What are net 90 vendors? Definition and when to use them

- What does net 90 mean?

- Net 90 vs. Net 30 vs. Net 60

- Types of vendors offering net 90 accounts

- How do net 90 vendors benefit cash flow

- How to find net 90 vendors without hurting supplier trust

- Building a smarter vendor terms strategy based on business goals

Net 90 vendors give businesses up to 90 days to pay for goods or services after receiving an invoice. These extended terms can offer more breathing room for managing cash flow, especially during periods of tight liquidity or seasonal demand. Net 90 terms can act as a short-term working capital tool for companies operating on tight margins or waiting on receivables.

What does net 90 mean?

Net 90

Net 90 is a payment term that gives a buyer 90 calendar days to pay an invoice in full after the invoice date. It’s a form of trade credit that allows businesses to receive goods or services upfront and pay later.

Net terms are common in B2B transactions, especially in industries like manufacturing, wholesale, and marketing services. For example, if a vendor issues an invoice on April 1 with net 90 terms, you need to pay by June 30. No additional interest rate is charged during this period unless specified in the contract.

Vendors may offer net 90 to trusted customers as a way to build loyalty or compete for large contracts. You can negotiate these terms to match long receivable cycles or stretch working capital.

Net 90 vs. Net 30 vs. Net 60

Net payment terms define when you must pay an invoice after it is issued. The most common terms, Net 30, Net 60, and Net 90, offer varying levels of flexibility and risk. Choosing the right one depends on your cash flow strategy, transaction size, and vendor relationships.

Feature | Net 30 | Net 60 | Net 90 |

|---|---|---|---|

Payment window | 30 days after invoice date | 60 days after invoice date | 90 days after invoice date |

Typical applications | Small B2B transactions, retail | Mid-sized contracts, recurring services | Large B2B deals, enterprise-level purchasing |

Vendor preference | High | Moderate | Low (unless negotiated upfront) |

Buyer cash flow benefit | Minimal | Moderate | High |

Vendor risk exposure | Low | Moderate | High |

Negotiation difficulty | Easy to obtain | May require prior relationship | Typically reserved for strong credit buyers |

Impact on vendor trust | Builds trust with prompt payments | Acceptable with consistent payment history | Risky if buyer has weak payment discipline |

Typical industries | Retail, hospitality, small suppliers | SaaS, marketing agencies, wholesalers | Manufacturing, distribution, government |

Effect on working capital | Minimal runway extension | Useful for smoothing out receivables | Maximizes capital retention for 1 quarter |

Types of vendors offering net 90 accounts

Net 90 credit terms are not offered across the board. They are more common among vendors who sell high-ticket items, work with repeat customers, or operate in industries with long sales cycles.

- Manufacturers and industrial suppliers: Manufacturers often provide raw materials, components, or equipment to distributors and wholesalers. Net 90 gives buyers time to convert that inventory into revenue before payment comes due. This is especially useful in the automotive, construction, and heavy equipment sectors. However, manufacturers usually require a formal agreement or long-term relationship before extending terms this generous.

- Wholesalers and distributors: Wholesale vendors may offer net 90 terms to retail chains or resellers with consistent purchase volumes. These buyers rely on the extra time to move inventory or sync with retail cash cycles. In return, vendors often require minimum order sizes or personal guarantees to offset the credit risk.

- Marketing and creative agencies: Agencies working with large corporate clients may agree to net 90 to win contracts, especially when clients have rigid procurement contracts. These terms are common in media buying, brand development, and content production. Agencies must factor delayed payments into their cash flow forecasts or use financing tools to bridge the gap.

- Packaging, printing, and promotional goods vendors: These vendors often serve smaller businesses with bulk needs, especially during product launches, seasonal campaigns, or branded merchandise. Net 90 vendor accounts help corporate clients align expenses with campaign timelines. In exchange, vendors may negotiate premium pricing or upcharge for smaller orders.

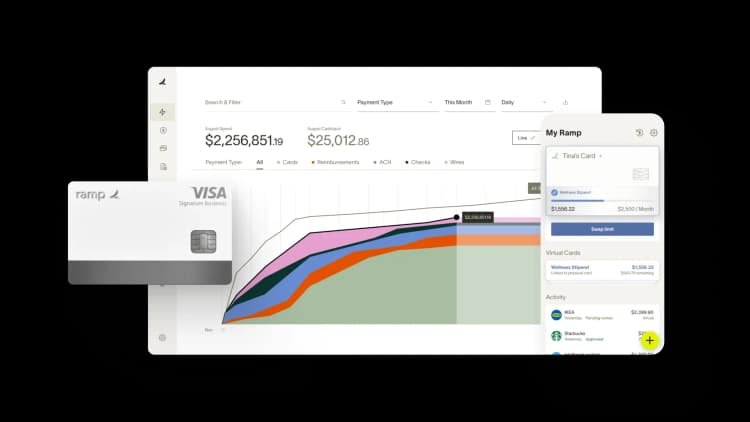

- Enterprise SaaS and IT service providers: Vendors may accept net 90 as part of custom contract terms in enterprise deals, especially with procurement-led sales cycles. While extended payment terms can strain smaller providers, established SaaS vendors often absorb the delay when the deal size makes it worthwhile. You can gain significant leverage in vendor negotiations regardless of your company size. Software like Ramp help identify savings opportunities and negotiate smarter contracts. For example, Crossbeam used Ramp to cut contract costs by 42.8% per seat, proving that even smaller companies can secure enterprise-level value.

- Government contractors: Vendors doing business with federal, state, or municipal governments typically face longer payment terms, which are often 60 to 90 days by default. These vendors price this delay into their vendor contracts and rely on consistent, if slow, payments. In return, they gain access to high-value contracts with low default risk.

Managing vendors with extended terms becomes simpler when you centralize all your vendor activity, contract details, and credit history. With a unified view of your vendor relationships, you can quickly identify who offers the most favorable terms, stay ahead of renewal dates, and make strategic decisions about which partnerships to prioritize or renegotiate.

How do net 90 vendors benefit cash flow

Net 90 terms gives you more time to hold onto cash. You free up working capital by delaying payment for 90 days after receiving goods or services without slowing down operations. This delay in cash outflow makes it easier to manage day-to-day expenses while keeping the business running smoothly.

For companies with long sales cycles or slow-paying customers, net 90 helps align outgoing payments with incoming revenue. Instead of covering costs upfront and waiting weeks or months to get paid, you can match your payables to your receivables.. That creates a more predictable cash flow and reduces the risk of shortfalls.

Liquidity also improves when vendor payments don’t immediately pull from available funds. Net 90 terms can stretch those limited reserves, reducing the need to dip into emergency savings or rely on high-interest financing.

The extra time also gives you flexibility to reinvest. With cash freed up, you can prioritize growth through hiring, expanding operations, or funding marketing campaigns. And because you are not relying on external financing to bridge gaps, there’s less interest expense and fewer liabilities on the books.

Real-time visibility into upcoming vendor payments, due dates, and invoice terms strengthens your cash flow planning. Instead of juggling spreadsheets or manual trackers, automated payment scheduling helps you forecast your cash position based on active vendor terms—giving you more control and less administrative work.

Net 90 terms improve your cash flow by giving you more time to generate revenue before you pay. When managed well, they strengthen your liquidity and reduce financial pressure without sacrificing operational momentum.

How to find net 90 vendors without hurting supplier trust

Finding vendors that offer net 90 terms takes time. You need to identify the right partners, negotiate terms, and build the trust that makes extended payment windows possible. Pushing too hard or asking too soon can damage relationships you depend on.

- Step 1: Identify vendors open to extended terms. Focus on vendors in industries that commonly offer net 90, such as manufacturing, wholesale, and B2B services. Review your existing contracts to see which suppliers already offer flexible terms or may be open to adjusting them based on order volume.

- Step 2: Build your case with a strong payment history. Suppliers are more likely to approve net 90 terms if they have seen consistent, on-time payments from your business. A clean track record reduces their vendor credit risk and builds confidence in your reliability.

- Step 3: Ask directly and transparently. When approaching a vendor, explain why net 90 terms align with your payment cycles or business model. Most vendors say communication breakdowns are the top cause of late payments. Clarity builds trust and positions your request as a shared benefit.

- Step 4: Offer something in return. If you ask for more time, be prepared to give something back. That could be a larger order, a longer contract, or agreeing to electronic payments to speed up processing. These concessions help vendors feel like they are gaining value in the exchange.

- Step 5: Stick to the agreement. Once net 90 terms are in place, hit every due date. Late payments erode trust fast. If you anticipate a delay, let your vendor know as early as possible. Proactive communication shows accountability and helps protect the business relationship.

Building a smarter vendor terms strategy based on business goals

Net 90 terms can reduce cash flow problems, give you room to grow, and improve your working capital management. But they only work when used strategically. Stretching payables without a plan can lead to vendor friction, hidden costs, and disrupted operations.

Start by identifying which vendors align with your payment cycles and can support extended terms without sacrificing reliability. Look for partners that value long-term relationships and are open to flexible agreements, especially if you bring consistent volume or strategic value.

At the same time, define your goals. Are you trying to improve liquidity, reduce financing costs, or scale operations? Your vendor terms should support those outcomes. Businesses that tailor payment strategies to their financial objectives are more likely to stay solvent, scale faster, and avoid unnecessary borrowing.

The smartest approach is to build vendor terms around your goals. You should negotiate carefully, communicate clearly, and pay on time.

Ramp's vendor management platform helps you turn strategy into action. With features like contract storage, price intelligence, and automated renewals, the platform enables finance teams to manage vendor terms proactively, stay compliant, and align every contract with larger business goals.

FAQs

Yes, if not managed properly. Missing payment deadlines on net 90 terms can negatively impact your business credit score, especially if the vendor offers credit reporting to bureaus.

While larger businesses typically have more leverage, small businesses can negotiate net 90 terms by offering upfront value. This includes consistent order volume, fast onboarding, or streamlined invoicing processes.

Some vendors offer early payment discounts, commonly 1–2%, if you pay before the due date. Others may simply appreciate the prompt payment, which can strengthen your negotiating position for future deals.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits