Sage Intacct expense management: What it is and integrations to use with it

- What is Sage Intacct expense management?

- Why expense management matters for finance teams

- How automation and real‑time visibility improve the process

- Top 4 expense management integrations to use with Sage Intacct

- Getting Sage Intacct and your integrations set up

- Integrating Ramp with Sage Intacct

- Streamline expense management with Ramp and Sage Intacct

Manual expense handling slows teams down—receipts get lost, approvals back up, and reconciliation takes longer than it should. Expense management software automates collection, review, and posting, and in Sage Intacct those functions sit inside the ERP so expense data connects directly to the ledger, payables, and reporting.

When needs go beyond the core module, integrations can add capabilities such as enhanced receipt capture, travel coordination, additional review controls, or expanded analytics—all while keeping financial data aligned across systems.

This guide explains how Sage Intacct manages expenses, why that matters for finance teams, and which integrations are commonly used to extend the platform.

What is Sage Intacct expense management?

Sage Intacct expense management is part of the ERP, not a separate application. Expenses entered by employees and managers move through configured approval chains, apply policy checks, and post into the accounting records that teams already use for close and reporting. Because the expense module shares the same data model with general ledger and accounts payable, fewer reconciliation steps are required to get from submission to payment and reporting.

In day-to-day use, teams capture receipts, categorize spend using dimensions and rules, route for review, and push approved items into payables for reimbursement or vendor settlement. That shared context lets finance track the status, source, and coding of each expense without leaving the ERP.

Why expense management matters for finance teams

Centralizing expense activity improves accuracy and oversight. Policy evaluation happens consistently at submission, approvers see the documentation they need, and employees have a clearer path from entry to reimbursement. Because expense data lives alongside the ledger, it’s easier to monitor budgets, analyze trends, and adjust policies as conditions change.

Standardized workflows reduce ad hoc steps that often cause delays. With consistent coding and documentation, audit preparation is more straightforward, and month‑end work depends less on manual follow-ups.

How automation and real‑time visibility improve the process

Most expense management software structures the expense lifecycle so each step feeds the next with the right context and controls:

- Capture and categorize: Employees add receipts from mobile or desktop. Key details are extracted and categorized against your chart of accounts and dimensions

- Policy evaluation: Submissions are checked against configured rules—amount thresholds, documentation requirements, per diem rules, and other policy settings

- Approval routing: Items move through approvers based on criteria such as department, project, location, or amount. Approvers see the full history and attachments

- Posting and payment: Approved expenses generate the accounting entries needed for reimbursement or billing, and flow into payables using established payment methods

Throughout, stakeholders can see status and history. Employees know what’s pending, approvers get the context to make decisions, and finance has a current view of outstanding, approved, and posted spend.

Here are other important functions expense management software, including Sage Intacct, provides:

Policy enforcement and configurable controls

Expense policies are implemented as rules so they apply the same way for every submission. You can define limits by category, role, or department; require specific documentation; and set escalation paths for exceptions. Approvers see which rules triggered and why, making decisions more consistent and traceable.

Policies can vary by team, entity, or region. For example, marketing may have different thresholds than engineering, and regional offices can apply country‑specific documentation and tax rules. Every action—submission, edit, approval, and post—records who did what and when, creating a complete audit history.

Multi‑entity, dimensions, and global operations

Expense management software should support multi‑entity structures, so organizations can keep books separated where needed while still sharing a common process. Expense categories, approval chains, and roles can be scoped to an entity, department, project, or location. Shared services teams can process expenses for multiple entities within one environment, while maintaining appropriate segregation of duties.

Dimensions (such as department, project, customer, location, or class) allow detailed tagging on each line, which supports budget monitoring and reporting without complex manual allocations. When costs span entities or departments, entries can be split using rules you define, with the due‑to/due‑from accounting created automatically.

For global teams, multi‑currency processing converts amounts to the appropriate functional currency for each entity at posting time. Employees can submit in supported local currencies, while approvers and accountants see values in the currencies relevant to their role. Regional tax handling (such as VAT) can be configured per jurisdiction so requirements are met at submission and posting.

Mobile experience and security considerations

Expense management software with mobile apps supports capturing receipts at the point of spend, creating and editing reports, and approving on the go. Applying the same rules on mobile and desktop keeps policy checks consistent and avoids rework later in the process.

Security controls—such as role‑based permissions, multi‑factor authentication, and mobile device policies—help ensure only authorized users can submit, view, or approve expenses. If devices are lost or roles change, access can be updated centrally to protect financial data.

Top 4 expense management integrations to use with Sage Intacct

Sage Intacct’s core module covers the main workflow, and many teams connect specialized tools for capabilities such as card programs, enhanced receipt capture, or travel management. Here’s a breakdown of the top five commonly used expense management integrations for Sage Intacct.

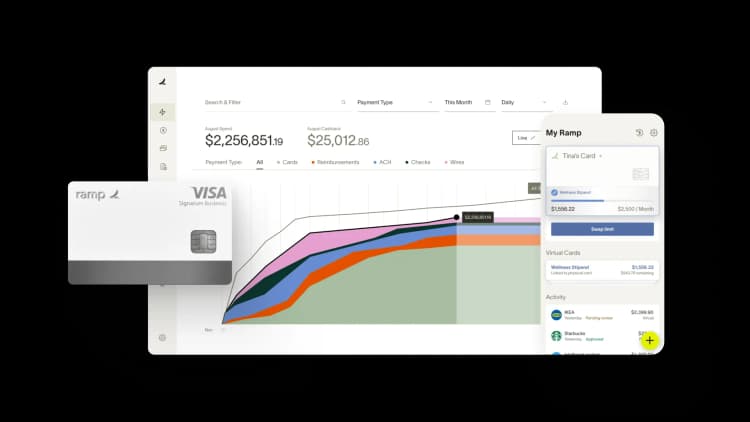

1. Ramp Expense Management

Ramp integrates with Sage Intacct to bring card transactions and reimbursements into the ERP, align coding with accounts and dimensions, and apply policy controls consistently. The connection is designed to reduce manual steps and keep audit detail in sync across systems.

Ramp's Sage Intacct integration is used by thousands of Ramp customers to automate tedious tasks, ensure accuracy, and close the books faster. This includes:

- Consolidate procurement, accounts payable, expense management, travel booking, and treasury

- Manage all global Sage Intacct entities in one Ramp multi-entity environment

- Sync accounting fields, transactions, reimbursements, payments, cashback, purchase orders, vendor bills, vendor bill payments and credits in real time via Ramp’s API

- Sync all Ramp data to top level in Sage Intacct or at the entity level allowing automated intercompany and inter-entity splitting

- Process vendor bills from start to finish: initiate your process in either Sage Intacct or Ramp, and complete it with Ramp payments

- Seamless integration with Sage Intacct, vetted as a Sage Recommended Solution

2. Emburse Certify

Emburse Certify provides expense reporting and receipt capture. Its Sage Intacct connector can exchange approved expense data with the ERP and align categories and approvals to match an organization’s accounting structure. Its main functionality includes:

- Reduce manual uploads by connecting Emburse to Sage Intacct with a real-time, two-way data flow—streamlining expense reporting and reconciliation

- Deploy the integration in minutes without technical resources, and configure it through a self-service interface built for non-technical users

- Map fields for GL dimensions, corporate cards, classes, and locations to ensure expense data fits seamlessly into your Sage Intacct environment

3. Concur Expense

Concur Expense’s integration with Sage Intacct is used to transfer approved expenses and keep records consistent between the systems for accounting and reporting. The integration provides the following functionality:

- Reduces manual re-entry by automatically posting expense reports and invoices from SAP Concur into Sage Intacct

- Supports mapping for employees, vendors, reimbursements, and corporate card transactions

- Admins can track posting status directly within SAP Concur and recall failed reports for correction

4. Expensify

Expensify offers receipt capture and automated report creation. The Sage Intacct integration can move approved expenses into the ERP and keep coding mapped to the appropriate accounts and dimensions. This includes the ability to:

- Streamline expense reporting with real-time syncing, automatic reconciliation, and next-day ACH reimbursements

- Gain visibility and control over corporate card spend with tools that help ensure expenses are categorized correctly and submitted on time

- Sync core Sage Intacct dimensions like departments, projects, and expense types—plus support for User Defined Dimensions

Getting Sage Intacct and your integrations set up

After choosing an expense management integration, begin by configuring Sage Intacct to reflect your accounting structure: chart of accounts, dimensions, entities, approval routing, roles and permissions, and reporting formats. Many organizations work with an implementation partner to migrate historical data, validate controls, and document processes.

For integrations, map fields and dimensions, define which records sync (and in which direction), and set a cadence for transfers. Establish how errors are surfaced and resolved, and confirm that policies and approval states are represented the same way in each system. Use a sandbox or test company to run end‑to‑end scenarios—receipt capture, coding, multi‑entity splits, approvals, posting, and reimbursement—before moving to production.

After launch, monitor sync logs and posting results, review user permissions regularly, and revisit policy rules as spending patterns change. Periodic audits of categories, dimensions, and approval chains help keep the process aligned with your organizational structure.

Integrating Ramp with Sage Intacct

Sage Intacct easily handles financial complexities, and pairing it with Ramp unlocks even greater potential. Ramp’s advanced expense management tools complement Sage Intacct’s ERP capabilities by automating expense tracking, simplifying invoice management, and giving you more control over your financial operations.

Here’s how Ramp’s features work with Sage Intacct:

- Sync data in real time: Update vendor data, bill payment details, and tracking categories in Ramp, and see those changes reflected in Sage Intacct instantly

- Manage multiple subsidiaries: Handle financial activity for multiple entities, including bill payments, reimbursements, and transaction coding, all in one platform

- Classify transactions your way: Use Sage Intacct’s tracking categories, custom fields, and UDD directly in Ramp for easy and consistent transaction coding

- Audit every transaction: Access your complete transaction history in Ramp, from initiation to sync, with direct links to specific reimbursements or payments

Together, Ramp helps Sage customers close their books faster, offering a trusted solution for spend and expense management.

How integrating Ramp and Sage Intacct closed Marqeta’s books 88% faster

The finance team at Marqeta, a card issuing platform, struggled with inefficient manual processes for corporate card management and reconciliation, which slowed down their close and limited time for analysis. By implementing Ramp alongside Sage Intacct, Marqeta was able to meet these challenges head-on, saving time and reducing manual effort.

For Marqeta, the impact of integrating Ramp with Sage Intacct included:

- 88% faster close: Marqeta dramatically reduced its close time by syncing Ramp and Sage Intacct

- 7 hours saved monthly: Marqeta’s AP specialist cut time spent on corporate card processing from eight hours per month to just one hour

- Automatic transaction syncing: Transactions flow directly from Ramp to Sage Intacct, removing the need for manual uploads

- Consistent transaction coding: Merchant category rules in Ramp ensure accurate, automatic transaction categorization

- Faster insights: Real-time syncing allows the finance team to analyze business performance before the month ends, accelerating learning and decision-making

“We’re able to review our expenses much faster in the close process and analyze them,” says Megan Gemoll, Marqeta’s Director of Corporate Accounting. “We’re able to start the analysis of our month-over-month analytics even before the month ends because those transactions are importing over regularly.”

Marqeta’s experience highlights how Ramp’s integration with Sage Intacct eliminates inefficiencies, enabling smoother workflows and freeing up time for higher-value financial tasks.

Streamline expense management with Ramp and Sage Intacct

Ramp and Sage Intacct integrate seamlessly to streamline financial workflows, improve decision-making with real-time visibility, and support businesses in scaling their operations efficiently. By combining Sage Intacct’s advanced ERP features with Ramp’s best-in-class expense management tools, you’re not just keeping up—you’re moving ahead.

Integrate Sage Intacct with Ramp and see how it can transform your financial workflows.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits