- What is an income statement?

- Why income statements matter

- Key components of an income statement

- How to prepare an income statement step by step

- Example income statement

- Multi-step vs. single-step income statement

- How to format your income statement

- How to analyze an income statement

- Common mistakes and how to avoid them

- Automate your income statement prep with AI that codes, categorizes, and closes for you

An income statement is more than a record of profits and losses—it explains how every dollar moves through your business. By learning how to prepare an income statement, you can see where revenue comes from, where expenses go, and whether your company is truly profitable.

This guide will cover what an income statement is, why it matters, and a clear step-by-step process to create one. You’ll also see an example, learn how to analyze results, and avoid common mistakes so you can report with confidence.

What is an income statement?

An income statement, sometimes called a profit and loss statement or income sheet, shows your company’s revenue, expenses, and profits over a set period. It tells you how efficiently the business is operating and whether you’re generating or losing money.

Unlike a balance sheet, which is a snapshot of assets and liabilities at a single moment, the income statement tracks performance across time. This makes it easier for stakeholders to see how effectively the company turns revenue into profit.

Why income statements matter

Income statements do more than show profit. They reveal how efficiently your company manages expenses and highlight where you might cut costs. Comparing statements across periods also shows how revenue and expenses change over time.

The SEC requires public companies to publish income statements. These reports give investors and shareholders the transparency they need. Failure to produce them can result in heavy fines or even delisting.

Private companies benefit too. Income statements help you track revenue, expenses, and profitability, and they’re essential if you plan to raise capital, apply for loans, or eventually go public.

Key components of an income statement

An income statement is built from a few key line items that show how money moves through your business:

- Total revenue: All sales revenue from goods or services provided

- Cost of goods sold (COGS): Direct costs of producing or delivering goods and services

- Gross profit: Revenue minus COGS, showing profit from core operations

- Operating expenses (OpEx): Day-to-day costs such as salaries, rent, utilities, and office supplies

- Operating income: Gross profit minus operating expenses, showing core profitability

- Other income/expenses: Items outside daily operations, such as interest, taxes, or investment income

- Net income: The bottom line—total profit or loss after all revenues, expenses, and taxes

The statement follows a simple flow—starting with revenue, subtracting costs and expenses, and ending with net income. Tracking these line items over time helps you spot trends, measure efficiency, and make better financial decisions.

How to prepare an income statement step by step

The three main elements of an income statement are revenue, expenses, and profit. Profit, which is typically listed last on an income statement, is used to calculate net profit margin. That’s the origin of the term “bottom line.”

If you're not using accounting software that automatically generates income statements, you can use a template to create an income statement.

Get Ramp's free income statement template

Step 1: Choose the reporting period

Every income statement covers a specific time frame. Public companies file quarterly reports, while private businesses often prepare monthly or annual statements. Choose the reporting period upfront, and create a separate statement for each period you want to analyze.

Step 2: Calculate your revenue

Record all sales earned during the period, not just cash received. Under Generally Accepted Accounting Principles (GAAP), you must use the accrual method, which recognizes revenue when it’s earned, not when it’s received. This distinction is especially important for businesses offering net payment terms because it tracks income based on invoice dates, not actual cash flow.

Step 3: Calculate COGS

COGS includes the direct production costs such as labor, materials, and distribution. Some companies list COGS under the revenue section to show gross profit margin before expenses, while others categorize it under expenses. Either approach is acceptable as long as it's consistent.

Use this formula to calculate COGS:

COGS = Beginning inventory + Purchases – Ending inventory

This shows the actual costs of producing or acquiring goods sold during the accounting period.

Step 4: Calculate gross profit

Gross profit reveals how much money your business keeps after covering direct costs.

Use this formula to calculate gross profit:

Gross profit = Gross revenue – COGS

This figure highlights pricing efficiency and production control.

Step 5: List operating expenses

Operating expenses are the everyday costs of running your business, such as salaries, rent, utilities, transportation, advertising, and marketing. If you use an automated accounting system, these should already be categorized for you. If not, you'll need to organize them manually to ensure accuracy.

Operating expenses differ from non-operating expenses in that they're direct costs of doing business. Non-operating expenses include items such as interest, investments, and taxes.

Step 6: Calculate operating income

Operating income is calculated as follows:

Operating income = Gross profit – Operating expenses

This reflects your company’s core profitability before factoring in taxes, interest, and other non-operating expenses.

Step 7: Include other income and expenses

Include items outside daily operations such as investment gains, interest income, taxes, depreciation, or amortization. List these below the operating income line to clearly separate core business performance from outside financial factors.

Use software to streamline income statement preparation.

Using accounting automation software like Ramp can save time and reduce errors. These tools automate many calculations, helping you generate income statements quickly while ensuring accuracy in operating expenses, COGS, and other income and expense figures.

Step 8: Calculate net income

Net income is the bottom line—the profit or loss after all costs. Use this formula:

Net income = Operating income + Other income – Other expenses

This figure shows whether your business made money during the period and is often the number investors look at first.

Example income statement

Here’s a sample income statement for a small business:

Line item | Amount |

|---|---|

Total revenue | $500,000 |

Cost of goods sold (COGS) | $250,000 |

Gross profit | $250,000 |

Operating expenses | $120,000 |

Operating income | $130,000 |

Non-operating expenses | $10,000 |

Income tax | $25,000 |

Net income | $95,000 |

This example shows how the numbers flow from top to bottom: the business generated $500,000 in revenue, with $250,000 spent on producing goods. After deducting $120,000 in operating expenses, operating income was $130,000. Once taxes and non-operating expenses were applied, the business reported $95,000 in net income.

Multi-step vs. single-step income statement

A multi-step income statement breaks performance into sections: gross profit, operating income, and net income. It separates operating activities from non-operating items like taxes or interest.

Here’s the typical flow:

- Net sales revenue

- Less: Cost of goods sold

- Equals: Gross profit

- Less: Operating expenses (salaries, rent, marketing)

- Equals: Operating income

- Plus/minus: Non-operating items (interest, taxes, gains/losses)

- Equals: Net income

This format gives deeper insight into profitability and is common for larger or more complex businesses.

How a single-step income statement differs

A single-step income statement is simpler. It groups all revenue at the top, all expenses below, and calculates net income in one step:

- Total revenue

- Less: Total expenses

- Equals: Net income

Single-step statements are easier to prepare and suit smaller or service-based companies. Both formats use the same accounting principles and reach the same net income figure—the choice depends on how much detail your audience needs.

How to format your income statement

A well-formatted income statement is easier to read and more useful for stakeholders. Keep these guidelines in mind:

- Use clear headings and spacing: Place revenue at the top, followed by expenses in order, with subtotals for gross profit and operating income

- Keep numbers consistent: Align figures, use the same number of decimal places, and show comparative periods if possible

- Include business details: Add your company name, the reporting period, and footnotes for context or clarifications

This simple structure helps readers quickly understand performance and compare results across periods.

How to analyze an income statement

Analyzing an income statement means looking beyond totals. Focus on whether revenue is growing, margins are stable, and profits are improving.

Here’s how to interpret the key figures:

Gross profit

Gross profit = Revenue – COGS

Gross profit shows how efficiently your company produces goods or services. A higher gross profit means stronger pricing power and production control.

Net income

Net income, or the bottom line, is profit after all expenses, taxes, and interest. It reflects what’s available for shareholders or reinvestment. Consistent positive net income signals strong financial health, while persistent losses may be a red flag.

Operating margin

Operating margin = Operating income / Total revenue

This ratio shows how much profit comes from core operations before taxes and interest. A stable or rising margin points to effective cost management.

Gross profit margin

Gross profit margin = (Gross profit / Total revenue) * 100

This ratio expresses gross profit as a percentage of revenue. It helps you compare efficiency across companies and track performance over time.

Net profit margin

Net profit margin = (Net income / Total revenue) * 100

This metric shows what percentage of sales becomes profit after all costs are deducted. Because margins vary widely by industry, it’s best to compare this figure within your sector.

EBITDA and EBIT

Earnings before interest, taxes, depreciation, and amortization (EBITDA) and earnings before interest and taxes (EBIT) exclude non-cash or financing costs. These measures highlight operational profitability more clearly than net income alone.

Tips for spotting trends and red flags

Beyond individual numbers, patterns across time periods reveal the real health of your business operation:

- Track quarterly trends to identify growth or decline over time

- Compare year-over-year results to account for seasonal swings

- Watch margin stability as a sign of cost control

- Check revenue quality to ensure growth is sustainable

- Review expense patterns to spot disproportionate increases

- Look for irregularities such as restatements or unusual one-time items

Mastering these analysis techniques helps you make better financial decisions based on solid data interpretation.

Common mistakes and how to avoid them

Even experienced teams can make errors that distort income statements. These mistakes can lead to poor business decisions, incorrect tax filings, or miscommunication with stakeholders. The key is to spot issues early and build safeguards into your process.

Misclassifying expenses

A common mistake when creating an income statement is misclassifying operating and non-operating expenses. For example, placing interest or tax expenses under operating costs inflates operating income and misleads stakeholders about core performance.

How to avoid: Use a standardized chart of accounts, train your team on expense categories, and conduct regular reviews.

Incorrect revenue recognition

Some teams confuse accrual accounting with cash accounting. Recording revenue when cash is received instead of when it is earned creates timing mismatches and audit challenges.

How to avoid: Apply your chosen method consistently. Record revenue when it’s earned, not when payment arrives. Document clear procedures so everyone logs revenue the same way.

Overlooking depreciation and amortization

Non-cash expenses like depreciation and amortization reduce asset values over time. If you forget them or calculate them incorrectly, net income will be overstated.

How to avoid: Use accounting software to automate tracking, and review asset schedules quarterly to keep values current.

Underestimating income tax

Tax miscalculations can cause major discrepancies in net income, especially when rates vary by structure, location, or deductions.

How to avoid: Confirm that the correct rate applies for the reporting period and jurisdiction. Use tax-integrated tools or consult a tax advisor.

Calculation errors

Manual entry in spreadsheets increases the risk of formula errors, especially in complex statements.

How to avoid: Double-check all formulas and totals. Better yet, use automation tools to categorize transactions and reduce manual work.

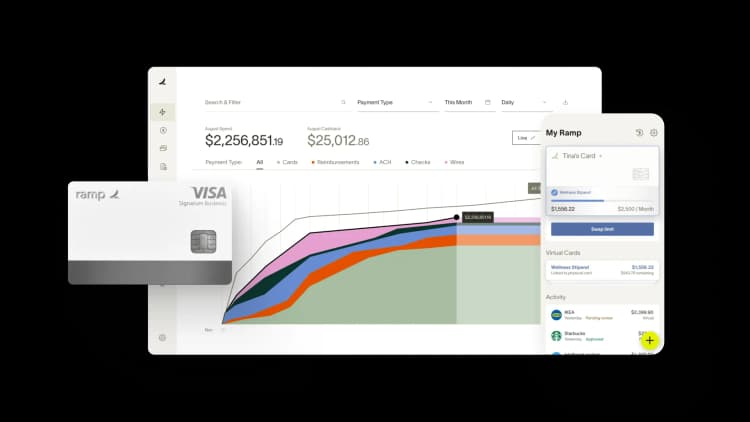

Automate your income statement prep with AI that codes, categorizes, and closes for you

Preparing accurate income statements requires clean data, consistent categorization, and complete transaction records—but manual processes make it nearly impossible to achieve all three without delays. Ramp's accounting automation software eliminates the bottlenecks that slow month-end close, so you can generate reliable income statements faster with less manual work.

Ramp codes every transaction in real time using AI that learns your chart of accounts and applies your feedback across all required fields. Instead of reviewing hundreds of uncoded transactions at month-end, you'll find most spend already categorized and ready for sync. Ramp also collects receipts automatically and matches them to transactions, so you're never chasing down documentation or making assumptions about expense classifications.

When it's time to close, Ramp posts accruals automatically to ensure expenses land in the correct period, even when invoices arrive late. The platform amortizes prepaid expenses and recurring charges according to your policies, so your income statement reflects accurate period-over-period comparisons. Ramp's reconciliation workspace surfaces variances and missing entries instantly, so you can tie out to your ERP with confidence and catch errors before they impact financial reporting.

The result: businesses using Ramp close their books 3x faster, saving 40+ hours every month on tasks that used to require constant manual intervention.

Try a demo to see how Ramp automates income statement prep from transaction to close.

FAQs

An income statement shows financial performance over a period—revenue, expenses, and profit. A balance sheet is a snapshot of assets and liabilities at a single point in time.

Yes. Each reporting period—monthly, quarterly, or annually—should have its own income statement so you can track and compare performance.

At a minimum, prepare one at the end of your fiscal year. Many companies also create monthly or quarterly statements to monitor results more closely.

Yes. Free templates are available, but accounting software is faster and less error-prone. Tools like Ramp automate the process and help ensure accuracy.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits