- What is GAAP?

- The 10 core GAAP principles

- Key GAAP concepts and methods

- GAAP vs. non-GAAP reporting

- GAAP vs. IFRS: Understanding the differences

- Who must follow GAAP?

- Benefits of GAAP compliance

- Common GAAP compliance challenges

- How Ramp supports GAAP compliance in your organization

Generally accepted accounting principles (GAAP) are the standardized rules and procedures U.S. companies use to ensure consistent and reliable financial reporting. GAAP is widely recognized by investors, lenders, and regulators as the authoritative framework for preparing financial statements.

Understanding GAAP helps companies of all sizes build credibility, secure financing, reduce errors, and prepare for growth or audits. Following these principles strengthens financial transparency and supports confident long-term decision-making.

What is GAAP?

Generally accepted accounting principles (GAAP) are the comprehensive framework of accounting standards, rules, and procedures used in the United States. The SEC requires publicly traded companies to follow GAAP, making it the authoritative basis for financial reporting nationwide.

GAAP exists to ensure consistency, transparency, and comparability in how businesses report financial information. Public companies must apply GAAP when preparing financial statements, while private companies have more flexibility, but many still adopt GAAP to build credibility with lenders, investors, and potential buyers.

Who sets GAAP standards?

The Financial Accounting Standards Board (FASB) is the independent organization responsible for establishing and updating GAAP. Created in 1973, the FASB replaced earlier standard-setting bodies and has since issued hundreds of accounting standards covering areas such as revenue recognition and lease accounting.

FASB operates under SEC oversight, giving its pronouncements official authority. When the board releases new or updated guidance, public companies must comply. GAAP has evolved significantly since its early development in the 1930s, reflecting the increasing complexity of business transactions and the need for detailed, consistent reporting standards.

The 10 core GAAP principles

GAAP is built on 10 foundational principles that guide how accountants record, report, and present financial information. While widely taught in accounting programs, these principles are not formal rules in the FASB Accounting Standards Codification. They function as a conceptual foundation that supports GAAP’s detailed authoritative guidance.

Basic GAAP principles explained

The first 5 principles create the baseline for consistent, transparent financial reporting:

- Principle of regularity: Companies follow established accounting rules and laws. For example, a retailer cannot invent its own method for recording sales and must follow the revenue recognition standards set by FASB

- Principle of consistency: Businesses apply the same accounting methods from one reporting period to the next. If you use FIFO to track inventory this year, you continue using FIFO next year rather than switching to last-in, first-out (LIFO) without clear justification

- Principle of sincerity: Accounting teams present an accurate and impartial view of the company’s financial position, including both positive and negative results such as declining sales

- Principle of permanence of methods: Companies maintain consistent procedures over time. If you establish depreciation schedules for equipment, you follow those schedules throughout the assets’ useful lives

- Principle of non-compensation: Financial statements present assets and liabilities separately rather than netting amounts to show only a difference

These principles work together to create comparable and trustworthy financial statements for internal and external stakeholders.

Additional GAAP principles

The remaining 5 principles address more specific reporting considerations:

- Principle of prudence: Financial reporting uses factual data rather than forecasts. For example, inventory is recorded at actual cost, not at a projected selling price

- Principle of continuity: Accounting assumes the business will continue operating unless evidence suggests otherwise, allowing costs such as equipment purchases to be spread over several years

- Principle of periodicity: Revenues and expenses are recorded in the periods when they occur. If you perform work in December but receive payment in January, December is still the correct reporting period

- Principle of materiality: Financial statements include all information that could influence decisions, along with footnotes describing accounting policies, significant events, or contingent liabilities

- Principle of utmost good faith: All parties involved in financial transactions act honestly, with management providing auditors full access to records and auditors conducting independent, unbiased reviews

Together, these 10 principles support clear and reliable financial reporting across industries.

Key GAAP concepts and methods

GAAP relies on specific accounting methods and defined financial statements to present a complete picture of a company’s performance. These concepts support consistency and comparability across reporting periods.

Accrual accounting under GAAP

Accrual accounting records revenues when earned and expenses when incurred, regardless of when cash moves. Cash basis accounting only records activity when money changes hands. GAAP requires accrual accounting because it reflects economic activity more accurately.

Under accrual accounting, companies recognize revenue when they deliver goods or services, even if they receive payment later. A consulting firm that completes a project in March records the revenue in March, not when the client pays in April. This timing aligns performance with the correct reporting period.

The matching principle also applies to expenses. When a company purchases inventory, it records the related expense when it sells the goods rather than when it pays for them. This approach gives stakeholders a clearer view of profitability.

Accrual vs. cash-basis accounting examples

A graphic design agency completes a $5,000 logo project for a client in March and sends an invoice with net 30 payment terms. Under accrual accounting, the agency records the $5,000 revenue in March when it delivers the work, even though the client pays in April.

Under cash-basis accounting, the same agency records the $5,000 revenue in April when the payment arrives. The timing of the cash receipt determines when revenue appears on the books.

Financial statements required by GAAP

GAAP requires four primary financial statements that together provide a comprehensive view of a company’s financial health:

- Balance sheet: Shows assets, liabilities, and equity at a specific point in time. GAAP affects how companies value inventory, depreciate fixed assets, recognize intangible assets, and classify current versus long-term liabilities

- Income statement: Reports revenues and expenses over a period to calculate net income. GAAP dictates when companies can recognize revenue, how to categorize operating versus non-operating expenses, and how to present earnings per share

- Cash flow statement: Tracks cash inflows and outflows from operating, investing, and financing activities. GAAP requires companies to reconcile net income to cash from operations and disclose non-cash transactions such as stock-based compensation

- Statement of shareholders' equity: Shows changes in ownership interest throughout the reporting period and reflects stock issuances, dividend payments, and changes in retained earnings

These statements work together to give lenders, investors, and internal teams a clear and consistent view of financial performance.

GAAP vs. non-GAAP reporting

Companies often supplement GAAP financial results with non-GAAP measures that adjust earnings for specific items. These supplemental metrics help highlight operational performance, but they are not standardized and must be reconciled to official GAAP figures.

| Aspect | GAAP | Non-GAAP |

|---|---|---|

| Definition | Standardized accounting principles required for public companies | Supplemental metrics that adjust GAAP figures by excluding or adding specific items |

| Regulation | Governed by FASB and the SEC | Not standardized; companies define their own adjustments but must provide GAAP reconciliations |

| When used | Required in financial statements, SEC filings, and audits | Used in earnings calls, press releases, and investor presentations |

| Common adjustments | Includes all revenues, expenses, gains, and losses as defined by accounting standards | Excludes items like stock-based compensation, restructuring charges, acquisition costs, and amortization of intangibles |

| Pros | Creates consistent and comparable results across companies and time periods | Highlights core performance trends without the effects of unusual or non-cash items |

| Cons | Can include non-cash or one-time items that may obscure operating trends | Can be misleading if companies apply adjustments aggressively |

| Example calculation | Net income of $50M includes a $15M restructuring charge and $10M of stock-based compensation | Adjusted earnings of $75M exclude restructuring and stock compensation |

Public companies must present GAAP results in official filings, and they can present non-GAAP measures only when they provide clear reconciliations. Non-GAAP reporting is common in industries with significant non-cash charges or one-time events.

GAAP vs. IFRS: Understanding the differences

International Financial Reporting Standard (IFRS) is the global accounting framework used in more than 140 countries, including the European Union, Canada, and Australia. While GAAP applies to U.S. markets, IFRS aims to standardize financial reporting across borders.

| Aspect | GAAP | IFRS |

|---|---|---|

| Overall approach | Rules-based system with detailed guidance | Principles-based system with broader guidelines and more reliance on judgment |

| Geographic use | Required for U.S. public companies and widely used by private companies | Used in more than 140 countries, including the EU, Canada, and Australia |

| Inventory valuation methods | Allows FIFO, LIFO, weighted average, and specific identification | Allows FIFO, weighted average, and specific identification but prohibits LIFO |

| Development costs treatment | Requires companies to expense all research and development costs | Allows capitalization of development costs once feasibility is demonstrated |

| Revaluation of assets | Requires historical cost less depreciation | Allows revaluation of property, plant, and equipment to fair value |

| Component depreciation | Permits but does not require component depreciation | Requires component depreciation when parts of an asset have different useful lives |

These differences affect how companies value inventory, recognize development costs, and measure assets. Multinational companies may need to maintain dual reporting or adjust accounting policies if they operate in jurisdictions that require IFRS.

Who must follow GAAP?

Publicly traded companies in the United States must follow generally accepted accounting principles when preparing financial statements. The SEC requires GAAP compliance for any company listed on U.S. stock exchanges, including businesses filing for initial public offerings.

Private companies have more flexibility in choosing their accounting methods. Many still adopt GAAP because lenders often require GAAP-compliant financial statements before approving loans. Private equity investors and potential acquirers also prefer GAAP reporting because it allows them to compare performance across companies.

Certain industries face additional reporting requirements beyond standard GAAP:

- Banks and financial institutions: Follow specialized GAAP guidance for loan loss reserves and investment securities

- Insurance companies: Apply industry-specific standards for policy liabilities and premium recognition

- Nonprofit organizations: Use a modified version of GAAP that addresses fund accounting and donor restrictions rather than shareholder equity

Whether required or voluntary, GAAP adoption signals financial credibility and improves access to funding, partnerships, and long-term growth opportunities.

Benefits of GAAP compliance

GAAP compliance provides clear advantages for companies and the stakeholders who rely on their financial information. It supports better financial management, builds credibility, and streamlines external reporting.

For businesses

Companies that follow GAAP standards gain several operational and financial benefits:

- Improved credibility with investors and lenders: GAAP-compliant financial statements signal professionalism and strong recordkeeping. Banks view GAAP reporting as evidence of consistent processes, which can make loan approvals more likely and lead to better financing terms.

- Easier access to capital and financing: Venture capital firms and private equity investors expect GAAP financials during due diligence. Companies with GAAP-compliant books move through funding rounds more quickly because investors can evaluate their statements without reconstructing data.

- Better internal financial management: GAAP requires proper accounting controls and documentation. These practices help management identify trends, spot inefficiencies, and make informed decisions based on reliable data rather than estimates.

- Simplified audits and regulatory compliance: Auditors can complete their work more efficiently when companies follow GAAP throughout the year. This reduces audit fees and minimizes year-end adjustments for tax preparation and regulatory filings.

For stakeholders

Investors, creditors, and analysts rely on GAAP because it creates a consistent basis for comparing companies:

- Consistency in comparing companies: GAAP enables reliable comparisons across businesses and industries. For example, two software companies will recognize revenue under the same principles, allowing stakeholders to evaluate results on equal footing.

- Transparency in financial reporting: GAAP’s disclosure requirements ensure stakeholders receive complete information about a company’s financial position, including notes that explain accounting policies, contingent liabilities, and significant events

- Reduced risk of fraud or misrepresentation: GAAP’s standardized rules make it harder for companies to manipulate financial results. Consistent presentation helps auditors and analysts identify unusual accounting treatments or red flags.

Common GAAP compliance challenges

GAAP compliance can be difficult for companies without dedicated accounting resources. The standards cover many detailed scenarios, and frequent updates from the FASB add another layer of complexity.

The cost of compliance goes beyond accounting software and systems. Companies need qualified CPAs or controllers to interpret standards correctly, and external audits can be expensive. These demands create strain for startups and growing businesses.

Maintaining compliance requires consistent processes and ongoing oversight:

- Implement regular financial close procedures: Use close checklists, review steps, and documented controls to ensure accuracy

- Invest in training: Update your accounting team when standards change, or consider outsourcing to firms with GAAP expertise if hiring full-time specialists is not feasible

- Document accounting policies clearly: Update policies as your business evolves or as new standards take effect

Although GAAP compliance requires time and resources, it strengthens financial transparency, reduces errors, and improves confidence among lenders, investors, and auditors.

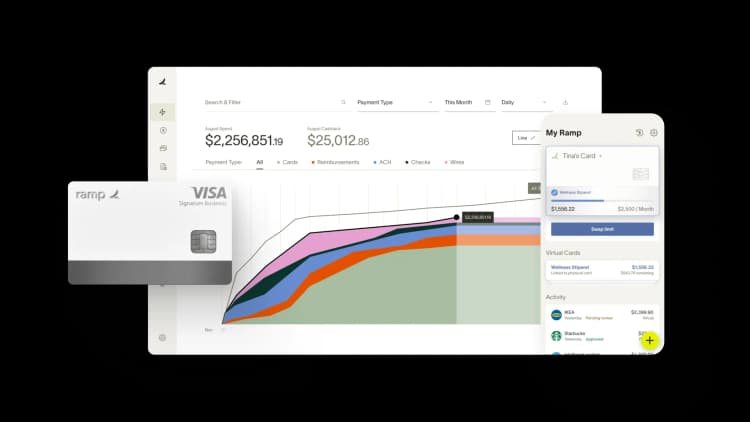

How Ramp supports GAAP compliance in your organization

Creating a strong foundation for GAAP compliance requires investment in people, processes, and technology. Modern finance teams can streamline GAAP compliance through automation.

Ramp's expense management platform automatically categorizes transactions and maintains detailed audit trails, making it easier to follow GAAP principles such as consistency and regularity. The platform integrates with your accounting software to ensure accurate revenue recognition and expense matching.

Try an interactive demo to see how Ramp’s automation makes GAAP compliance easier.

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide.” ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn’t just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn’t exist in Zip. It’s made approvals much faster because decision-makers aren’t chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits

“More vendors are allowing for discounts now, because they’re seeing the quick payment. That started with Ramp—getting everyone paid on time. We’ll get a 1-2% discount for paying early. That doesn’t sound like a lot, but when you’re dealing with hundreds of millions of dollars, it does add up.”

James Hardy

CFO, SAM Construction Group

“We’ve simplified our workflows while improving accuracy, and we are faster in closing with the help of automation. We could not have achieved this without the solutions Ramp brought to the table.”

Kaustubh Khandelwal

VP of Finance, Poshmark