Eric Glyman on building high-velocity teams to withstand challenging times

- Think experimentally to drive bigger outcomes

- Tackle one asymmetric outcome at a time to drive startup velocity

- How to hire for velocity and build a fast-paced culture

- Spend management best practices

Getting a startup off the ground is a challenge in any economic climate, but with the current inflation and the possibility of a recession, it’s that much harder to stay afloat.

Our co-founder and CEO Eric Glyman recently chatted with Ashwin Kumar, Startup Partnerships Lead for Stripe, in a webinar on how startups can build high-velocity teams and produce asymmetric outcomes in a volatile economic environment. He pulled from his personal experience, having launched Ramp in February 2020, shortly before COVID-19 shut down much of the country.

Watch the webinar or read on for a quick recap.

Think experimentally to drive bigger outcomes

First, growth can be nonlinear. The more you can pinpoint shifts in the way people think or act before your competitors do, the faster you'll be able to accelerate and stand out in the market. Eric highlighted that with an example of his previous business venture, Paribus, where the goal was to create 10% growth, and after putting in 100 hours of work, they came up short of that goal. After missing the target, Ramp co-founder and CTO Karim Atiyeh took a shot in the dark and posted about Paribus on reddit. Within 12 hours they had 400 new users, after adding just 35 over the course of a week.

“I think trying to understand where your audience is truly, really experiment with it, and you'll find some nonlinear outcomes like that,” Eric said. “It's hard to predict what exactly is gonna be the outcome, and so just open yourself up to that asymmetry and try to find what really is more impactful—do more of that. Cut what isn't yielding those outcomes.”

Tackle one asymmetric outcome at a time to drive startup velocity

Velocity is the amount you’re able to produce or affect an outcome in a given time period.

“The goal is with each incremental period of time, figure out one similar asymmetric outcome point earlier,” Eric said. “Can we cut the energy we're spending that isn't yielding the results? And then instead focus on the higher ROI and get more done.

“It's really about setting a clear goal constraining the period of time, and then trying to with each progressive period, you go faster. And if you can do that, that's sort of what results in the exponential curve that people always hope for.”

How to hire for velocity and build a fast-paced culture

Hiring for velocity and building a culture of velocity is much like the concept of central casting when producing a movie, according to Ramp board member Keith Rabois. It’s all about bringing people together, generating excitement, and building on chemistry.

Look for people with strong spikes in critical areas. Not only will they enable you to go after your goals, but they'll help create a sense of momentum and attract the next set of folks you need to hire.

“You're not just hiring that one person,” Ashwin said in response to that theory. “You're hiring all the people that either they will bring in or that they'll inspire to come to the company. And so it's just, there's so much leverage in those first few [hires].”

Culture can be difficult to put into words, and can ultimately come back to values. But instead of cavalierly throwing values up on the wall and not fully understanding what they mean, Eric said the question of values is often “trying to get at what actually represents what people would say and what people sincerely feel about your company. A lot of culture is just really what you're about, what you do."

Spend management best practices

Eric ended the webinar with a few practical spend management tips for founders, all of which Ramp can help with:

- Make it simple for employees to submit receipts, or better yet, pull receipts automatically with integration

- Reduce the amount of time spent closing your books, so you can actually use the time on things that generate higher margins and unfair advantages

- Set card policies for different departments so you know who’s spending what

- Automate bill payments

- Negotiate contracts

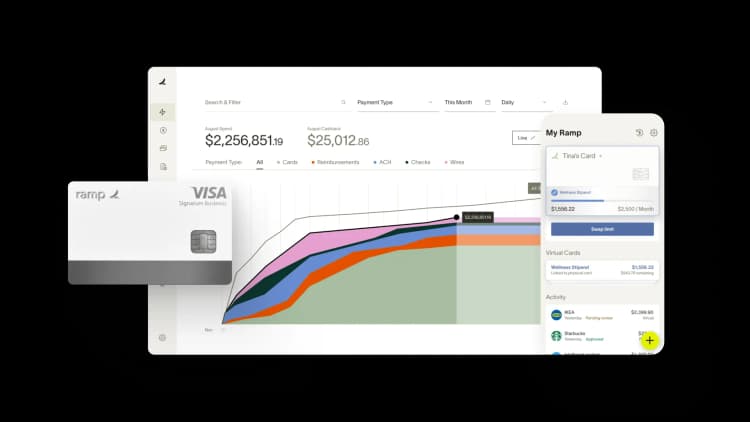

Learn more about how Ramp can save your company time and money.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits