The best business expense tracking apps and tools of 2026

- At a glance: Comparing the best expense trackers for business

- 1. Ramp: Best expense tracker overall

- 2. Zoho Expense

- 3. Expensify

- 4. SAP Concur

- 5. FreshBooks

- What is expense tracking?

- How to choose a business expense tracker

- Why Ramp is the best expense tracker for business

- Get more from your expense tracker

Key takeaways

- Expense tracking is the process of recording, categorizing, and monitoring your business spending to improve budgeting, financial decisions, and tax preparation.

- The best expense tracking apps vary in pricing, features, and ideal use cases, from tools for freelancers to platforms designed for complex enterprise needs.

- When choosing a tool, you should evaluate its cost, ease of use, integration capabilities with your accounting software, and scalability for future growth.

- Automating expense tracking with dedicated software helps you reduce errors, improve policy compliance, and control spending more effectively than manual methods like spreadsheets.

- Ramp automates the entire expense management process by combining corporate cards with AI-powered software that captures receipts, enforces spending policies, and syncs with your accounting system.

Regularly monitoring your business expenses helps set accurate budgets, maximize tax deductions, and curb out-of-policy spending. That's why robust expense management software is essential.

Sure, you may be able to get away with manual expense tracking, especially as a small business owner or startup. But as you grow, using the best expense management software to track spending automatically will make your life a whole lot easier. More than half of small businesses still rely on spreadsheets for financial management, and 37% cite poor integration between tools as a top challenge—strong signals to graduate from manual tracking sooner rather than later.

In this article, we take a deeper dive into some of the most popular expense tracking apps available today, including Zoho Expense, Expensify, SAP Concur, FreshBooks, and our own Ramp. But before we get started, let’s clarify what it means to track business expenses and what the general process looks like.

At a glance: Comparing the best expense trackers for business

Here are our top choices for the best expense trackers available today, selected on key factors like features, integrations, ease of use, pricing, and more:

Tool | Best For | G2 Rating | Starting Price | Pricing Tiers | Free Trial/Promo | Platform Availability |

|---|---|---|---|---|---|---|

Ramp | Overall best business expense tracker | 4.8 | Free | $15/user/mo. for Ramp Plus, Enterprise pricing available | Unlimited free tier | Web, iOS, Android |

Zoho Expense | Existing Zoho users | 4.5 | Free for 3 users + 20 scans | $5/user/mo. (Standard), $9/user/mo. (Premium), Enterprise pricing | 14-day free trial; Free plan with usage limits | Web, iOS, Android |

Expensify | Simple use cases | 4.5 | Free for individuals | $5/user/mo. (Collect), $9/user/mo. (Control), up to $36/user/mo. | Free for individuals | Web, iOS, Android |

SAP Concur | Complex expense needs | 4.0 | Quote-based | All pricing is quote-based | 15-day free trial | Web, iOS, Android |

FreshBooks | Freelancers and small teams | 4.5 | $8.40/mo. (Lite) | $38/mo. (Plus), $65/mo. (Premium), Select plan (custom quote) | 30-day free trial | Web, iOS, Android |

1. Ramp: Best expense tracker overall

Ramp is an all-in-one expense management platform with integrated corporate cards. Its user-friendly web and mobile applications help automate expense tracking with the power of AI. Ramp integrates seamlessly with your tech stack, including popular accounting platforms like Xero, QuickBooks, NetSuite, and Sage Intacct. Some of Ramp’s features include:

- AI-powered receipt capture: Ramp's mobile app lets your employees upload receipts using their smartphone cameras and automatically matches the expense with predefined business expense categories

- Automated expense categorization: Ramp automatically categorizes receipts, making expense reporting and reimbursements fast and easy

- Bank integrations: Ramp has 60+ bank integrations, allowing you to manage all your bank accounts from one centralized platform

- Real-time spend reporting: Ramp's expense management platform lets you see all your business's expenses in a single dashboard, simplifying financial reporting

- Intelligent recommendations: Ramp Intelligence provides actionable insights related to your expenses, like alerting you to overpriced vendors and duplicate subscriptions

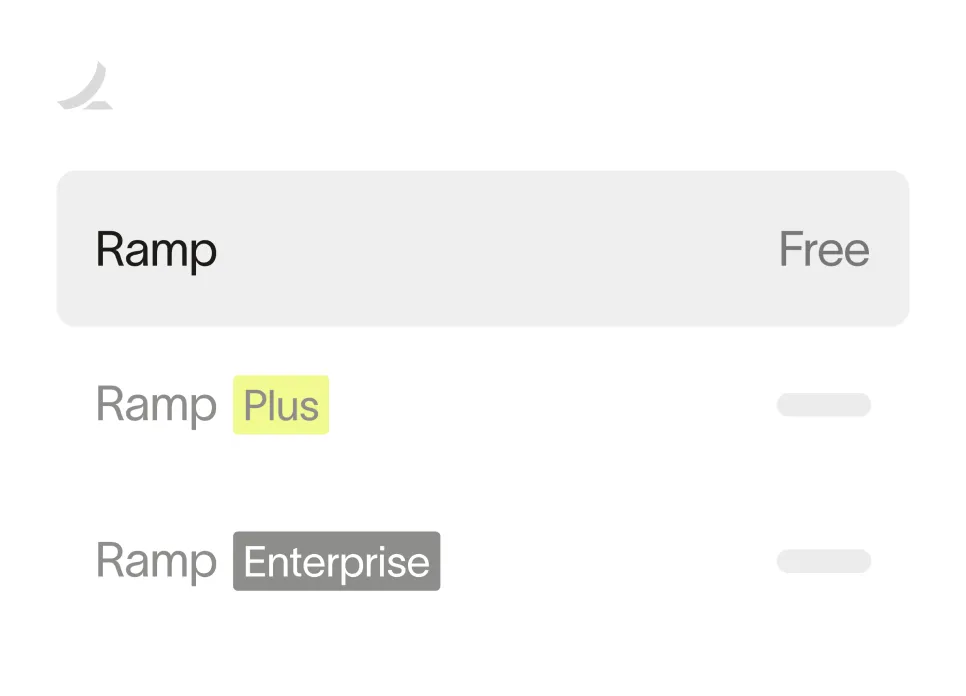

Pricing: Ramp offers an unlimited free tier with access to its most powerful expense management features, including expense tracking, reporting, and reimbursements. For even more control, you can upgrade to Ramp Plus for $15 per user per month. Ramp also offers enterprise pricing on request—just reach out for a quote.

Ready to take control of your finances?

Learn about Ramp’s pricing plans and start saving today.

2. Zoho Expense

Zoho Expense is another popular business expense tracker, with cloud-based applications available on web, mobile, and desktop. Zoho Expense can also integrate seamlessly with Zoho's dedicated accounting software. Its features include:

- Cash advances: Zoho’s platform allows employees to request cash advances ahead of work trips or upcoming expenses

- Delegation: Allows users to delegate admin roles to other employees, giving them the power to manage expense reports submitted by other employees

- Budgeting: Zoho lets users create budgets for projects or business units and compare them against real-time or current expenses

Pricing: Zoho offers a 14-day free trial for its Standard and Premium plans. If you choose annual billing, the Standard plan starts at $4 per user per month, while the Premium plan starts at $7 per user per month. Custom pricing is available for businesses with more than 100 users.

3. Expensify

Expensify is another expense tracker for businesses. It also offers expense management features, an integrated credit card, and a mobile app for expense reporting while on the go. Some of Expensify's features include:

- Corporate card reconciliation: The Expensify app allows users to track all their corporate card data on one platform for easy confirmation, review, and expense management workflows

- Extensive integrations: Expensify integrates with many popular accounting systems and HR platforms, and offers travel and receipt integrations with common vendors like rideshare companies and airlines

- One-click receipt scanning: Expensify’s receipt scanner automatically captures expense details and pulls them into an expense report

Pricing: Expensify is more expensive than other expense trackers, with costs as high as $36 per user per month. Your rate will vary based on your plan, your number of monthly users, whether you use Expensify’s corporate card, and how much you spend each month on your Expensify card. It’s best to check out their billing support page for the full details.

4. SAP Concur

SAP Concur offers businesses customized plans, with pricing based on their unique needs. Due to its somewhat dated UI, Concur may take more time for employees to learn, use, and navigate. It also doesn't analyze your spend for savings insights, unlike many other business expense trackers on the market today. Its features include:

- Integration with existing systems: SAP Concur has integrations with over 100 systems and lets users customize their integrations according to their specific needs

- ROI calculator: SAP’s platform lets users calculate their return on investment (ROI), which is crucial for justifying business expenses.

- Automated invoice management: Streamline the invoicing process, ensuring that all invoices are processed and paid on time

Pricing: SAP Concur Expense offers a 15-day trial, and all pricing is quote-based. However, the platform is free for existing Concur customers.

5. FreshBooks

FreshBooks is another cloud-based business expense tracker with a heavy emphasis on invoicing; unsurprisingly, it’s a popular choice for businesses with extensive invoicing and invoice management needs. FreshBooks’ other features include:

- Bill business expenses: Allows users to mark expenses as billable and automatically convert them into invoices for their clients

- Cloud receipt storage: Stores all expense receipts in the cloud, so it doesn't matter whether they update their expenses on mobile or desktop—all the records will match

- Automatic expense categorization: Makes tax filing easier by automatically bucketing expenses into several default expense categories

Pricing: FreshBooks offers a 30-day trial and has four plans to choose from:

- $21 per month for Lite

- $38 per month for Plus

- $65 per month for Premium

- Reach out for a quote for Select

Note that additional users cost $11 per month for each plan.

What is expense tracking?

Expense tracking refers to the process of recording, categorizing, and monitoring your business expenses to understand where you're spending money. Business expense tracking helps you set more accurate budgets, make better financial decisions, and prepare your business for tax season.

The expense tracking process is pretty consistent from one business to another. Here are the basic steps:

- Collect and retain all receipts and invoices related to your business transactions

- Properly categorize each expense to determine whether it’s tax-deductible

- Add these details to your financial records regularly

Many small businesses get by with manual expense tracking methods like Excel spreadsheets or other templates. However, using purpose-built expense management software helps simplify your process and is the best way to track business expenses. Automating the process of tracking, managing, and reimbursing expenses ensures that you reduce errors, improve compliance, and control spending. For compliance, the IRS explicitly expects you to keep records that substantiate business expenses—see Publication 583 and Publication 463 for what to retain and how.

How to choose a business expense tracker

As you’re zeroing in on the best expense tracker for your business, keep these factors in mind before making a decision:

Cost-effectiveness

Make sure the tool’s pricing structure aligns with your budget. Can you save money on user seats? Scrutinize who truly needs access to the tool and who can go without. Could you make do with just the free features? Spare yourself the expense of a paid plan altogether. The idea is to balance affordability with feature set.

Ease of use

It’s important to evaluate expense trackers for user-friendliness before committing to one. An online demo should give a sense of usability. A good UI makes navigating and using the app easier, and training your employees will be more straightforward. Finally, be sure to choose a tool with a mobile app for convenience when you’re on the go.

Integration capabilities

Always check whether the tracking tool integrates well with your existing tech stack, including ERP systems or accounting software. This allows for the smooth and open transfer of information between teams within your company and with any external accountants or bookkeepers as well.

Scalability and functionality

Always consider whether the tool can evolve with your business. As you grow, your expense tracker should be able to process bulk transactions and allow you to easily add new users—ideally, at no extra charge. Finally, don’t underestimate the value of automation. As you make more frequent transactions, automating approval workflows will save you a ton of time.

Security

Your financial data is sensitive and needs to remain safe and secure. Look for a tool with high standards for encryption and security. Learn more about multi-factor authentication, and how they store and back-up your data. Fraud risk is also real: Certified Fraud Examiners estimate organizations lose ~5% of revenue to fraud each year—another reason pre-spend controls and policy checks matter.

Reporting and tracking

Your business expense tracker should offer detailed, customizable reporting capabilities to give you a complete picture of where your business is spending money. This also includes the ability to budget for business expenses so you can see how your actual spend is tracking against your projections. With real-time visibility into your spending patterns, you’ll be able to adjust spend and identify cost-saving opportunities as needed.

Customer support

Last but not least, research the reputation of the software’s customer service or support team before making your purchase. Customer service can be the quickest way out of a mess when things go wrong. Look for live chat support as well as phone support. And, be sure to fully understand the onboarding process, so you’re starting with a strong foundation.

Why Ramp is the best expense tracker for business

For finance teams, managing employee expenses can feel like a constant game of catch-up—chasing receipts, categorizing transactions, and making sure everything aligns with policy. Ramp streamlines the entire process.

Ramp's AI-powered software automatically matches receipts to transactions in real time. Employees simply snap a photo, and Ramp extracts key details like merchant, date, and amount and links them to the correct charge. Finance teams get full visibility into spend without manual matching, while employees save time.

Ramp also makes it easy to enforce spending policies. You can set granular controls and limits by employee, department, or merchant category—whether that’s restricting daily meal spend or limiting business-class flights. Ramp’s AI flags out-of-policy expenses before reimbursement or reconciliation, reducing friction and keeping everyone compliant.

Beyond tracking and controls, Ramp integrates directly with accounting software like QuickBooks, Xero, Sage Intacct, and NetSuite. Expenses sync to your general ledger with consistent categorization and custom GL mapping, making reconciliation and analysis easier.

With automation, built-in controls, and seamless accounting integrations, Ramp simplifies expense management for finance teams while giving employees a clearer, faster experience.

Get more from your expense tracker

Ramp goes beyond basic expense tracking by automating the most time-consuming parts of managing business spend:

- Easy policy enforcement: Automate expense approvals and reimbursements to keep spending aligned with policy

- Accelerated reconciliation: Accurately code, categorize, and map transactions with AI to speed up month-end close

- Accounts payable automation: Manage bills and payments alongside employee expenses in one place

Check out our interactive demo environment and see how Ramp's expense management software saves businesses an average of 5% a year.

FAQs

Expense tracking software is a business app that allows you to automate many processes related to your costs, including budgeting, categorization, corporate cards, reimbursement, and more, depending on the tool you choose.

You can also sync it up directly with any reimbursement policies you have in place to ensure compliance and ease of use for your team.

Life as a small business owner can be hectic, so you may not feel like it’s worth it to track every little expense you make. But these things can add up against your bottom line. Tracking your expenses ensures you’re getting the most out of your budget and any potential tax deductions. You can do this manually, but choosing an automated expense tracker will ultimately save you time and money.

The best tools simplify workflows by automatically capturing receipts, enforcing policies, routing approvals, and issuing reimbursements without extra steps. Ramp brings these workflows together in one place, making the reimbursement process faster, more accurate, and less manual.

Look for tools that go beyond simple tracking by offering budgeting controls, real-time reporting, and seamless integrations with your accounting software. These features ensure expenses are easier to monitor, analyze, and manage as your business grows.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits