- What is an expense account?

- 4 types of expenses that need to be accounted for

- 5 expense account challenges for small businesses

- How Ramp transforms expense account management

- Optimize your expense accounts with automation

Every business has expenses.

In the beginning, when there are fewer people involved, expenses can be centralized and paid out of one account. That changes as businesses scale as the need may arise for employees to have and maintain their own expense accounts. That requires an expense policy, an approval process, and a mechanism for reimbursements.

But managing all that manually can pose some challenges. In this article, we’ll go over some of the ways to overcome those challenges.

What is an expense account?

An expense account is not a separate bank account. It’s a ledger used to keep track of costs that fall into business expense categories. Accountants generally set them up as t-accounts that are part of the general ledger, giving them the ability to allocate those expenses when they prepare financial reports. They’re also useful for tax filings, as many business expenses are deductible.

When the company pays expenses directly, the expense account is credited, and a cash account is credited. When employees pay expenses and later submit for reimbursement, the expense account is set up as an accounts payable account on the liability side of the general ledger. The expense account is debited, and cash is credited when the reimbursement is processed.

This process might get confusing for business managers because debits and credits work differently on the asset and liability sides of the general ledger. Investing in small business accounting software can eliminate some of that confusion and expense management tools make it even simpler.

4 types of expenses that need to be accounted for

Accurately classifying expenses is important for several reasons.

Your company can only legitimately claim business tax deductions with clear expense categorization. The finance team is tasked with putting together an accurate balance sheet. Ownership wants to make sure there’s no wasteful spending. These are all factors that go into expense management and budgeting.

1. Essential expenses

We’re all familiar with essential expenses in our personal lives. That list looks different for the business. Certain expenses are obvious, like rent, utilities, and taxes. Other additions to the “essential” list include, professional fees, office supplies, licensing fees, salaries, and insurance premiums. These all need to get paid for you to stay in business.

2. Discretionary expenses

A discretionary expense, unlike an essential expense, is a cost that you have a choice about taking on. Examples of this are marketing expenses, public relations, events, video production, freelancers, and collateral (business cards, posters, flyers). You could also put that expensive brew you have for the coffee maker in this category. These are all wants, not needs.

3. Operating expenses

Most of your essential expenses will be in the operating expense category. An operating expense (OPEX) is a cost that your company incurs as a result of its normal business activities. Examples of this include rent, equipment, inventory, payroll, insurance, and R&D. Marketing expenses could also fall in this category, but they are not essential.

4. Non-operating expenses

Anything that doesn’t classify as an operating expense is a non-operating expense. Interest payments on debt, inventory write-offs, and legal settlements fall in this category. Investment losses are also non-operating expenses. There are others that may not be as obvious. Expense management software and a handy set of expense guidelines can help with this.

5 expense account challenges for small businesses

Managing expenses gets more complicated as companies grow. Expansion, marketing, adding new employees, and supporting the infrastructure required for all that can create some challenges for small business owners. Some of those may not be as visible as others. We’ve highlighted a few of the more troubling issues in the sections below.

1. Travel and expense (T&E) procedures and costs

Without strict policies and vigilant attention to detail, T&E can become an issue for ownership, employees, and accountants. T&E reimbursement is one of the key areas of concern for SMBs. Reimbursable spending on travel needs to be clearly defined in policy. The employee reimbursement process should be automated, but even that can be a problem if there are no spend controls.

2. Manual entry errors

Modern aggregation technology can track expenses and eliminate manual entry errors. That doesn’t work if employees are using their own credit cards for expenses and then submitting for reimbursement. That’s the type of scenario where errors occur because everyone involved is doing a manual entry, from the employee to the bookkeeper to the accounting department.

3. Receipt discrepancies

Let’s say you find a discrepancy in a manual entry, or you want to challenge an expense on a reimbursement report. Without receipt automation, there may not be a good way to prove or disprove the transaction happened. Paper receipts without digital copies are an inefficient way to keep records.

4. Maverick spending without screening vendors

Procurement departments can become their own little kingdoms inside a company when they don’t follow a set of procurement rules. One example of this is called maverick spend. It’s when the procurement team spends more than they’re authorized to and doesn’t properly vet or pre-screen vendors. This is more than an expense issue—it can affect all levels of operations.

5. The hidden cost of zombie spend

How many subscriptions and membership fees do you pay for every month? Chances are you’re not using them all. Most of them are so small you barely notice them. Imagine that number multiplied by the number of employees or departments you have at your company. That’s known as zombie spend. It’s an expensive problem that’s difficult to get rid of.

How Ramp transforms expense account management

Managing expense accounts for a small business often feels like herding cats—receipts go missing, employees submit expenses weeks late, and you're left scrambling to close the books each month. The manual processes that many businesses rely on create bottlenecks, compliance risks, and countless hours of administrative work that pull you away from strategic finance initiatives.

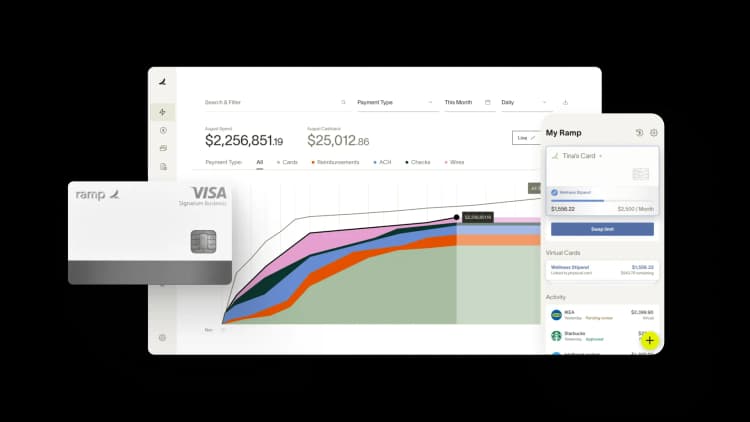

Ramp's expense management platform tackles these challenges head-on with intelligent automation and built-in controls. The platform's real-time expense tracking automatically captures and categorizes transactions as they happen, eliminating the need for manual data entry and reducing errors.

When employees make purchases with Ramp cards, transactions flow directly into your expense management system with merchant details, amounts, and categories already populated. This means no more chasing down receipts or trying to decipher cryptic credit card statements at month-end.

Beyond automation, Ramp gives you unprecedented control over spending before it happens. You can set custom spending limits, restrict merchant categories, and create approval workflows that match your business policies.

Need to ensure marketing stays within their monthly budget? Set a spending limit that automatically declines transactions once reached. Want to prevent personal expenses from slipping through? Block specific merchant categories at the card level. These controls work 24/7, so you're not relying on manual review to catch policy violations after the fact.

The combination of automation and proactive controls transforms expense management from a reactive scramble to a streamlined process. Finance teams save hours per week on expense-related tasks while maintaining tighter control over company spending. Instead of playing detective with last month's expenses, you're empowered to shape spending behavior in real time and focus on driving business growth.

Optimize your expense accounts with automation

Imagine being able to limit where your employees can spend money on behalf of your company. Ramp’s spend controls allow you to set limits, designate specific vendors they can shop at, and eliminate waste. We also provide a real-time dashboard so you can see expenses as they happen, not weeks after the fact.

Ready to learn more? Try our interactive demo.

FAQs

An expense account is only an asset when the company is paying expenses directly. In that scenario, the expense account is set up as a t-account on the asset side of the general ledger. If the expense account is being used for employee reimbursement, it’s an accounts payable account, which goes on the liability side of the general ledger.

Expenses come in several categories. Operating expenses include rent, equipment, inventory, payroll, insurance, and R&D. Examples of discretionary expenses are marketing costs, public relations, events, video production, freelancers, and collateral (business cards, posters, flyers). There are also non-operating expenses like Interest payments on debt, inventory write-offs, legal settlements, and investment losses.

Yes. Ramp has some of the most advanced expense management software on the market today. Our platform includes an expense policy generator, corporate charge cards, receipt automation, spend controls, and automated reimbursement. Contact one of our team members today to learn more about these and other features of Ramp.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits