How to team up with HR leaders for smoother operations in 2025

- Foundations for a strong HR-Finance partnership

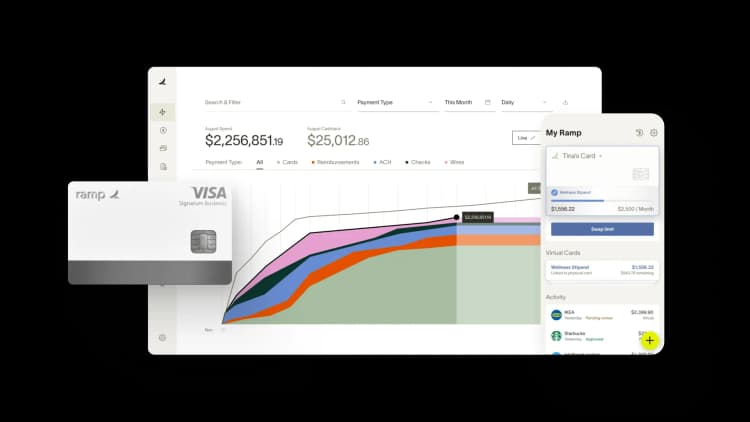

- Build an integrated HR and finance stack

- Invest in a high-trust culture

Recently, the finance team at Tomo, a real estate software platform, joined forces with its HR team to consolidate their tools and improve operational efficiency—resulting in 40 hours saved per month.

We wanted to learn what drove this initiative and how finance teams can work more effectively with their HR counterparts. So we invited Tomo's VP & Head of People and Talent Kim Rogers to share her insights in a recent webinar. She was joined by Nelson Rose, Executive Relationship Manager at UKG, and together they discussed how integrating your finance and HR tools can boost collaboration, automation, and ultimately, a high-trust company culture. Here's a recap of the discussion.

Foundations for a strong HR-Finance partnership

For organizations to thrive, HR and finance must go beyond project collaboration and embrace a “one-team” mindset. Kim says at Tomo, “it hasn't really ever been finance versus HR. We're all here to help make this company work. We all care about spending, and we all care about making our systems work well for our teammates.”

What does this look like in practice? At Tomo, it means key decisions are made with both cost control and employee enablement in mind. Given the small size of the organization, the finance and HR teams also cross-train on core processes like payroll and benefits to avoid a single source of failure.

Build an integrated HR and finance stack

Another area for close collaboration? Selecting the tools for your finance and HR operations.

Connected tools are essential for efficiency, particularly for tasks that involve both finance and HR functions, like employee onboarding/offboarding and expense management. Automation has allowed Kim’s lean team of two to support over 100 employees at Tomo and spend more of their time on high-value work.

Kim and Nelson recommend that HR and finance leaders do the following when evaluating new vendors:

- Collaborate on vendor selection: Include Finance, IT, and HR specialists in vendor demos and evaluation discussions. Use a shared Slack channel to discuss dependencies and speed up decision-making.

- Prioritize data security: Ensure that only necessary data is shared between tools to maintain security and compliance standards. If your business involves a lot of travel, choose tools that make it easy to lock and reissue cards if they are lost or stolen.

- Streamline user management: Ensure your finance and HR systems integrate with each other so you can securely onboard and offboard employees.

- Verify integration claims: Confirm that integrations have been tested with all your vendors. Don’t just rely on the claims of one vendor.

- Ensure easy implementation: Confirm that vendors offer implementation and project management support.

- Focus on employee experience: Select tools that are user-friendly and don’t slow down employees. Avoid solutions that require manual processes or complex training. For example, if you have a hybrid team, make sure your expense management tool can issue travel funds from day one, making it easy for new employees to travel to HQ or other locations.

The right tools not only help you keep your team lean but also build trust within the organization. Kim explains, “As we move beyond the basics and add new capabilities, we've been very thoughtful about demonstrating ROI. The groundwork we've laid over the past few years has built credibility within the organization. This credibility ensures that when we propose investing in new tools or systems, the organization understands the value and supports those decisions.”

Invest in a high-trust culture

Creating a high-trust culture is top of mind for many HR leaders—and it should be top of mind for finance teams too.

Nelson explained, “Your employees are the ones who get the job done. Your employees are the reason why you're a profitable company. If you don't treat them as the most important thing that you have, then you're not going to be successful.”

Ultimately, fostering an environment of trust allows employees to feel more empowered / be more productive.

So how do you build a high-trust culture? It starts with trusting your team. As Nelson wisely puts it, “You can't build a culture of trust if you don't first trust the people that you hire to do their job.” Kim adds, trust also begins with leadership believing employees can manage their work and lives responsibly. When you treat people like adults, they’ll rise to the occasion.

This high level of employee trust is apparent with Tomo's approach to their expense policy—or rather, their lack of one. Spending guidelines exist, but the team doesn’t set a hard cap on hotels, flights, or per diems. If issues come up, the team brings it up directly with employees. “In the three and half years [since Tomo was founded], we haven’t had any abuse. Nine times out of ten, folks are going to make the right choice and spend the company’s money wisely,” Kim says.

Kim shared other pragmatic ways that finance can partner with HR to create a high-trust culture:

- Provide essential tools and access immediately: Ensure new employees have access to all necessary tools and systems, such as Slack channels and corporate cards, from their first day.

- Include spending guidelines in onboarding: During onboarding, provide clear information on spending guidelines and expense policies––new hires will understand expectations and feel confident in managing their expenses.

- Be transparent about financials and decisions: Share financial information and any difficult decisions openly with your team to build trust and maintain transparency.

To hear more insights from Kim and Nelson, watch the full webinar.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits