Profitability analysis: Step-by-step guide with examples

- What is profitability analysis?

- Types of profitability ratios

- Margin ratios

- Return ratios

- Common profitability ratio ranges

- How to conduct a profitability analysis step by step

- Interpreting your profitability analysis results

- Advanced profitability analysis techniques

- Common challenges and how to avoid them

- How Ramp transforms profitability analysis from guesswork to precision

- Uncover savings and improve profitability with Ramp

Profitability analysis examines your revenue streams and costs to evaluate how effectively your business generates profit. It goes deeper than standard income statements and balance sheets to uncover which products, customers, or activities actually drive your bottom line. With a clear view of where profits come from, you can make more informed decisions about pricing, resource allocation, and growth investments.

What is profitability analysis?

A profitability analysis evaluates a company’s ability to generate profit from its revenue, assets, and shareholder equity using a set of financial ratios and performance metrics. Rather than focusing only on whether your business is profitable, it breaks down operations to show where profits are created, what they cost to generate, and which activities or segments deliver the most value.

Many companies integrate profitability analysis into their enterprise resource planning (ERP) systems to monitor performance in real time. This approach allows finance teams to track profit drivers continuously and adjust strategy based on current data instead of waiting for quarterly results.

While financial ratios form the foundation of profitability analysis, the most useful insights come from pairing those metrics with operational context, such as pricing changes, customer mix shifts, or rising support and fulfillment costs. This combination helps explain not just how profitability changed, but why it changed.

Key components of profitability analysis

An effective profitability analysis examines a few core components together to reveal your business’s true financial performance:

- Revenue stream examination: Track income by product line, customer segment, geographic region, and sales channel to identify your most profitable revenue sources

- Cost structure analysis: Break down fixed and variable expenses across operations, marketing, production, and distribution to pinpoint where money is being spent

- Margin evaluation: Calculate gross, operating, and net margins for different business segments to compare profitability across your portfolio

- Asset utilization assessment: Measure how efficiently you deploy capital, inventory, equipment, and personnel to generate returns

Together, these components provide a complete picture of what drives profitability and where improvements are possible.

Why profitability analysis matters for your business

Regular profitability analysis gives you the insight you need to make better financial decisions and respond more quickly to change:

- Strategic decision-making: Use detailed profit data to evaluate pricing changes, expansion plans, product launches, and new markets with confidence

- Smarter resource allocation: Direct budget, headcount, and capital toward high-return activities while scaling back investment in underperforming areas

- Performance benchmarking: Compare results across teams, time periods, and industry standards to identify gaps and improvement opportunities

- Growth opportunity identification: Spot profitable trends, high-value customer segments, and emerging opportunities before competitors do

Companies that analyze profitability consistently are better equipped to adapt to market shifts and build more resilient business models.

Types of profitability ratios

Profitability ratios are financial metrics that show how effectively your business converts revenue into profit. Finance teams use these ratios to compare performance over time, evaluate operational efficiency, and benchmark results against competitors or industry standards.

Most profitability ratios fall into 2 categories: margin ratios and return ratios. Margin ratios focus on how much profit remains at different stages of operations, while return ratios measure how efficiently your business generates profit from assets, equity, or invested capital.

Margin ratios

Margin ratios measure profitability relative to revenue and operating costs. They help you understand how efficiently your company turns sales into profit and where costs may be eroding margins.

Gross profit margin

Gross profit margin shows how much profit you retain after accounting for your cost of goods sold (COGS). It highlights pricing power and production efficiency before operating expenses come into play.

Gross profit margin = ((Total revenue – COGS) / Total revenue) * 100

In most cases, gross profit margin should remain relatively stable over time unless you change pricing, suppliers, or production methods.

Net profit margin

Net profit margin measures your company’s overall profitability after accounting for all expenses, including operating costs, interest, and taxes. It reflects how much of each dollar of revenue becomes true bottom-line profit.

Net profit margin = (Net income / Sales revenue) * 100

Improving net profit margin typically requires a combination of revenue growth and tighter expense control.

Operating profit margin

Operating profit margin measures earnings before interest and taxes (EBIT), focusing specifically on core business operations. Unlike gross profit margin, it accounts for operating and administrative expenses in addition to COGS.

Operating profit margin = (Operating profit / Total sales) * 100

This ratio is especially useful for comparing operational efficiency across periods or business units.

Margin per user

Margin per user calculates how much profit your business generates per customer over a given period. This metric is most commonly used by subscription-based and usage-based business models.

Margin per user = ((Total revenue – Operating expenses) / Users for period)

Finance teams can analyze margin per user alongside churn and acquisition costs to assess whether growth is sustainable.

Cash flow margin

Cash flow margin measures how effectively your business converts sales into cash from operating activities. It highlights liquidity and cash efficiency rather than accounting profit alone.

Cash flow margin = (Net cash from operating activities / Net sales) * 100

Higher cash flow margins generally indicate stronger cash discipline and fewer collection or working capital issues.

Return ratios

Return ratios measure profitability relative to the resources invested in the business. They help assess how efficiently your company uses assets, equity, or specific investments to generate returns.

Return on assets (ROA)

Return on assets evaluates how efficiently your company uses its total assets to generate profit. It’s particularly useful for asset-heavy businesses that rely on inventory, equipment, or infrastructure.

ROA = (Net income / Total assets) * 100

In general, higher ROA values indicate more efficient use of assets.

Return on equity (ROE)

Return on equity measures how effectively your business generates returns for shareholders using their invested capital. It’s a common indicator of financial performance from an investor perspective.

ROE = (Net income / Shareholders' equity)

Investors often favor companies with consistently strong ROE because it signals efficient capital management.

Return on investment (ROI)

Return on investment evaluates the profitability of a specific investment by comparing the profit earned to the cost of that investment. It’s widely used for campaigns, projects, and capital expenditures.

ROI = (Net profit from investment / Cost of investment) * 100

ROI makes it easier to compare opportunities and prioritize investments that deliver the strongest returns.

Common profitability ratio ranges

Profitability ratios vary widely by industry, business model, and company size, but general ranges can help you assess whether performance is strong, average, or lagging compared to peers:

- Gross profit margin: Service businesses often maintain 50–70%, while retail and manufacturing typically fall between 20–40%; margins below 10% may indicate pricing or production cost issues

- Net profit margin: Strong businesses often achieve 10–20%, with 5–10% considered average; margins under 5% may signal cost or pricing pressure

- Operating profit margin: Many industries target 10–15, with 15%+ indicating high efficiency; margins below 5% often reflect operational challenges

- Margin per user: Subscription businesses may range from $50 to $500+ per user depending on complexity and market, with negative margins indicating unsustainable acquisition or servicing costs

- Cash flow margin: Healthy companies often generate 10–15%, while margins below 5% can point to collection or working capital issues

- Return on assets: Solid performance typically falls between 5–10%, with 10%+ indicating efficient asset use; results under 3% may suggest excess or underutilized assets

- Return on equity: Investors often look for 15–20% as a sign of strong returns, with results below 10% raising questions about capital efficiency

- Return on investment: Acceptable ROI varies by project but often exceeds 15–25% annually; returns below your cost of capital destroy value

Compare these ranges against industry benchmarks whenever possible for the most meaningful interpretation.

How to conduct a profitability analysis step by step

Here’s a practical framework you can use to run a profitability analysis using the most common ratios and supporting tools. Following these steps helps ensure your results are accurate, comparable, and actionable.

Step 1: Gather financial statements

Start by collecting accurate financial statements for your company and, if available, comparable data for a competitor or industry benchmarks from the same period:

- Income statement, or profit-and-loss (P&L) statement

- Balance sheet

- Cash flow statement

Before you begin, confirm that figures are up to date and consistent across statements. Choose a time period that matches your goals, quarterly data for short-term trends or annual data for longer-term performance.

Step 2: Calculate key profitability ratios

Using the data from step 1, calculate core profitability ratios for your business and compare them with peers where possible.

Gross profit margin

Company A:

($1M total revenue – $800k COGS) / $1M total revenue * 100 = 20% gross profit margin

Company B:

($1.25M total revenue – $950k COGS) / $1.25M total revenue * 100 = 24% gross profit margin

Operating profit margin

Company A:

$100k operating profit / $1M total sales * 100 = 10% operating profit margin

Company B:

$200k operating profit / $1.25M total sales * 100 = 16% operating profit margin

Net profit margin

Company A:

$50k net income / $1M sales revenue * 100 = 5% net profit margin

Company B:

$100k net income / $1.25M sales revenue * 100 = 8% net profit margin

Margin per user

Company A:

($1M total revenue – $900k total expenses) / 10k users for period = $10 margin per user

Company B:

($1.25M total revenue – $1.05M total expenses) / 12k users for period = $16.67 margin per user

Return on assets

Company A:

$50k net income / $500k total assets * 100 = 10% return on assets

Company B:

$100k net income / $750k total assets * 100 = 13.3% return on assets

When calculating ratios, avoid common mistakes such as mixing time periods, combining accrual and cash-based figures, or including one-time expenses in operating profit.

Step 3: Perform break-even analysis

Break-even analysis shows the sales volume required to cover all fixed and variable costs without generating a profit or loss. It helps you evaluate pricing decisions and set realistic sales targets.

Break-even point = Total fixed costs / (Sales price per unit – Variable cost per unit)

Start by separating fixed costs, such as rent and salaries, from variable costs that change with production volume. Your contribution margin represents how much each sale contributes toward covering fixed expenses and generating profit.

You can also calculate your margin of safety by subtracting break-even sales from actual or projected sales. A larger margin of safety provides more cushion against unexpected cost increases or revenue declines.

Interpreting your profitability analysis results

Profitability metrics only become useful when you put them into context. Interpreting your results helps you understand whether performance is improving or deteriorating and what factors are driving those changes.

Benchmarking against industry standards

Start by comparing your ratios with industry benchmarks from trade associations, financial databases, or market research reports relevant to your sector. These benchmarks provide reference points for evaluating whether your margins and returns are competitive.

Adjust comparisons based on company size, geographic market, and business model. A regional retailer, for example, shouldn’t benchmark itself against national chains, just as premium brands operate under different margin expectations than discount competitors.

Performance gaps highlight where to investigate further. If your operating margin is several percentage points below the industry average, dig into whether rising overhead, inefficient processes, or pricing decisions are driving the difference.

If your operating margin is 6% while peers average 12%, break the gap into drivers. Determine whether gross margin is declining due to higher COGS, operating expenses are growing faster than revenue, or discounting is shifting your customer or product mix. That breakdown points to whether pricing, procurement, headcount efficiency, or channel strategy needs attention.

Identifying profit drivers and drains

Tracking margin trends over multiple periods helps you spot whether profitability is improving, stagnating, or eroding. Rising margins often reflect effective pricing and cost control, while declining margins may signal competitive pressure or operational inefficiencies.

Asset efficiency also plays a major role in profitability. Reviewing turnover ratios for inventory, fixed assets, and working capital can reveal resources that tie up cash without generating proportional returns.

Capital structure affects profitability through interest expense and return expectations. Your funding mix between debt and equity financing influences net margins and return on equity, especially when leverage increases.

Segmenting results by product line, customer type, sales channel, or region often exposes underperforming areas. In many businesses, a small share of products or customers generates the majority of profit, while others consume resources without delivering adequate returns.

Advanced profitability analysis techniques

Basic financial ratios show how profitable your business is overall, but advanced techniques help you pinpoint exactly where that profit is created or lost. These methods are especially useful when margins are tightening or growth decisions require more precision.

Customer profitability analysis

Customer profitability analysis breaks down profit by individual customer or customer segment rather than treating all revenue as equal. It helps you identify which accounts generate strong returns and which ones consume disproportionate resources.

Start by ranking customers based on net profit contribution after accounting for sales costs, discounts, support expenses, and payment terms. This view often reveals that high-revenue customers aren’t always the most profitable.

To deepen the analysis, calculate customer lifetime value (CLV) by projecting future revenue and subtracting acquisition and retention costs. Customers with high CLV typically share traits such as frequent purchases, predictable payment behavior, and lower service demands, which can inform sales targeting and retention strategies.

Product profitability analysis

Product profitability analysis evaluates profit at the individual product or SKU level rather than looking only at aggregate margins. This approach helps uncover products that sell well but deliver weak returns once costs are fully allocated.

Begin by assigning direct costs such as materials and labor to each product, then incorporate indirect costs like warehousing, shipping, and marketing. Activity-based costing can improve accuracy by allocating overhead based on actual resource usage rather than simple volume measures.

With this information, you can refine your product mix by emphasizing higher-margin offerings, renegotiating supplier terms, adjusting pricing, or discontinuing products that consistently erode profitability. These decisions help balance revenue growth with sustainable margins.

Common challenges and how to avoid them

A profitability analysis is only valuable if the results are accurate and interpreted correctly. These common challenges can lead to misleading conclusions if you don’t address them:

- Using incomplete or outdated data: Ensure your income statement, balance sheet, and cash flow statement are current and accurate, since even small errors can distort results

- Misinterpreting ratios: Individual ratios rarely tell the full story, so review multiple metrics together to understand how costs, pricing, and operations interact

- Ignoring external factors: Market conditions, seasonality, and competitive dynamics can all affect profitability, making industry benchmarking essential

- Overlooking indirect costs: Administrative overhead and hidden inefficiencies often erode margins if they aren’t fully allocated

- Focusing on snapshots instead of trends: Single-period results can be misleading, so track profitability over time to identify durable patterns

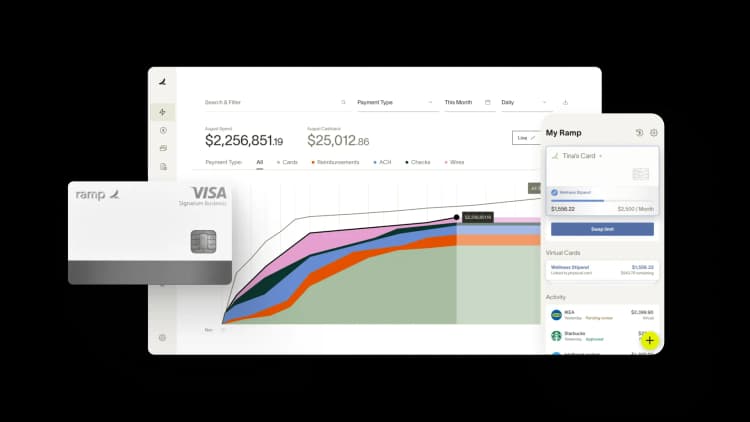

How Ramp transforms profitability analysis from guesswork to precision

Analyzing profitability can quickly become overwhelming when spending data is fragmented or outdated. Without real-time visibility, finance teams often spend hours manually categorizing transactions and building reports that are obsolete by the time they’re finished.

Ramp’s expense management platform simplifies this process with automated expense categorization and real-time reporting. When employees use Ramp cards, transactions are categorized automatically using merchant data and machine learning, reducing manual work and giving finance teams immediate insight into where money is being spent across departments, projects, and vendors.

Customizable spending controls add another layer of protection for profitability. You can set limits by category, vendor, or time period to prevent unexpected expenses while still giving teams the flexibility they need to operate effectively. This structure helps keep budgets on track and makes it easier to evaluate which spending categories deliver the strongest returns.

Ramp’s accounting integrations keep your books up to date by syncing transactions directly with your general ledger. With accurate, current data always available, profitability analysis becomes a proactive tool for improving financial performance rather than a backward-looking exercise.

Uncover savings and improve profitability with Ramp

Beyond analysis, Ramp helps you act on profitability insights. Ramp Intelligence surfaces cost-saving opportunities such as duplicate subscriptions and unused software licenses that quietly drain budgets.

To see how Ramp supports smarter spending decisions, explore an interactive product tour and review the full suite of expense management automation capabilities.

FAQs

A good profitability ratio depends on your industry and business model. A higher ratio is generally better and means you’re keeping more profit from your sales. Compare your ratios to industry benchmarks to assess your performance relative to competitors to determine what good means for your business.

The four biggest factors impacting a company’s profitability are revenue, costs, pricing strategy, and operational efficiency—in other words, how much you sell, how much it costs to produce and deliver, how you price your products, and how efficiently you run your business.

Direct costs, like materials and labor, reduce the profit you make on each product sold. Indirect costs, like rent and administrative expenses, eat into overall profits and need to be carefully allocated to ensure products are priced high enough to cover them.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits