Operational budget vs. capital budget: Key differences and examples

- What is an operational budget?

- What is a capital budget?

- Why is budgeting in strategic planning important?

- Examples of operational and capital budgeting across industries

- Tools and software for effective budgeting

- Track operational and capital budgets in one unified view

Operational and capital budgets form the financial foundation of your business. An operational budget covers your day-to-day expenses, like payroll, rent, and office supplies, within a fiscal year. A capital budget, on the other hand, plans for significant long-term investments such as equipment purchases or facility expansions that benefit your company for years.

These two types of budgets are essential for achieving your strategic objectives, managing capital expenditures, and ensuring strong financial health across your organization. We cover the definitions and key differences between a capital vs. operating budget and how to use each budget type strategically.

What is an operational budget?

An operational budget is a financial plan that outlines your expected revenues and expenses for routine activities over a set period, usually a fiscal year. It focuses on short-term planning and provides a framework for monitoring and controlling everyday business costs.

Key components typically include direct costs like raw materials and labor, indirect costs like utilities and administrative expenses, projected revenue, departmental breakdowns, and variance tracking.

Operational budgets support financial stability by helping you track spending patterns, identify cost control opportunities, and ensure adequate cash flow for daily operations. They also contribute to overall operational efficiency by aligning spending with department-level objectives and ensuring teams stay within their means.

What is a capital budget?

A capital budget is a financial plan for major investments in long-term assets or projects that support business growth and provide value over multiple years. It focuses on high-cost initiatives, like equipment purchases or facility upgrades, that improve productivity, efficiency, or competitiveness.

Capital budgets typically include project descriptions, estimated costs, expected return on investment (ROI), timelines, funding sources, and risk assessments. These budgets often cover investments such as new manufacturing equipment, upgrading IT infrastructure, renovating facilities, or expanding operations.

A capital budget helps businesses prioritize large investments that can increase efficiency and expand market reach while supporting strategic financial goals and long-term resource allocation planning.

Why is budgeting in strategic planning important?

Effective budgeting ensures you allocate resources wisely and that your financial decisions align with your strategic goals. By setting clear spending limits and revenue targets, you can prioritize key initiatives while maintaining reserves for unexpected challenges.

Well-structured budgets guide decision making, such as identifying cost-saving opportunities during downturns with minimal disruption to operations.

They also shape procurement strategy. Operational budgets inform routine purchasing and vendor negotiations, while capital budgets support major investments and long-term vendor relationships.

Ultimately, budgets turn high-level goals into concrete financial plans that support long-term budget management and day-to-day business running.

Examples of operational and capital budgeting across industries

Budgeting practices look different depending on your industry and organization size. Here’s a look at operational vs. capital budgeting examples across four different industries:

Manufacturing

Manufacturers rely heavily on operational budgets to manage production inputs like raw materials, direct labor, equipment maintenance, and energy use. For example, a furniture business might track the costs of wood, fabric, hardware, and labor to maintain profitability and set competitive prices.

Technology

In the tech sector, capital budgets often focus on infrastructure. A software company, for example, may invest in cloud platforms to support new services, factoring in hardware and software costs, implementation expenses, and potential gains from scalability and efficiency.

Government

Government agencies operate within rigid fiscal constraints and are accountable to the public. Budgets are shaped by tax revenues, bond funding, and strict regulatory requirements, making both operational and capital planning critical.

Healthcare

Healthcare providers must strike a balance between operational costs and capital investments, sometimes referred to as capital vs. O&M (operations and maintenance) budgeting, while navigating reimbursement models and regulatory demands.

Tools and software for effective budgeting

You can use a range of tools to streamline your budgeting process, including:

- Spreadsheets: Spreadsheets are ideal for smaller teams looking for flexibility and customization. While not purpose-built for budgeting, free platforms like Microsoft Excel and Google Sheets are easy to use and familiar to most teams, making them great for building simple budget templates and manually tracking costs.

- Dedicated budgeting platforms: Platforms like Planful and Prophix are specifically designed for financial planning and analysis. These tools help mid-sized organizations create more accurate budgets, forecast cash flow, and model different financial scenarios with ease.

- Enterprise resource planning (ERP) systems: Larger organizations use an ERP to integrate budgeting with broader financial operations like accounting, procurement, and reporting. Platforms like Oracle, NetSuite, and SAP provide real-time data and a single source of truth.

Track operational and capital budgets in one unified view

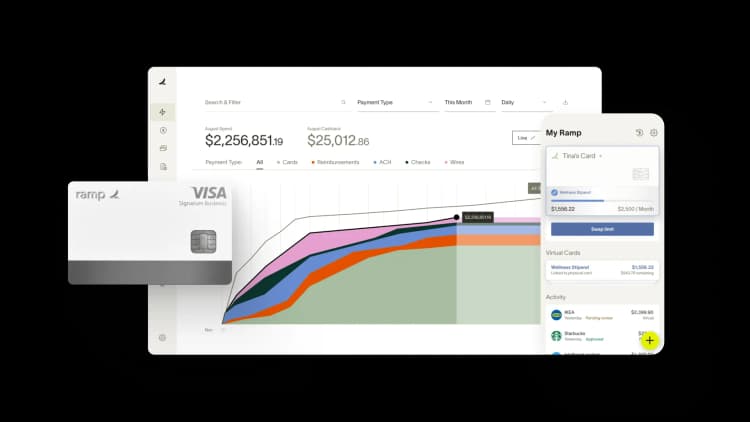

Separating operational expenses from capital investments sounds simple until you're juggling spreadsheets, chasing down department heads for updates, and reconciling numbers that never quite match. Ramp Budgets gives you real-time visibility into both budget types from a single dashboard, so you always know where your money is going.

Ramp lets you create distinct budgets for operational costs like payroll and utilities alongside capital expenditures like equipment purchases or facility upgrades. You can track each budget by department, vendor, category, or custom dimensions that match how your business actually operates.

Here's how Ramp helps you manage both budget types effectively:

- Set spending notifications: Configure alerts at specific spending levels for each budget so you know immediately when operational costs creep up or capital projects approach their limits

- Include budget owners in approvals: Route expense requests through the people who own each budget, giving them visibility into how each transaction affects their remaining balance

- See projected impact before approving: Review how each pending expense will affect your budgets before you approve it, preventing surprises at month-end

- Monitor committed spend: Track upcoming obligations alongside historical transactions, so your budget reflects both what you've spent and what you've committed to spend

- Nest budgets hierarchically: Roll up departmental operational budgets into company-wide totals while keeping capital projects separate and trackable

Learn more about how Ramp can simplify budget tracking across your entire organization.

FAQs

The two main types include traditional methods and modern methods. Traditional methods include techniques like the payback period and accounting rate of return, which are simpler but less precise. Modern methods, such as net present value (NPV) and internal rate of return (IRR), account for the time value of money and provide more accurate investment evaluations.

An operating budget outlines projected revenues and expenses for day-to-day business activities over a specific period, usually a fiscal year. A cash budget focuses solely on expected cash inflows and outflows to help manage liquidity and ensure the business can meet its short-term obligations.

Emerging trends in operational and capital budgeting center around automation, data-driven forecasting, and flexible planning models. Businesses are increasingly using AI-powered tools, real-time dashboards, and predictive analytics to improve accuracy and responsiveness.

Traditional annual budgets are being replaced by rolling forecasts, zero-based budgeting, and driver-based models that better align spending with strategic goals and operational performance.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits