How to calculate net profit margin to better understand your business's profitability

- What is net profit margin?

- How do you calculate net profit margin?

- What does net profit margin tell you?

- How to put net profit margin in context

- How to quickly improve net profit margin by controlling expenses

Calculating profitability is an exercise that all businesses should perform frequently. Financial numbers change often when costs go up or down, so monitoring expenses is a big part of this. Revenue is the other primary variable. The tools that your company uses for spend control and revenue tracking need to be accurate, transparent, and reported in real-time for the best results.

Net profit margin is one of a handful of metrics used to measure business profitability. In this article, we’ll explain what it is, how to calculate it, and why it may be a better option than other profit margin calculations for some businesses.

What is net profit margin?

The net profit margin of a business is the percentage of revenue that is net profit. It’s the most complete measurement of profit because it takes all expenses into account, unlike gross profit margin, which only uses cost of goods sold (COGS). Investors generally look at net profit margin because it directly affects share prices.

Net profit margin is calculated by deducting all expenses from net revenue. Expenses include COGS, overhead, operational expenses, administrative expenses, debt payments, interest payments, and one-time payments such as lawsuits and taxes. Revenue includes total revenue from sales, investment income, and any income from secondary operations.

By measuring a company’s profitability using the net profit margin formula, investors can determine if a company is managing cash flow properly and generating enough sales revenue to sustain itself. This directly affects their decision to buy or sell stock in the company. It also gives management the insights they need to start cutting costs or boosting sales.

Net margins are published quarterly and when the company does their annual report. Lower profit margins don’t necessarily mean the company is not a good investment, but they could be a warning sign that they need to reduce operational costs.

It’s important to understand that a net profit margin is a percentage and not an itemized report. There are limitations to what you can do with it, which we’ll go over below. Another thing to consider is that smaller margins could be the result of poor spend management, excessive debt payments, or rising costs that are beyond the control of the company.

How do you calculate net profit margin?

The formula to calculate net profit margin (NP) is Net Income divided by Revenue (R). Net income is calculated by subtracting cost of goods sold (COGS), operating expenses (E), interest (I), and taxes (T) from total revenue (R), then multiplying by 100. It looks like this:

Both the net income and total revenue can be found on the company income statement if you want to do this on your own. The multiplier of 100 turns the decimal into a percentage, which is how net profit margin is most often expressed. This makes it simpler for internal employees and investors to evaluate the profitability of the business.

Keep this formula handy because net profit margin is a key element when developing financial management strategies. The main reason for starting a business is to make money. That only happens when revenue exceeds costs. This calculation shows you whether your company is accomplishing that.

What does net profit margin tell you?

The net profit margin of your business reveals how much profit you’re making from each dollar of revenue. For instance, if your company’s net profit margin is 20%, you’re making 20¢ profit on each dollar. Lower net margins are an indicator that your business needs to either reduce costs or increase revenue.

Of course, the percentage by itself doesn’t show where cost reduction needs to happen or how sales revenues can be increased. It should be considered a starting point for any evaluations of inflows and outflows. In other words, the net profit margin lets you know if changes are necessary. Figuring out where to make those changes requires more data.

Timeliness is also an important factor here. Net profit margin is useful for reporting on periods that have already passed, but not the best metric for projecting future profits. A net margin of 20% is calculated using existing costs and revenues. Those will change going forward, so expect the margin to change also. This can be caused by inflation, new suppliers, and market demand.

Treating net profit margin as a fluid number is the best approach for assuring continued profitability. After calculating it for several periods in a row, a pattern should emerge that gives you a net margin “range” for profitability. This range is what investors are looking for. A net profit margin from one period tells them very little.

There is a model where you can calculate net margin by using projected costs and revenue. This is often done when a business is going to raise prices on their own goods and services or plans to switch to a more expensive/cheaper supplier. This is a useful spend analysis tool for evaluating the impact of those changes on the company bottom line.

Higher net profit margins are an indicator that a company can effectively manage business expenses, but it could also mean that they’re not spending enough to build the business. The latter can be determined by looking at the total revenue number. If that number is not growing and margins remain high, the business may need to invest more in sales and marketing.

How to put net profit margin in context

Frequently calculating the net profit margin is particularly important for companies that are looking to scale. It’s a step towards more effective small business expense management and a measuring stick for what the company can afford to spend on growth programs. The projected net margin exercise we outlined above can show how that growth can turn to profit.

As we’ve mentioned several times already, net profit margin by itself doesn’t tell you everything you need to know about a company’s profitability. There are other metrics that can help you complete the picture. Once you’ve determined the net profit margin, calculate the gross profit margin and the operating profit. Here’s how to do that:

- Gross profit margin: For this metric, you’ll need two pieces of information from the quarterly income statement. The first is called COGS, an abbreviation for cost of goods sold. It’s the breakdown of all the costs involved in the production and sales of goods. The second number is the net sales number for the period. To calculate the gross profit margin, divide COGS by net sales.

- Operating profit: Where gross profit margin measures the profit margin of a company on just their goods sold, operating profit is determined by dividing the total overhead costs (salaries, advertising, rent, etc.) by the total net sales number. Overhead expenses are also known as SGA (salaries, general, and administrative) expenses. Operating profit, like gross and net profit, is expressed as a percentage.

To put this process in perspective, the net profit margin lets you know whether a company is profitable. The gross profit margin and operating profit show where that profit is coming from. If you’re viewing this as a business owner, you’ll still need to do some real-time expense management to see cost breakdowns, but these three metrics are a good place to start.

These metrics are important for investors also. They can be combined with tracking revenue growth to get some real insights into where a company is going. It’s also useful to review the statement of cashflows and balance sheet, in addition to the income statement that you’ve already examined. These numbers will help you make an investment decision.

How to quickly improve net profit margin by controlling expenses

Revenues are dependent upon sales and customer adoption. Expenses, on the other hand, can often be controlled internally. A low net profit margin is a warning sign that expenses may be too high. Use that data point to evaluate your outflows and get spending under control. There are several ways to do this, including expense automation and corporate cards for employees.

Automation won’t change your actual costs, but it will help you organize them and create a level of transparency. Expense automation can also help you with tail spend—a $1.8 trillion problem in the United States.

Cut down your costs and your profit margin will go up. Instead of allowing employees to use their own credit cards for company expenses, issue corporate charge cards with spend controls. It will eliminate those “borderline” expenses you’ve been reimbursing on manual reports and allow your company to more effectively budget employee expenses.

For cost of goods sold (COGS), consider automating the vendor negotiation process and tracking existing spend to look for waste or duplication. Real-time expense tracking can show you when you’re spending money you don’t need to spend.

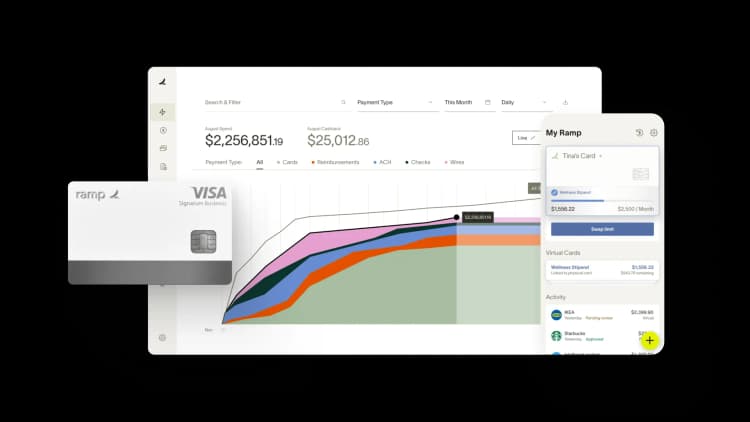

Ramp's corporate cards can streamline employee spending, while our integrated dashboards can show you expenses in real-time and provide insights into where you can cut costs.

FAQs

The formula to calculate net profit margin (NP) is Net Income divided by Revenue (R). Net income is calculated by subtracting cost of goods sold (COGS), operating expenses (E), interest (I), and taxes (T) from total revenue (R), then multiplying by 100. It looks like this:

Net profit margin measures the profitability of a company based on all revenue and costs. Gross profit margin tracks the profit on net income from sales, deducting only the COGS (cost of goods sold). Administrative costs, salaries, and overhead are not factored in.

Net profit margin can be used to narrow down a list of potential investments, but it should never be the only metric evaluated before making a final decision. Investors should also look at the quarterly financial reports, gross profit margin, operating profit, and revenue growth.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°