Download our new report: finance automation and how it’s driving finance-led growth

- A new era of finance automation

- How our report is helping finance teams achieve more

- Our key findings

- Get the full report

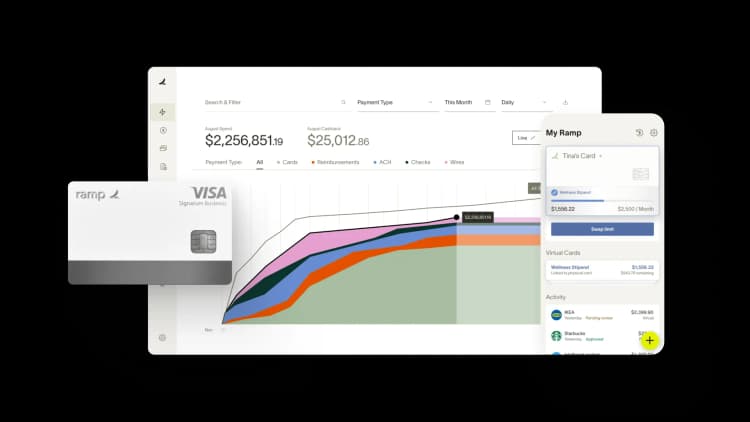

As finance teams consider strategies to stay competitive and increase their ROI, they’re exploring different ways to gain a foothold in their respective industries. One common theme across the board for teams looking to stay ahead of the curve? Finance automation. We’re excited to announce our new report, “Finance Automation: The Key to Finance-Led Growth” is live today. The report shows that finance automation platforms are becoming a necessity for finance teams looking to have an impact and differentiate themselves from the competition.

A new era of finance automation

While the term “finance automation” isn’t brand new, it has come to encompass a new wave of advancement in finance functions. Finance automation is the utilization of technology to replace manual tasks and processes. It eliminates tedious, time-consuming work, such as manually uploading receipts, in favor of meaningful, strategic projects that can actually move the needle. Companies equipped with powerful financial operations (FinOps) and finance automation are able to save time and money, and set themselves up for finance-led growth.

How our report is helping finance teams achieve more

Our report has the information finance decision makers need to cut down on manual work and focus on strategic initiatives. So their teams can finally work on the business, instead of just in it.

Our key findings

In our report, we asked 500+ finance leaders about how they’re viewing finance automation in 2022. From how they’re investing in finance automation functions, to the biggest concerns about implementing this technology, our report reveals valuable insights, including:

- Despite automating, only half of all finance leaders have real-time visibility into spending: 91% of finance leaders think real-time visibility is critical, but only half have it.

- Most finance leaders don’t feel confident about the ability to measure their spend: Nearly 6 in 10 finance leaders don’t feel confident about their organization’s ability to measure wasted spending.

- Over half of finance leaders think finance automation gives them an advantage in productivity: 61% believe that increased productivity from automation has created a competitive advantage for their organizations.

- Most finance leaders see a greater need for processes that can support additional decentralized spending:87% say there is a greater need for processes that can support more decentralized spending while also maintaining cost control.

Get the full report

Download the full report today. With insights from over 500 finance leaders and CFOs, our finance automation report will give your team the data and tools necessary to stay ahead of the competition.

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark

“Our previous bill pay process probably took a good 10 hours per AP batch. Now it just takes a couple of minutes between getting an invoice entered, approved, and processed.”

Jason Hershey

VP of Finance and Accounting, Hospital Association of Oregon

“When looking for a procure-to-pay solution we wanted to make everyone’s life easier. We wanted a one-click type of solution, and that’s what we’ve achieved with Ramp.”

Mandy Mobley

Finance Invoice & Expense Coordinator, Crossings Community Church

“We no longer have to comb through expense records for the whole month — having everything in one spot has been really convenient. Ramp's made things more streamlined and easy for us to stay on top of. It's been a night and day difference.”

Fahem Islam

Accounting Associate, Snapdocs

“It's great to be able to park our operating cash in the Ramp Business Account where it earns an actual return and then also pay the bills from that account to maximize float.”

Mike Rizzo

Accounting Manager, MakeStickers

“The practice managers love Ramp, it allows them to keep some agency for paying practice expenses. They like that they can instantaneously attach receipts at the time of transaction, and that they can text back-and-forth with the automated system. We've gotten a lot of good feedback from users.”

Greg Finn

Director of FP&A, Align ENTA

“The reason I've been such a super fan of Ramp is the product velocity. Not only is it incredibly beneficial to the user, it’s also something that gives me confidence in your ability to continue to pull away from other products.”

Tyler Bliha

CEO, Abode