Q3 2022 spending benchmarks: how businesses are reallocating their spend

Rising interest rates, recent layoffs, and other changes from the Fed are beginning to take their toll on how companies are choosing to spend their cash. While overall expenses remained flat, we see businesses reallocating their spend in Q3 and specifically divesting from growth categories like advertising and shipping to maintain long-term health.

Below you’ll find the key findings summarized from our most recent report. Click here to download the full report and delve into new datasets and additional insights.

Key findings

Expenses stayed flat, but companies shifted spend from ads to software

Businesses are focusing on cost efficiency. Spending in many categories either held steady or dropped. Ads remained the biggest expense for companies, but their transaction volume dropped for the first time this year, sending the strongest signal yet that businesses are worried.

The one area where companies continued to invest? Software and cloud computing, signaling businesses are relying on technology to drive efficiency. Software overtook general merchandise as the second-largest expense category, which typically comprises retail purchases from merchants like Amazon and The Home Depot.

Bigger businesses curbed total spending to improve margins

Mid-market companies aggressively decreased spend by 8.0% while enterprise companies lowered their spend by a more modest amount. Both segments pulled back the most on advertising and shipping spend, suggesting they’re decreasing their reliance on rapid growth measures. Their average transaction size did increase, indicating they’re reserving budget for larger purchases.

SMBs strove for savings by pulling back on big purchases

Small SMBs reduced their average transaction size by 25.4%, mostly by making smaller software purchases. Large SMBs also reduced the size of their general merchandise and professional service transactions. But overall spend increased for these segments, suggesting that SMBs are still dependent on top-line growth.

Travel spending remained elevated after jumping 34.2% in Q2

T&E transaction volume has more than doubled since the start of the year. We recently took a closer look at how different vendor categories are faring over time by applying a "Same Store Sales" lens to our transaction data. Specifically we looked at spend volume that occurred while holding both the customer and vendor pools constant across a category and over a period of time. Many T&E categories saw this metric every single month for six consecutive months. Enterprise travel expenses in particular kept increasing in Q3, by 14.9%.

Businesses in top metros are taking drastically different measures

The economy is making its impact felt in different ways across the country. Businesses in San Diego, Denver, and Washington D.C. reduced their spend the most in Q3, particularly those in the consumer goods & services space. In contrast, Austin, Miami, and Boston businesses grew spend by more than 10%, particularly those in the energy space.

Get the full report

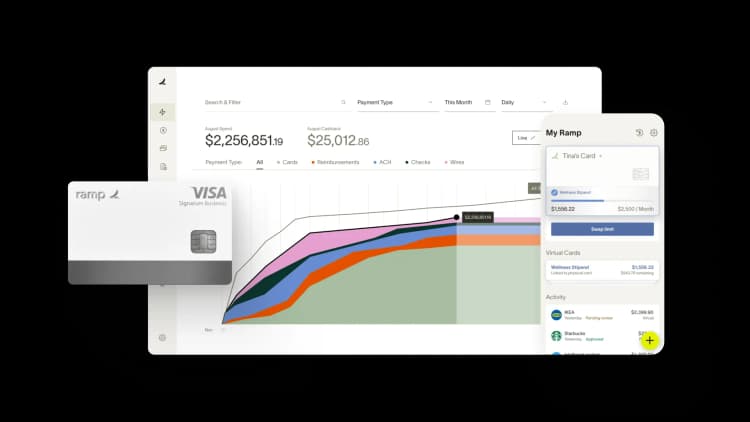

As you start to prepare budgets for 2023, download our Q3 Spending Benchmarks report to see how your company’s spend compares with other businesses of your size or industry. Where do you need to trim costs? Where can you afford to spend more to stay on par with your peers’ investments? At Ramp, we’re committed to providing you with the financial intelligence and tools you need to guide your business toward greater profitability and growth.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits