- What is SOX compliance?

- Who needs to be SOX compliant?

- Key SOX compliance requirements

- Steps to achieve and maintain SOX compliance

- Leveraging technology to simplify SOX compliance

- Automate SOX controls with Ramp's built-in approval workflows and audit trails

Key takeaways

- SOX compliance ensures financial transparency, prevents fraud, and holds executives accountable for accurate reporting.

- Public companies and their subsidiaries must establish strong internal controls and undergo regular audits to remain compliant.

- Failing to comply with SOX can lead to severe legal penalties, including fines of up to $5 million, up to 20 years in prison for executives, and significant damage to investor trust.

- Maintaining accurate financial records and implementing compliance technology simplifies reporting and reduces risks.

- Strong SOX compliance builds investor confidence and strengthens long-term business stability.

What is SOX compliance?

SOX

SOX, or Sarbanes-Oxley Act of 2002, is a U.S. law designed to prevent corporate fraud and improve financial transparency. SOX compliance requires public companies, auditors, and financial professionals to maintain accurate financial records and ensure truthful financial reporting.

At its core, SOX compliance helps you protect investors, prevent fraud, and improve corporate accountability. The law was introduced after major scandals like Enron and WorldCom, where accounting fraud and data breaches led to billions in losses. Since then, SOX has helped restore trust in financial markets by enforcing strict reporting and oversight rules.

You must follow SOX regulations if your company is publicly traded in the U.S. The law also applies to your international subsidiaries. Private companies don't need to comply, but many choose to. Strong financial oversight can prepare your business for an IPO and reduce fraud risks.

Who needs to be SOX compliant?

Companies that violate SOX may face fines of up to $5 million, while executives involved in fraudulent reporting can receive prison sentences of up to 20 years. Beyond legal penalties, non-compliance damages investor trust, increases financial risks, and weakens business stability.

- Public companies listed in the U.S.: If your company is publicly traded on a U.S. stock exchange, such as the New York Stock Exchange (NYSE) or Nasdaq, you must comply with SOX. These rules apply to all public companies, no matter the industry or size. Compliance ensures accurate financial reporting and helps protect investors from expense fraud.

- Wholly owned subsidiaries of public companies: If your company is a subsidiary of a publicly traded company, you also need to follow SOX. Your parent company must ensure that all subsidiaries meet SOX reporting and internal control standards. This keeps financial reporting consistent across the entire organization.

- Accounting firms auditing public companies: If your auditing firm provides audit services for public companies, you must comply with SOX. The law requires you to follow strict guidelines, including independent oversight and proper documentation. This ensures that financial reports are accurate and free from fraud. Failing to meet these standards can result in loss of certification and legal action.

- Foreign companies listed on U.S. exchanges: SOX regulations apply to you if your company is based outside the U.S. but trades on a U.S. stock exchange. The law ensures that foreign companies with U.S. investors meet the same financial reporting standards as domestic businesses.

- Private companies preparing for IPOs: Private companies aren't legally required to follow SOX. However, if you plan to go public, adopting SOX controls early can make the IPO process smoother. Investors look for strong financial oversight, and SOX compliance helps build their confidence.

Key SOX compliance requirements

The Sarbanes-Oxley Act (SOX) sets strict financial reporting and internal control requirements for public companies. These rules are enforced by the Securities and Exchange Commission (SEC) and the Public Company Accounting Oversight Board (PCAOB).

SOX compliance isn't optional. The SEC oversees compliance, while the PCAOB regulates auditors to ensure accurate financial statements.

Section 302: Corporate responsibility for financial reports

Section 302 of the Sarbanes-Oxley Act makes you, as a company executive, directly responsible for accurate and honest financial reporting. If you are a Chief Executive Officer or a Chief Financial Officer, you must personally certify that financial statements are complete, truthful, and follow SEC regulations. If reports contain false or misleading information, you could face criminal charges, heavy fines, or even prison time.

Now, every quarterly and annual report must include a signed certification from top leadership. This ensures that executives stay accountable for financial accuracy. You must also confirm that your company has internal controls to prevent fraud and reporting errors.

Section 404: Management assessment of internal controls

Section 404 of the Sarbanes-Oxley Act requires you to set up, document, and test internal controls to prevent fraud and financial mistakes. Your management team must review these controls every year and confirm they work. Independent auditors must also check and verify them to ensure accuracy.

This section is one of the most expensive and time-consuming parts of SOX compliance. On average, companies spend $1.4 million per year to meet Section 404 requirements. Even though it costs time and money, it helps reduce financial risks and build investor trust.

If you fail to comply, your company could face SEC penalties, loss of credibility, and financial trouble. Weak SOX internal controls increase the risk of financial restatements, which can damage investor confidence. Following Section 404 strengthens financial processes and protects your business from compliance failures.

Section 409: Real-time financial disclosures and transparency

Section 409 of the Sarbanes-Oxley Act requires you to immediately report major financial changes that could affect investors. If your company faces a significant change in operations, liquidity, or financial health, you must disclose it right away. This prevents misleading financial reporting and keeps investors informed.

Unlike standard quarterly or annual reports, Section 409 demands real-time updates. You must report material changes as they happen, not months later.

Section 802: Criminal penalties for fraudulent activities

Section 802 of the Sarbanes-Oxley Act enforces strict penalties for financial fraud. You can face serious legal consequences if you alter, destroy, or falsify financial records to mislead investors or regulators. This applies to executives, employees, and auditors involved in fraudulent activities.

Penalties are severe. If convicted, you could face up to 20 years in prison. Your company may also receive fines of up to $5 million for tampering with financial records or failing to retain them properly. The law requires businesses to store financial records for at least five years to prevent data manipulation.

Section 906: Certification of financial statements

Section 906 of the Sarbanes-Oxley Act makes CEOs and CFOs personally responsible for the accuracy of financial statements. You must certify that all reports are truthful, complete, and follow federal regulations. If you knowingly approve false financial statements, you can face serious penalties, including fines and prison time.

Financial fraud has cost companies billions in penalties and damaged investor trust. Section 906 ensures top executives stay accountable for financial reporting. Following this rule protects your company from legal trouble and builds trust with investors.

Steps to achieve and maintain SOX compliance

Companies spend an average of 5,000 to 10,000 hours annually on SOX-related work. Large organizations often require six months or more to complete compliance audits. To meet SOX standards, you must identify risks, document controls, conduct SOX compliance audits, and ensure accurate financial reporting.

Step 1: Assess financial risks and internal controls

To stay SOX compliant, you must identify financial risks and evaluate internal controls regularly. Start by mapping out your financial processes and pinpointing areas vulnerable to fraud, misstatements, or reporting errors. Look at transaction approvals, data access, and financial reporting workflows to spot weak points.

Next, test your internal controls to ensure they function as expected. Conduct walkthroughs, control tests, and gap analyses to verify that processes prevent unauthorized transactions and errors. If you find weaknesses, update policies, strengthen security controls, or automate controls to reduce risks.

Under SOX Section 404, you must document all internal controls and risk assessments. Create a compliance report detailing your financial safeguards, test results, and corrective actions. This documentation will be crucial for external audits and regulatory reviews.

Step 2: Establish clear internal controls

Strong internal controls to prevent fraud and ensure accurate financial reporting. Start by setting approval processes, restricting access, and separating duties for financial transactions. This reduces the risk of unauthorized actions and reporting errors.

Next, standardize financial information and procedures across all departments. Make sure every transaction, from expense approvals to revenue tracking, follows documented policies.

Once controls are in place, test them regularly. Conduct internal audits, control checks, and automated monitoring to spot weaknesses. If you find gaps, update policies, improve oversight, or use automation to strengthen compliance.

Step 3: Implement compliance technology

To stay SOX compliant, you must use technology to automate compliance tasks and reduce errors. Start by integrating audit management, financial reporting, and risk management tools into your workflow. Automated systems track transactions, flag issues, and generate real-time reports.

Next, set up access controls and data security measures. Use role-based permissions, encryption, and automated logs to prevent unauthorized access to financial records. As we discussed earlier, SOX requires you to store financial data securely for at least five years. So, keeping them secure is essential.

You should also schedule automated control tests and risk checks. SOX compliance software continuously monitors financial processes and detects weaknesses instantly. This helps you avoid compliance failures and financial misstatements.

Make sure you document all system updates and security changes. The audit committee will review your compliance tools to ensure they meet SOX cybersecurity and record-keeping standards.

Step 4: Train employees on SOX policies

Start by creating a structured training program that covers key SOX act sections, including fraud prevention, document retention, and reporting procedures.

Next, train employees based on their roles. Finance teams must focus on accurate reporting and audit preparation. IT teams need to learn data security and access controls. Executives must understand their legal responsibilities and certification requirements. Role-specific training helps employees apply SOX policies effectively.

Use real-world examples and case studies to reinforce learning. Interactive methods, like quizzes and workshops, help employees recognize compliance risks early.

Step 5: Conduct regular audits

You must perform regular internal audits to check financial accuracy and spot control weaknesses to stay SOX compliant. Schedule audits at least once a year to review financial statements, risk controls, and compliance processes.

After each audit, document findings and fix issues quickly. Update policies, strengthen weak controls, and create a remediation plan. External auditors will review these records to confirm compliance.

Finally, work with independent auditors to verify financial reports. The Public Company Accounting Oversight Board (PCAOB) requires external audits for all public companies. Regular audits help you stay compliant, improve financial accuracy, and avoid penalties.

Step 6: Maintain accurate financial records

To stay SOX compliant, you must keep detailed and accurate financial records for audits and legal reviews. Start by organizing all financial documents, including transaction records, invoices, payroll data, and expense reports.

Next, digital record-keeping systems can be used to track financial data securely. Automated solutions reduce errors and streamline efficiency. Companies that switch to electronic record-keeping lower compliance costs and reduce the risk of lost or altered documents.

You should also limit access to sensitive data. Use role-based permissions and encryption to prevent unauthorized changes. External auditors will check how well you manage financial records. You stay compliant, improve readiness to audit processes, and strengthen financial accountability by keeping accurate records.

Leveraging technology to simplify SOX compliance

Technology helps you automate compliance tasks, reduce human errors, and improve financial accuracy. SOX compliance requires tracking financial records, testing internal controls, and preparing for audits. Manual processes can slow this down and increase the risk of mistakes. Automation makes compliance faster, more efficient, and less costly.

By using compliance software and robotic process automation (RPA), you can monitor financial transactions, detect anomalies, and generate real-time reports. This helps you identify risks early and take corrective action before audits.

However, only 11% of organizations currently use RPA, meaning most businesses still rely on outdated manual processes. Many businesses hesitate to adopt RPA for SOX compliance due to high costs, implementation challenges, and concerns about disrupting existing workflows. However, adoption is increasing as companies recognize its ability to reduce compliance costs, improve accuracy, and integrate seamlessly with modern financial systems.

Keeping financial records accurate and organized is also important for SOX compliance. Automated tools can help reduce manual errors, improve reporting accuracy, and ensure compliance with record-keeping requirements.

Platforms like Ramp integrate with QuickBooks, Xero, and NetSuite, automatically syncing transactions and receipts. This eliminates manual reconciliation, making it easier to maintain audit-ready financial records while saving businesses valuable time.

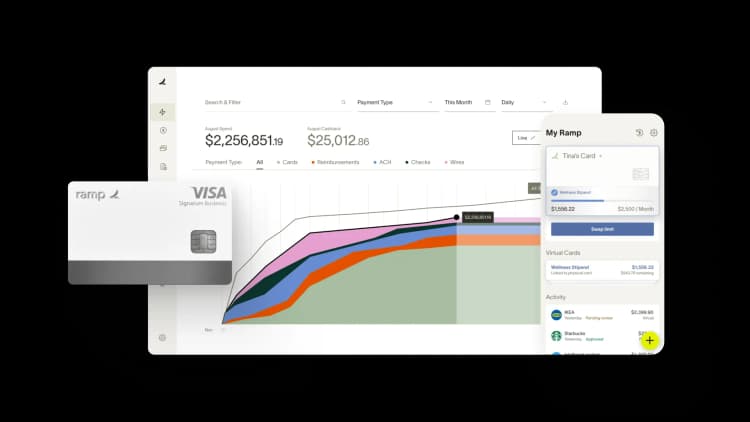

Automate SOX controls with Ramp's built-in approval workflows and audit trails

SOX compliance requires rigorous internal controls over financial reporting, but manual approval processes and scattered documentation make it hard to maintain consistent oversight. You need automated controls that enforce policy, create audit trails, and scale with your business without adding headcount.

Ramp builds SOX-compliant controls directly into your spend management workflow, so every transaction follows your approval matrix and creates a complete audit trail automatically. You set spending limits, define approval chains, and enforce policy at the point of purchase—no manual intervention required.

Here's how Ramp strengthens internal controls:

- Multi-level approval workflows: Configure approval chains based on amount thresholds, departments, or vendors so high-risk spend always routes to the right stakeholders before it's authorized

- Real-time policy enforcement: Block out-of-policy purchases automatically and require manager approval for exceptions, so controls are applied consistently across every transaction

- Immutable audit trails: Capture who approved what, when, and why for every transaction, with timestamped records that can't be altered or deleted after the fact

- Automated receipt collection: Require receipts and memos at the point of purchase, so supporting documentation is attached to every transaction before it posts to your books

- Role-based access controls: Restrict who can view, approve, or modify transactions based on their role, so segregation of duties is enforced automatically

Ramp's accounting automation software turns SOX compliance from a manual audit scramble into a continuous, automated process that runs in the background.

Try a demo to see how Ramp automates internal controls and simplifies SOX compliance.

Don't miss these

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits