What is expense fraud? How to detect and prevent it

- What is expense fraud?

- How common and costly is expense fraud?

- How does expense fraud happen?

- Why do employees commit expense fraud?

- Common types of expense fraud

- How to detect expense fraud

- How to prevent expense fraud

- How Ramp stops expense fraud before it happens

- Put an end to expense fraud with Ramp

Key takeaways

- Expense fraud occurs when employees intentionally submit false or inflated claims for business expenses for their own financial benefit.

- Common forms of expense fraud include fabricating expenses, mischaracterizing personal spending as business-related, inflating legitimate costs, and submitting duplicate reimbursement requests.

- You can prevent expense fraud by establishing and consistently enforcing a clear expense policy, providing regular employee training, and conducting periodic audits.

- Personal financial pressure, poor workplace culture, and a low perceived risk of getting caught are common reasons why employees commit expense fraud.

- Ramp's expense management software helps you stop expense fraud before it happens by using automated controls and real-time monitoring to flag or block out-of-policy spending at the point of sale.

Expense fraud refers to the intentional inflation of reimbursement claims by employees. It’s one of the most common and costly forms of workplace fraud, threatening the financial health and trustworthiness of businesses of all sizes.

In this article, we cover what expense fraud is, explore the most common types, and share some strategies for how to detect and prevent expense report fraud.

What is expense fraud?

Expense fraud happens when employees intentionally claim false or inflated business expenses for reimbursement. Also known as expense reimbursement fraud or employee expense fraud, it's among the most pervasive types of occupational fraud.

There are several ways employees might commit expense fraud, including:

- Fabricating expenses

- Padding or inflating costs

- Duplicating expense claims

- Altering receipts,

- Submitting personal expenses as business-related

In all these cases, employees are deliberately taking advantage of a company's reimbursement system for their own benefit.

It’s important to distinguish between expense fraud and simple mistakes. For example, employees might make a typo on their claim or misunderstand your company’s expense policy. While both can hurt your bottom line, the key difference is intent: Expense fraud is a deliberate attempt to gain financially, while errors are unintentional.

How common and costly is expense fraud?

According to the Association of Certified Fraud Examiners (ACFE) 2024 Report to the Nations, which analyzed nearly 2,000 cases worldwide, expense fraud is one of the most common forms of asset misappropriation. Expense reimbursement fraud appeared in 13% of cases and lasted an average of 18 months before detection, making it one of the longest-running types of fraud.

The median loss from these schemes was $50,000 per year, a $10,000 increase from the ACFE’s 2022 report. Expense fraud is also one of the most common types of asset misappropriation schemes across industries, from technology and manufacturing to government and social services.

How does expense fraud happen?

Expense fraud often stems from company culture. Employees may pick up bad habits from more senior colleagues, viewing them as simply "the way things are done."

According to the ACFE's 2024 report, 20% of small businesses (with fewer than 100 employees) and 12% of larger companies (with more than 100 employees) experience expense fraud, illustrating the deep-seated nature of these behaviors. To change this mindset, small business owners need to actively promote a culture that discourages fraud.

It starts with the little things. For instance, a sales representative might ask a merchant to write a receipt for more than what they actually paid. This is especially common with cash transactions, where the merchant is unlikely to report the sale as taxable income. Both parties are breaking the law, and over time, this "everyone does it" attitude can become systemic.

The problem can also be internal. Without proper expense tracking tools and policies, there’s no effective way to stop employees from inflating claims or submitting questionable expense reports. Each seemingly harmless infraction chips away at the company’s integrity and bottom line.

Ultimately, business owners and leadership are responsible for addressing expense fraud. While the accounting department can help identify suspicious claims, it’s up to management to set clear policies, provide the right tools, and foster accountability across the organization.

Why do employees commit expense fraud?

In almost all cases, employees commit expense reimbursement fraud for personal financial gain. It’s natural to wonder why employees would risk their jobs for such a seemingly small reward. The reasons vary, but here are some of the most common:

- Financial pressure: Personal financial trouble or debt can drive employees to commit expense fraud for additional income

- Rationalization: Some employees may justify fraud by claiming they deserve higher compensation or that the company owes them for their dedication

- Low risk of being caught: Employees may believe that the risk of getting caught is low, or that their fraudulent reimbursements are so small they’ll go unnoticed

- Workplace culture: As we mentioned above, if employees see their co-workers get away with claiming false expenses, they may be more likely to try it themselves

Increased cost of living and inflation likely contribute to the rate of expense fraud as well, which means it’s more important than ever to take steps to strengthen your internal controls to get a handle on expense fraud.

Common types of expense fraud

There are several ways that expense fraud occurs, and not all of them are intentional. Here's a look at each:

Fraudulent business expenses

This occurs when employees request reimbursement for business expenses they never actually incurred. For instance, an employee might submit a receipt for a luxury dinner at a high-end restaurant when they actually dined somewhere more affordable.

They may also provide false receipts for expenses such as taxi rides, claiming they used a cab service when they actually took public transportation.

Mischaracterized expenses

Submitting personal expenses for reimbursement is also a form of fraud, though it can sometimes happen accidentally—for example, when an employee uses their personal credit card for business purchases.

Multiple reimbursements

Submitting the same expense more than once is usually an error rather than an intentional act. For example, an employee might accidentally submit the same hotel receipt in two separate reports. Fortunately, your finance or accounting team can catch this by checking dates and documentation.

Inflated expenses

Inflating legitimate expenses rather than entirely fabricating them, such as overstating their mileage log or inflating meal costs, is another common tactic. In these cases, employees do incur the business expense but intentionally submit an expense claim for more than they actually spent.

Altered receipts

According to the ACFE’s 2024 report, altering physical or digital documents is one of the most common methods employees use to conceal fraudulent activity. For instance, an employee could manipulate a receipt by adding a few dollars to the total, showing a larger tip than they actually paid, or digitally removing alcohol from a receipt if it’s out of policy.

Maverick spending

Maverick spending refers to employees submitting accurate reimbursement requests but ignoring company expense policies or spending guidelines. For example, they might use unapproved vendors or exceed category limits despite otherwise legitimate expenses.

Zombie spending

Zombie spending happens when your company continuously spends money on goods or services you no longer use, like SaaS subscriptions. It can also lead to shadow IT, where employees sign up for unauthorized SaaS programs or download apps outside your company system, potentially exposing you to malware or other cyber risks.

Many of the examples listed above are oversights rather than intentional fraud. Still, each instance of unauthorized spending, whether intentional or unintentional, erodes your company’s bottom line and contributes to the cultural acceptance of these behaviors among employees.

How to detect expense fraud

Identifying expense fraud early is critical to protecting your company’s bottom line. Manual reviews can uncover some red flags, but automated tools make expense fraud detection faster and more reliable.

Automated controls and technology

Automated expense management software helps flag suspicious activity as it happens. This software monitors transactions and automatically alerts you to potentially unauthorized or fraudulent charges. Automation also makes it easier to catch issues that manual reviews often miss, such as duplicate receipts, inflated amounts, or out-of-policy purchases.

Manual audits and spot checks

Even with automation, periodic manual audits are important for expense fraud detection. Random spot checks and detailed reviews can identify subtler issues or emerging patterns that automated systems might overlook. Keep an eye out for warning signs such as:

- Duplicate or suspiciously similar receipts

- Round, uniform amounts that seem fabricated

- Frequent small claims just under approval thresholds

Employee training and awareness

Educating employees about your expense policies and the risks of fraud can also help. When employees understand what's acceptable and what's not, they're less likely to engage in risky behavior.

How to prevent expense fraud

A proactive approach is the best way to stop expense fraud before it happens. Here are a few steps you can take to build a culture of accountability and trust:

- Create clear expense policies: Well-documented and easy-to-access expense reimbursement policies are the foundation of prevention. Outline exactly what’s allowed and what isn’t, and include specific examples to avoid confusion.

- Enforce your policy: Even the best policies won’t work if they aren’t enforced consistently. Set the tone by modeling compliant behavior and making sure violations have consistent consequences. A culture of accountability sends a strong message that you won’t tolerate fraud.

- Leverage technology: Expense management platforms automate workflows, set predefined spending limits, and restrict purchases to approved vendors and categories. Integrating these systems with your accounting software ensures accurate, real-time tracking and minimizes manual errors.

- Provide regular training and communication: Ongoing employee training keeps policies top of mind and gives employees a chance to ask questions or report concerns. Open communication channels also make it easier for employees to report suspicious activity. For more on this, see Ramp’s report on preventing expense fraud and related risks.

How Ramp stops expense fraud before it happens

Expense reimbursement fraud costs businesses millions annually, yet many finance teams still rely on manual reviews and outdated spreadsheets to catch suspicious activity.

You're left playing detective after the fact, combing through receipts and trying to spot duplicate submissions, inflated amounts, or personal expenses disguised as business costs, all while legitimate reimbursements pile up in your queue.

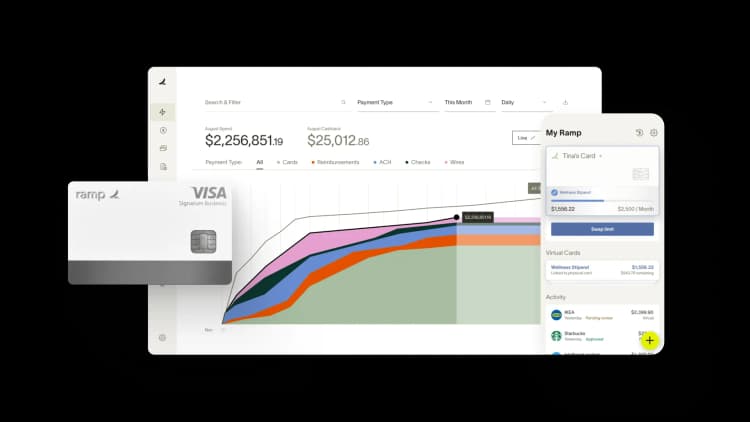

Ramp's expense management software transforms this reactive approach into proactive fraud prevention through intelligent automation and real-time controls. The platform's receipt matching technology automatically flags discrepancies between submitted receipts and transaction amounts, catching inflated expense claims before they're approved.

If an employee tries to submit a $200 dinner receipt for a $50 transaction, Ramp's system immediately identifies the mismatch and blocks the reimbursement until you resolve it. This same technology detects duplicate submissions across multiple expense reports, preventing a common tactic of submitting the same receipt multiple times across different reporting periods.

Beyond detection, Ramp's customizable spend controls let you set precise limits and approval workflows that match your company's policies. You can require additional approvals for expenses over certain thresholds, restrict expense categories by employee or department, and automatically enforce your expense policy through the platform.

For instance, if your policy caps individual meals at $75, Ramp will automatically flag any food expenses exceeding this limit for review. The platform also provides complete audit trails for every transaction, creating an unalterable record that shows who approved what and when.

These automated controls don't just catch fraud; they prevent it from happening. Ramp makes policy violations immediately visible, creating friction for would-be fraudsters while streamlining the process for honest employees.

Put an end to expense fraud with Ramp

With Ramp's modern finance operations platform, the days of manual expense reports and fake receipts are over. Upload your expense policy and set spend controls that only allow purchases from certain vendors or expense categories.

We also provide an online dashboard where you can track expenses in real time with an API you can use to connect your expense platform to your accounting software. Automatically process, record, verify, categorize, and register expenses on the general ledger.

Ready to curb expense fraud? Try an interactive demo and see why more than 50,000 businesses, from family farms to space startups, choose Ramp for their finance operations.

FAQs

Duplicate receipts, frequent small expense claims just under approval thresholds, inconsistent or round-number expenses, and expenses submitted outside of policy may be signs of expense report fraud. Unusual spending patterns or an unwillingness to provide documentation can also signal potential fraud.

Accountants are generally expected to report suspected fraud they uncover, following professional standards, company policy, and local laws. This usually means escalating concerns to management, the board, or, in some cases, external authorities, depending on the severity and their role.

Fraud expense coverage is an insurance policy that helps businesses cover the costs of investigating and recovering from employee fraud. It can include expenses such as forensic audits, legal fees, and some of the financial losses resulting from fraudulent activities.

“In the public sector, every hour and every dollar belongs to the taxpayer. We can't afford to waste either. Ramp ensures we don't.”

Carly Ching

Finance Specialist, City of Ketchum

“Ramp gives us one structured intake, one set of guardrails, and clean data end‑to‑end— that’s how we save 20 hours/month and buy back days at close.”

David Eckstein

CFO, Vanta

“Ramp is the only vendor that can service all of our employees across the globe in one unified system. They handle multiple currencies seamlessly, integrate with all of our accounting systems, and thanks to their customizable card and policy controls, we're compliant worldwide. ”

Brandon Zell

Chief Accounting Officer, Notion

“When our teams need something, they usually need it right away. The more time we can save doing all those tedious tasks, the more time we can dedicate to supporting our student-athletes.”

Sarah Harris

Secretary, The University of Tennessee Athletics Foundation, Inc.

“Ramp had everything we were looking for, and even things we weren't looking for. The policy aspects, that's something I never even dreamed of that a purchasing card program could handle.”

Doug Volesky

Director of Finance, City of Mount Vernon

“Switching from Brex to Ramp wasn't just a platform swap—it was a strategic upgrade that aligned with our mission to be agile, efficient, and financially savvy.”

Lily Liu

CEO, Piñata

“With Ramp, everything lives in one place. You can click into a vendor and see every transaction, invoice, and contract. That didn't exist in Zip. It's made approvals much faster because decision-makers aren't chasing down information—they have it all at their fingertips.”

Ryan Williams

Manager, Contract and Vendor Management, Advisor360°

“The ability to create flexible parameters, such as allowing bookings up to 25% above market rate, has been really good for us. Plus, having all the information within the same platform is really valuable.”

Caroline Hill

Assistant Controller, Sana Benefits