What is payroll automation, and how does it work?

- What is payroll automation?

- How does payroll automation work?

- What are the benefits of payroll automation for small businesses?

- Common payroll automation features

- How to implement payroll automation

- Payroll automation software examples

- Payroll automation best practices

- Common payroll automation challenges and solutions

- Streamline payroll and accounting with Ramp

Payroll automation simplifies the work of paying employees accurately and on time, especially for teams that still rely on manual calculations and spreadsheets. Instead of calculating wages, applying tax rules, and entering data by hand, automated payroll software handles these steps for you and works seamlessly with tools like accounting automation and automated vendor management.

What is payroll automation?

Payroll automation is the use of software to calculate wages, apply tax rules, track deductions, and run payroll with minimal manual work. It reduces the time spent entering data by hand and lowers the risk of errors that come from manually calculating pay, overtime, and taxes.

Manual payroll relies on spreadsheets and hand calculations, while semi-automated payroll uses basic tools but still requires manual data transfer and review. Fully automated payroll systems handle the entire workflow for you, from importing hours to processing payments and generating payroll reports. Most systems also include automated wage and tax calculations, direct deposit, time-tracking integrations, employee self-service tools, and secure digital recordkeeping.

Here’s how different levels of automation compare:

| Level of automation | How it works | Pros | Cons |

|---|---|---|---|

| Manual payroll | Hand calculations and data entry in spreadsheets | Low software cost, full control | High error risk, time-consuming, compliance risk |

| Semi-automated payroll | Basic tools help with some steps but require manual review | Reduces some manual work | Still requires data transfer and oversight |

| Fully automated payroll | Integrated system handles calculations, taxes, filings, and payments | Fast, accurate, scalable; lowest long-term cost | Requires setup and onboarding |

How does payroll automation work?

Payroll automation works by pulling in the employee data you already collect, such as hours worked, salaries, tax information, and benefits, and using software to handle the calculations and payments for you. Once the system has accurate payroll details, it calculates wages, applies the right tax rules, and schedules payments automatically.

Behind the scenes, the software follows a repeatable workflow: it imports time and attendance data, applies pay rules, updates tax tables, generates payroll summaries, and prepares pay stubs and tax documents. Many tools also sync payroll data to your accounting system so expenses stay current without additional data entry.

Key components of automated payroll systems

A modern payroll system includes tools that work together to reduce the manual work of running payroll. These components pull in time and attendance data, apply the correct rules, and help you pay employees accurately each cycle:

- Time and attendance tracking pulls in hours worked without manual entry

- Tax calculation engines automatically apply the correct tax rates and deductions

- Direct deposit processing pays employees quickly and securely

- Reporting and compliance tools create payroll summaries, tax documents, and audit-ready records

Integration with other business systems

Automated payroll works best when it connects to the tools you already use. Many payroll platforms integrate with:

- Human resources information system (HRIS) software, so employee details update automatically

- Accounting software, keeping payroll expenses synced with your books

- Benefits platforms, helping you manage deductions and contributions without extra work

What are the benefits of payroll automation for small businesses?

Setting up an automated payroll system takes some upfront work, but the time and cost savings you gain quickly outweigh the effort. Here are the main ways automation helps small businesses:

Time and cost savings

Manual payroll can take hours each pay period, especially if you're tracking hours, taxes, and deductions by hand. Many small businesses see a fast return on investment because the software reduces the need for manual reviews and eliminates the time spent fixing payroll journal entry mistakes.

Improved accuracy and compliance

Automation reduces the chance of human error by calculating wages, deductions, and overtime automatically. Automated payroll also keeps tax tables updated in real time and handles tax filings for you, helping you stay compliant. Built-in audit trails make it easier to track changes and prepare for year-end reporting.

Enhanced employee experience

Employees can access pay information through self-service portals, often from their phone, without waiting for HR or their manager. This gives them instant access to pay stubs, tax forms, and time-off balances and helps resolve payroll questions faster. A smoother experience leads to fewer back-and-forths and happier employees overall.

Common payroll automation features

Every company has different priorities when choosing automated payroll software, but most teams look for the same core features:

- Automatic tax calculations and withholdings

- Time tracking and overtime calculations

- PTO and leave tracking

- Same-day direct deposit

- Software integrations

- 24/7 support

Compliance and reporting features

A strong payroll system should also help you stay compliant by offering:

- Year-end tax forms like W-2s and 1099s

- Automatic state, local, and federal tax filing

- New-hire reporting

- Labor law compliance tracking and audit-friendly reporting

Employee self-service capabilities

Payroll process automation improves the employee experience with tools such as:

- Access to pay stubs and tax forms

- PTO balance and request tracking

- The ability to update personal information

- Mobile access for on-the-go viewing

How to implement payroll automation

Before switching to automated payroll, take a close look at your current process so you know where automation will help most. Identify where you’re spending the most time, where mistakes tend to happen, and how much payroll currently costs in hours and actual expenses. From there, set simple goals for automation, whether that’s reducing manual data entry, shortening payroll cycles, or eliminating compliance errors.

1. Find a payroll system that works for you

Not all automated payroll systems are created equally. Choose a product that fits your company size, expected growth, and budget. As you compare tools, look for key features like automated tax calculations, time-tracking integrations, direct deposit options, and self-service portals. Questions you may want to ask include:

- Will this payroll software save me time and money?

- Will this tool work with my current HR software?

- Will this payroll provider work for the size of my business as it grows?

- Does this payroll solution fit within my budget?

2. Input your information into the system

Your automated system is only as good as the information you give it. Enter your payroll data and employee information carefully the first time to avoid errors later. This step often includes migrating data from spreadsheets or older systems, so double-check employee details, tax documents, and pay rates before going live.

3. Make sure you have the necessary documents and processes in place before launching

Get your tax forms and documents (EIN, I-9, W-4) ready, and make sure employees are aware of the switch before you roll it out. Some businesses run a brief parallel period, processing one or two payroll cycles in both the old and new systems, to confirm everything works correctly.

4. Train any employees who will use the automated payroll system

Give employees time to learn the new system, whether you handle training internally or enlist outside help. The American Payroll Association is a good option if you’re considering outsourced training. Clear communication and some light change-management support can make the transition smooth and help everyone feel confident using the new tools.

Payroll automation software examples

Here are a few payroll software options that show how different platforms approach automation:

Square Payroll

Square Payroll automates employee wage calculations, tax deductions, and salary payments via direct deposit. It can also calculate, file, and pay your state, federal, and local payroll taxes. Known for its user-friendly interface, Square integrates seamlessly with other Square products.

QuickBooks Payroll

QuickBooks Payroll automates salary calculations, tax deductions, and payroll tax filings. It integrates with QuickBooks accounting software, offers flexible payment options like direct deposit, updates tax tables automatically, and provides detailed payroll reports.

ADP Payroll

ADP Payroll supports businesses of all sizes and includes payroll calculations, tax deductions, and payroll tax management. It integrates with a wide range of HR and financial systems and offers multiple payment options along with comprehensive reporting. ADP also provides automatic updates to stay aligned with changing tax laws and labor regulations.

Payroll automation best practices

Once your automated payroll system is in place, a few best practices can help everything run reliably and efficiently:

- Conduct regular system audits and updates to keep employee details, tax rates, and deductions accurate

- Maintain strong data security by limiting access to sensitive payroll information and updating permissions as your team changes

- Create backup processes or enable automatic backups to ensure you always have secure copies of payroll data

- Establish clear approval workflows, such as manager review of hours or a final check before payroll runs

- Provide ongoing training and support so employees stay confident using the system as new features roll out

Common payroll automation challenges and solutions

Even with the right tools, switching to automated payroll can come with a few bumps along the way. Being aware of these challenges ahead of time makes the transition smoother and helps you get more value from your system over the long term.

Implementation challenges

Some businesses run into data migration issues when moving information from spreadsheets or older payroll tools into a new system. Giving yourself time to clean up employee records before importing them can help avoid errors later.

You may see some resistance from employees who are used to the old process, especially if they’re unsure how the new system works. Clear communication and short training sessions usually solve this quickly. Integration can also be tricky if you rely on multiple HR or accounting tools, so it helps to confirm that your new payroll software connects smoothly with the systems you already use.

Ongoing management considerations

Once everything is up and running, the main challenges tend to come from staying current with changing tax laws and handling exceptions like bonuses, garnishments, or mid-cycle adjustments. Most modern systems update automatically, but it’s still wise to review changes occasionally.

You may also need to maintain strong vendor relationships if you integrate payroll with accounting, HR, or time-tracking platforms. Consistent upkeep helps keep everything synced and accurate.

Streamline payroll and accounting with Ramp

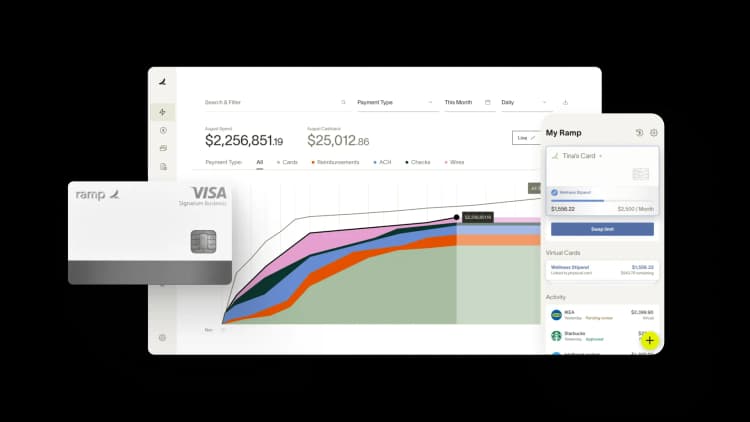

Ramp’s accounting automation software helps you close the books faster and keep your payroll data clean, consistent, and fully synced.

By connecting with the payroll and accounting tools you already use, like QuickBooks, NetSuite, Xero, and Square Payroll, Ramp automatically pulls in expenses, categorizes transactions based on past patterns, and ensures every receipt is collected and coded correctly.

With automated reconciliations, real-time syncing, and built-in error detection, we speed up your monthly close, eliminate repetitive data entry, and reduce the risk of human mistakes.

Ready to get started? Explore a free interactive demo.

FAQs

An automated payroll system can calculate employee wages, deduct taxes and benefits, process direct deposits, generate pay stubs, and maintain payroll records for compliance and reporting purposes. It can also automate tax filings and manage year-end forms like W-2s and 1099s., normal

There are free automated payroll software options, such as Payroll4Free and Wave Payroll (for basic functions), though they often have limitations like paid add-ons for tax filing or direct deposit services.

AI can’t run payroll completely on its own, but it can automate most of the work for you. Many payroll systems use AI to handle calculations, catch errors, update tax rules, and streamline approvals, so you spend far less time on manual payroll tasks.

It’s a good idea to start using payroll automation software once you’re spending more time on payroll than on running your business. If you have employees, recurring payments, or growing compliance needs, automation can make the process much easier.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits