- What are current assets?

- What are current liabilities?

- Understanding how working capital works

- How to find working capital

- A real-life example of improving working capital

- How to deploy working capital

- Need working capital to fuel your business? Consider Ramp

This post is from Ramp's contributor network—a group of professionals with deep experience in accounting, finance, strategy, startups, and more.

Interested in joining? Sign up here.

Working capital is the difference between current assets and current liabilities. When you have enough resources to pay short-term debts, your working capital is positive. When you have fewer current assets than current liabilities, your working capital is negative, indicating potential liquidity problems.

As the President of Brady CFO, a fractional CFO service firm, I have seen my fair share of companies operating in negative working capital. My team is highly skilled in helping such companies reverse their financial situation. Depending on the details, this can include obtaining better terms for short-term debt, optimizing inventory management to reduce carrying costs and free up cash, and other strategies to improve financial efficiency and liquidity.

But the real success lies in structuring a company for long-term financial health. Maintaining an ideal balance between current assets and current liabilities is the biggest focus here. A clear understanding of these assets and how they work will help you know how to find and deploy working capital effectively.

What are current assets?

Current assets are the liquid assets in your business that you can easily convert to cash (or are already cash) in a year or less. They are key indicators of your company's short-term liquidity, meaning its ability to cover its debts and obligations. Current assets include:

- Cash and cash equivalents: Physical cash, bank deposits, and similar liquid resources.

- Accounts receivable: Money owed to the business by its customers for goods or services already delivered.

- Inventory: Goods available for sale or raw materials waiting to be used in production.

- Marketable securities: Investments that can be converted into cash quickly, such as stocks and bonds.

- Prepaid expenses: Payments made in advance for goods or services to be received in the future.

- Short-term investments: Investments that will be sold or mature within a year.

- Short-term notes receivable: A claim for payment documented by a promissory note to be paid within a year.

These assets are essential for day-to-day business operations and for funding growth and expansion initiatives. The idea is that you can collect or sell these assets quickly, and they convert to cash. Keep in mind that this is different from selling a piece of real estate. While real estate can sell quickly, in many cases, it takes a long time and, therefore, isn't a current asset.

What are current liabilities?

Current liabilities are all of your bills and debt due within the next year or less. Examples of current liabilities include:

- Accounts payable: Money owed by the company to its suppliers for goods or services received.

- Short-term debts: Loans or other borrowed funds that must be repaid within one year.

- Accrued expenses: Costs that have been incurred but not yet paid, such as wages, taxes, and utilities.

- Deferred revenue: Payments received in advance for goods or services that the company has yet to deliver.

- Notes payable: Short-term loans that need to be paid within one year.

- Dividends payable: Dividends declared by a company that are yet to be distributed to shareholders.

- Current portion of long-term debt: The portion of long-term debt that is due within the next year.

Managing these liabilities effectively is vital for maintaining liquidity and ensuring smooth business operations.

Understanding how working capital works

Working capital is essentially the lifeblood of a business. It’s the net amount of funds used for daily operations, which is separate from funds set aside for investments such as machinery purchases or acquisitions.

Having negative working capital (more current liabilities than assets) spells trouble. It signals a need for higher profit margins or external financing to balance the scale.

While it's crucial to have more current assets than liabilities, the composition of those assets matters significantly. Cash is king. If you've tied up a lot of your cash in inventory that won't sell for months but have immediate bills to pay without the cash to cover them, you're facing a serious problem.

Therefore, maintaining a healthy cash reserve is high-priority, not just having a favorable overall ratio of current assets to liabilities. It's about having enough liquid assets to meet immediate obligations.

How to find working capital

There are two ways to right-size your working capital position: Improve your margins and obtain outside funding.

Improve your margins

To improve your margins, you must have fewer expenses associated with each sale you make. The fewer expenses per sale, the fewer debts you pile up in relation to your sales. Lowering your costs for each sale means that with every dollar you earn from a sale, you accumulate fewer liabilities as a percentage of those sales. By doing this consistently, you can balance your working capital.

For example, if you sell something for $100 and it costs you $100 to make, your current assets increase by $100 from the sale. But you also have $100 worth of bills to pay, increasing your debts. If you started with no working capital prior to the sale, you still have none after the sale because your assets and debts are equal.

However, if you sell something for $100 but it only costs you $80 to make, your assets increase by $100 from the sale. Your debts also grow, but only by $80 for the costs. If you started with no working capital prior to the sale, you have improved your working capital balance to net $20.

Obtain outside funding

Outside funding can consist of two forms: debt or equity. Regardless of the type, the idea is that you obtain outside funding and deposit it into your cash accounts, which will increase your current assets. As long as you aren't required to pay back that funding within the next year or less, you have effectively increased your current assets more than your current liabilities. This results in an improved working capital position.

A real-life example of improving working capital

At Brady CFO, we’ve helped multiple clients reverse a negative working capital situation. Here’s the latest example of how we turned things around:

1. Understanding the situation: After making hefty investments in an acquisition, our client had used up much of their cash reserves and also used their credit line to fund the investment. The credit line balance was due in a year or less. This made this client's working capital position negative and put them at risk of losing their credit line because they were defaulting on their banking agreements.

2. Negotiating a solution: To rectify this, we approached the bank and negotiated a deal to refinance their existing credit line balance into a long-term debt. The new agreement allowed for equal monthly payments spread over seven years.

3. Reshaping liabilities: By refinancing, we effectively shifted a large portion of their short-term liabilities (due within a year) to long-term liabilities (due after a year).

4. Achieving positive working capital: With a significant reduction in current liabilities, the client's current assets now exceeded their current liabilities. This shift resulted in a positive working capital position.

5. Ensuring debt repayment: With this new arrangement, the company was able to comfortably cover all its debts and bills due within the next year using current assets on hand.

In essence, we converted a potentially damaging financial situation into a manageable one, ensuring our client's stability and financial health going forward.

How to deploy working capital

Once your company is in a positive position and you have excess working capital, the question becomes how and when to deploy it. You must decide on your company’s priorities to spend the money in a strategic way that’ll support long-term goals. Three common areas to deploy working capital are:

- Product development: A business might invest its working capital into research and development to create innovative products that meet customer needs.

- Sales generation: A company could use its working capital to fund marketing campaigns, promotional events, or sales training to drive revenue growth.

- Staffing: An organization might allocate its working capital toward hiring new talent, offering competitive salaries, or investing in employee development programs to build a strong and capable team.

While deploying working capital is crucial for the growth and success of any business, it’s essential to make wise, strategic decisions that don’t leave you in a negative position. Investing in areas that will positively impact your bottom line and bring more cash into the business is a win-win.

Whenever you’re making decisions, always make sure you have more current assets than current liabilities, and you’ll be in a stronger position to weather any financial storms that may come your way. This will enable you to continue operations even in challenging times, invest in future growth opportunities, and maintain a healthy cash flow. A stronger financial position also enhances your business's reputation among stakeholders, which can open doors to more opportunities.

Need working capital to fuel your business? Consider Ramp

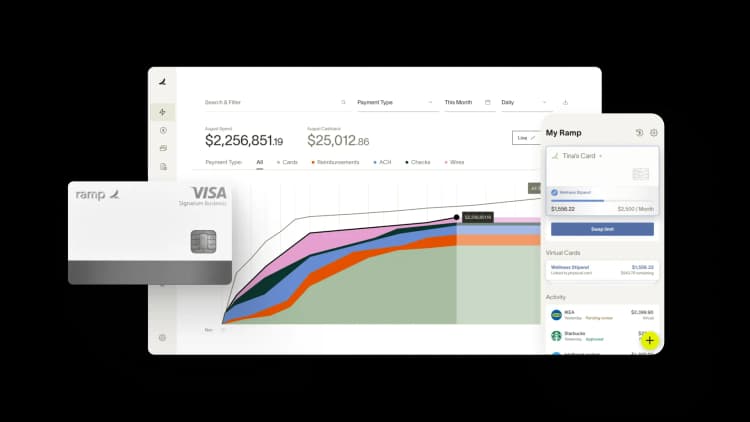

Running a business is hard, and accessing working capital to help streamline your day-to-day operations can be an even bigger chore. With Ramp, you can access the working capital you need, faster, with our commerce-sales-based underwriting process.

Ramp's finance automation platform gives you the tools you need to manage expenses, vendors, bill payments, and more. Learn more about Ramp today.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits