5 best payroll systems for startups and small businesses

- What is payroll software?

- Best payroll software for small businesses compared

- 5 best payroll software platforms for startups and small business

- Payroll software functionalities to look for

- Best practices for setting up small business payroll

- Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

You expect your employees to meet deadlines. They expect the same of you, especially when payday comes—and with nearly 60% of Americans saying they live paycheck to paycheck, timing is everything.

The startup world is particularly sensitive because teams are smaller, and errors are easier to notice. Miss a payday or underpay an employee, and it could cause a morale issue. Do it again, and it might escalate into a retention problem.

Enter payroll software. It’s a lifesaver when handling payroll for startups, but how do you know which platform is best for you? Luckily, we’ve done the homework. Below, we’ll compare the five top payroll systems for startups and small businesses.

What is payroll software?

Payroll software is a program that manages and automates the process of paying employees. It handles the time-consuming parts of the process and ensures your business complies with federal, state, and local tax laws.

Tax compliance is especially important for companies with employees in different states. With 22% of the US workforce expected to be working remotely by the end of this year, chances are you’ll soon be paying team members in another state if you aren’t already. Each state has its own unique set of employment laws and tax guidelines. Getting them wrong can mean hefty penalties and fines.

Some platforms go beyond basic payroll systems features—offering add-on services such as tax filing, HR support, health benefits administration, and time tracking.

Best payroll software for small businesses compared

Platform | Ratings | Key Features | Pricing |

|---|---|---|---|

Gusto Payroll | Capterra: 4.6 | Full-service payroll | Simple: $40/month plus $6 per person/month |

RUN Powered by ADP | Capterra: 4.5 | Robust integrations | Variable, based on company size, ADP products already used, functionality, and other factors. |

Intuit QuickBooks Payroll | Capterra: 4.3 | QuickBooks integrations | Payroll core: $50/month plus $6 per employee/month |

Square Payroll | Capterra: 4.7 | Square POS integrations | Full-service: $35/month plus $6 per person/month |

Patriot Software Payroll | Capterra: 4.8 | Unlimited runs | Accounting Basic: $20/month |

5 best payroll software platforms for startups and small business

The right software depends on your business’s unique needs; these are the best options for founders and entrepreneurs to consider. Each one shines in a particular area, but all five platforms simplify payroll for startups and other businesses with their ease of use, flexibility, and abundant features.

Gusto Payroll

Capterra: 4.6 out of 5 | G2: 4.5 out of 5

Best for: Those seeking a comprehensive one-size-fits-all system

Features: Gusto Payroll offers feature-rich yet affordable plans that work well for handling payroll for startups and small businesses. Full-service payroll, unlimited payroll runs, helpful automations, and an easy-to-use interface simplify what’s typically a complicated process for new business owners. Gusto also comes with a suite of human resources (HR) support tools to handle everything from online offer letters to onboarding.

Pros

- Knowledgeable customer support

- Ease of use and intuitive navigation

- Wide-ranging features

Cons

- Customer support can be slow to respond

- Can get pricey, depending on features and number of users

- No global payroll solutions

Pricing

- Simple: $40/month plus $6 per person/month—includes full-service payroll, employee self-service, basic hiring and onboarding, basic PTO and holiday pay, and more

- Plus: $80/month plus $12 per person/month—adds next-day direct deposit, multi-state payroll, time and project tracking, expenses and reimbursements, and more

- Premium: $180/month plus $22 per person/month—adds dedicated customer service, HR resource center, full-service payroll migration and set-up, and more

RUN Powered by ADP

Capterra: 4.5 out of 5 | G2: 4.5 out of 5

Best for: Fast-growing businesses

Features: ADP Run is a great option for scaling organizations with W-2 employees, with its flexible plans and a robust library of accounting, ERP, time and attendance integrations, and more. HR teams can further customize the platform with business insurance, health benefits, and retirement add-ons to make it a full-fledged HR solution. Once businesses are ready to transition to a more powerful solution, they can easily migrate to ADP's mid-market and enterprise payroll options.

Pros

- “Outstanding” customer service

- Simple-to-use reporting functionality

- Easy implementation and employee set-up

Cons

- Pricing can rise quickly as your needs increase

- Some users say features are too limited

- Reporting customization could be more robust

Pricing

- Variable, based on company size, ADP products already used, and other factors, but tiers include:

- Essential: Payroll, taxes, compliance assistance

- Enhance: Adds garnishment payment, state unemployment insurance management, background checks, job-posting functionality

- Complete: Adds HR management (live HR support, compliance alerts, HR forms, and more)

- HR Pro: Adds a complete array of HR offerings (proactive HR support, training, advice, legal help)

Intuit QuickBooks Payroll

Capterra: 4.3 out of 5 | G2: 3.8 out of 5

Best for: Companies using QuickBooks

Pricing

- Payroll core: $50/month plus $6 per employee/month—includes full-service and auto payroll, 1099 E-file & Pay, next-day direct deposit, team management tools, employee portal, and more

- Payroll Premium: $85/month plus $9 per person/month—adds time-tracking, 24/7 support, expert review, HR support center, enhanced team management, and more

- Payroll Elite: $130/month plus $11 per person/month—adds expert setup, tax penalty protection, personal HR advisor, premium team management, and more

- Accounting: Functionality available for additional fees

Features: Because of its seamless integration with QuickBooks Online, QuickBooks Payroll works best with companies already using the brand’s accounting software. But that doesn’t mean this online payroll option won’t work for others. The platform offers easy-to-read reports, unlimited runs, same-day direct deposit, time tracking, and an employee self-service portal with all pricing plans.

Pros

- Financial data accessible anywhere an internet connection is available

- Affordable and comprehensive solution for small businesses

- Extensive integrations with a wide range of third-party offerings

Cons

- Costs can add up for desired functions

- Some users want more in-depth reporting options

- Online version can be slow and doesn’t offer all features of desktop app

Square Payroll

Capterra: 4.7 out of 5 | G2: 4.6 out of 5

Best for: Companies using Square POS

Features: Just as QuickBooks Payroll works great with companies already in the QuickBooks ecosystem, Square Payroll is ideal for retailers and businesses using the Square POS software. It comes with an impressive suite of features for an affordable price, including full-service payroll, automated payroll tax filings, employee benefits, plus timecard, tips, and commissions integrations.

Pros

- Easy-to-use interface and mobile app

- Automatic tax features for state and federal filings

- Compliance management

Cons

- Customization limitations

- High transaction fees

- Some users want speedier transactions

Pricing

- Full-service: $35/month plus $6 per user/month—includes unlimited monthly pay runs, auto payroll, next-day direct deposit, multiple pay rates, employee benefits management, and more

- Contractor-only: $6 per user/month—lacks functionality for full-time employees (new-hire reporting, for example) and offers other features as add-ons, increasing cost

Patriot Software Payroll

Capterra: 4.8 out of 5 | G2: 4.8 out of 5

Best for: Early-stage startups and companies on a budget

Features: Patriot Software Payroll packs a punch for its price. Take advantage of unlimited runs, two-day direct deposit, accounting and HR software integrations, an employee portal, plus free payroll support for all plans. New business owners who aren’t familiar or interested in setting up payroll themselves may find this option particularly helpful. Just hand off your information to a Patriot representative, and they’ll take care of it for you.

Pros

- Time-saving tax-related functions

- Customer service

- Value for the money

Cons

- Customization limitations

- Learning curve can be a bit steep

- Documentation could be more comprehensive

Pricing

- Accounting Basic: $20/month—includes unlimited customers, invoices, vendors, contractors, and payments; automatic bank imports, income and expense tracking, account reconciliation, and more

- Accounting Premium: $30/month—adds user-based permissions, recurring invoices, reminders, receipts and document management, and more

- Basic Payroll: $17/month—free direct deposit, employee portal, unlimited payrolls, free 401(k) integration, and more

- Full Service Payroll: $37/month—adds federal, state, and local tax filings and deposits; year-end tax filings, and guaranteed tax-filing reliability

Payroll software functionalities to look for

If you’re interested in the benefits payroll software for startups and small businesses can bring to your organization, here are some features that every offering should include.

1. Easy to use

Payroll is already difficult enough for most new business owners, so choose a user-friendly offering with a simple interface. Chances are, your team will use the software to update payment information, access pay stubs, and download tax documents, so you’ll also want an intuitive employee portal that’s easy to navigate.

Read reviews, watch YouTube videos, and take advantage of any software trials or demos available. Also look for providers that offer extensive help articles and customer support for you and your team to rely on.

2. Runs payroll automatically

In addition to saving you time on running payroll for startups and similar organizations, the right payroll automation platform ensures you don’t have to hire someone to manage it for you. With the software doing most of the heavy lifting, you’re also much less likely to make a mistake with someone’s paycheck.

Keep an eye out for full-service tools with unlimited runs—and avoid ones that require you to manually initiate payroll yourself.

3. Manages employee benefits

Great benefits help you attract and retain top talent. Some payroll software includes benefits administration tools that allow you to manage employee benefits packages.

Benefits administration features typically include a dashboard to view employee benefit data, a benefits portal where employers and employees can enroll in benefits or update information, and built-in compliance and reporting tools.

If you’re not ready to offer health insurance and other employee benefits just yet, consider choosing a payroll solution that allows you to do so in the future.

4. Offers tax support for full-time, part-time, remote, and contract workers

Depending on what kind of workers you employ, you may be required to submit payroll reports, W-2s, 1099-NEC forms, and other documents to a number of tax agencies throughout the year. Companies with remote employees or additional income reporting requirements have other guidelines to follow as well.

The best payroll software gathers all of this information and submits it to the proper authorities for you, so you don’t have to worry about missing critical deadlines.

5. Integrates with your finance and HR stack

Payroll management software that doesn’t integrate with the other tools in your tech lineup will slow your team down, increase the potential for errors, and ultimately prevent you from getting an accurate look at your company’s finances.

For a streamlined back office experience for your business, make sure the tool you choose offers API integrations for your existing finance automation and HR software.

Best practices for setting up small business payroll

Choosing the best payroll software in the world won’t make much of a difference if you use it incorrectly or follow outdated practices. So, as you set up payroll for your own company, keep these tips in mind to avoid future problems.

Use direct deposit

Enabling direct deposit allows you to simplify the payroll process for you and your employees and send payments to your workers securely.

With this in mind, it’s little wonder that so many businesses have opted for direct deposit. If you plan on doing this, make sure to collect your employees’ banking information during the onboarding process so they don’t have to deal with paper checks in their first few weeks.

Spend the right amount on payroll

Payroll is the largest expense for most small businesses and startups, so it’s important to allocate enough money for it every pay period. Otherwise, you might be short on money for other necessary business expenses.

Stay on top of your finances by estimating, based on your current expenses, what percentage of your funds should go to payroll every month. Check in every few months and adjust this number as needed.

Tools such as Ramp help manage payroll budgets. Streamlined expense management and automation solutions simplify processing, and the tools integrate with payroll software, cutting down on manual tasks.

Classify your workers correctly

Incorrectly classifying employees as independent contractors (or vice versa) could result in unexpected fees and benefits expenses for your business. To avoid this, review resources from the IRS and the Department of Labor before you set up payroll to ensure your workforce is correctly classified.

Because states such as California and New York have updated their employment classification guidelines recently, consider reviewing yours regularly so you remain compliant with the latest employment laws.

Organize your records

Even with an automated solution, your company’s payroll responsibilities don’t end after setup. You’ll want to ensure all your payroll and tax forms are kept organized and safe. Consider making multiple copies and storing them in separate places—such as a digital copy in your payroll software and a hard copy in your office—in case they’re lost or damaged.

Keep in mind that certain documents, such as payroll records and employment information, must be kept on file for several years in case you need them during an audit.

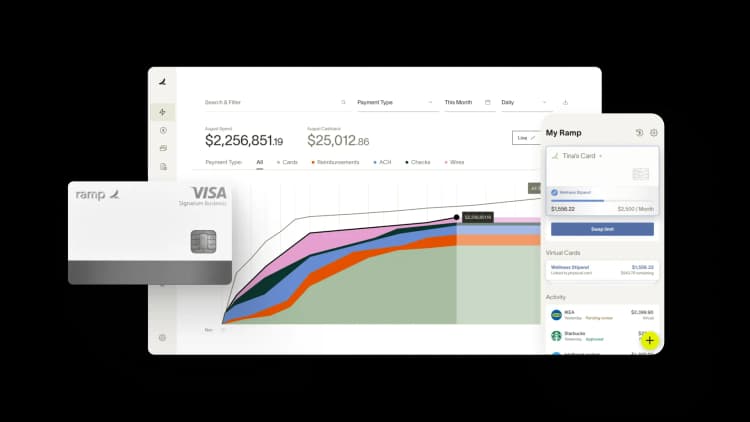

Close your books faster with Ramp’s AI coding, syncing, and reconciling alongside you

Month-end close is a stressful exercise for many companies, but it doesn’t have to be that way. Ramp’s AI-powered accounting tools handle everything from transaction coding to ERP sync, so teams close faster every month with fewer errors, less manual work, and full visibility.

Every transaction is coded in real time, reviewed automatically, and matched with receipts and approvals behind the scenes. Ramp flags what needs human attention and syncs routine, in-policy spend so teams can move fast and stay focused all month long. When it’s time to wrap, Ramp posts accruals, amortizes transactions, and reconciles with your accounting system so tie-out is smoother and books are audit-ready in record time.

Here’s what accounting looks like on Ramp:

- AI codes in real time: Ramp learns your accounting patterns and applies your feedback to code transactions across all required fields as they post

- Auto-sync routine spend: Ramp identifies in-policy transactions and syncs them to your ERP automatically, so review queues stay manageable, targeted, and focused

- Review with context: Ramp reviews all spend in the background and suggests an action for each transaction, so you know what’s ready for sync and what needs a closer look

- Automate accruals: Post (and reverse) accruals automatically when context is missing so all expenses land in the right period

- Tie out with confidence: Use Ramp’s reconciliation workspace to spot variances, surface missing entries, and ensure everything matches to the cent

Try an interactive demo to see how businesses close their books 3x faster with Ramp.

FAQs

Yes, you can do your own company payroll, but it requires a solid understanding of tax laws and payroll regulations. As your business grows, you may find it more practical to hire a professional or use a payroll service to ensure compliance and save time.

It can be more cost-effective to have someone else do your payroll for you, especially if you're a startup or a small business. You’ll save on salary as well as what it would cost to set up your own systems. But as you grow, so will the price of outsourcing. Before you decide to outsource, consider such factors as how complex your payroll needs are, your growth timeline, and whether or not compliance is a requirement for your business.

Any payroll system should offer such security features as data encryption, frequent security audits, adherence to industry standards, and multi-factor authentication. It’s important to choose a reputable platform, maintain strong internal discipline, and educate your team on best practices.

Depending on the severity of the mistake, your business could be on the hook for back taxes and interest plus fines. Employees can sue for missing pay. Even if they don’t, you may create substantial trust issues and problems with morale. You could also take a reputation hit if employees go public with the problem, and social media makes that easy to do.

Payroll software can help with such tasks as calculating taxes, filing forms, tracking withholdings, and staying up to date on tax law. Keep in mind, though, that because laws can vary from state to city to county, you may still need additional expert help.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits