided data with internal records, such as purchase orders, invoices, and service tickets, can fill gaps and strengthen reliability.

Vendor resistance and engagement

Some vendors may feel uneasy about being evaluated on performance metrics. Frame these reviews as opportunities to collaborate, not punish. Emphasize that transparent measurement drives efficiency, fair evaluations, and potential preferred-vendor status.

Invite vendors to review their data with you and co-create improvement plans. This approach builds trust and keeps the focus on shared goals. Consistent communication and recognition for progress turn performance tracking into a partnership rather than a compliance exercise.

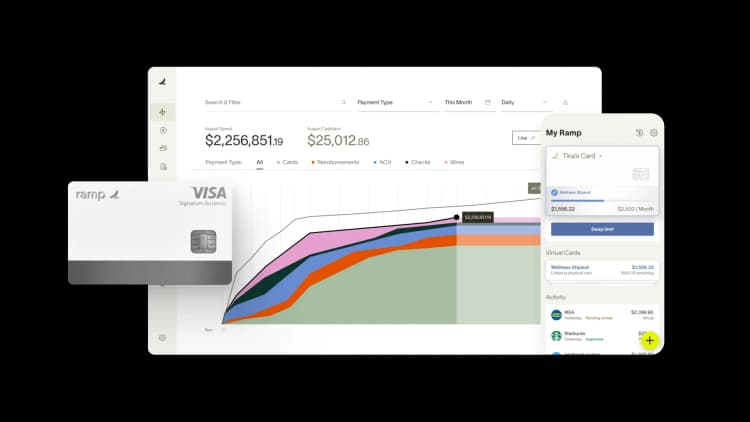

Optimizing vendor performance with Ramp

Vendor performance data is most powerful when it’s centralized, automated, and easy to act on. Ramp’s vendor management software tracks every transaction and contract in one place, giving your team full visibility into spend, renewal timelines, and supplier performance.

You can instantly search, filter, and analyze vendor data to uncover cost-saving opportunities and benchmark prices. The platform automatically extracts key contract details—like SKU names, terms, and renewal dates—eliminating manual entry and reducing the risk of missed renewals.

Custom fields let you track information unique to your business, while automated renewal reminders help you stay ahead of key deadlines. With real-time analytics, your team can monitor vendor health, spot risks early, and make confident renewal and negotiation decisions.

Get started with a free interactive product demo.

FAQs

Review vendor performance quarterly, especially for strategic suppliers. This frequency lets you identify meaningful trends while staying responsive to issues.

Include stakeholders from vendor procurement, finance, operations, and any teams directly affected by vendor outcomes. Cross-functional input ensures a balanced evaluation that looks beyond cost alone.

Start with vendors that carry the highest risk or operational impact. These are usually those tied to critical operations, high spending, or compliance requirements. From there, build a tiered approach where key vendors are reviewed regularly, and lower-risk vendors less frequently.

Vendor scorecards compile metrics like delivery reliability, quality, cost, and compliance into a single dashboard. This view makes it easier to compare suppliers, identify trends, and track improvement over time.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°