The new state of finance operations, according to Plastiq, 1Password, SwagUp, and 100+ professionals

- The challenges brought on by remote work

- 4 strategies for the forward-thinking finance leader

- Digital-first finance tools enable seamless remote collaboration

- What's next for finance operations

Finance operations has traditionally been an in-office function. But in the last year, processes that were highly manual and reliant on paper documentation changed by necessity. As offices slowly reopen, finance teams everywhere are once again re-assessing the way they work. Moreover, in many cases, they've been tasked with helping their organizations transition to hybrid and remote work.

We surveyed 101 finance managers from small startups to large enterprises to understand what changes they’ve made to their operations in the past year and what changes they plan to keep. Additionally, we spoke with top finance leaders to learn how they’re thinking ahead, including:

Here’s a look at how finance operations have changed in the past year—and the next wave of changes coming as we look to the future.

The challenges brought on by remote work

In 2020, many areas of finance work became challenging to manage remotely due to legacy systems and processes that relied on hard-copy documentation and in-person communication. The abrupt shift to remote work exposed the fragility and ineffectiveness of these systems.

Month-end reconciliation was especially cumbersome in a virtual setting, as reported by 30% of respondents, followed by employee reimbursements (29%) and accounts payable (28%). Indeed, many teams never made a full transition to remote work. “Check payments come to the office, so someone in accounts receivable has to be in the office,” noted one respondent. Others reported that team members had to go into the office to process invoices.

But with other employees working from home, getting information now required more effort. “It was no longer as simple as walking across the hall,” wrote one respondent. “Now, we need to see if someone is online and hope they answer.”

Omar Choucair, CFO of Trintech, summed up the challenges well in a recent CFO Dive article: “A virtual financial close is more challenging when you rely on dated and siloed technological infrastructure. When data comes from disparate sources and is manually processed, opportunities for delay and error increase. Add to that a team working in entirely different places, and there is a particular challenge.”

In response to these challenges, 73% of respondents in our survey adopted new finance operations tools and processes. Changes ranged from large-scale retooling to smaller optimizations. Some examples from our research:

- SwagUp adopted Trello to help teams increase productivity and transparency across projects without the need for extra meetings. They also implemented a new employee reward platform Bonusly to bolster virtual employee recognition and engagement.

- 1Password started using AWS Workspaces to collaborate on and store permanent files instead of a traditional shared drive. They also switched from on-premise software to NetSuite for accounting.

- Customer engagement platform 6sense leaned into automation. According to its CFO Rob Goldberg, “Every place where we have a process flow involving downloading something and putting it into a spreadsheet as a CSV file, and uploading it to another system, is ripe for change. Ideally, in the next six months, we'll replace that with some form of automation.”

Most respondents reported positive benefits from the changes they made: 47% percent said their new tools and processes led to greater financial control, 34% reported increased compliance, and 33% saw efficiency gains.

Given these benefits, many of these new tools and systems will become a permanent part of finance operations.

4 strategies for the forward-thinking finance leader

The nature of work has changed irrevocably for all functions and finance teams everywhere are stepping up to help their companies adapt. We spoke with a few leaders to learn what strategies they’re using to guide their organizations.

1. Proactively plan for a hybrid workforce

The rise of hybrid and remote work means that finance teams need to consider new logistical needs for their organizations. What kind of IT does a distributed workforce require? How much travel will teams be doing in a hybrid world? How should offices be handled?

SwagUp Chief of Staff Sarah Sakura flagged staffing as a key area that finance teams should pay attention to in particular: “A shift toward outsourcing will likely increase since most companies had to slash headcount and found that this did not fully handicap the organization. There will be an overabundance of tools to solve the macro to the micro as the workforce rebalances post-pandemic.”

2. Adopt automation to improve spend control

It’s difficult to predict just how business operations, from marketing to sales, will continue to evolve in the coming year. That’s why, for Plastiq CFO Amir Jafari, the most important work that finance teams can do right now is to improve their efficiency and spend control so they’re prepared for whatever changes come their way.

Greater controls shouldn’t translate to more red tape for employees. According to Jafari: “The world of procure-to-pay, which is asking people to open a purchase order for every single thing, that’s unrealistic. Controls doesn’t mean you go so deep where someone buys something and I ask him 500 questions [and require] 10 receipts, a picture of the store, a picture of the goods. That’s excessive control. It needs to be something simpler.”

In Jafari’s mind, simple spend control means that employees should be able to easily swipe a card and get managers to review the expense in real-time. From there, tools should automatically collect receipts on behalf of finance teams and integrate with accounting systems to seamlessly log the expense.

For this reason, Jafari thinks finance leaders should continuously evaluate their toolset, particularly historical solutions that are not open platforms. The best tools should enable open data flows between different systems so teams can easily gain insights. They should offer a great user experience, to ensure adoption by teams. Per Jafari, “Booking a journal entry is one level of data. Knowing what happened in all of our travel spend without having 20 people download data to go analyze it so that we know what's happening? That’s the automation element.”

3. Put more focus on business continuity planning

Given the experience of the last 18 months, another area where finance leaders should take a more proactive approach is business continuity planning and strategies to handle sudden widespread disruption to business operations.

Swagup's Sakura predicts the following: “Finance teams will now include a complete in-person workforce shutdown in all forecasting, which will likely impact budgets, spending, and less risky decision-making.”

6sense’s Goldberg is thinking along the same lines. When the pandemic hit, “it took four weeks and involved our entire customer success team, half our sales team, a large part of the management team, and even some of our board members” to revise their forecast, he said. "We want to be able to do that better."

4. Stay close to your employees

Every leader we spoke with agreed on one thing: the most important thing that finance leaders can do as they prepare for the reopening of workplaces is to stay attuned to their employees’ concerns and well-being.

1Password’s CFO Jeannie De Guzman shared this advice: “Be on the lookout for burnout. I think we’ve all felt it this year where there was nothing to do but work—and so people just worked and continuously delayed their vacation in hopes of travel opening up. 18 months in and I know some people out there haven’t taken the time to refresh. Everyone needs to take a break, even if it’s a staycation—so I urge leaders to ensure their teams are getting the rest they need.”

Plastiq plans to do a soft office opening that “is going to be very human centric,” according to Jafari. “It’s got to be a safe environment for employees where there’s a comfort level to go back to.”

SwagUp’s Sakura offered these best practices: “Allow your team to provide input and have a say in what the future of your company's in-person expectations are, even if the final decision is ultimately to return to the office. Feeling heard is ultimately what employees crave, particularly when it comes to situations (like a pandemic) that have been completely out of their control. At the end of the day, your team will want to put their best foot forward, but that is far easier to do when they feel the company is also looking out for their best interest.”

Digital-first finance tools enable seamless remote collaboration

Managing finance operations across distributed teams creates unique challenges. You're juggling expense reports from employees in different time zones, struggling to maintain visibility into spending when you can't physically review receipts, and dealing with the security risks of sharing sensitive financial data through unsecured channels. Traditional finance processes that rely on paper receipts, in-person approvals, and desktop-only software simply don't work when your team is spread across locations.

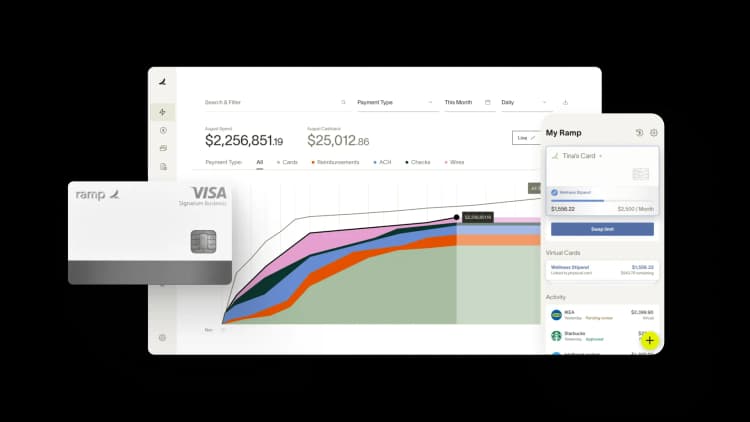

Ramp transforms these outdated workflows with expense management automation that works anywhere your team does. The mobile app lets employees capture receipts instantly by taking a photo, eliminating the need to save physical receipts or scan them later. Your finance team can review and approve expenses in real-time from any device, cutting the typical reimbursement cycle from weeks to days. This immediate visibility means you catch policy violations or unusual spending patterns right away, not at month-end when it's too late to address them.

The platform's automated controls and approval workflows replace manual oversight with intelligent guardrails that work 24/7. You can set spending limits, merchant restrictions, and category rules that apply automatically to every transaction, regardless of where employees are working. When someone tries to book a flight outside policy guidelines or exceeds their monthly software subscription limit, Ramp blocks the transaction before it happens.

Multi-level approval chains route high-value purchases to the right stakeholders automatically, maintaining proper oversight without creating bottlenecks. These digital-first features give you stronger financial controls than traditional processes while eliminating the friction that slows down remote teams. Your distributed workforce gets the flexibility they need to be productive from anywhere, while you maintain the visibility and control necessary to manage spending effectively.

What's next for finance operations

The shift to digital finance tools has done more than streamline processes—it's fundamentally changing what finance teams do. Today's finance leaders aren't just number crunchers. They're strategic partners who shape company culture and drive business decisions.

As 1Password's De Guzman puts it: "I see finance teams playing a bigger role in the operations of a company as a business partner to the rest of the organization. I think it's only a matter of time before we start calling finance professionals 'Finance Business Partners' like they do in HR."

This evolution demands new skills. Success now depends on your ability to connect with employees across the organization and anticipate their needs before problems arise. The best finance leaders combine analytical expertise with deep empathy—using data to tell stories that resonate with every department.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Compared to our previous vendor, Ramp gave us true transaction-level granularity, making it possible for me to audit thousands of transactions in record time.”

Lisa Norris

Director of Compliance & Privacy Officer, ABB Optical

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°