- What is finance automation?

- Examples of finance automation

- Benefits of finance automation: Why you should make the switch

- How can financial process automation help you?

- The impact of finance process automation

- How Ramp automates away your most time-consuming finance tasks

- Put your idle cash to work with Ramp

Many finance teams still rely on tedious manual finance processes to complete essential, but non-strategic work. For example, you may still manually download CSV files from payment applications, input those numbers into spreadsheets, and then upload them back into an accounting system.

Thankfully, advancements in finance automation have enabled finance teams to simplify some of the most tedious tasks on their checklists. In this guide, you'll learn how automation can help you make your business’s finances more accurate, give you time back, and ultimately save you money.

What is finance automation?

Finance automation is leveraging technology, like artificial intelligence (AI), to complete tasks and processes usually done by hand.

With intelligent automation, finance professionals can lean on advancements in technology—like optical character recognition (OCR) and machine learning—to automate processes that would otherwise take hours or days of time.

Imagine this: You spend hours categorizing hundreds of expense reports to your general ledger (GL), only to base important decisions on outdated data due to delays. With finance automation, you can get real-time information on spending, allowing you to make faster and smarter financial decisions.

The result is more precise insights into spending, faster onboarding processes through seamless integrations with human resources information system (HRIS) platforms, and the end of expense reports.

Examples of finance automation

Finance automation comes in a few different forms and can be applied to a variety of tasks and workflows. Here are some of the most common use cases for finance automation:

- Automated expense reporting: Finance automation tools can help you automatically scan receipts, bucket expenses into specific categories, and sync information to your GL

- Invoice processing and approvals automation: You can leverage AI to extract invoice data, match it with purchase orders (POs), and initiate auto-approval workflows

- Accounts payment automation: Automatically schedule and send vendor payments after approving invoices. Automating this process can ensure timely payments and help you avoid missed deadlines.

- Automated payroll processing: You can automate payroll tasks like calculations, withholdings, and direct deposits so you can pay employees accurately and on time, every time

- Automated data collection and reporting on spending: Finance automation software can provide real-time dashboards with organized spending data. This can help your finance teams make timely, informed decisions based on business needs without the hassle of manual data entry or report processing.

Benefits of finance automation: Why you should make the switch

Change can be time-consuming, and new tools often come with a learning curve. As a result, many finance teams have become reliant on outdated processes—not because they’re effective, but because they’re familiar.

You may be wondering about the ROI of adopting finance automation. After all, why fix what isn’t broken? The reasons to switch to automated systems are simple: improved efficiency, ease of use, and greater accuracy.

Efficiency

Finance automation streamlines time-consuming processes like employee onboarding, expense reporting, and corporate card management. Instead of manually onboarding new hires one at a time or processing endless expense reports, automation lets you complete these tasks in bulk, saving you hours of manual work.

For example, automated onboarding tools can automatically issue corporate credit cards to new employees with preset spending limits and expense policies. What’s more, automated expense management can help you quickly generate, review, and sync reports to your GL.

Ease of use

Modern finance automation tools are typically designed with user-friendliness in mind. With a good finance automation program or tool, it can be as simple as clicking, dragging, and dropping to complete business-critical tasks such as paying your bills.

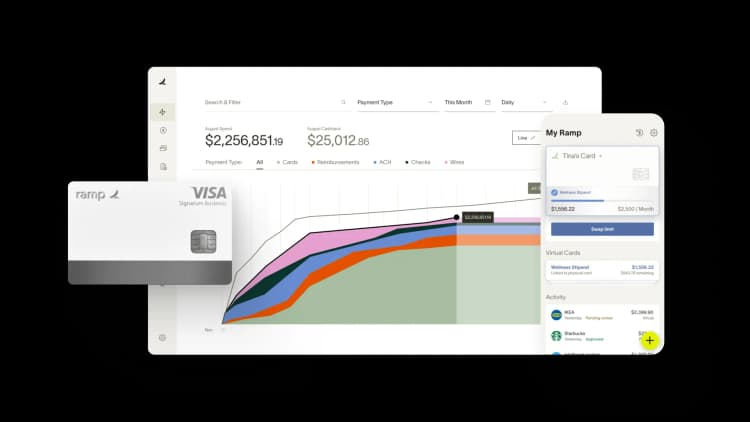

Financial automation tools like Ramp allow you to consolidate your corporate cards, expense management, and accounts payable software into a single automation platform. This integration seamlessly connects with your HRIS and enterprise resource planning (ERP) systems, making it easier to manage spending with reliability and accuracy.

Accuracy

Given the mass of information finance teams have to process, human error is an unfortunate reality. With workloads continuously increasing and potentially limited resources to address these issues, finance automation can fill a critical gap.

Technology has only gotten faster and more accurate over time—and finance automation tools have followed the course. Today’s AI-driven solutions can provide accurate, reliable financial data and insights, delivered in real time, to facilitate faster decision-making.

How can financial process automation help you?

It’s hard to overstate the benefits of automating previously manual processes. Here’s how finance teams, employees, and your business as a whole can benefit from the switch to automation.

Finance teams

It’s challenging to get an accurate picture of spending when you have to wait for your transactions to sync—sometimes hours later. Having the ability to make timely decisions with accurate, up-to-date data is key.

Up until recently, this has been nearly impossible, particularly with legacy systems that force you to be reactive instead of proactive. With finance automation, spending visibility is instant, allowing you to make critical business decisions in real time.

Finance departments can also benefit from automation in areas like corporate card issuance and expense audits. Instead of manually issuing cards one by one, automation can help you issue corporate cards in bulk with preset controls. Similarly, automation can help make expense audits faster and easier by instantly flagging unusual spending and highlighting ways to save money.

For example, online marketplace Poshmark found that using Ramp’s corporate credit cards and expense management tools helped reduce the amount of time wasted on manual processes, leading to a 50% faster month-end close process.

Employees

For employees, the process of spending usually goes like this:

- They realize they need a critical software, tool, or resource

- They ask their manager for a corporate credit card or pay out of pocket

- If they paid out of pocket, they manually fill out an expense report and wait for reimbursement—sometimes days, weeks, or months

Not only is this process time-consuming and frustrating, it’s simply not ideal in a modern, agile business. With finance automation solutions, employees can easily be assigned their corporate cards in bulk with predetermined spending parameters. Once employees make an approved purchase, it syncs automatically to your GL.

This means no more end-of-month expense reports for employees and no more chasing down reports for finance teams.

Your business

Every business can benefit from SaaS tools to drive productivity. However, many companies end up overspending on these tools or even duplicating them. Finance automation can save you both time and money by automating your SaaS audit process.

For example, after switching to Ramp, Zola—a wedding planning and registry platform—was able to replace time-consuming manual tasks like tracking expenses in spreadsheets, chasing receipts, and coding transactions by hand. With automation, the team now has real-time insight into spending, which improves reporting accuracy and saves valuable time. Instead of manually reviewing expenses, Zola’s finance team can now focus on analyzing trends and completing strategic work.

Ultimately, finance automation allows you to make faster, smarter, and more strategic business decisions—helping you optimize your business’s cash flow while boosting efficiency.

The impact of finance process automation

The move to automation can significantly benefit your financial operations in 2025. While you may have concerns that automation could eliminate certain job functions, adopting finance automation is important for long-term operational efficiency.

Finance automation enables finance teams, employees, and businesses by freeing up time from manual and repetitive tasks. In addition to reclaiming time, automated finance functions dramatically reduce the risk of human error on tasks such as expense management, invoicing, and financial reporting. More accurate data and consistent processes give you the confidence you need to make strategic budgeting decisions.

How Ramp automates away your most time-consuming finance tasks

Manual finance processes drain your team's time and energy. Between chasing receipts, reconciling transactions, and enforcing spend policies, finance teams spend countless hours on repetitive tasks that automation could handle in seconds. These manual workflows also introduce human error and create bottlenecks that slow down month-end close.

Ramp's automated expense management eliminates the receipt chase entirely. When employees make purchases with their Ramp cards, transactions flow directly into your accounting system with merchant data, categories, and receipts automatically attached. The platform uses AI to extract key information from receipts and match them to transactions in real-time. Instead of manually reviewing hundreds of expenses each month, your team can focus on exceptions and strategic analysis. The system even sends automated reminders to employees for missing receipts, taking the burden off your finance team.

Beyond expense tracking, Ramp's automated controls prevent out-of-policy spending before it happens. You can set custom spending rules based on merchant categories, amounts, or specific vendors. When an employee tries to make a purchase that violates policy, the transaction gets blocked automatically—no more awkward conversations or after-the-fact corrections. The platform also automates approval workflows, routing high-value transactions to the right managers based on your organizational hierarchy.

For accounts payable, Ramp transforms invoice processing from a manual slog into a streamlined workflow. The platform automatically captures invoice data, matches it to purchase orders, and routes it for approval based on your configured rules. Vendors get paid on time through automated ACH transfers, while your team maintains full visibility into cash flow. By automating these core finance processes, Ramp helps teams reduce month-end close time by up to 8 days while virtually eliminating manual data entry errors.

Put your idle cash to work with Ramp

While automation handles your daily finance tasks, your cash deserves the same level of optimization. Money sitting in low-interest accounts is a missed opportunity—especially when you could be earning meaningful returns on your operating funds.

Ramp Treasury1 turns idle cash into a growth engine. You'll earn up to 2.5%2 on your business account and 4.34%3 on investments, all while maintaining instant access to your funds. The platform sends automatic alerts when it's time to move or invest money, and integrates seamlessly with your existing ERP and GL systems. Your cash works as hard as your team does.

1) Ramp Business Corporation is a financial technology company and is not a bank. All bank services provided by First Internet Bank of Indiana, Member FDIC.

2) Get up to 2.5% in the form of annual cash rewards on eligible funds in your Ramp Business Account. Cash rewards are paid by Ramp Business Corporation and not by First Internet Bank of Indiana, Member FDIC. Cash rewards are subject to change. See the Business Account Addendum for more information.

3) Before investing in a money market fund, carefully consider the fund's investment objectives, minimum investment requirements, risks, charges and expenses, as described in the applicable fund's prospectus. You may obtain a copy of the fund prospectus here. Yield rate is the current effective annualized 7-day rate for the Invesco Premier U.S. Government Money Portfolio fund (FUGXX), and is variable, fluctuates, and is only earned on cash invested into money market funds in the Ramp Investment Account. Market data provided by and copyright © 2025 Nasdaq, Inc. All rights reserved. Past performance is not indicative of future results. Investing in securities products involves risk of loss, including loss of principal. This is not an offer to buy or sell, or a solicitation of an offer to buy or sell, any security, and no buy or sell recommendation should be implied.

Don't miss these

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group