Best Comdata Fleet Card alternatives: A comparison guide

- What is the Comdata Fleet Card?

- What makes a good Comdata Fleet Card alternative?

- Best Comdata Fleet Card alternatives: Pros and cons

- How to decide which fleet card is best for your business

- Switching from one fleet card to another

- A corporate card built for total spend control

Comdata Fleet Cards are commercial expense and fuel cards used to control spend, monitor transactions, and access a large fueling network, especially along major trucking routes. They help businesses track purchases by driver or vehicle, apply policy controls, and streamline billing and reporting.

If you're considering alternatives, focus on the factors that most affect cost and day-to-day operations: network coverage (retail and commercial), transparent fees, fuel discount structures, fraud controls, reporting and analytics, and integrations with your accounting or fleet systems.

What is the Comdata Fleet Card?

Comdata Fleet Cards are commercial payment cards used to manage fuel and vehicle expenses across a fleet. They're accepted at many truck stops, commercial fueling sites, and retail stations through partner networks, and they let businesses track spending by driver or vehicle, apply purchase controls by product, amount, time, or location, and streamline billing and reporting.

Depending on account setup, Comdata can also support maintenance and other approved non-fuel purchases and integrate with common fleet and accounting workflows.

What makes a good Comdata Fleet Card alternative?

A good Comdata alternative should keep drivers fueling without detours, preserve the value of any per-gallon discounts by minimizing fees, and give finance teams precise control and clear insight. In practice, that means broad acceptance in your service area, straightforward pricing, meaningful and predictable discounts, strong policy controls with real-time visibility, robust reporting, and integrations that move data cleanly into your accounting and fleet tools.

Here’s what to look for when comparing fleet fuel cards:

Network coverage

Network coverage should keep your drivers fueling without detours. This means you should look for cards accepted at major chains, independent stations, and truck stops throughout your primary operating area, which directly addresses the potential acceptance gaps in Comdata's network.

Fee structure

Fee structure transparency helps you predict and control costs. It's best to choose cards with clear fee disclosures, reasonable transaction charges, and minimal monthly fees. Ideally, the best options will offset any fees with meaningful fuel discounts.

Discount programs

Discount programs directly reduce your net fuel costs. Effective programs should offer volume-based savings, consistent discounts at participating locations, and valuable loyalty benefits. Ultimately, these savings help counteract fees and improve your fleet's overall fuel economics.

Fraud controls

Fraud controls are essential for protecting your business from unauthorized spending. Advanced cards offer real-time purchase alerts and customizable spending limits. They also provide time and location restrictions, along with detailed exception reporting, which are features that often beat Comdata's standard offerings.

Reporting tools and analytics

Reporting capabilities turn raw transaction data into cost-saving insights. To get past Comdata's reporting limitations, look for a solution with detailed analytics on spending patterns, driver behavior, MPG tracking, and exception flagging.

Integrations

Integration options save administrative time and improve data accuracy. The best alternatives solve one of Comdata's major weaknesses by connecting directly to popular accounting platforms, fleet management software, and tax tools.

Best Comdata Fleet Card alternatives: Pros and cons

WEX Fleet Card

WEX offers a fleet fuel card designed to help businesses manage fuel spend with purchase controls, real-time monitoring, and automated accounting. They provide broad acceptance and measurable savings, positioning the card as a way to reduce wasteful spending.

- Potential savings: WEX states they help save customers up to 15¢/gal savings through its nationwide savings network, plus up to 3¢/gal everywhere else (per program terms and partner participation). Specific pricing, fees, and terms depend on the account and program details.

- Network acceptance: WEX provides acceptance at 180,000+ locations and coverage at about 95% of U.S. gas stations, with a nationwide savings network. The card can also be used for select non-fuel spend categories highlighted in their benefits.

- Fraud protection and controls: Administrators can set purchase controls, require driver PINs, and limit transactions by amount, time of day, and more.

- Reporting and tools: WEX provides fuel accounting and expense tracking, with reporting and detailed transaction capture. The mobile app lets managers look up driver PINs and spot potential misuse.

Pros:

- 180,000+ locations and ~95% gas station acceptance in the U.S.

- Savings of up to 15¢/gal in-network and up to 3¢/gal elsewhere

- Spend controls with real-time monitoring

- Automated accounting and detailed transaction data

Cons:

- Savings depend on network participation and program terms; actual results vary

- Paying the balance in full each month is encouraged to maximize savings

Voyager

Voyager provides a flexible, dual-network fleet card solution (Voyager + Mastercard) designed to cover routine fuel needs and the unexpected on the road, managed on a single platform for both drivers and fleet teams.

- Potential savings: Voyager can accommodate negotiated discounts and is built to help lower total fleet costs through process improvements. Actual savings depend on program terms and merchant participation.

- Network acceptance: Accepted on both the Voyager and Mastercard networks with nationwide coverage in the U.S., plus acceptance in Canada and Mexico. Beyond fuel, the card can be used for approved fleet-related purchases such as maintenance services, tolls, parking, and more.

- Fraud protection and controls: Fleet managers can issue cards to drivers or vehicles, set spend controls and pump prompts, and maintain visibility to control purchases and minimize risk.

- Reporting and integration: Administration happens in one fleet management tool with transaction data for fuel and maintenance, plus a companion mobile app for drivers.

Pros:

- Dual-network acceptance (Voyager + Mastercard) with U.S., Canada, and Mexico coverage

- Supports fuel, maintenance, and unexpected expenses

- Can accommodate negotiated discounts, mobile refueling, and driver training purchases

Cons:

- Savings depend on negotiated terms and merchant participation

- Broad acceptance may require careful control settings to limit non-fuel spend

Fuelman

Fuelman is a fleet fuel card program focused on flexibility, cost control, and visibility, with plan tiers that pair fuel rebates with controls, reporting, and maintenance management on a single account.

- Potential savings: The Discount Network advertises savings of up to 8¢ per gallon on diesel and unleaded at 40,000+ locations. Rewards are available (typically 1 point per gallon on Basic/Pro and 2 points per gallon on Enterprise).

- Network acceptance: Rebates are earned at gas stations on the Fuelman Network, with the Discount Network providing 40,000+ participating locations for up to 8¢/gal savings. Availability and discounts vary by location and plan.

- Fraud protection and controls: Customizable fuel controls and driver profiles let you limit spend by category and enforce policy in real time. Administrators can enable real-time alerts to help prevent misuse or suspicious activity.

- Reporting and integration: Fuelman provides driver- and vehicle-level reporting, including detailed fuel and tax reporting for reconciliation. Their Pro and Enterprise plans provide customizable dashboards and data visualization tools.

Pros:

- Published 8¢/gal savings at 40,000+ Discount Network locations

- Real-time controls, driver profiles, and alerts to curb fraud and misuse

- Integrated maintenance management and payment workflow (included on Pro/Enterprise)

Cons:

- Monthly plan fees apply and become more expensive for small businesses (Mixed Fleet Basic at $39/month, Pro at $59/month, and Enterprise at $99/month)

- Savings depend on use of participating Discount Network locations and plan selection

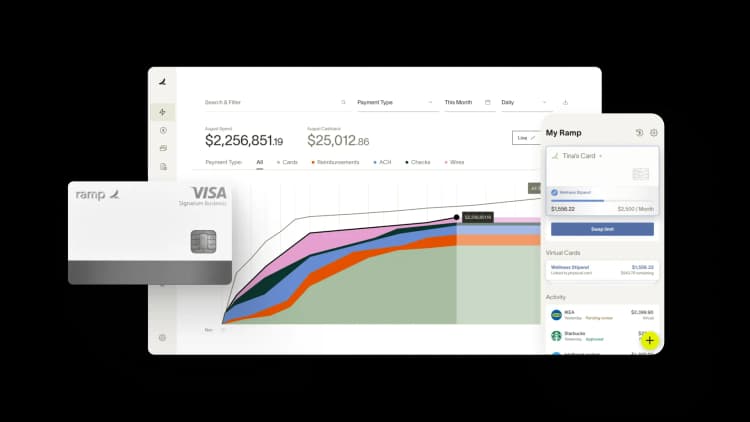

Honorary mention: Ramp corporate card

Ramp is not a traditional fleet card—it’s a corporate card and expense management platform built to help businesses track, control, and optimize employee spend, including fuel.

For companies that operate multiple teams and want visibility into all purchases, Ramp offers features like purchase restrictions, real-time policy alerts, and automated receipt matching. Since it’s accepted anywhere Visa is, Ramp works at almost every gas station.

Ramp also integrates with accounting systems to streamline reconciliation, and offers flat cashback on almost all purchases. There are no annual fees and no personal guarantee required.

Key features:

- Save more by preventing out-of-policy spend: Preset controls on corporate cards for specific vendors and categories.

- Be free from expense reports: Easily submit expenses through SMS, mobile app, and integrations.

- Unlock savings in real time: Get insight into spend as it happens, with a platform that pays off immediately.

- Grow your business with the right terms: Get rewards and perks, like 5% savings*. There’s no personal credit checks or personal guarantee.

Considerations:

- Requires a $25,000 minimum in a U.S. business bank account

- Not available to sole proprietors

- Full monthly payment required (charge card)

What's the difference between business gas credit cards and fleet fuel cards?

A business gas credit card is mainly a rewards tool, offering cash back or points on gas and other purchases. Fleet fuel cards go further by providing purchase controls, volume discounts, and expense tracking. If you want rewards, pick a gas card; if you need management, pick a fleet card.

How to decide which fleet card is best for your business

To choose the right fleet card, it's important to start by looking at your specific operational needs.

1. Look at your fleet size and composition

- Small fleets (1-25 vehicles): Prioritize minimal monthly fees and simple administration when looking for top-rated small business fleet cards

- Medium fleets (26-100 vehicles): Focus on balanced solutions with strong reporting capabilities

- Large fleets (100+ vehicles): Seek robust management tools and volume-based savings

2. Consider vehicle types

For instance, light-duty fleets benefit most from broad retail networks. Mixed fleets, however, will need cards that work for both gas and diesel at various station types. If you run heavy-duty trucking operations, you should look for specialized programs that focus on truck stops and IFTA reporting.

3. Match geographic coverage to your footprint

Regional operations, for example, may find better pricing with specialized providers in the Western US. For national operations, however, consistent coast-to-coast coverage from a provider is essential. If your fleet operates internationally, you'll need to find a global solution with cross-border capabilities.

4. Check integration requirements

First, identify your current accounting and fleet management software. Then, you can figure out which card programs connect directly to those systems.

5. Define your reporting needs

If you only need basic tracking, simpler solutions may work fine. However, if you require advanced analytics, look for providers that offer more detailed cost analysis and optimization tools.

6. Set your security priorities

Real-time alerts and customizable controls are key features that help prevent unauthorized purchases. You should also look for driver ID requirements and purchase restrictions to limit misuse, while exception reporting helps you identify suspicious patterns.

Key takeaways

For fleets operating in diverse regions or using specialized vehicles, using multiple cards can help optimize benefits. This approach lets you use regional specialists where they're strongest while maintaining broader coverage through national providers. If you take this approach, just be sure to balance the benefits against the administrative overhead of managing multiple accounts, training drivers on different systems, and consolidating reports.

Decision process summary:

- Figure out your geographic needs and vehicle types to narrow down providers

- Look at integration requirements to further narrow your choices

- Compare fee structures and discount programs for the best financial fit

- Check reporting and security features to make sure all operational needs are met

Switching from one fleet card to another

- Look at and pick your new provider: Review alternatives based on your needs, request detailed proposals, and check references from similar fleets

- Create a transition plan: Create a timeline with milestones, assign responsibilities, and set success metrics

- Look at and map data: Export historical data from your current card, identify essential data points, and map fields for migration

- Set up your new account structure: Set up departments, cost centers, and vehicle/driver relationships to match your organization

- Set up integration connections: Work with IT and your new provider to connect the fleet card system with your accounting and fleet management platforms

- Set up security settings: Set up PINs, spending limits, purchase restrictions, and alert parameters

- Run both cards at the same time: Hand out new cards while keeping your current card active for testing and troubleshooting

- Train drivers: Provide clear instructions, conduct training sessions, and create quick reference guides

- Let vendors and stations know: Alert frequently-used locations about your card transition, especially if the network is changing

- Watch initial transactions: Check early purchases, validate data flow to connected systems, and address issues immediately

- Phase out your current card: Set a firm cutover date, collect and destroy old cards, and close your current account after all transactions clear

- Review implementation: Look at the transition, document lessons learned, and make necessary adjustments

A corporate card built for total spend control

Choosing a business credit card isn’t just about earning rewards, it’s about gaining control over one of your largest recurring costs. Businesses often overspend on fuel and other operational expenses not because they’re using more, but because they can’t see who’s spending what, where, or when.

Ramp isn’t a traditional fleet card, but it can help businesses manage fuel spend as part of a broader corporate card program. It's built to handle real-world business spend—from travel to fuel and beyond. Accepted wherever Visa is, it comes with no annual fee and is available to businesses with at least $25,000 in a U.S. business bank account. With centralized controls and automation, Ramp gives finance teams visibility across all employee spend.

See how Ramp helps you manage expenses. Try the Ramp corporate card.

Information about third-party card providers is based on publicly available sources and may change over time. Details have not been independently verified or endorsed by the providers themselves.

*We calculate average savings as a percentage of an illustrative customer's total card spending when using Ramp features designed to reduce business expenses. Keep in mind that this percentage is an estimate, not a guarantee. Ramp delivers savings from more than just card spending; savings can also come from non-card expenses so we may factor decreases to non-card spending into our calculation. For example, savings may result from reduced time spent on manual expense tracking, the financial benefit of cash back or other rewards, smarter expense monitoring, and eliminating costs associated with alternative solutions. Our calculations are based on platform data, industry research, customer surveys, and info on alternative options. Your actual savings may vary.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°