How to simplify cash flow management for your e-commerce business

- Why e-commerce businesses need to know their cash flow

- How to calculate e-commerce cash flow

- What is a “good” operating cash flow ratio for an e-commerce company?

- Common cash flow setbacks for e-commerce businesses

- How to forecast cash flow for an e-commerce business in 4 steps

- Cash flow forecast examples

- How Ramp streamlines cash flow management for e-commerce businesses

- Optimize your cash flow management

Without an understanding of cash flow and a good strategy to manage it, it's very difficult to run a profitable business. That’s true in all sectors, but cash flow for e-commerce businesses can look very different from that of a brick-and-mortar store. In this article, we’ll go over how to manage e-commerce cash flow and some of the common pitfalls to avoid.

E-commerce businesses are faced with several uncertainties when launching a new product. Developing a minimum viable product (MVP) and achieving product market fit (PMF) requires some educated guesswork based on extensive research. Cash flow does not need to be another mystery. With the right tools, you can forecast, measure, and control it.

Why e-commerce businesses need to know their cash flow

Think of cash flow as the lifeblood that powers the heart of a business. Like a human heart, it flows in and out, giving the body vitality and energy to go about its daily activities. The main difference is that the cash inflows and outflows of e-commerce businesses are not equal. To be successful, there must be more cash coming in than going out.

Positive cash flow is essential for any business to stay open. Consistent negative cash flow will quickly end any venture, no matter how promising. Positive cash flow, on the other hand, can inspire investors and drive up share prices. Market analysts look at long-term “free cash flow” (FCF), which is cash generated minus capital expenditures, to set target share prices.

It’s difficult to maintain positive cash flow in the early years of an e-commerce company because there are rarely any physical assets to use as collateral for debt financing. This puts the onus on the business owner and investors to come up with enough cash necessary to run the operation until profits can be realized. We’ll get into that in more detail below.

How to calculate e-commerce cash flow

Accurately calculating operating cash flow begins with proper spend management. E-commerce reporting usually involves the “direct method” of reporting operating cash flow, which records all transactions as actual cash inflows and outflows during the accounting period. The sum of the inflows minus the sum of the outflows equals the operating cash flow.

More complex companies that have non liquid assets like real estate and equipment may want to use the “indirect method,” which includes factors like depreciation and amortization on debt. If your bookkeeping department is recording inflows and outflows on an accrual basis, this might be a better option for you. Speak to an accountant about the differences.

Why is operating cash flow so important? It’s the standard by which every company’s potential profitability is measured. It’s also an important metric for internal use when making decisions about important operating activities like adding new product lines, hiring employees, and launching marketing campaigns. In short, if you don’t have a good operating cash flow number, your company may struggle.

What is a “good” operating cash flow ratio for an e-commerce company?

In business, there’s a ratio for everything. Operating cash flow is no different. Determining whether it’s “good” or “bad” is a simple matter of looking at the numbers and applying a specific formula. The formula for operating cash flow ratio is:

The math is simple. “OCFR” is the operating cash flow ratio, “OCF” is cash flow from operations, and “CL” is current liabilities. Cash flow from operations can be found on the company’s cash flow statement published as part of your quarterly reporting. Current liabilities include obligations due within a year, like short-term debt, accounts payable, and accrued liabilities.

Operating cash flow ratios are measurements of liquidity. A OCRF of under “1” means that the company cannot meet its current obligations. That’s a warning sign to investors and company managers. A “good” operating cash flow ratio is a number greater than 1. Ideally, an e-commerce store wants to aim for 1.25 or above, if possible.

Common cash flow setbacks for e-commerce businesses

E-commerce profit margins are typically small if you’re selling products, particularly in the online retail space. They’re larger for service businesses, but there’s still very little room for error. Learning how to manage cash flow is a good first step in avoiding some of the potential pitfalls that can arise when doing business online. Here are some areas to pay attention to:

- Payment cycles: Offering 30-day or 90-day payment terms may seem like a good idea to acquire new customers, but that system could get you in trouble if there’s not sufficient capital and inventory to back it up. Shortening the payment cycle or requiring customers to pay upfront is a more efficient business model.

- Revenue/expense alignment: This speaks to the previous point about payment cycles. Expenses and costs should be closely aligned with revenue. When revenue lags behind expenses, that creates cash flow problems. Add in a company burn rate if you’re a startup and things will get tight quickly and your operating cash flow ratio will drop.

- Inventory build-up: Consumers go through swings in their buying cycles, so building up extra inventory of “hot” products can easily backfire. This problem can be solved with strict cost controls and guidelines for order quantities. Simplified, that means don’t buy more products than you can sell in a specific period.

- Employee spending: Employee spend control is an area often overlooked in the beginning that becomes a real problem as time goes by. Implementing a strict and controlled spending policy, with automated expense tracking, can significantly increase cash flow percentages. Remember, the inflows need to exceed the outflows.

- Unnecessary expenses: This also comes back to spend control. It’s not just employees who overspend. Business owners and executives can take on unnecessary expenses. Accounts payable departments can easily overlook zombie spending and subscription creep that adds up over time. This cuts into a business's cash flow.

- Invoice management: Monitoring and tracking your spending won’t do you any good if there isn’t a solid invoice management system in place. Expenses are cash outflows. Invoices produce cash inflows. Unpaid invoices (AR) may count as a current asset on the balance sheet, but they don’t do anything to improve your cash flow.

How to forecast cash flow for an e-commerce business in 4 steps

Accurate cash flow forecasts are a key component to success. In e-commerce, where debt financing is limited, projecting realistic future cash flows is critical. It’s important to use real expense numbers and conservative sales projections. Underestimating cash flow and coming in over the forecast is better than underestimating and falling short. Here’s what to do:

Step #1: Choose the length of time for the forecast

For internal purposes, a cash flow forecast for a shorter length of time is more efficient. Looking at cash flows monthly or quarterly gives the business timely data that can be used to make quick adjustments. Real-time expense management software can make this even simpler. Longer projections of one, three, or five years are for investors or lending institutions.

Step #2: Add up costs and expenses

This can be a stumbling block without an efficient expense management system. Ideally, you want this part of your business to be automated, so when it comes time to do a cash flow forecast you won’t need to scramble to get accurate numbers. Missing a seemingly meaningless expense could seriously skew your cash flow numbers.

Step #3: Realistically project sales number

Optimism and passionate zeal are great, but they have no place in the cash flow forecast process. Sales projections need to be realistic and based on real data, not a “feeling” that sales will increase next month. If they do, let that be reflected in next month’s report. This is one area where “underpromise and overdeliver” will serve you well.

Step #4: Account for payment cycles

Remember those 30-day and 90-day terms you're offering new customers? This is where that gets tricky. If you’re doing a cash flow forecast for the next thirty days, the revenue numbers will be invoices paid from the last thirty days of sales if you’re operating on net-30. The same principle can be applied to net-90 customers. You can probably see the problems with this.

Cash flow forecast examples

Let’s assume that a company sells a product with a unit cost of $20. They sold 1000 units last month and all customers were required to pay up front. That’s a gross revenue of $20,000. Expenses and costs for the company totaled $16,000, so the operating cash flow ratio is 1.25. That’s excellent. The company is on-track and considered a healthy investment.

Now, it’s time to forecast next month’s cash flow. You could assume that sales and liability numbers remain the same, but then the company isn’t growing. Realistically, can you increase those sales numbers. But will costs go up if you do? Some costs are fixed and won’t change. Others are variable and will go up as sales numbers increase.

Project an increase in sales of 10%. That brings your total units sold to 1100 and your gross revenue to $22,000. Let’s say your costs go up to $17,000, so now your operating cash flow ratio is 1.29. Shareholders will be happy about that. Business owners might be tempted to expand their operations if they hit that goal. Everyone is happy!

That’s a positive scenario. Now, let’s look at another situation. Let’s say that the company uses 90-day payment incentives for customer acquisition. Sales projections for next month will still be 1100 units and costs will be $17,000. Unfortunately, revenue will be what’s owed on sales from three months ago. They only sold 800 units back then. That’s revenue of $16,000.

The operating cash flow ratio in the scenario described above is .94. That basically means the company cannot afford to pay its bills. Sales projections might be optimistic, but the cash flow forecast tells another story. To survive, the business will need to either change its payment cycles or significantly cut expenses. We’ll cover both in the next section.

How Ramp streamlines cash flow management for e-commerce businesses

Managing cash flow in e-commerce can feel like a never-ending struggle. Between tracking inventory purchases, monitoring multiple payment processors, and reconciling transactions across various platforms, it's easy to lose sight of your actual financial position. The constant flow of small transactions, combined with varying payment processing times and supplier payment terms, creates a perfect storm of cash flow complexity that many finance teams struggle to navigate.

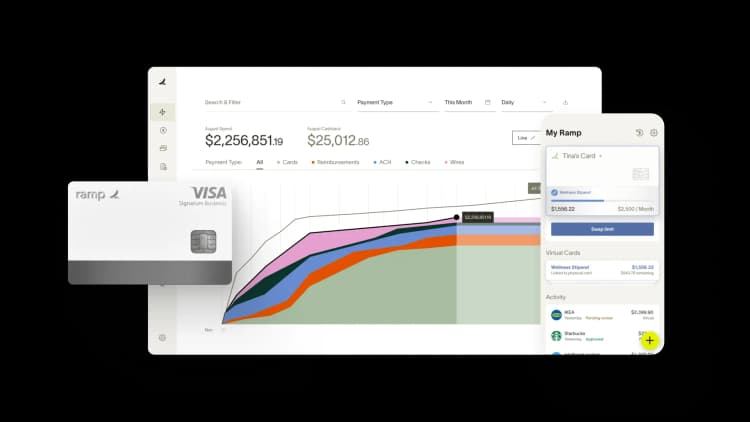

Ramp's expense management platform tackles these challenges head-on with automated expense tracking and real-time visibility into your spending. Instead of manually categorizing hundreds of transactions from different vendors and marketplaces, Ramp automatically captures and categorizes expenses as they happen. When your team makes inventory purchases or pays for shipping services, these transactions flow directly into your expense management system with merchant details, amounts, and categories already assigned. This automation eliminates hours of manual data entry while ensuring nothing slips through the cracks.

The platform's virtual card capabilities prove particularly valuable for e-commerce businesses managing multiple vendor relationships. You can create dedicated virtual cards for each supplier or marketplace, setting specific spending limits and controls. This granular control helps prevent overspending while making it simple to track exactly how much you're investing in inventory from each source. When combined with Ramp's real-time reporting features, you gain instant visibility into your cash position—no more waiting until month-end to discover you've overextended on inventory purchases.

By consolidating expense tracking, automating categorization, and providing real-time spending insights, Ramp transforms e-commerce cash flow management from a reactive scramble into a proactive strategy. Finance teams can finally focus on optimizing working capital and growth opportunities rather than drowning in transaction reconciliation.

Optimize your cash flow management

Extended payment terms like 90-day cycles can strain your cash flow, especially when you're scaling quickly. While these terms help attract enterprise customers, they create a funding gap that many e-commerce businesses struggle to bridge.

Traditional financing often falls short for e-commerce companies. Banks hesitate to lend without physical assets as collateral, and newer businesses lack the revenue history they want to see. Even business credit cards for startups may offer limits too low for serious inventory purchases.

Ramp's commerce sales-based underwriting process solves this problem by offering credit limits higher than traditional cards. We base these limits on your actual monthly revenue—not outdated credit scoring models. This approach gives growing e-commerce businesses the working capital they need to manage inventory cycles and scale operations without cash flow constraints.

FAQs

The best way for an E-commerce business to manage cash flow is to have a real-time tracking system that logs expenses and controls spending. With these tools, an E-commerce business can put together more accurate cash flow forecasts and make faster business decisions.

Cash flow is the net revenue received after deducting business expenses and costs. Cash management is the process of recording the amount of cash coming in and out.

Ramp provides the tools to track expenses and control spending, making it easier to produce accurate cash flow forecasts. We also offer business credit cards with higher limits to alleviate the stress of spending before revenue becomes available.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits