Can you use a business credit card to manage cash flow?

- What is cash flow?

- Are credit cards cash flow?

- How to manage cash flow with a business credit card

- Credit card grace periods

- Are loans better than credit card debt?

- Manage cash flow with a Ramp Business Credit Card

Yes, credit cards can help businesses manage cash flow by providing short-term liquidity and covering temporary shortfalls between expenses and revenue.

Cash flow—the movement of money in and out of a business—determines financial stability. And for many businesses, credit cards can serve as a short-term cash flow tool by offering immediate purchasing power, deferred payments, and potential rewards. When used strategically, they help bridge financial gaps without accumulating unnecessary debt.

Keep reading to learn how cash flow and credit cards can work together.

What is cash flow?

Cash flow refers to the movement of money in and out of a business. It's a crucial measure of a company's financial health, indicating whether your company can generate enough revenue to cover its operating expenses.

Positive cash flow means that your business has more money coming in than going out, allowing it to pay bills, invest in growth, and provide a buffer against financial challenges. Negative cash flow, on the other hand, can signal financial trouble, making it difficult to sustain operations without external funding. Effective cash flow management is essential for making sure a business can avoid loan and credit card debt, meet its short-term obligations, and plan for long-term growth.

What is a cash flow loan?

A cash flow loan is a type of short-term borrowing typically used to finance working capital expenditures, such as paying suppliers or covering payroll, until a company's cash flow improves. Cash flow loans are usually unsecured, meaning they don't require collateral, and are based on the borrower's projected cash flow and creditworthiness.

Are credit cards cash flow?

Credit cards can be used as a cash flow management tool, but they are not cash flow themselves.

Credit cards allow individuals and businesses to make purchases or cover expenses upfront while deferring actual payment until the billing cycle ends, which can help manage short-term cash flow by providing liquidity. However, it also creates a liability that must be repaid.

Properly used, credit cards can mitigate gaps between costs and income, but relying on them too heavily without a repayment plan can lead to debt and financial strain.

How to manage cash flow with a business credit card

A credit card can help sustain your small business during cash flow disruptions or economic uncertainty. Here are some ideas for how to manage cash flow in a small business.

Smooth out cash flow gaps

Using credit cards can help smooth out cash flow gaps by providing immediate access to funds when revenue is delayed or expenses are higher than anticipated. This can prevent disruptions in operations and allow your business to meet its financial obligations on time.

Track and categorize expenses

Some business credit cards offer detailed reporting and expense categorization. This can help you monitor your spending, identify cost-saving opportunities, and make more informed financial decisions. Effective tracking also simplifies your accounting and tax preparation.

What is a cash access line?

A cash access line is a portion of a credit card's total credit limit designated for cash advances, which allows cardholders to withdraw cash from an ATM or bank. This line typically has a lower limit than the main credit limit and may come with higher interest rates and additional fees.

Earn rewards and cashback

Business cards typically offer rewards programs that provide points, cashback, or miles on purchases. These rewards can be used to offset business expenses, reducing your business’s overall costs and improving cash flow. Some cards also offer sign-up bonuses, which can provide an additional financial boost.

Improve your credit score to access financing options

By making timely credit card payments each billing cycle, you can build your business credit score, which can in turn help you access more financing options. A higher credit score typically leads to better interest rates on loan repayments and access to larger lines of credit, giving your business more flexibility in managing its cash flow.

Access to credit during emergencies

Business credit cards can serve as a financial safety net during emergencies or unexpected expenses. As a small business owner, having access to a line of credit ensures that your business can handle any sudden financial needs without resorting to more expensive or less flexible borrowing options.

Is too much cash flow bad?

Too much cash flow is generally not a problem. However, if your small business has excessive cash flow, it may indicate that you’re not investing enough capital in growth opportunities or capital improvements. It's crucial to find a middle ground between keeping sufficient cash reserves and efficiently using funds to encourage growth and innovation.

Credit card grace periods

What is a grace period on a credit card? Most credit cards offer a grace period for regular purchases, but not typically for balance transfers. This interest-free window lasts from the date of your purchase until your payment due date, potentially giving you up to 60 days before interest applies.

Using your credit card grace period for cash flow management

Your credit card’s grace period can help manage cash flow by delaying payment without incurring interest.

If you're facing a short-term cash crunch, strategically using a card that just closed its billing cycle can extend your repayment timeline.

Are loans better than credit card debt?

Loans are generally better than credit card debt because they offer lower interest rates and fixed repayment terms, which makes them easier to manage.

Credit card debt tends to have higher interest rates and can quickly become costly if not paid off in full each month. They are better for short-term expenses and everyday purchases.

If you can pay off the balance quickly, a credit card may work, but for structured, long-term borrowing, a loan is usually the more affordable and structured option.

Manage cash flow with a Ramp Business Credit Card

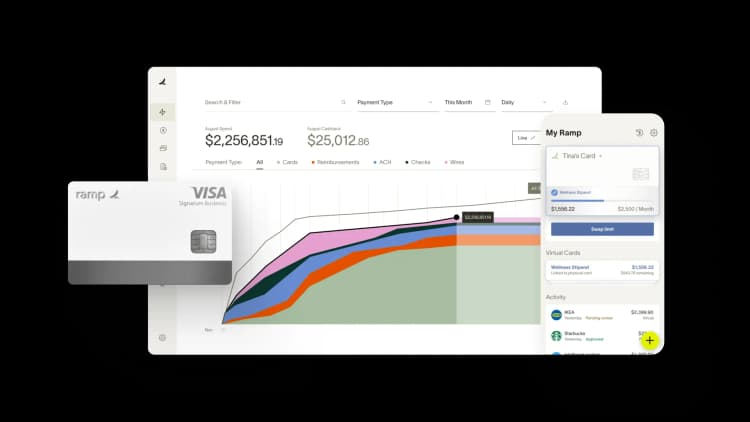

The Ramp Business Credit Card is designed to help businesses manage cash flow. With real-time expense tracking and automated categorization, Ramp provides detailed insights into spending patterns, helping your business identify areas for cost savings.

Ramp's integrations with accounting software also simplify bookkeeping and ensure accurate financial reporting. By using Ramp, your business can gain better control over its finances, making it easier to navigate cash flow challenges and focus on growth.

Ramp offers higher credit limits than traditional credit cards, since our limits are determined based on revenue. All you need to qualify is a registered business with an EIN and $25,000 in a U.S. business bank account. See a demo to learn more about how Ramp can help your business.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits